From July to September 2025, gaming companies made deals totaling $57.8 billion—twice as much as in the entire year of 2024

The announcement of the sale of Electronic Arts (EA) to a group of investors became the largest event in the gaming investment market in the third quarter of 2025. As a result, the total quarterly transaction value surged, surpassing the totals for the entire previous year.

EA SPORTS FC 26

This is stated in a report by Aream & Co., based on data from InvestGame. Below is a brief overview of the market situation in July-September 2025.

- In three months, gaming companies completed 136 transactions—this includes both closed deals and announcements. Compared to the third quarter of 2024, the number of deals decreased by 43.

- The total transaction value was $57.8 billion, which is a 1826% increase compared to the same period last year. When compared to the entire year of 2024, the increase is 138.8%.

The number and volume of gaming transactions (M&A, public offerings, and private investments) from July 2023 to September 2025

- Virtually all of the transaction value was from mergers and acquisitions—$56.9 billion over 49 deals. However, if we exclude the sale of EA from the statistics, this number shrinks to a more modest $1.9 billion. Even so, it significantly—by 216%—exceeds the M&A transaction value in July-September 2024.

The largest mergers and acquisitions in the third quarter of 2025

- Meanwhile, activity in the private investment segment continued to decline. During the quarter, game-related companies attracted 82 investments totaling $0.6 billion (-14.3%).

- The largest investment went to XR headset manufacturer VITURE, which secured $100 million.

The largest private investments in the third quarter of 2025

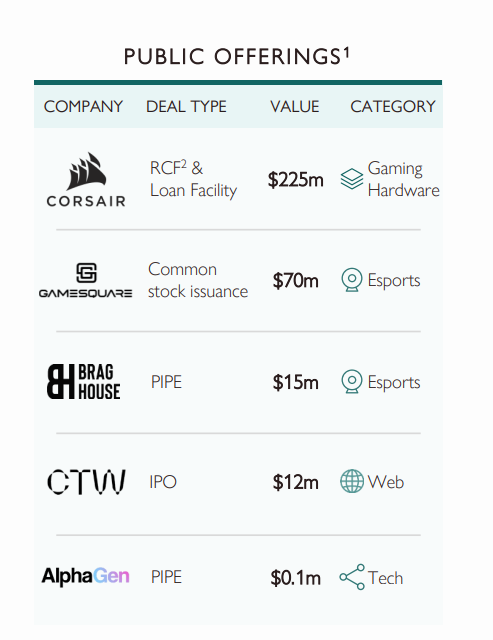

- In the public offerings segment, things were also not smooth. Over three months, gaming companies carried out only five such deals with a total value of $0.3 billion (-82.3%)—the worst result in two years both in terms of the number of deals and the amount of money.

- The largest deal of the quarter in the public offerings category was the securing of a $225 million revolving credit facility by Corsair Gaming.

The largest public offerings in the third quarter of 2025