What is the current state of the web games market in Russia — developers' perspective

In recent years, there has been a surge of activity in the web games market. This is particularly true for Russia, where this segment has been historically strong. App2Top discussed the reasons for developers' interest in web games and the potential earnings from such games with market experts — Alexander Schevelev, Eduard Kumykov, and Yan Yankelowitz.

The experts shared their views on the following topics:

- What does the web games market in Russia look like today?

- Many young teams and mobile companies are actively migrating to the web. Why this interest?

- How much can you earn from web games in Russia at their peak?

- A few years ago, the market entry threshold was low. There weren't enough projects. You could launch and start earning with a crossword. What about now?

- Can we say that the cost of web projects in terms of development and LiveOps has now approached that of mobile games?

- What about marketing? How effective and expensive is it for web games today?

- What challenges and difficulties in the web market significantly hinder developers?

- Which platforms are of most interest, and which ones should be approached with a residual principle?

- What trends are currently observed in the web games market?

1. What does the web games market in Russia look like today?

Alexander Schevelev — CEO — Maningame

Currently, the web games market in Russia can be compared to the global mobile games market in terms of competition, but with a very palpable ceiling in revenue levels. This means that by releasing a decent game or a quality clone of any top mobile game, you are very likely to start earning thousands of dollars a month. However, to elevate your income to the next level (over $10,000), you need to transition to a professional work pipeline similar to developing a standard mobile game. This makes launching on web platforms just another strategic component alongside focusing on mobile stores.

Eduard Kumykov — CEO — Itking.pro

Today in Russia, there are several main platforms: "Yandex Games," "Odnoklassniki," and VK. These platforms have been around for a while, so it's hard to speak of a strong market development. The market can already be considered established: there are big players, old projects with large audiences, and competition that complicates access to significant earnings for very young and inexperienced teams.

Nevertheless, each year the market makes small strides toward improvement. It grows and develops. One of the growth drivers is new developer tools on the platforms mentioned.

For further market development, access to a global audience is primarily needed.

A notable event is the launch of a games platform on "Pikabu." Due to this, developers now have access to one of the largest audiences in the Runet. "Pikabu Games" was recently released but is developing much faster than others. The number of games on it is already significant. In the future, I think it will become an essential project for "Pikabu," allowing the UGC platform to earn well. And it's gratifying to see that the "Pikabu Games" team actively helps promote projects on "Pikabu" itself, advertising them in various ways within the site's feed.

Yan Yankelowitz — Business Development Director — Overmobile

Today, the web games market represents an actively developing segment of game development, featuring both large/medium teams and a vast number of small developers trying to transfer popular mechanics and images from the mobile market.

There are major players in the market with traffic for all genres — VK Direct Games, "Odnoklassniki," "Yandex Games," and new platforms growing rapidly — "Pikabu Games," Gamepush. Large ecosystems of banks and operators are also showing interest, though more at the level of gamification. Few dare to create full-fledged gaming platforms like Beeline.

2. I see many young teams and mobile companies actively migrating to the web. Why this interest?

Alexander Schevelev — CEO — Maningame

The main reason is technological progress, which has enabled anyone to make games without a specialized education. Among the main changes:

- Improvements in the Unity engine, greatly enhancing build performance for the web;

- Development of asset stores;

- Advancements in vibe coding capabilities.

Thus, you no longer need to know how to draw, code, or be a UX specialist. If you want to create a game, with the help of assets, neural networks, and Unity (or Construct), you can piece together a game in just a few days.

Eduard Kumykov — CEO — Itking.pro

If we're talking about young teams (and in Russia), I think it's related to simple and convenient tools for release and profit. You can quickly release a game on the web and receive payments as a self-employed individual, which can be set up in five minutes.

However, if we discuss major players, for them it's just a way to generate additional revenue from a project. I know many cases where developers received payments from platforms simply for transferring large franchises to the web.

Importantly, such broad access to the Russian audience is only ensured by the web. In terms of reach, PC and mobile seriously lag behind the web as platforms.

Plus, to answer your question, developers are eyeing the web and forming an active community around it, which in turn drives conversations on this topic.

Yan Yankelowitz — Business Development Director — Overmobile

Mobile games are already a well-established market, where at the start it's almost impossible to get any organic reach and, therefore, installs for your game without marketing. So migrating to the web allows many small teams to acquire fresh players from platforms almost for free through features and placements in new releases.

Modern engines allow creating a multiplatform project with almost no changes, hence the web becomes just another distribution channel for many teams.

3. How much can you earn from web games in Russia at their peak (at least in terms of share from mobile)?

Alexander Schevelev — CEO — Maningame

If we consider the context of all releases from the past one to two years, ignoring "old" web games ("Pirate's Treasures," "Bottles," "Avatar," and other projects operated for more than 10 years), the situation is approximately as follows:

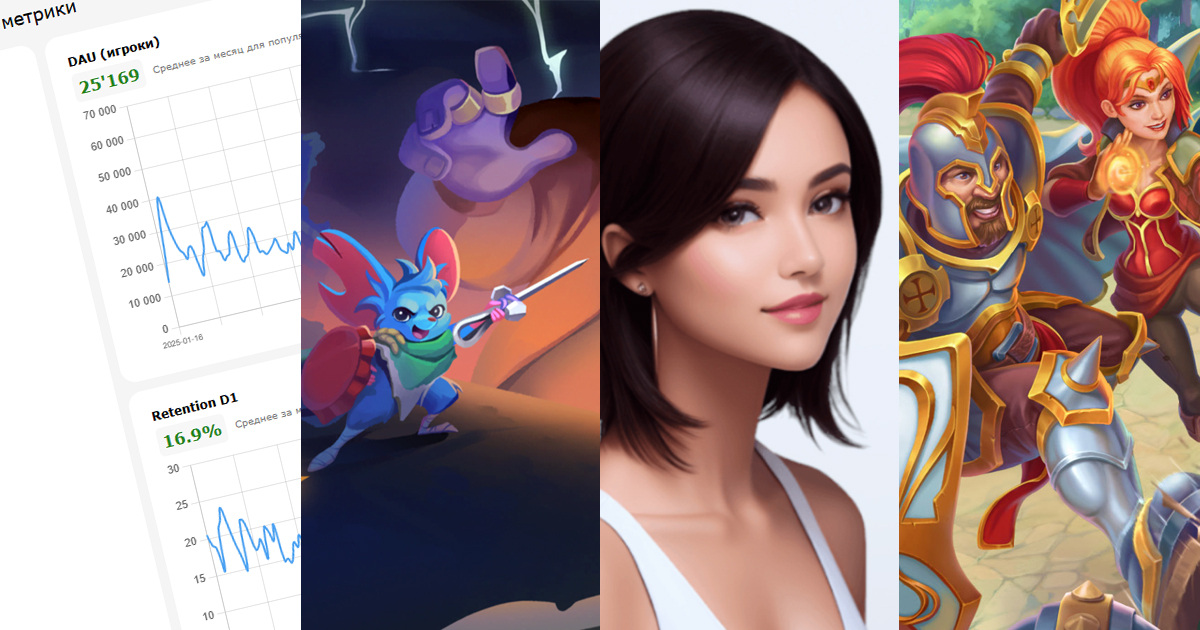

Professional studios (10-30 people with salaries, sprints, strategy, and experience of 10+) currently earn in the range of 2-8 million rubles a month from any of their titles. Their strategy is very straightforward: one or two quality games a year and launching on 15+ platforms ("Yandex.Games," VK, "Odnoklassniki," CrazyGames, GD, Beeline, AG, etc.) + mobile (Google Play, App Store, RuStore plus alt stores). They mainly make casual games with deep meta, mid-core, hyper-core, and farms. Basically, anything that can be operated for a long time.

The second part of the market consists of amateur teams (usually solo or 2-3 people). Some work 24/7, while others work "for fun in their spare time." When it comes to their level of income, it all depends on the developer's exposure and quickness. There are two main opportunities: either to catch a trend (Labubu, Italian animals, Obby, Huggy Wuggy, Skibidi) and quickly assemble something playable from templates and assets, or quickly create clones of hit mobile games or Roblox games that made it to the top. If a developer has such skills, they can earn between 100,000 to 1.5 million rubles per month (solo). Without such skills and trying to vibe code something unique and creative with assets, the developer's income is fixed at exactly 5 rubles, a single tariff.

Eduard Kumykov — CEO — Itking.pro

The best examples I know range from $10,000 to $30,000 per month from all partner platforms or about five percent of revenue from mobile versions.

Yan Yankelowitz — Business Development Director — Overmobile

It's difficult for me to speak for the entire market since there isn't much transparency in web market analytics services, but based on our experience, a successful project can earn from 5 million to 15 million rubles a month and above purely from organic traffic on web platforms without marketing expenses.

4. Regarding competitiveness. A few years ago, the market entry threshold was low. There weren't enough projects. You could launch and start earning with a crossword. What about now?

Alexander Schevelev — CEO — Maningame

Yes, that's true. Two years ago, you could make a joke game and earn a few hundred thousand rubles in a week. Now the situation has changed. Local oversaturation of games has occurred, but platforms still sharply lack quality projects. Every platform wants a more stable and predictable model to anticipate external traffic purchase. For this reason, platforms began explaining to developers exactly what they want to see in their catalog, in which genres and with which mechanics. Platforms view the market with a long-term planning horizon.

As for young developers, they don't have a few years; they want it here and now, so they still try to respond to organic audience moods, where mainly kids summon Labubu and Tralala requests.

However, there's still plenty of room in the web for everyone. There's still a lot of organic reach. Even if you create a not-so-great game, you'll definitely get thousands of organic installs. Based on the game's product metrics, the platform will either increase traffic to your game or ask you to start developing the next game, turning off the tap.

Eduard Kumykov — CEO — Itking.pro

It's much tougher now: the market has formed, and with it competition and a large number of projects, some of which have been earning for years. Hence, we have a familiar situation from mobile games, where users continue playing old games, and developers are forced to attract them to new titles for money. Not everyone can afford this. It may not be about traffic costs but rather an absence of experience in UA and a lack of understanding that marketing is a vital part of any project's development.

Plus, the issue of uniqueness arises. If you release a word game today without implementing something special, players will question why they should play your probably incomplete game with little content. In the end, they will return to an old, beloved project, and your game will receive low scores, reviews, and results. Bringing something new to a word game is challenging because players often don't want it; they usually prefer simple, familiar mechanics already realized in many projects.

Yan Yankelowitz — Business Development Director — Overmobile

Over the last couple of years, competition has become more intense. In particular, the question of traffic and the use of IAP monetization has become a focal point. An overwhelming number of simple casual games that flooded the web market in the past 2-3 years have significantly undermined eCPM.

Consequently, many platforms today focus not on the quantity of new projects but on their key metrics. They now pay attention to how well titles retain players and successfully monetize users.

5. Given the high competitiveness, can we say that the cost of web projects in terms of development and LiveOps has now approached that of mobile games?

Alexander Schevelev — CEO — Maningame

I think everyone professionally engaged in web games simultaneously develops for both mobile and web. Publishing a game on web platforms offers two excellent opportunities for mobile developers:

- Hedging the risk of failure in mobile installs (especially in initial tests if the CPI/LTV ratio fluctuates significantly);

- Diversifying income sources from a business perspective.

Therefore, I would respond to this question by saying that thanks to additional revenue from the web direction, mobile game authors have an excellent opportunity to cut their development costs, and, if successful, gain a new and stable source of traffic and funds from web platforms.

But, yes, because the development tools and pipeline for web games are similar to mobile, to meet the market standards, you'll have to spend as much as you would for mobile games development.

Eduard Kumykov — CEO — Itking.pro

Yes, but it's unlikely anyone is evaluating it that way. Usually, everything in mobile versions is included in the web as well. Porting to the web is simply implied. It's an additional source of revenue alongside mobile.

I haven't encountered situations where anyone assessed the cost of developing a specific web game, viewing the web as the main platform. Ultimately, launching in mobile is more promising. Everyone understands this.

Yan Yankelowitz — Business Development Director — Overmobile

I wouldn't say so. It's unwise to create a project solely for the web. More likely, large and medium teams plan the web as one of the distribution platforms. Consequently, the cost of web development just adds to the overall development cost.

6. What about marketing? How effective and expensive is it for web games today?

Alexander Schevelev — CEO — Maningame

If we look at the market from a high level, today web games mainly thrive on organic reach. There's plenty of it, and any significant attempt to purchase within the platform may lead to cannibalizing your free traffic. So with an abundance of organic traffic, few engage in significant purchases.

Attempts to purchase traffic outside the platform typically mean competing with fintech and e-commerce, which have broader purchasing capabilities. Additionally, it's important to understand that if your game is high-quality, the platform takes care of all external purchases. They handle it extremely well, leveraging their extended tools and historical data on purchasing for a broad pool of games.

Returning to self-purchase, mid-core takes a distinct approach here, purchasing over half of its traffic on its own. It's a very niche story. If you're interested, you can find a video of my talk about purchase for the web on App2Top. I covered all the details there: numbers, channels, and tools.

Eduard Kumykov — CEO — Itking.pro

In my opinion, the web offers more opportunities for experiments than mobile gaming, mainly due to the lower cost. In mobile, users are expensive, and the cost of UA mistakes is high. Hence, everyone treads carefully, using proven methods. On the web, though, the CPI can be very low (which I discussed in articles here and here). This allows for numerous tests and successful results.

This is vital for creative and new teams, as it allows them to craft very engaging and effective marketing campaigns, thereby attracting a large number of players and achieving high results, something they certainly wouldn't achieve on mobile. Breaking into the top through web marketing is much easier than on mobile, and especially on PC. I've personally seen this multiple times through my own experience.

Yan Yankelowitz — Business Development Director — Overmobile

The marketing of web games is limited to platforms with quality web traffic. For example, large networks like Google Ads or Yandex Advertising Network. This leads to high competition for ad placements with other market players — e-commerce, retail, fintech. But if you have a good product with solid monetization, buying traffic profitably is possible. However, don't expect budgets in the millions like in classic mobile games.

7. What challenges and difficulties in the web market significantly hinder developers?

Alexander Schevelev — CEO — Maningame

Compared to the challenges faced by mobile developers, the issues in the web market are so minor that they're almost embarrassing to mention. For newcomers, there are vast opportunities that outweigh any problems. Only one's laziness and unwillingness to learn can stop them.

For those with some experience, the main issue is the perpetual risk of falling into an endless cycle of clone generation. It's quick and easy money, plus a simple development cycle. You quickly get used to it and can no longer push yourself to create full-fledged games with some USP for the player (since you'll need to invent something on your own, and risks are higher). Eventually, you might start to believe that clones of someone else's intellectual work are your hits. And then you lose years away from real development, failing to enhance your expertise to reach the next stage of your growth.

Eduard Kumykov — CEO — Itking.pro

Optimization and strict control by platform managers — these two things greatly hinder the market and developers' growth.

In my opinion, web platforms should be freer (much). If a developer creates a non-optimized game, the audience should be the ones to "evaluate" it first.

Developers have never had issues with releases on Google Play or the App Store. When it comes to releasing adequate projects, managers there rarely influence or hinder the release. That's great. We've long wanted to see this on the web.

Anyway, judging by my experience, you always have to attract players yourself. So give more freedom in terms of release. Concerning managers, it would be better if they focused on features: deciding whether or not to promote the game to other platform users.

So, when discussing the web in Russia, the most important thing is maintaining close and excellent relations with managers. Overall, it's not bad, but that shouldn't be the priority for developers.

Yan Yankelowitz — Business Development Director — Overmobile

Lately, we've often faced technical difficulties due to various RKN blockings. We have to quickly come up with workarounds to ensure an uninterrupted gaming process.

There's a general difficulty in promoting IAP web games — acquiring traffic is hard and expensive.

We don't see fintech platforms and super apps like Ozon and "T-Bank" entering the gaming market, except for rare telecoms. They could add audiences to web games and invigorate the market.

8. Which platforms are of most interest, and which ones should be approached with a residual principle?

Alexander Schevelev — CEO — Maningame

It highly depends on the genre and target audience of the game.

If we're being very general, the first level for most genres is "Yandex Games," VK, and "Odnoklassniki."

If there's a foreign legal entity or publisher involved, then Crazy Games, Poki, Game Distribution, and PlayDeck are options.

Everything else largely depends on the game and the platform's interest in you. If you show good results somewhere, platforms themselves might approach you, offering interesting terms — often in terms of welcome traffic and features. They might guarantee some install volume. Some might offer a recoup or even discuss individual revenue share terms if you have a very strong hit.

In general, it's enough to understand that platforms are run by people too. You can openly discuss and negotiate with them without any issues.

Eduard Kumykov — CEO — Itking.pro

Definitely — it's "Yandex Games," as Yandex has the largest ad network in Russia, and web monetization largely relies on advertising if we exclude large and complex cases like Hero Wars.

Then the path diverges: mid-core and hardcore can look at VK, while something casual for women can head to "Odnoklassniki."

Next is the new player — "Pikabu Games," and platforms with access to audiences outside of Russia (e.g., Poki).

And for the most extensive non-casual projects — a release on your own website if you have big budgets for tests and UA.

Yan Yankelowitz — Business Development Director — Overmobile

In the web games market, there's a well-established trio that should be prioritized:

- VK;

- "Odnoklassniki";

- "Yandex Games".

These are must-haves for any developer.

Next, I'd approach new platforms:

- "Pikabu Games";

- Gamepush.

It is also worth trying to tap into major traffic sources (telecoms, banks) for potential cooperation. If there are resources for marketing, I recommend attracting audiences to your website.

9. What trends are currently observed in the web games market?

Alexander Schevelev — CEO — Maningame

Overall, the web market quickly picks up trends from TikTok, Roblox, YouTube, and mobile stores. Whatever appears there, shows up here within a week.

Eduard Kumykov — CEO — Itking.pro

I see a very positive trend towards the emergence of high-quality, large, complex, and interesting projects. This is encouraging, even though many of them were ported from mobile or created with a focus on it.

This is a positive trend for players. They should always be a priority. Players should motivate developers to create better games, dedicate more time to development, and not just chase quick profits by releasing simple or unfinished projects trying to jump on a hype trend.

Yan Yankelowitz — Business Development Director — Overmobile

Many large studios are entering the web market with quality projects. Recent examples include Ludus from Top App Games, Warfare 1942 from Fahrenheit Dev, and Pirate Ships from Herocraft.

Such releases drive the market, attracting players who can now play web projects of the same quality as on mobile or PCs. In the case of truly multiplatform projects, they can play anywhere.

The prevalence of simple web games has led to a drop in eCPM. Platforms are increasingly considering IAP projects.

There's also interest from major players — fintech, e-commerce, operators. However, their primary focus is on gamifying their loyalty programs. We would like to give their users the ability to play games without leaving the platform, generating additional ARPU for the platforms.

The Telegram game market has stalled; tentative steps there have not yet led to significant growth or success for games aiming at classic monetization methods (i.e., without issuing tokens and listing on exchanges).

New platforms like "Pikabu Games" are making steady yet confident strides. We are seeing an initial audience from there, and it's quite high quality. I hope their growth continues and that other major players in this internet segment start exploring web games.