OGQ: crypto gambling and crash games could become growth drivers for iGaming companies

OGQ Magazine has published the results of the iGaming sector for the fourth quarter of 2024, with a special focus on Western European countries.

Key Findings

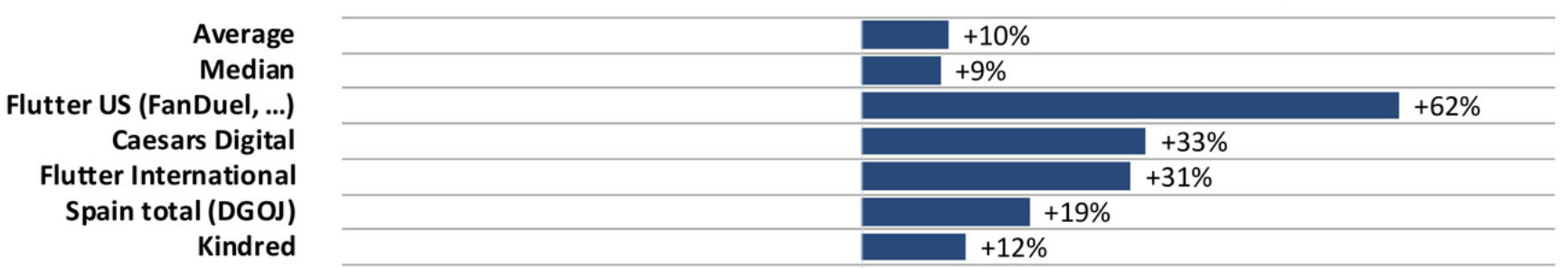

- From October to December 2024, the net revenue of bookmakers increased by an average of 10% year-over-year. The highest growth rates were recorded by the American division of Flutter Entertainment (+62% YoY) and Caesars Digital (+33% YoY).

Year-over-year growth rates of bookmaker revenue for the fourth quarter of 2024

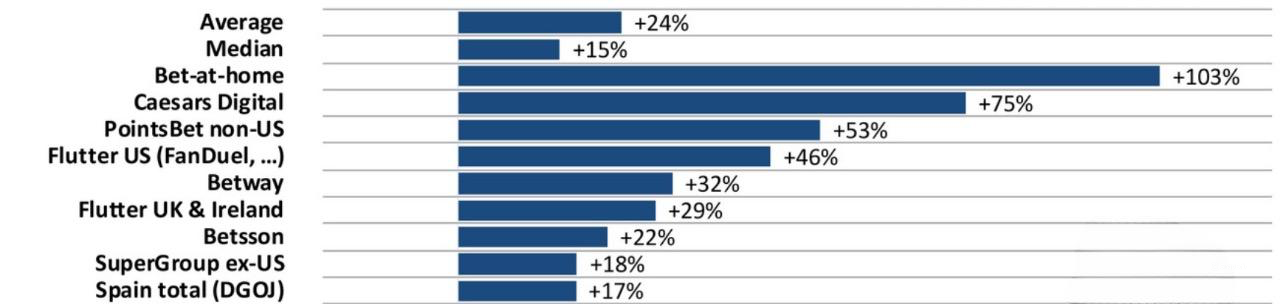

- Online casino operators earned an average of 24% more than the previous year. Financially, the best results were achieved by Bet-at-home (+103% YoY), Caesars Digital (+75% YoY), and PointsBet divisions operating outside the US (+53% YoY).

Year-over-year growth rates of online casino operator revenue for the fourth quarter of 2024

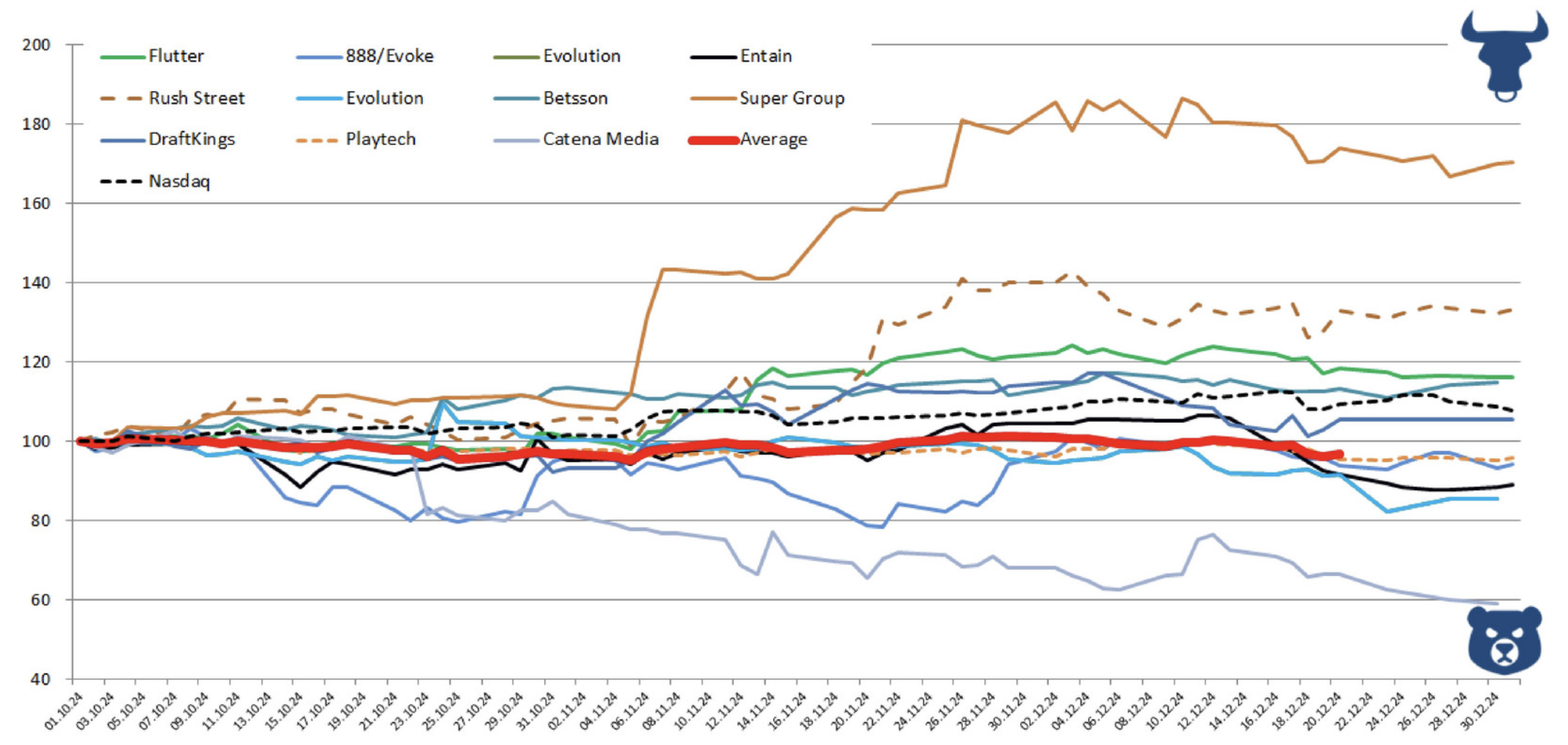

- In terms of stock trading on the exchange, the shares of the ten largest gambling companies traded on NASDAQ declined in value by an average of 2% compared to the same period in 2023. However, not all were affected by this decrease—Super Group's shares saw the largest increase (+71%) and PointsBet (+42%) for the quarter.

Stock price trends of major iGaming companies from October to December 2024

- According to an OGQ survey, 56% of industry analysts rated the current state of the sector as "satisfactory," while another 34% of respondents described it as "good."

- Surveyed experts expect that over the next year, the brand Kaizen Gaming (owned by Betano) and the online casino Stake will demonstrate the highest growth rates.

- OGQ also analyzed promising products in the iGaming market. Analysts estimate that the GGR of companies involved in crypto-gambling and creating crash games will gradually increase.

Sports Betting

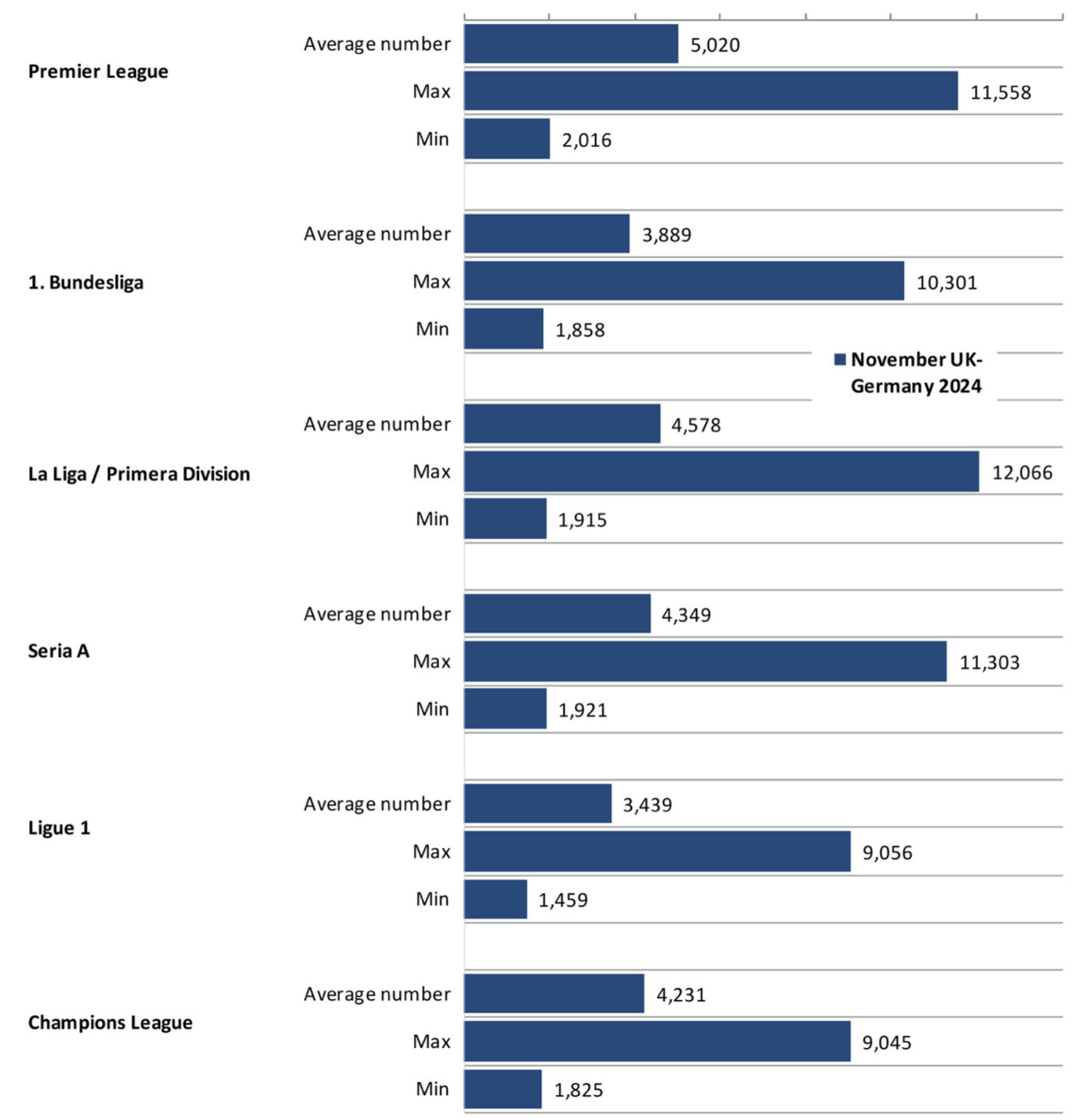

- In the fourth quarter of 2024, European bookmakers offered an average of 25,500 different markets (betting options) on football events. The top three events by this metric: English Premier League matches—an average of 5,020 bets; Spanish Championship (La Liga)—4,578 bets; Spanish Series A (Serie A)—4,349 bets.

- William Hill became the largest bookmaker in terms of the number of betting options offered: over 63,300 bets were available to users.

Top 6 football events by the number of markets offered by bookmakers

Live Sports Betting

- European bettors could choose between an average of 45 sports events for real-time betting.

- In live betting, Marathonbet was the absolute leader in the number of events offered—100 matches across various sports.

Distribution of Online Casino Categories by Number of Games Offered in Spain

- Slots—on average 1,442 slots. Leader—Bwin—with 3,388 games.

- Jackpot Slots—an average of 118 games. Leader—Casino777—with 213 such games.

- Table and Card Games (blackjack, roulette, etc.)—an average of 29 games. Most available on Luckia—70 titles on its site.

- Live Games—an average of 18 projects from each operator. Codere led with 34.

Distribution of Online Casino Categories by Number of Games Offered in Sweden

- Slots—an average of 3,723 slots. The largest number of offerings was from Videoslots—6,022 games.

- Jackpot Slots—an average of 324 games. In this category, Videoslots outperformed other operators with 714 games.

- Live Games—an average of 205 offerings. This segment also saw Videoslots leading—667 games.

- Table and Card Games—an average of 38 games. Videoslots offered 106 titles.