Tax Realities 2025 for IT Companies and Their Owners — A Detailed Analysis by Prospectacy

About the new tax changes in Russia concerning IT companies, explained senior legal counsel at Prospectacy Viktor Ivanov.

This material is an edited version of Viktor's speech at the business conference "Gaming Industry," which took place in October 2024 in Moscow (below is the lecture posted on YouTube, and by this link on VKontakte).

Briefly about what we will discuss today.

We will touch on personal income tax (PIT) and the introduction of a progressive scale. Unfortunately, for the most part, we will talk about increasing the tax burden, including on IT companies. We will discuss the simplified tax system (STS). We will touch on the introduction of VAT. We will discuss corporate tax and rate changes. There's a lot of grim stuff here. And finally, we'll discuss amnesty for business fragmentation and agreements on avoiding double taxation.

So, we start with PIT.

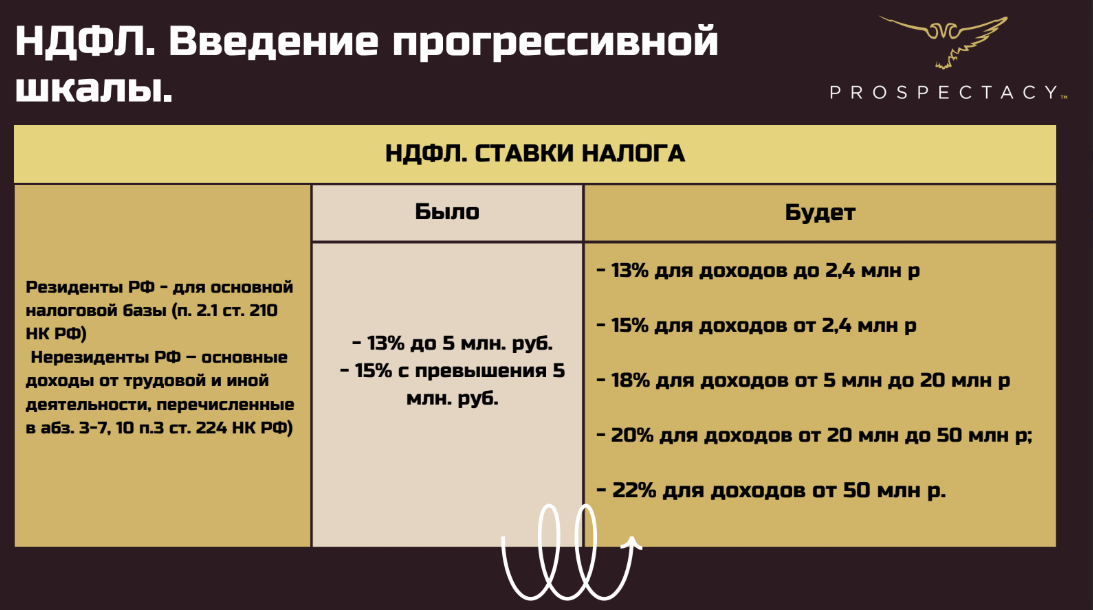

The main thing we need to know: the PIT calculation order has changed. It is now a five-tier scale, starting at 2.4 million rubles.

How might this actually affect income?

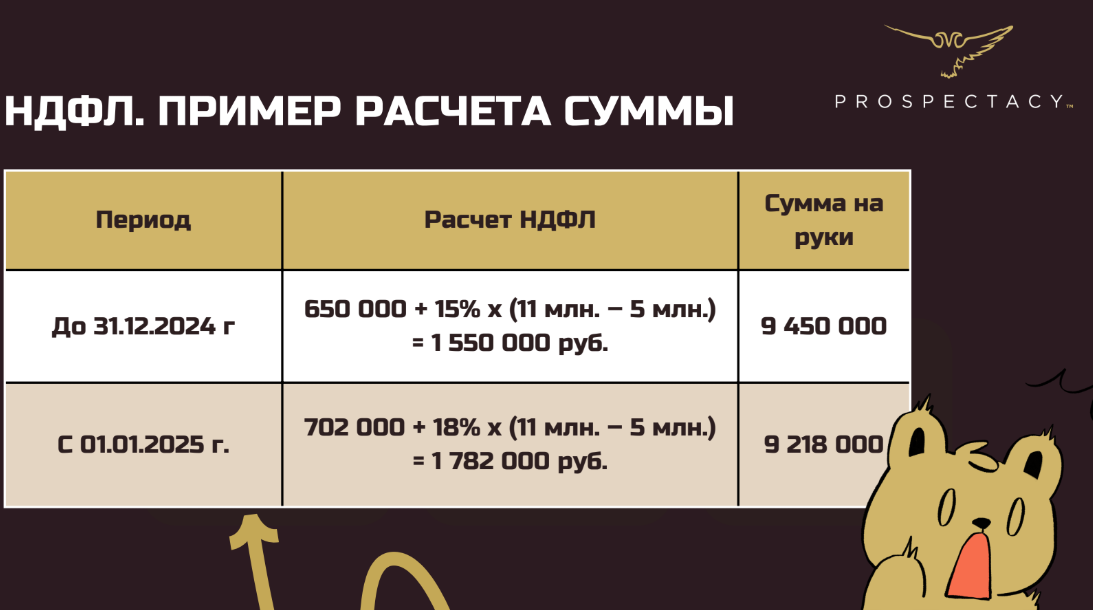

Let's look at an example.

We'll take a base income of 11 million rubles. This is a significant income, a good one. And let's see how the amount we receive changed in 2025 compared to 2024.

We see that from such an income, we now have to pay 232 thousand more.

It seems like a lot, but actually not that much, because the increased percentage doesn't apply to the entire amount. When calculating PIT, the amount up to 5 million is calculated at a 13% rate, and only above that at 15%. In other words, there are changes, but they're not fatal.

Let's also look at tax rates.

We see a trend toward unification. The 13-15% rates remain, for instance, on dividend income. However, now the threshold is set at 2.4 million, not 5 million.

For Russian tax residents, previously, income from the sale of property, the value of gifted property, and insurance payouts were taxed at only 13%, now the percentage depends on the income amount.

We look at non-residents, namely those Russian citizens who are outside of Russia for more than 180 days. They now have a unified 15% tax on interest earnings. Meanwhile, 30% remains for other incomes.

Who won't be affected by the PIT rate changes?

They won't affect participants in special operations. They currently do not face debt responsibilities, do not have court enforcement proceedings against them, and the same goes for bankruptcy.

Yes, if you or your employees have relocated, it is important to inform your company's accountant. If you relocated and were absent from the Russian Federation for more than 180 days, different rates will apply.

We have a case with our clients who relocated but didn't inform their accountants, while still earning income in Russia.

There are several methods to rectify the situation. One way is to formalize a remote employment contract. However, if it involves directors (any position including the word "director"), according to legal practice, a 30% tax is levied.

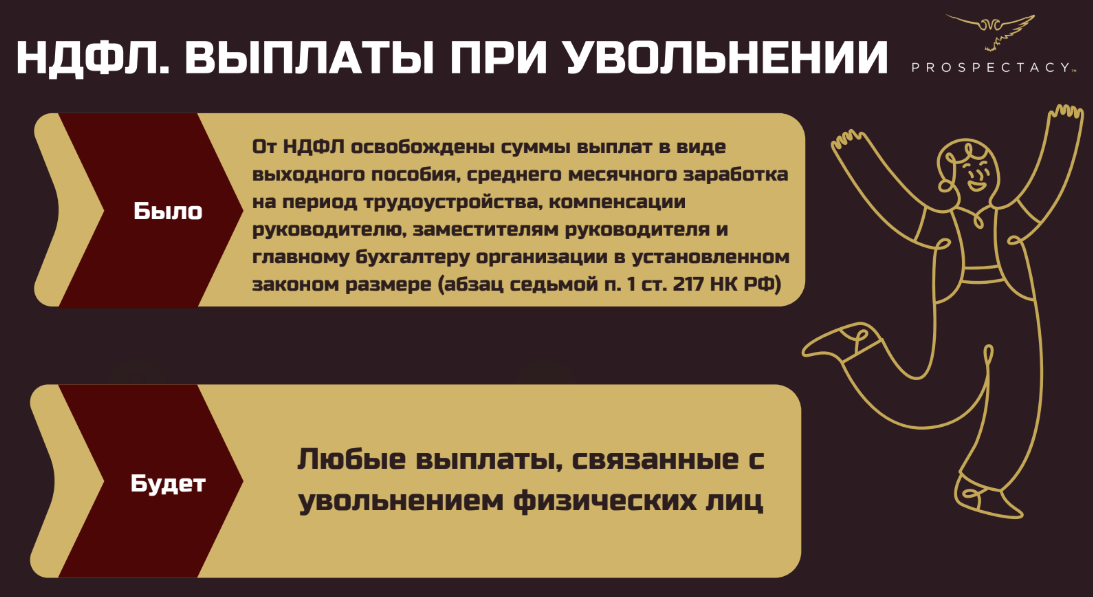

A little about layoffs. Previously some payments were not taxed under PIT, now most do not fall under PIT. This is a small ray of positivity.

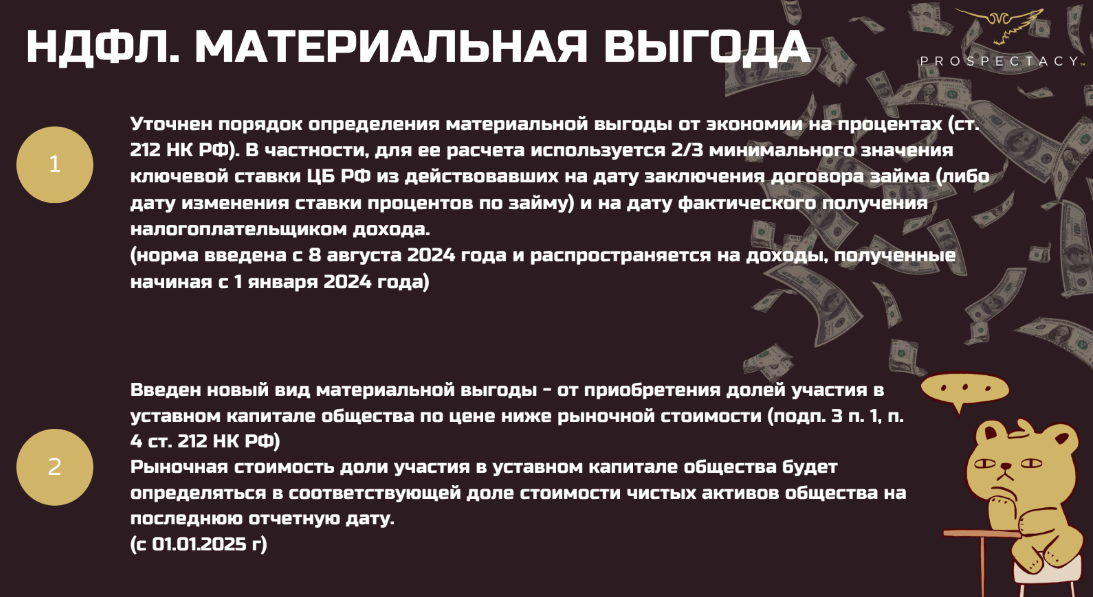

Let's now talk about material benefits. A new term, a new type of material benefit has appeared. This is the acquisition of shares in companies. What does this mean? For example, you are a co-founder of a company in Russia, and you decide to sell it.

How is it normally sold? It goes for nominal value, for example, 10 thousand rubles.

But now the tax authority says, hold on, let's take a look at:

- how much your net assets cost last year on the last reporting date (which is always December 31 of the previous year, meaning if the sale is, for example, on January 20, 2025, they will look at your company’s net assets as of December 31, 2024);

- the proportion of the share you sold.

After this, they will subtract the nominal share and use this base to calculate the tax for you.

This is a very unpleasant situation.

There's another point to be aware of — Article 212 of the tax code, which talks about material benefits and different types that may be taxed.

For instance, you are an affiliated person with your company. What does it mean? Well, suppose you have a share, you are a director, or you're a decision-maker, generally exerting some influence on the company. And the company gave you an interest-free loan.

Now the tax authority claims that for the duration of this loan, you essentially saved on interest, implying that you gained some profit. The tax authority wants to charge tax on this. They will take two-thirds of the key rate, calculate the interests for all the time this loan was used until it was repaid, and levy tax on that base.

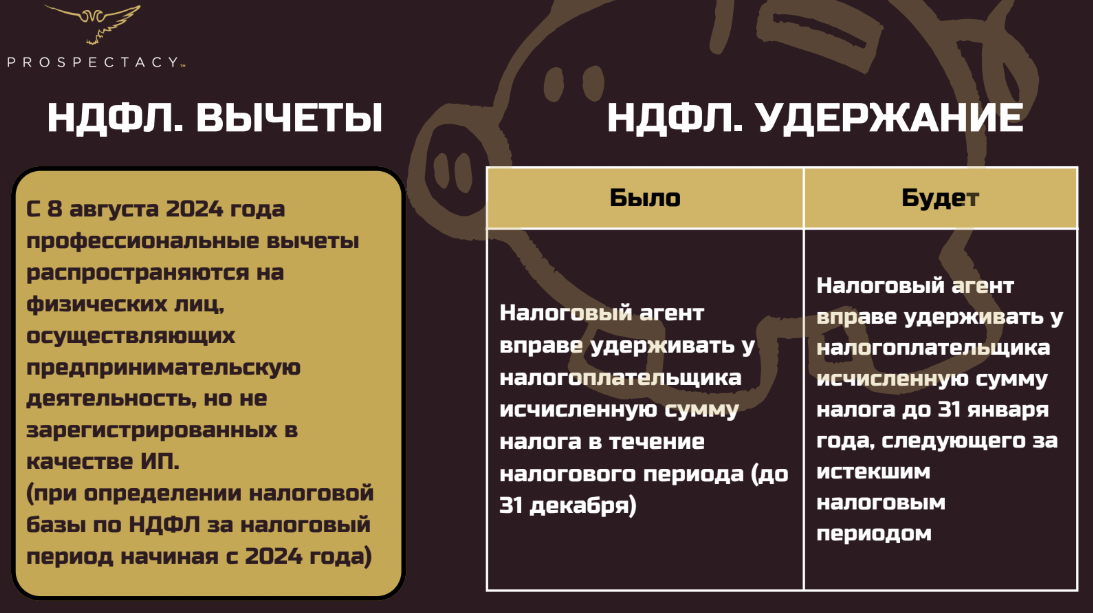

Touching slightly on deductions. There is an interesting aspect that must be mentioned: individuals engaged in entrepreneurial activity but not registered as individual entrepreneurs.

Who are they? They are, for example, those who rent out premises systematically, sell goods systematically, or earn royalties for certain activities without formal IP registration.

Now, you have the right to claim a deduction as a professional market participant. Previously, only individual entrepreneurs could claim this. This is positive news.

Regarding withholding: the option to withhold PIT, accruing from the previous period, has been extended until January 31. Previously, it had to be done by December 31, but now they gave an extra month. This slightly eases the burden on accounting.

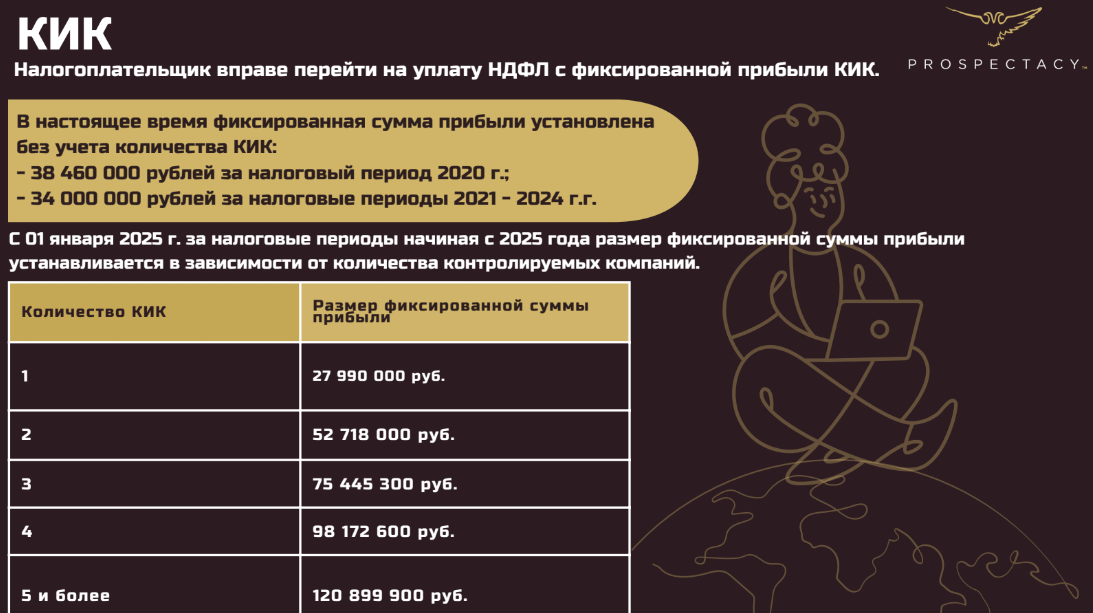

Proceeding to CFCs. For those not aware — a CFC is a Controlled Foreign Company. It involves an individual who controls, for instance, a domestic resident controlling a company abroad. Let’s say you open or buy a company in Kazakhstan; this company is a CFC.

It might seem that foreign company issues are not very relevant now, but actually, they are very relevant. No matter how long ago you established such a company, wherever it might be, even in a hostile country, you must still submit reports.

What has changed?

Currently, a fixed profit amount is established at approximately these figures.

The key change is that now the tax authority will look at fixed profits based on the number of CFCs.

For instance, you have a CFC, and it earns something. Let’s assume you want to tell the tax authority: my profit is this amount, I only want to pay tax on that. Legislation responds: you can only choose this amount based on the roster of CFCs. If your profit doesn’t reach, say, 27.9 million rubles, that’s your problem. The time has come to contribute financially; please pay tax on this, even if you didn’t receive this profit.

Important: once every five years, you can opt-out of such fixed profit unless the legislator changes the tax amount.

Such an opportunity is currently available. In the year the amount changes, you can opt-out of such fixed profit until December 31. By December 31, 2025, you can declare: no, I am no longer a payer of fixed profit as it has significantly increased, and it is much better for me to report and pay tax on the profit I show.

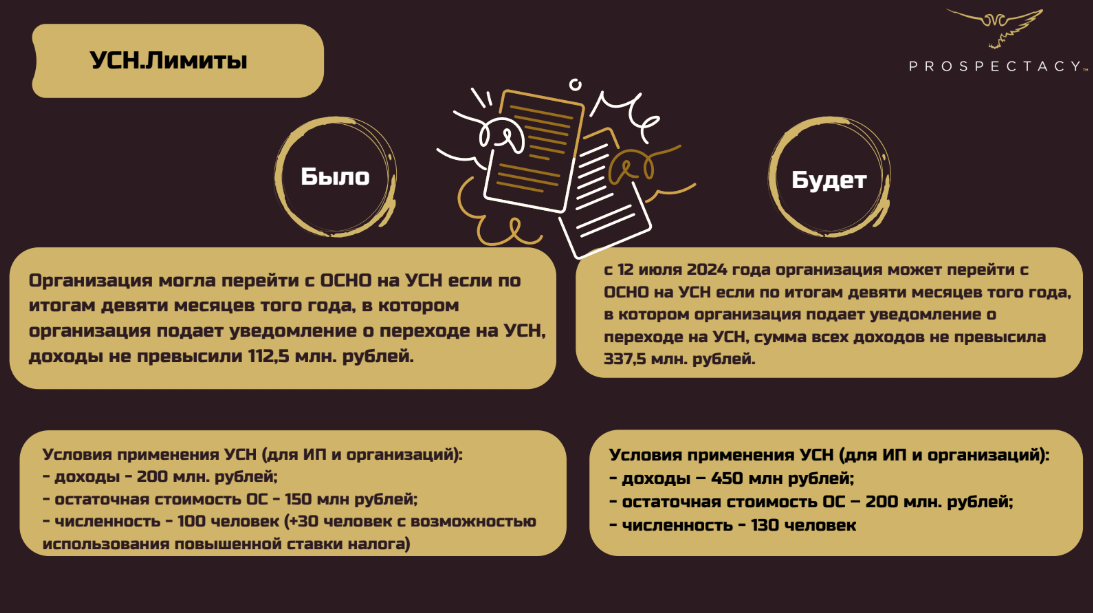

This brings us to the topic of the simplified tax system (STS).

Let's first look at the rates. The STS is now 6% and 15% (in Moscow, other regions have slightly different rates).

We won't dwell on conditions. Previously there were many conditions, including those depending on whether you had 100 or 130 employees. Now it’s easier. STS is applicable if you have up to 130 employees. If more than 130, then please consider forming, for instance, an LLC.

They also removed the limits concerning increased rates, although the main limits, of course, are preserved. The main one is not more than 450 million; it was previously 200 million.

Next up is VAT. Previously, STS and VAT were not even in the same sentence. Now, if you exceed a limit of 60 million in income per year, you will pay VAT. This is, of course, a negative point.

There's one asterisk: you can avoid paying VAT on developing and selling software if the software is listed in the unified software registry of the Russian Federation. Yes, then you will have a zero rate.

The legislators explain the introduction of VAT as a means to ensure a smooth and gradual transition to the general tax regime. In other words, our legislator wants most of our companies to predominantly pay VAT.

So, what should we do? We need to understand what type of VAT you should pay because there are several options.

Now on corporate income tax. It's grim, with an increase to 25%. The funds collected will go into the federal budget. Essentially, all changes are aimed at boosting the federal budget. Therefore, avoiding the tax is not possible.

With IT specialists and companies, the situation is somewhat different. The rate was previously 0%, now until 2030 it will be 5%. What happens after 2030 is currently unknown, but possibly the rate might increase.

Moving on to the topic of intangible assets (IA) and research and development (R&D). What do these scary abbreviations stand for?

IA are intangible assets, intellectual property objects that are used for more than a year and generate income (while they must have no material form and be separable from other assets).

Regarding R&D, it is a set of works, experiments in the innovative field aimed at obtaining scientific novelty and public utility.

From January, the coefficient used in forming the initial cost of IA and in determining actual R&D expenses in tax records has increased from 1.5% to 2%.

This means that our tax base has slightly decreased, so we now pay less corporate tax. This is good.

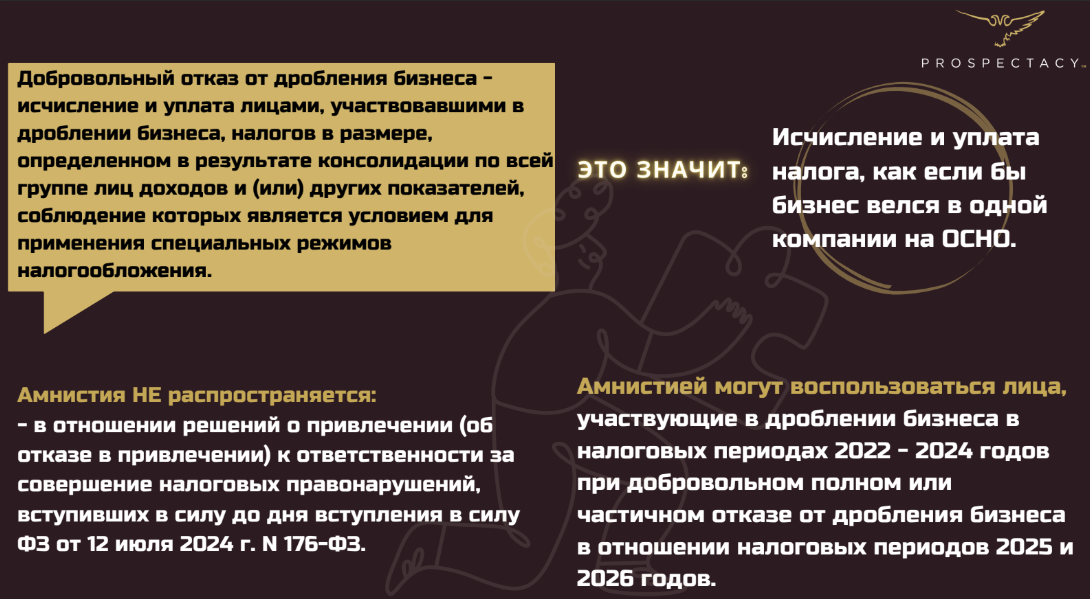

Moving further. We finally approach the issue of amnesty for voluntary refusal from business fragmentation. Now it's necessary to slightly discuss what business fragmentation is.

Imagine a hypothetical situation. You are engaged in game development. Different aspects of the game are managed by different companies. You might be an individual entrepreneur, your partner an LLC, another partner another IE. Despite different legal entities, work proceeds under one brand.

Why is this usually done?

To pay fewer taxes.

The state doesn't like it. It is actively combating this now.

For example, the state says: yes, we are raising taxes because we need to increase the federal budget, but at the same time, we are willing to forgive your efforts on fragmentation in the past three years.

By the way, the depth of reassessment is precisely three years (2022-2024), they won’t look at what happened before.

The state is ready to forgive this practice, promising not to levy additional taxes or impose fines on those who acknowledge the fragmentation and unite their assets into a single structure. Market participants have two years (2025-2026) to do this.

Yes, amnesty does not cover already made decisions regarding liability, you will still have to pay those.

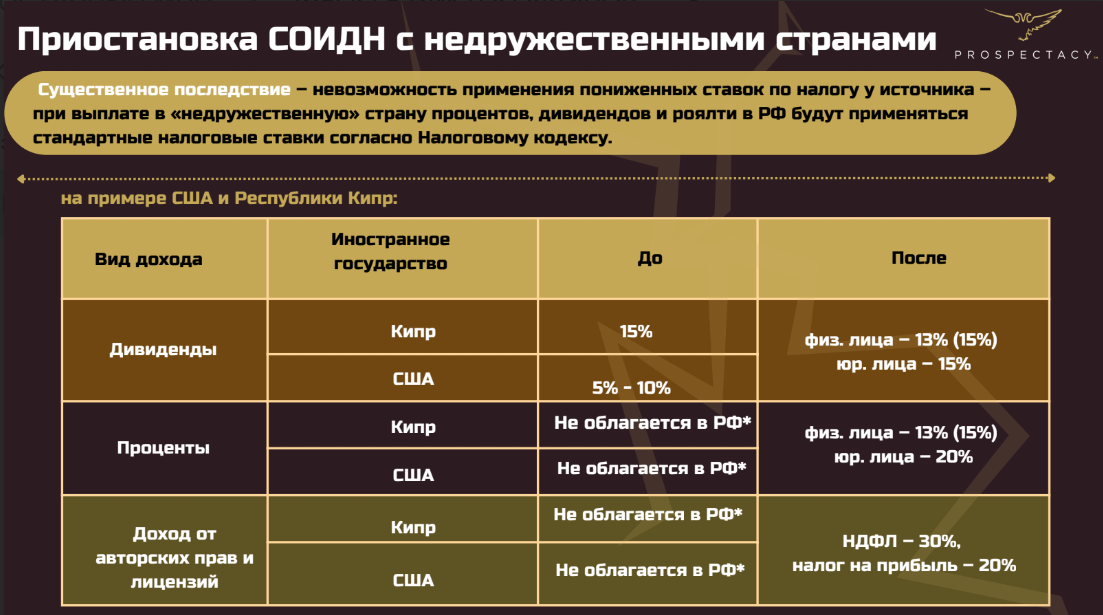

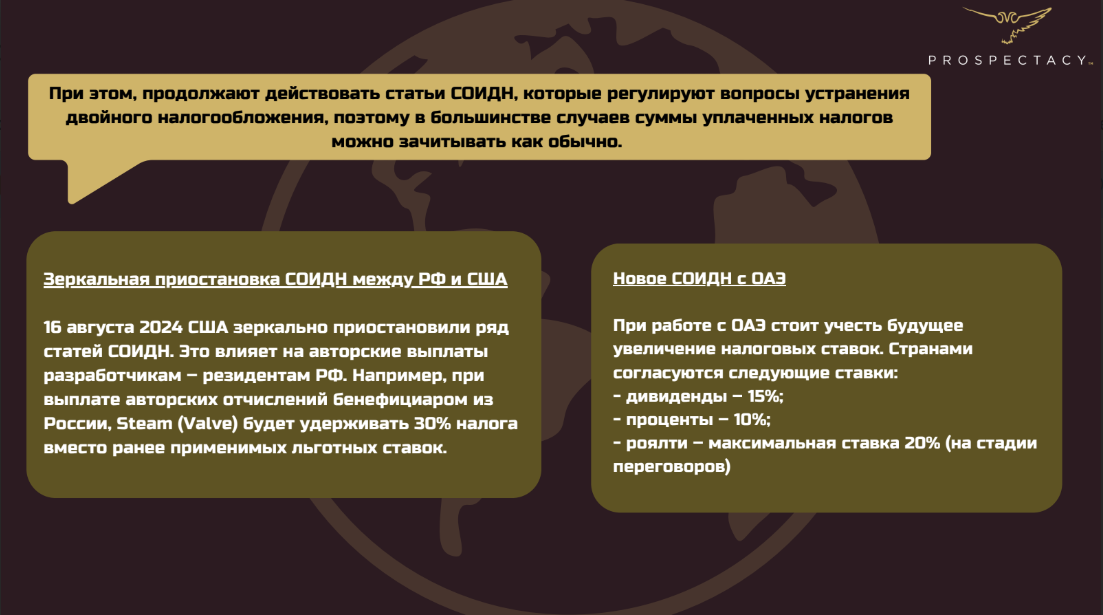

Now let's pause on the suspension of the DTT agreement. This abbreviation stands for the agreement on avoiding double taxation with unfriendly countries. I won't focus too much on this, just encourage you to review the table below.

Understanding that these agreements are not fully suspended is crucial. Some articles, particularly on avoiding double taxation, still operate, even in unfriendly jurisdictions.

For example, we have a Cypriot client with a company in Russia. He paid taxes in our country and then filed a declaration in Cyprus. The island credited them.

We will analyze the tax burden in former CIS countries.

In Armenia, we have 5-10% on interest and dividends. Income from copyrights is not taxed at all if you are a Russian resident.

In Kazakhstan, everything is taxed at 10%.

There are countries with which Russia does not have a DTT agreement. In this case, you will have to pay income tax in full both in Russia and in another country. This is how things are in Georgia, for example.

The last point we'll touch on is the taxation of foreign income in 2025. Note that PIT also applies to wages received from a foreign company and remuneration under service contracts with foreign companies.

That's all. Thank you so much for reading to the end.