Tencent "rejuvenating" its key games amid slowing domestic revenues, with focus on engagement and team reorganizations

Tencent has published its financial report for the first quarter ended March 31, 2024. With domestic game revenues slowing, the Chinese tech giant is now in the process of reorganizing some of its development process to accelerate growth of its portfolio.

Fight of the Golden Spatula

Financial highlights

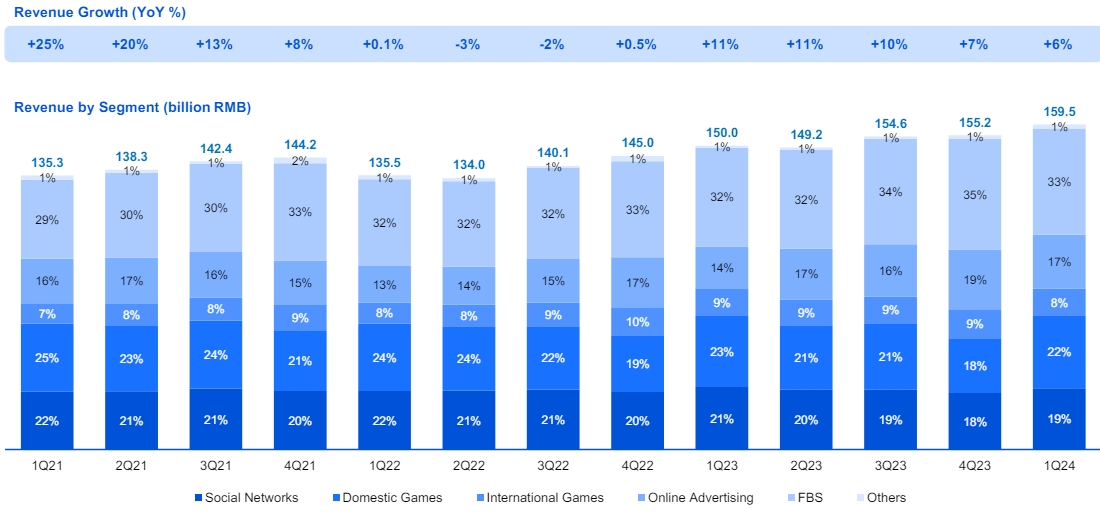

- According to its earnings release, Tencent reached 159.2 billion yuan ($22.5 billion) in revenue in the first quarter, up 6% year-over-year.

- Operating profit grew 38% year-over-year to 52.6 billion yuan ($7.4 billion), and net profit was 42.7 billion yuan ($6 billion) — up 62% compared to the same period last year.

- Video games accounted for 30% of the company’s total revenue in Q1 — 48.1 billion yuan ($6.6 billion).

- “During the first quarter of 2024, several of our leading games in China and internationally started to benefit from team reorganisations we put in place, resulting in an increase in games gross receipts and creating a foundation for our games revenue to resume growth in future quarters,” Tencent CEO Pony Ma said in a statement.

- The Domestic Games segment generated 34.5 billion yuan ($4.8 billion) in revenue last quarter, down 2% year-over-year. The main reason was the decline in revenue for its two main domestic titles, Honor of Kings and Peacekeeper Elite (Chinese version of PUBG Mobile).

- However, Tencent noted that both games experienced growth in March due to “new monetization cadence and enhanced content design.” In addition, several domestic titles such as Fight of the Golden Spatula (Chinese spin-off of Riot’s Teamfight Tactics), CrossFire Mobile, and Arena Breakout achieved record-high quarterly revenues.

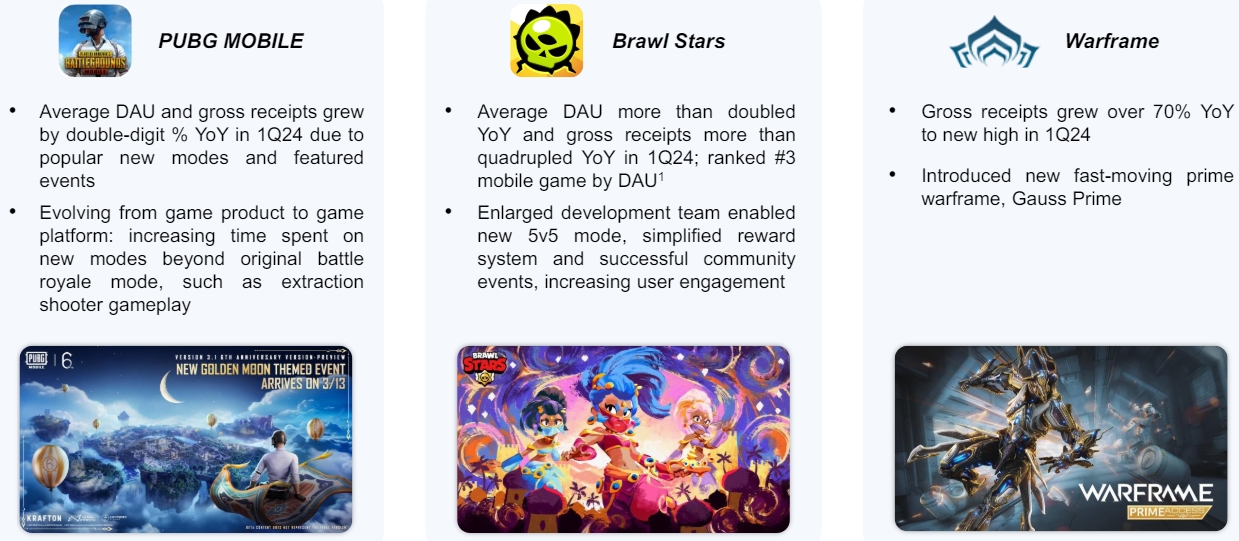

- The International Games segment’s revenue increased 3% year-over-year to 13.6 billion ($1.9 billion). Tencent cited strong performance of Supercell’s portfolio as the main reason for the growth, with Brawl Stars’ average DAU more than doubling YoY and its gross revenue more than quadrupling YoY.

- In addition, PUBG Mobile’s average DAU and gross revenue grew by double-digit percentages, and Warframe experienced a 70% growth in gross revenue compared to the same period last year.

Tencent is “rejuvenating” its gaming portfolio

As Tencent chief strategy officer James Mitchell said during an earnings call, “PUBG Mobile is evolving from a game product into a game platform with increasing user time spent on new modes beyond the original Battle Royale, notably the extraction shooter mode Metro Royale.”

He added that the company has been “in the process of rejuvenating some of our key games.” One of the things that Tencent learned during this process is that its successful live service titles should be capable of “growing new shoots and, indeed, rejuvenating themselves as evergreen trees should.” And if an evergreen game is stagnating, the problem is with the team running it. So the company plans to solve it by reorganizing certain teams, changing their mindsets and, sometimes, people on them.

When we make those changes, then we see positive results flow quite quickly. And if we don't see the positive results slow, then we make further changes. But the games themselves, these big competitive multiplayer games are inherently evergreen just as key sports, such as football, basketball, are inherently evergreen. And with the right people running the games, then we get the right results.

Chief strategy officer at Tencent

Mitchell also opened up about another challenge in today’s games market — launching new games. The biggest problem is that new releases have to compete not only with other new titles, but with existing live service games that continue to evolve and become better.

“That’s true on PC, it’s true on mobile, it’s true on console, it’s true in China, it’s increasingly true internationally as well, where you can see the time spent on the big consoles is more and more centered around the gigantic evergreen games like Fortnite, like Call of Duty,” he explained.

Tencent doesn’t plan to turn every new title into an evergreen live service product, with Mitchell saying that “they can still be successful profitable games that players enjoy and love.” But when launching a game with an evergreen potential, the company focuses on its retention rates rather than downloads and revenues. So engagement is key.

For example, Fight of the Golden Spatula had a moderate launch in terms of revenue and installs, but has now turned into the third-biggest mobile game in China, behind Tencent’s two other titles — Honor of Kings and Peacekeeper Elite.