Mistplay: "41% of gaming whales plan to reduce their spending and pay less in games"

The loyalty service for mobile players Mistplay has published a study on the behavior of paying users. We tell you about the key points of the work.

Methodology

For the study, Mistplay experts surveyed about 2,000 mobile paying players. Only those over the age of 18 and living in the United States and Canada participated. The survey was conducted from December 2023 to January 2024.

Types of buyers in mobile gaming

Mistplay divides paying players either by the amount of payments or by what games they spend their time in.

According to the amount of payments, players are divided into:

- high-cost buyers (high-value spender) — more than $100;

- buyers with an average cost level (mid-value spender) — from 10 to 99 dollars;

- low-cost buyers (low-value spender) — less than $ 10.

According to the games, users are divided into profiles. In total, the company allocates three:

- Casulka Candice;

- Midcore Mike;

- Lucky Lucy.

Not everything is obvious here, so let's focus on each of the profiles in detail.

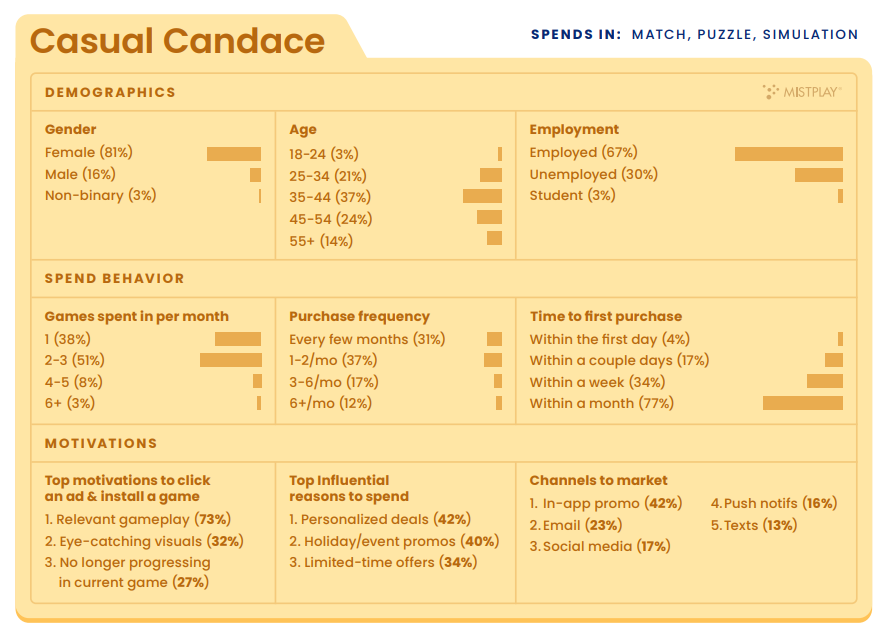

Casual Candace

We are talking about players who, as a rule, spend in match games, puzzles and simulators (here - farms and builders).

In 81% of cases, these are women. 75% of the profile representatives are over 35 years old. Half of these players spend 2-3 games a month at once. Only 4% of buyers from this group start paying on the first day.

Candice's Casual Profile

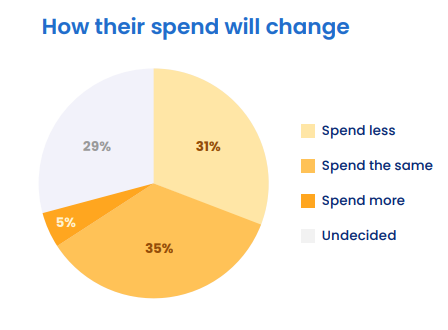

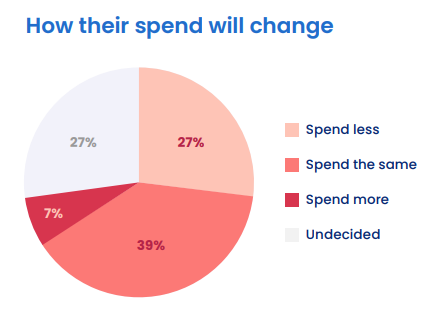

31% of respondents belonging to this profile are going to spend less on games.

How the players of the Casual Candice profile are going to change the nature of their spending on games in 2024

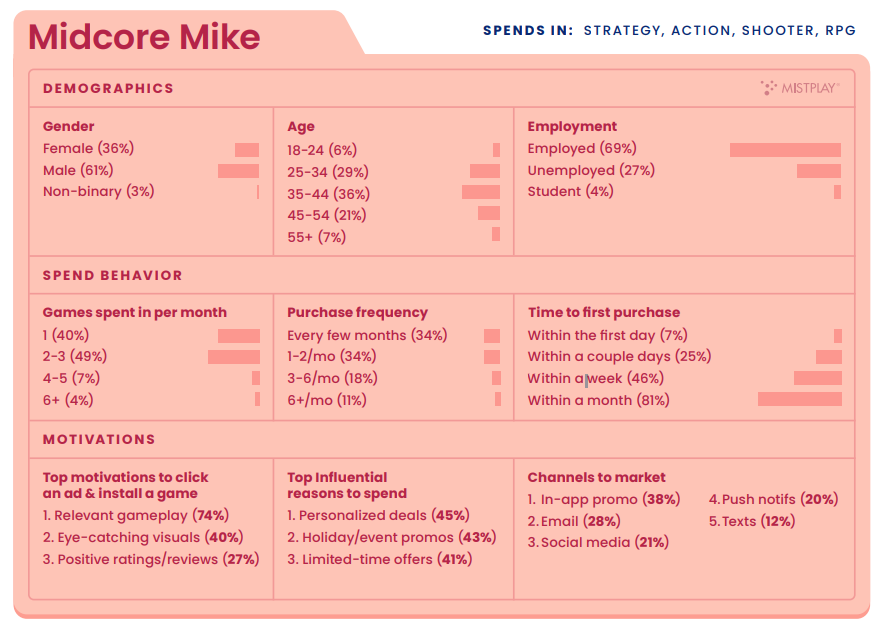

Midcore Mike

Those players who spend money in strategies, action games, shooters and role-playing games.

61% of the players in this profile are men. Despite the fact that the most numerous age group is the segment from 35 to 44 years old (36%), the share of "youth" is the largest here. Players under the age of 35 account for 35% of the profile.

Midcore T-Shirt Profile

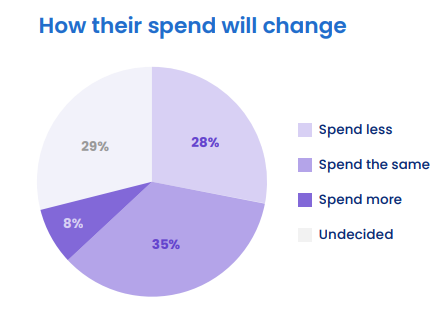

39% of the profile representatives assure that in the future they are going to spend as much on games as they spent before.

How are Midcore Mike Profile Players Going to Change the Nature of Their Spending on Games in 2024

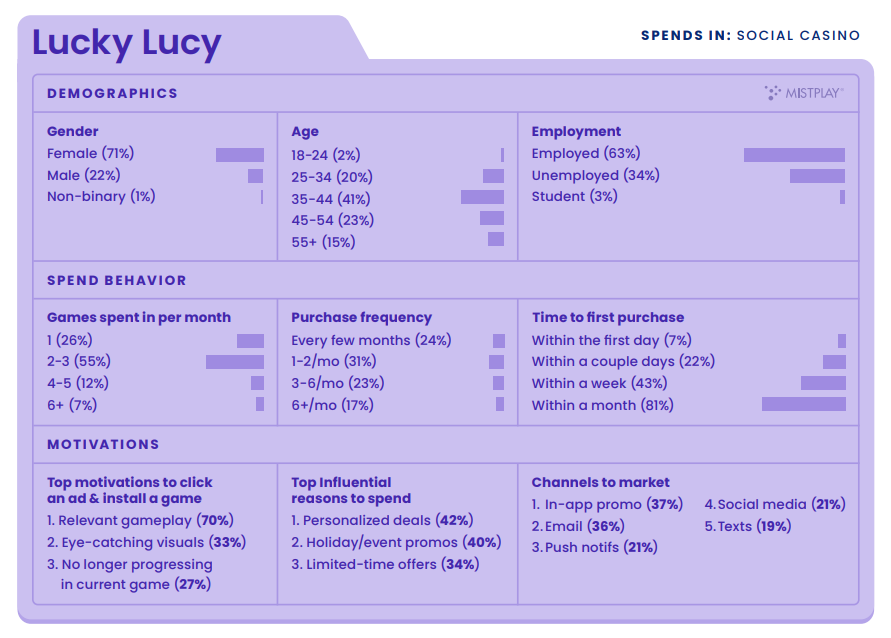

Lucky Lucy

Representatives of this profile spend in games that belong to the social casino genre.

71% of the segment's representatives are women. By age, the profile is as close as possible to the casual one. It is curious that among the fans of the social casino, the most unemployed (34%) are relative to fans of other gaming trends.

Lucky Lucy's Profile

Also, among the representatives of the profile, the proportion of those who are going to spend more than before is relatively significant — 8%.

How are the Lucky Lucy profile players going to Change the Nature of Their spending on Games in 2024

General patterns of behavior of paying players

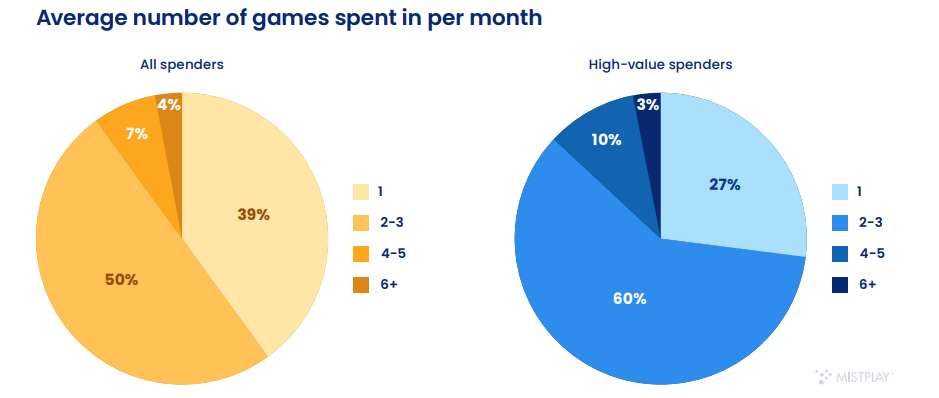

- 50% of paying players are not limited to one game, but spend two or three titles per month at once.

- 39% of paying players limit their spending to one game.

- There is a trend according to which high-cost buyers are generally spending in more games.

The average number of games in which paying players spend per month

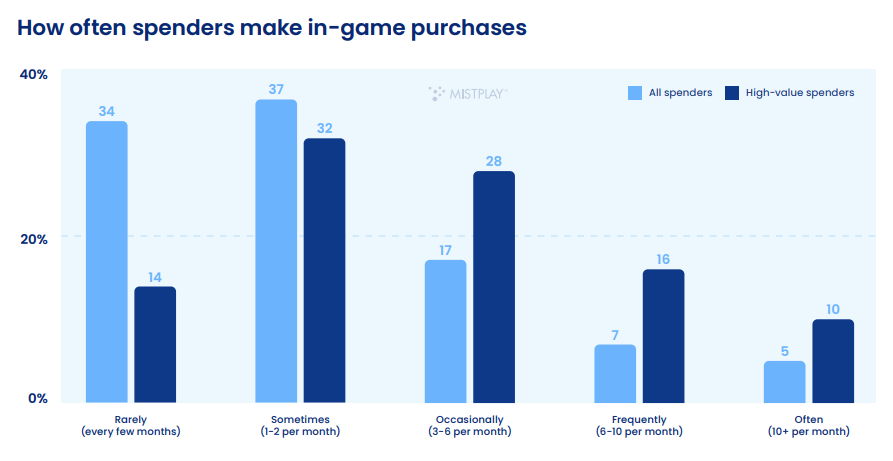

- 37% of customers make 1-2 purchases per month.

- 54% of high-cost buyers make three or more purchases per month.

How often do paying players make in-game payments

By the way, players belonging to the Lucky Lucy profile are less likely to pay in one game (26% versus an average of 39%), and more likely to spend in six or more titles at once (7% versus 4%), as well as to commit more three purchases per month (40% vs. 29%).

Paying players and advertising

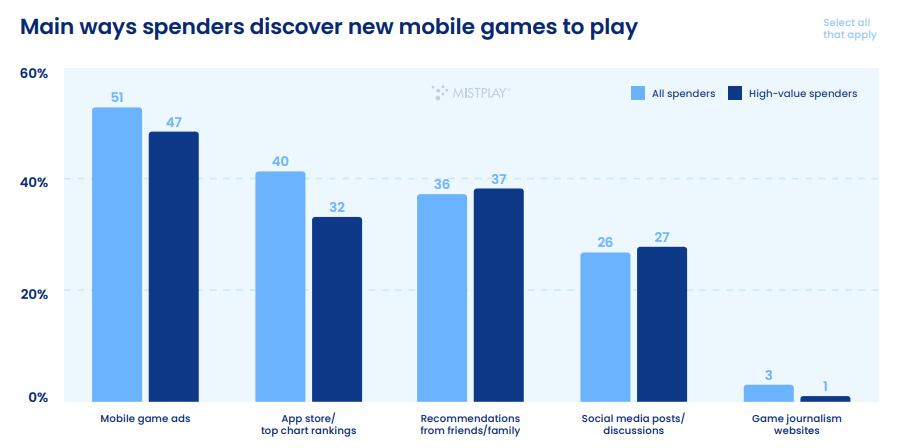

Mobile advertising is today the main channel through which paying players learn about new games. At least 51% of Mistplay respondents said this. The app stores/charts are noticeably lagging behind. This is especially noticeable in relation to high-cost buyers.

How do paying players find out about new games?

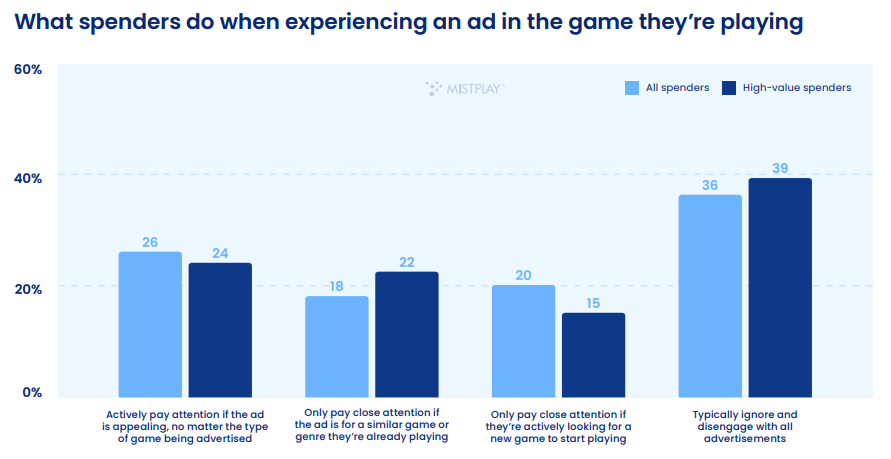

20% of customers pay attention to ads only if they are looking for a new game. But most expectedly ignore it and try not to interact with it once again.

The behavior of paying players when encountering in-game advertising

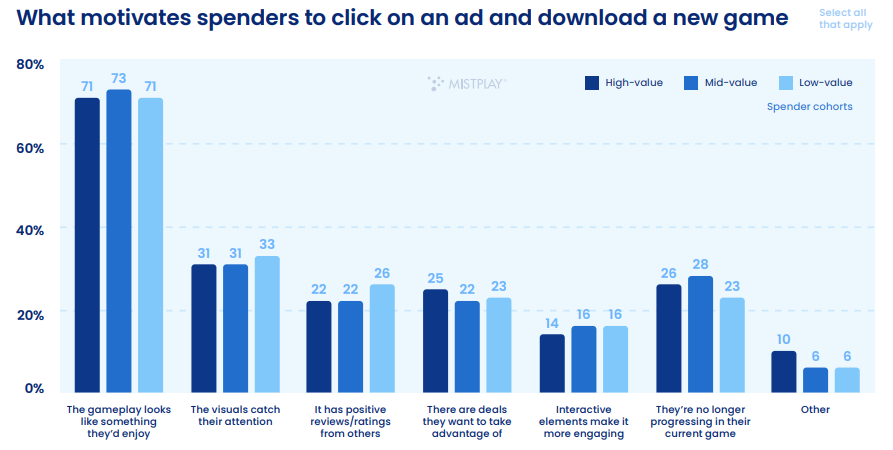

As for the successful conversion, 72% of paying players click on ads if they see the gameplay relevant to them. Curiously, a significant factor in the click is also the lack of progress in the game where they saw the banner.

What makes paying players click on ads and download the game

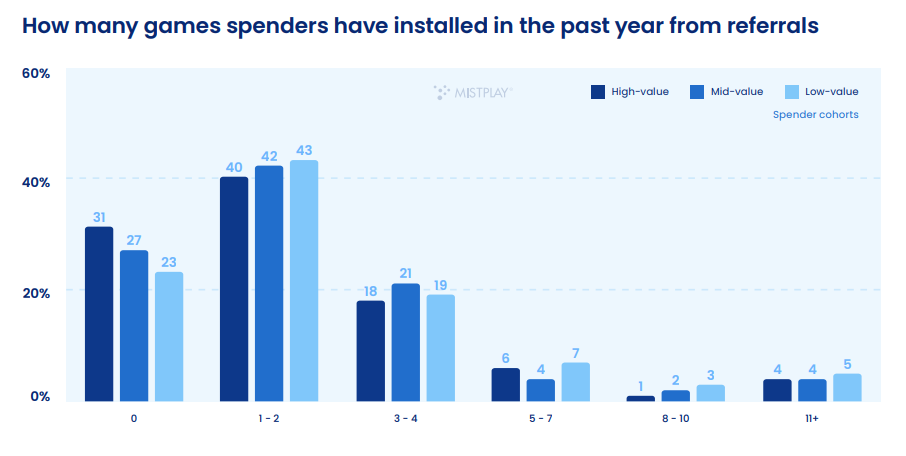

Paying players cannot be called experienced users of referral links. Most of the buyers over the past year have used one or two similar links in most cases.

How many games have paying players downloaded through referral links in the last year

Paying players and making payments

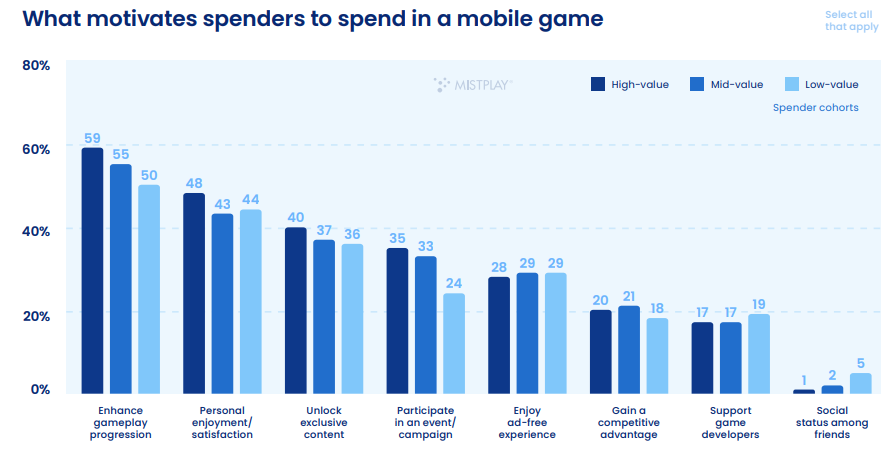

The main motive behind the purchases is the payment for progress. Also, paying brings pleasure and satisfaction to many people.

What motivates paying players to spend more

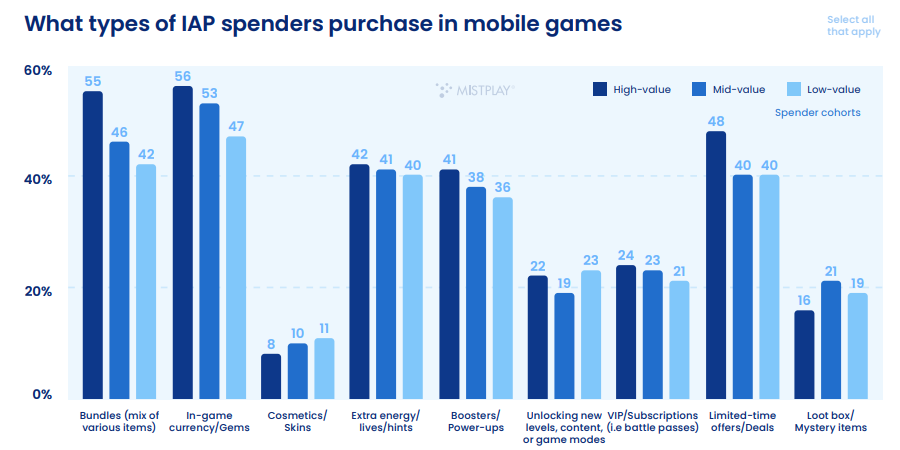

Most often, in-game currency and bundles are bought in games. In third place, with a noticeable lag, are time—limited offers.

What types of IAPs do paying players purchase in mobile games

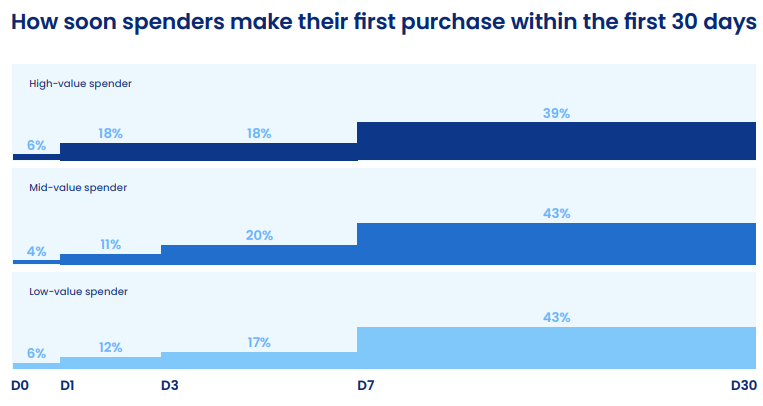

The first purchase in games usually takes place between the seventh and 30th day.

How soon do paying players make their first purchase in the game

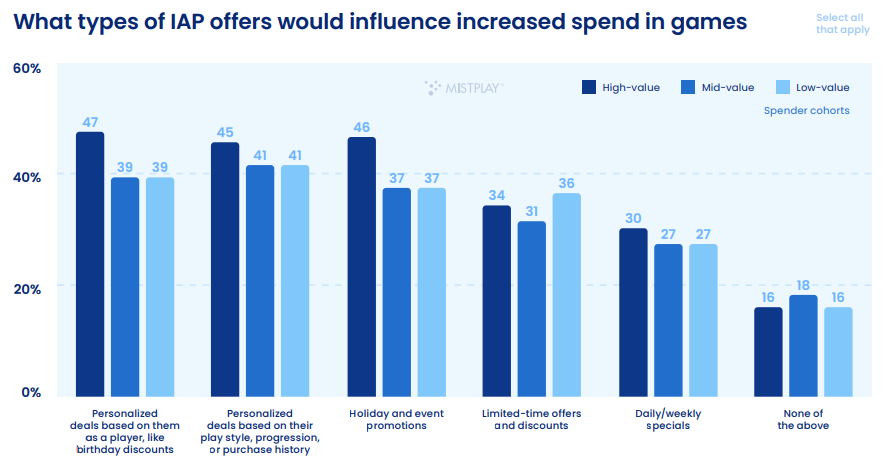

Answering the question of which type of offer will be able to convince to increase the payment, the majority of respondents noted "Personalized, taking into account personal data about the player (for example, Birthday)."

What type of offer will make the paying user pay more in the game

Paying Players and retention

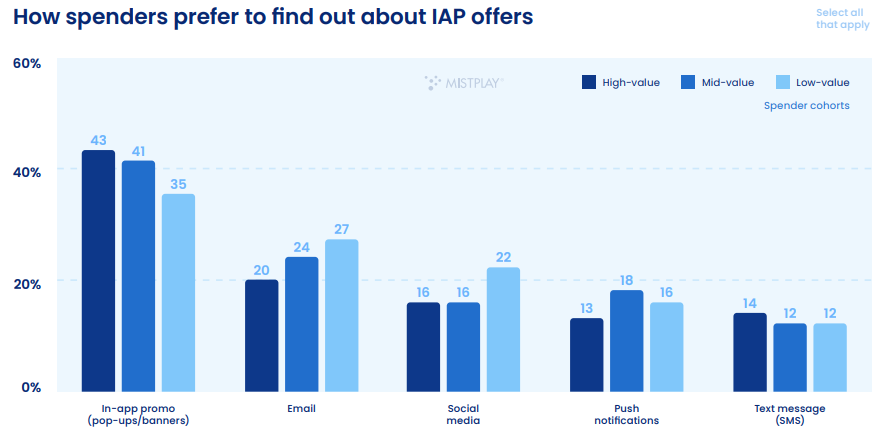

Most paying players prefer to learn about special IAP offers from in-game banners/pop-ups (39%). In second place is the mailing list with 25%.

How do paying players prefer to learn about in-game offers

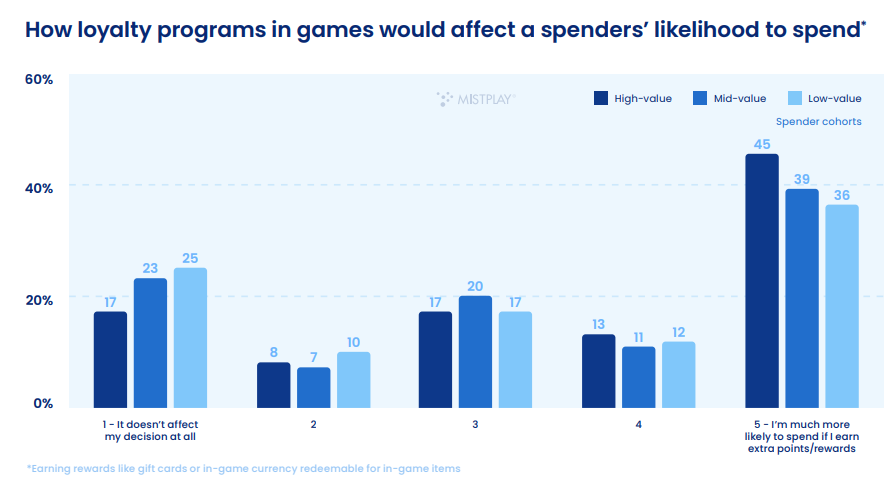

About half of the paying players noted that they are more likely to spend in the game if they can get exchange points or a cash reward for their purchase.

How loyalty programs affect the willingness of paying players to spend

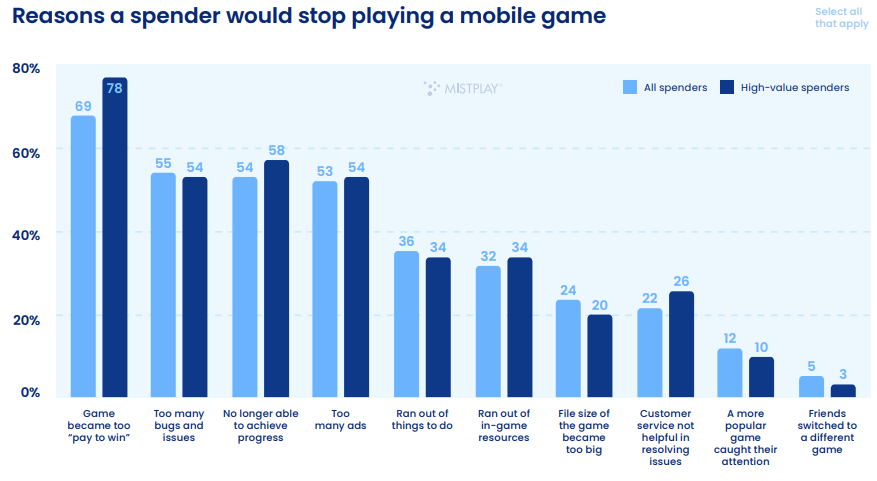

Most paying users have indicated that they will stop playing if the game becomes unnecessarily pay to win. Also, more than half of the respondents noted that they do not plan to play if the game has a lot of bugs or there is no opportunity for further progress.

The reasons why paying players can stop playing the title

Paying players and their future behavior

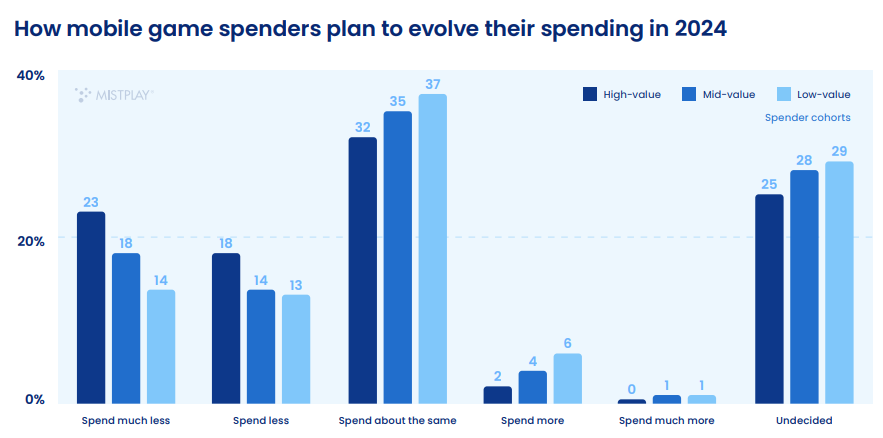

Most of the respondents noted that they do not plan to spend more. Moreover, 32% of paying players (41% of high-cost buyers) said they would spend less on games in 2024.

How paying players are going to change their spending in 2024

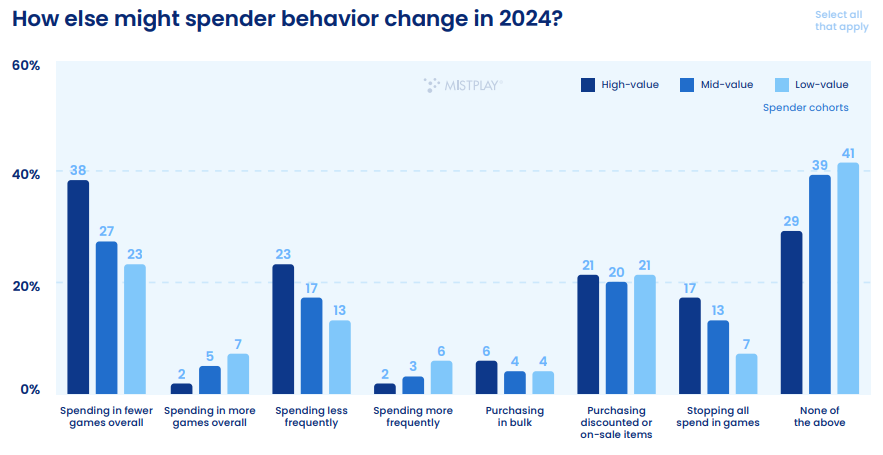

Also, many high-cost buyers noted that this year they will spend in fewer games and with less frequency.

How are Paying players going to change their behavior in 2024

The full version of the study can be downloaded here.