Gaming deals activity in 2023 decreased by over 50% compared to record numbers of 2020-2022

The global games industry saw 567 closed deals in 2023, according to market intelligence platform InvestGame. The Activision Blizard deal fueled growth in the total deal value, but overall the investment climate remains turbulent.

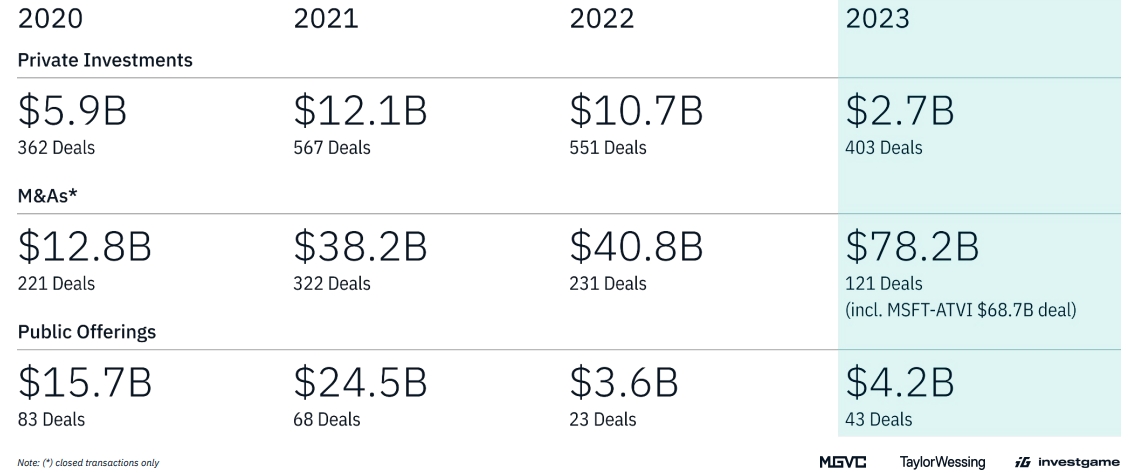

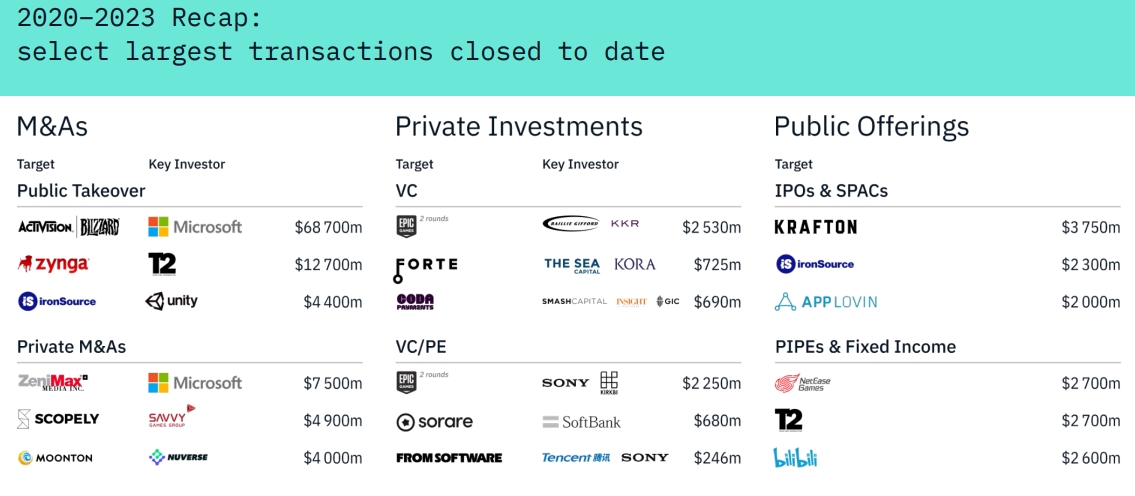

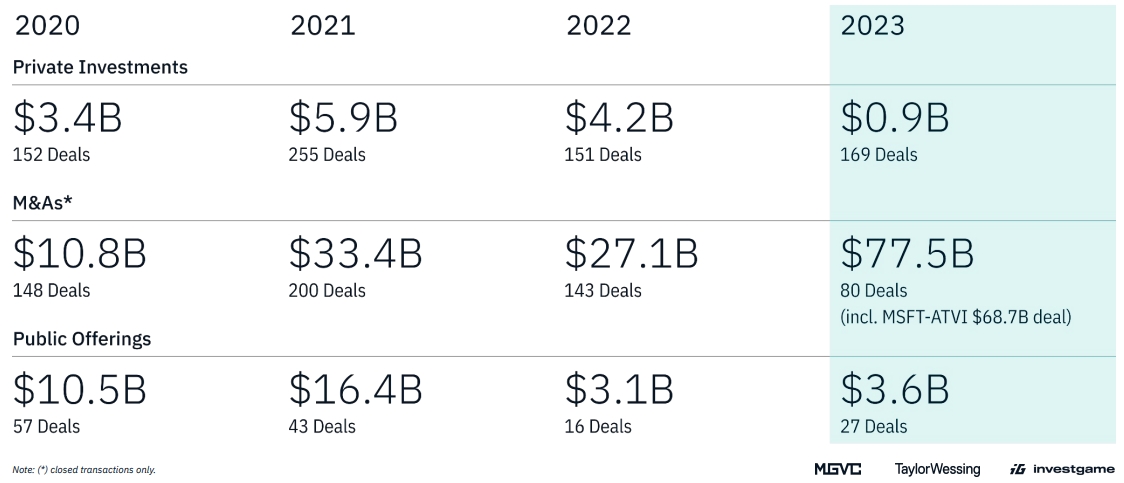

- According to InvestGame’s Global Gaming Deals Activity report, the total value of deals in the games industry was $85.1 billion, up 54.5% year-over-year. However, if we exclude Microsoft’s $68.7 billion acquisition of Activision Blizzard, the total would be much lower at $16.4 billion (-70% YoY).

- To put this in more perspective, the number of closed deals and overall investment values decreased by over 50% compared to the heights of 2020-2022.

- There were 403 private investments last year. Although the amount of capital raised totaled just $2.7 billion, InvestGame noted that the deal volume was above the pre-COVID level. Analysts expect activity to jump in 2024, as game-related companies raised a total of $1.7 billion in January alone (including the Disney x Epic Games deal).

- The M&A landscape saw 120 deals for a total value of $9.5 billion (excluding Microsoft x Activision) in 2023, with the number of closed transactions being 2x lower than the average across the previous three years. If macroeconomic conditions stabilize, analysts expect a “potential uptick in deal-making activly” this year, also citing the recently announced CVC’s acquisition of Jagex as a positive sign.

- Activity in the Public Offerings segment remained low, generating just $4.2 billion last year, a nearly sixfold decrease compared to $24.5 billion raised in 2021. However, there was still a recovery compared to 2022, both in value (+16% YoY) and the number of deals (+87%).

- When it comes to deals targeting game publishers or developers, there were 276 transactions with a total disclosed value of $82 billion (including the Activision Blizzard acquisition).

- The total value of private investments in the sector declined by 78.5% year-over-year to just $900k.

- Bitkraft was the most active VC game fund last year, with 18 closed deals. It is followed by Sisu Game Ventures (16), Andreessen Horowitz (12), and Griffin Gaming Partners (10). Bitkraft was also the leader in deal volume, investing a total of $290.7 million.

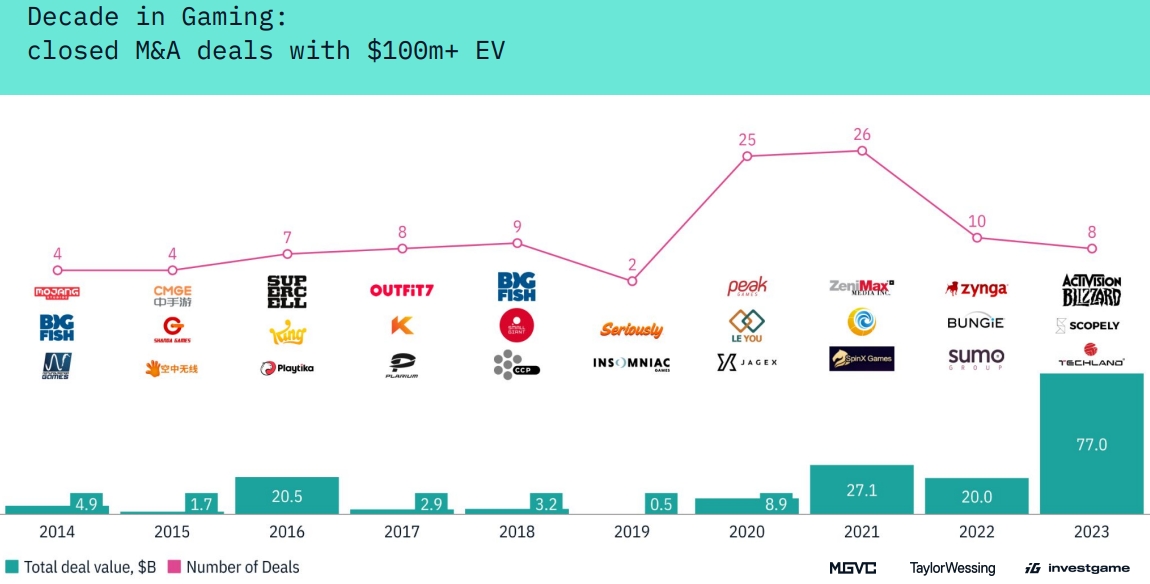

InvestGame also recalled all the closed M&A deals targeting video game companies with more than $100 million in estimated value over the past decade. Here are the years that stand out the most:

- 2016 — $20.5 billion, including Tencent x Supercell ($8.6 billion), Activision x King ($5.9 billion), and China (consortium of companies like Giant, Yungfeng Capital, etc.) x Playtika ($4.4 billion);

- 2021 — $27.1 billion, including Microsoft x ZeniMax ($7.5 billion), ByteDance x Moonton ($4 billion), and Netmarble x SpinX Games ($2.19 billion);

- 2022 — $20 billion, including Take-Two x Zynga ($12.7 billion), Sony x Bungie ($3.6 billion), Tencent x Sumo Group ($1.27 billion);

- 2023 — $77 billion, including Microsoft x Activision ($68.7 billion), Savvy Games Group x Scopely ($4.9 billion), and Tencent x Techland ($1.5 billion).