Nexters and the purchase of three gaming companies for $100 million: what profile investment experts think about the deal

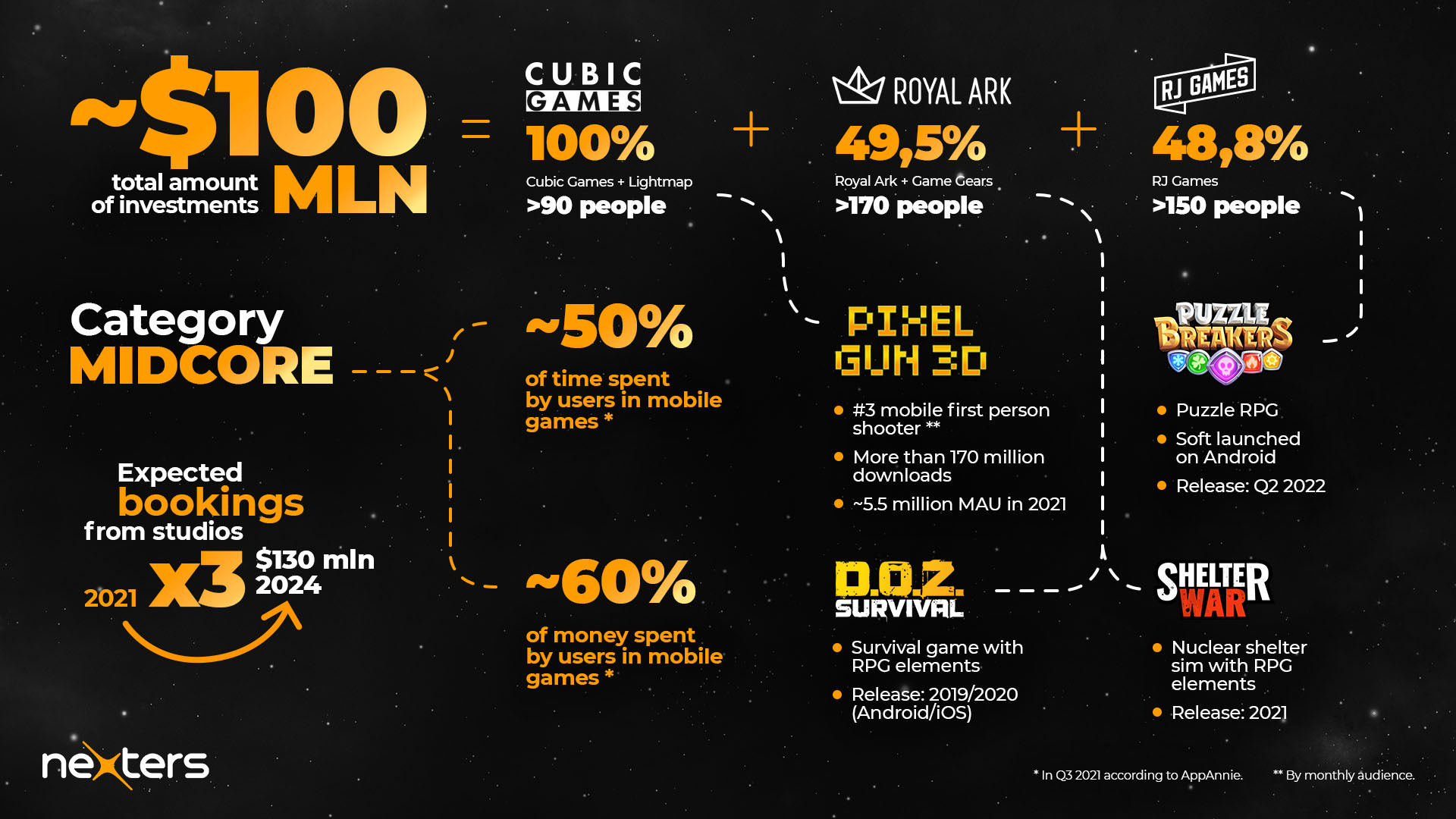

Nexters has conducted one of the largest M&A deals in the Russian-speaking gaming market. She spent $100 million to acquire three assets. We asked market experts to comment on the deal.

Transaction structure

The deal did not come as a big surprise to Kirill Gursky, one of the leaders of GEM Capital’s gaming business.

According to him, Nexters announced a strategy to consolidate the Russian-speaking gaming market at the beginning of 2021. Now she is implementing it.

Kirill also notes that as part of the deal with Kismet Acquisition One, the company previously talked about its plans to increase EBITDA from the $138 million expected at that time for 2021 to $201 million for 2023. A significant part of the increase in financial results was planned due to the purchase of other market players. These plans, according to him, were to a certain extent laid by investors in the evaluation of the company. To confirm it, Nexters needs to make predictions.

“As a result of the deal with SPAC in 2021, $ 300 million was raised, of which $15 million went to the costs of organizing the transaction and $ 150 million to buy out shareholders. The remaining $135 million was also provided for M&A,” Kirill recalls.

Without going into details, the deal with the Cubic Games group of companies cost Nexters $60 million at the current stage, RJ Games $15 million (plus an initial loan of $11 million), and with the Royal Ark group $ 5 million (plus the first convertible loan of $7.5 million). This is without taking into account future tranches, which depend on the performance of the acquired assets.

It turns out that most of the funds from entering the stock exchange were directed to the purchase of these companies. At the same time, the editorial board had a question about whether the acquired assets were revalued.

According to Gursky, it is not easy to assess the marketability of these transactions for a number of reasons.

Firstly, the complexity of their structuring and the absence of all the introductory ones: “In their press releases, Nexters discloses the initial payments and the amounts of loans issued to companies, but the devil, as they say, is always in the details. Each of the deals includes additional conditions, which, of course, are not disclosed.”

For example, the shareholders of Gracevale Ltd (Cubic Games) receive 15% of the transaction amount tied to certain KPIs. In the deal with MX Capital Limited (RJ Games), along with earn-out for $35 million, there are counter put and call options. And the structure of the acquisition of Castcrown Limited (Royal Ark) shares, in addition to the above options, includes a convertible loan.

“Any estimates without understanding all the terms of transactions (KPIs, rates on debt, conditions for its conversion, conditions for options) can be erroneous,” says Kirill.

Secondly, such important financial indicators as data on net debt and the level of profitability / EBITDA are not disclosed. Only the receipts (bookings) of Cubic Games and Royal Ark are published, which also makes it difficult to evaluate.

Finally, Gracevale Ltd (Cubic Games) and Castcrown Limited (Royal Ark) have an overlapping shareholder structure. Perhaps both transactions were considered together. In this case, their conditions must also be analyzed together.

Grigory Bortnik, editor-in-chief of the InvestGame analytical platform, agrees with Gursky. He also believes that it is difficult to answer this question directly, since the press release does not reflect the financial performance of the studios, only the receipts of two companies out of three over the past year.

“However, if we rely on bookings and on the fact that we link multipliers to the valuation of companies for 100% (excluding loans), then in general it looks like the multipliers are within the average market indicators,” says Grigory.

Kirill agrees with this position: “If we abstract from other conditions and assume that the profitability of Cubic Games is at an average level of 20-30% for the market, then annual EBITDA may be in the range of $ 5-8m. In this case, the studio was estimated at x7-x12 EBITDA with the potential to grow to x9-14 EBITDA when performing KPIs, which is in the range of market multipliers for other deals with gaming companies.”

Ilya Eremeev, co-founder and general partner of The Games Fund, agrees with Bortnik and Gursky regarding Cubic Games: “To estimate the authors of Pixel Gun 3D at $70 million with an annual revenue of $26 million is quite in the market. For comparison, there was recently a deal to sell Reworks for $600 million with revenue of about $6-7 million per month, excluding advertising revenue.”

According to Ilya, it may even seem that the market value of Cubic Games could well be even higher: “Pixel Gun 3D is a real hit, one of the best shooters on the mobile market.”

At the same time, he admits that the project has difficulties with scaling, which could affect the assessment.

“According to analytical services, Pixel Gun 3D revenue has been at the same level for many years. Perhaps one of the reasons is not the highest ARPPU and difficulties with the purchase of traffic. This is where there can be synergy with Nexters, which specializes in marketing and live-ops,” says Ilya.

At the same time, the Cubic Games group of companies is the least risky of the assets,” Grigory believes. Unlike the other two studios, the Cubic Games project has been in operation for a long time and demonstrates stable performance. For reference, in December alone, the revenue of her Pixel Gun 3D amounted to $2 million, taking into account the deduction of the share of stores and taxes.

The situation with the other two assets being acquired is more complicated.

RJ Games has put everything now on the Puzzle Breakers mobile battler under development. The company was owned for several years by the firm of the Buchman brothers, who also own 38% of the shares and votes of Nexters. And it is unclear why now, just before the release of the game, it was decided to transfer this asset to the disposal of the new owner.

“For the Buchmans, the transaction can be a test of the option with the distribution of all available small assets to large companies, according to the main expertise of the team (for example, they can decide to combine all their casual assets under the Playrix brand, all midcore assets under the Nexters brand, and so on),” Grigory shares.

However, according to him, the reason may be simpler.

“The studio’s main project is Puzzle Breakers. This is a midcore project. And it is on such games that Nexters himself specializes. Playrix, on the other hand, rather specializes in casual projects. Therefore, the transfer of RJ Games to Nexters looks as logical as possible. The authors of Hero Wars are ideally suited to the role of a team capable of helping the midcore game with both resources and expertise in the further development of the project,” Grigory emphasizes.

Ilya looks at the deal with RJ Games a little differently. He admits that this story is also about internal relations between shareholders, about which it is useless to guess. But at the same time, Yeremeyev points out the importance of acquiring itself.

“A public company needs to increase revenue to increase capitalization. In part, this can be implemented organically, through the development of internal products. But also an almost mandatory program is the purchase of companies with potential, where the buyer can accelerate the growth of the acquired company,” says Ilya.

As for the acquisition of Royal Ark, then both experts agree that the valuation of the entire Royal Ark at $ 10 million looks fair.

“Some startups raise money based on this assessment, without having a finished product and revenue. And Royal Ark has several hundred thousand revenue per month,” Eremeev notes and immediately adds: “Midcore, survival and zombies are something that will always be relevant. Plus, in the current state of the market, it has good prospects in terms of attracting an audience.”

Nexters management expects that by the end of 2024, the total receipts of acquired games (Pixel Gun 3D, Puzzle Breakers, Dawn of Zombies and Shelter War) will reach $130 million.

“The task is ambitious. I wonder if companies will be able to achieve similar results with the help of Nexters’ marketing experience. By the way, the opening of Nexters trading on Nasdaq was $10.5 (the value of the company’s shares at the end of January 28 was $7.23). The implementation of plans to increase financial indicators can be positively perceived by investors and contribute to the growth of quotations,” concludes Kirill Gursky.