"Panic is stupid. The long—term investor who does not succumb to it wins," - Vlad Suglobov about the history of G5 Games

Next year G5 Games turns 20 years old. The company is approaching the anniversary at the peak of its form. In January-September of this year alone, she earned $117 million. We talked about how the company developed with its co-founder and permanent CEO Vlad Suglobov.

Vlad Suglobov

Alexander Semenov, Editor-in-Chief App2Top.ru : You started playing games in 1995. How and where did you start?

Vlad Suglobov, CEO of G5 Games: It’s important to note here: in 1995, at the age of 17, I started creating games professionally. I was playing games as a hobby long before that.

Even as a child, I decided that I would make games, or at least work with computer graphics.

I started trying to write them from the 7th grade, that is, since about 1990. First he wrote in Basic, then in Pascal and Assembler. The latter was needed to work quickly with video memory, if anyone remembers.

At first I was engaged in development in computer classes (computers were rare then, almost no one had them at home), then on a home self-soldered Orion-128K computer in hexadecimal codes, then my parents took pity and brought me a decommissioned EC1841 from work, and then, when they were convinced that it was serious, they bought the 286th and then the 386th.

In 1995, there weren’t many gaming companies in Russia. Which one exactly did you start at?

Vlad: In Nikita. Then it was probably one of the three gaming companies in Moscow. She had a two-room office and several employees. At the same time, I entered the first year of the Moscow State University. That’s how it started: I studied at Moscow State University for half a day, made games for half a day, first 2D, and then 3D. This went on for 5 years while I was studying at the university, although I rarely appeared there for the last three years.

And you were a programmer?

Vlad:Yes. I have already programmed, of course, not in Pascal, but in C++.

At Nikita, Vlad also took part in the development of Parkan: Iron Strategy (2001), which was released after his departure from the company

In 2000, you graduated from the university with a degree in mathematics, programmer. What happens next?

Vlad: I was well aware that I only wanted to play games, and there were very few such options at that time, you could count on the fingers on one hand. The problem was that all or almost all of them were located either in rented apartments or in basements.

Nikita, by the way, was an exception. She had the best office in the industry at that time.

There were already as many as five rooms, the renovation was fresh and bright, and from the balcony there was a good and somewhat philosophical view into the distance.

But it so happened that I left. On the one hand, the salary situation has ceased to satisfy me. On the other hand, I have been developing games for 5 years, I wanted to try something different.

That’s why I joined a small team of my former colleagues who worked on the American startup Voxster. At the same time, I continued my studies in graduate school.

How did it happen that you returned to the games, especially in a new capacity — as a business owner?

Vlad: Life made me.

At Voxster, we made a voice chat from e-mail with the money of American investors.

I quickly regretted leaving the games. It turned out that doing something other than games is extremely boring for me. I forced myself to go to work.

Plus, we didn’t finish the system, because the year 2000 happened: markets collapsed, technology companies went bankrupt en masse, the investor’s money ran out abruptly.

We stayed in the office with computers, but without money and salaries, we had to decide what to do next. We decided to make games, and I was very happy about it.

After a few months of hard, free, but very pleasant work for me, we were able to attract Angel’s money. As for the graduate school of the VMK and thoughts in the spirit of “and not to enroll in philosophy”, I gave them up: there was not enough time anyway.

Wasn’t it scary?

Vlad: At first, no, but when they took the money, it quickly became scary.

Is it scary now too?

Vlad: Now we have more than 20 projects on sale, many of them can be called large. There are also many projects in development. We are able to support and do all this with our own money.

We also understand that some of the games in development will fail (this is normal, those who are not mistaken are not trying hard), some will earn a lot of money, and some will turn out to be just normal games.

Such a differentiated portfolio makes us a very stable and reliable company.

At that moment we didn’t have such opportunities. We made a bet on two small projects for different markets, we had no income, we spent the investor’s money. Our future completely depended on the outcome of these two games. Working without the right to make mistakes is difficult and nerve-wracking. This is the fate of any startup: one out of 1000 succeeds, and everyone gets scars.

But, as I understand it, everything worked out: the G5 has been successfully functioning for almost twenty years. Did your bet on mobile play an important role in this?

Vlad:Yes. It turned out to be a very successful solution.

It was 2001. In my opinion, almost no one made mobile phone games back then.

Vlad:Yes. We became the first developer of mobile games in the CIS and one of the first in the world. In the USA, when we released our first downloadable mobile game in 2003, it was number 43 among the mobile games released there. At the game developers conference in Moscow, we were the only developer of mobile games for several years.

But at the beginning of the noughties, you were also known from PC releases. Why did you then turn this direction?

Vlad: Our trip to the development of three—dimensional games for PC (we developed this direction for three years – from 2001 to 2004) was a mistake. We were neither the first nor the best there. In general, we took up them only because at that time these games were already in demand on the market, there were publishers who were ready to finance them.

It was only later that it became clear that it was not worth entering this market, since it is best to create and develop a company in growing markets, at their early stages of formation. In large highly competitive markets, where millions of dollars are needed for product development and millions more dollars for marketing, a large organization is needed for success.

Over time, we realized this and focused on our early successes in mobile games. Of course, it had to be done right away, and not wait three years, it was necessary to focus on a new, promising, growing market, where we were among the first in the world, where we already had accumulated unique experience.

Red Shark (2002)

When did you realize that it was time to leave the PC market?

Vlad: For me, probably, the turning point was the day when the publisher took the three-dimensional shooter for PC from us and gave it to another studio for completion. I reacted very emotionally at the time, but they did the right thing, and it finally “dawned” on me that it was time to focus on what was working. Live forever, learn forever.

But this wrong focus did not prevent you from growing rapidly. By 2004, the team had grown from 9 to 62 people, some of whom were developing hardcore simulators and shooters.

Vlad: In 2004, there were even more of us, about 100 people. At the same time, there was no managerial experience with such teams. I think this can also be called the reason why we did not work out with big projects.

In mobile games, then it was possible to do without the difficulties of managing a large team: the team of any mobile project always consisted of several people.

Plus, there was no need to satisfy the established tastes of fans of “old” genres, it was possible to approach work on games more creatively. The audience of mobile games was less demanding, was open to casual projects that seemed closer to us than hardcore simulators and historical games.

Has leaving the PC games market helped your success in mobile games?

Vlad:Yes. Our staff has significantly decreased since those who did not want to make mobile games left us. For several years we had only a few dozen employees, and at the same time — low costs and good manageability.

By that time, the mobile games market was dominated by large Western publishers who had access to licenses for large brands. They produced games based on iconic movies and console games. The scheme worked perfectly, especially since the number of applications in the application stores of mobile operators was artificially limited at that time.

Have you also worked within such a system?

Vlad:Yes. In 2004, we attracted the attention of the American office of Disney (this happened thanks to our mobile engine, which was very innovative at that time due to the ability to make an isometric pseudo-three-dimensional image), which soon ordered us to develop a mobile game based on the movie “Pirates of the Caribbean”. We received an order of magnitude higher budget than the average in the CIS at that time for creating a mobile game.

After the release of this game, I got a call from Electronic Arts and was asked to make a game based on The Simpsons on the same engine. So we made the world’s first mobile game for this brand in 2006.

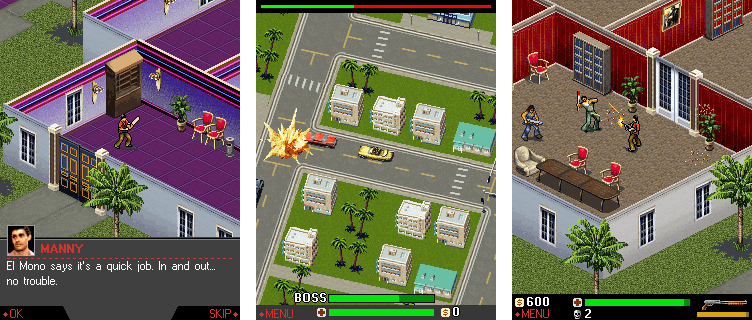

Contracts with THQ, Sony and other publishers followed. We made custom mobile games based on Star Wars, The Sims, Scarface and other popular brands.

For a while, this model of working for publishers for a fixed fee suited us, because there was no other way to the market, and we were paid hundreds of thousands of dollars to create one game by a small team.

Scarface: The Rise of Tony Montana (2006)

Around the same time you move to Sweden. Why did you choose her?

Vlad: Rather, Sweden chose us. In 2005, I met a group of investors from Sweden who were very impressed with our success in mobile games, working with Disney and EA. They proposed a development option for the company, in which the headquarters is moved to Sweden, and the shares are listed on the stock exchange in Stockholm.

I went with them to Sweden for a road show, told the story of the company to a number of investment funds and banks. I was struck by how we were treated against the background of conversations with potential investors in Moscow.

There was genuine admiration in Stockholm that a group of young guys were making world-class products in such a high-tech field. We liked it so much that we agreed to the plan proposed by Swedish investors.

What advantages did you immediately get from working in Sweden and placing shares there?

Vlad: It is unlikely to be possible to say about all of them, but, for example, one of the largest Swedish banks opened a credit line for us to factor invoices to our American publishers, which greatly smoothed the situation with cash flows. The board of directors also includes people with business experience in various sectors of the economy. It helped me a lot personally.

In 2006, you enter the stock market. Is it possible to talk about this as the most significant event in the entire history of the company, not counting the foundation?

Vlad: I wouldn’t say that.

It scares me when companies consider raising capital or going public the most significant event. The company’s goal is to create a sought—after product and find a consumer. Raising money or listing is just a means of realizing the company’s goals.

Significant events for us are almost 20 years of success and growth of our business in a dynamic international market, the multiple growth of our audience and our sales for many years, this is the joy that we give to millions of users around the world.

But, yes, entering the market was the right step. When the financial crisis of 2008 broke out, we were able to attract additional capital to the company on the market, then we used this opportunity several more times (the last time was in 2013, when we financed 20 fritupley projects of casual studios).

And, of course, we gradually “upgraded” our listing. We are currently on the Nasdaq Stockholm main list listing (trading symbol G5EN.ST ), this is a listing of the highest level possible in the European Union, among our “neighbors” on the stock exchange, for example, Ericsson and H&M.

The success of our listing in Sweden pushed local gaming companies to enter the stock exchanges and actively expand, because for a while we could say to ourselves “Sweden’s largest public gaming company by capitalization.”

Plus, we are still the only purely gaming company from Eastern Europe whose shares are listed on a prestigious stock exchange.

Let’s stop here. Why did you even need to become a public company then, wouldn’t it be better to just attract a large round of investments?

Vlad: Attracting a big round, if you can do it, is usually a loss of control. A venture investor will need an exit after some time, he will whine that the company must be sold when it is time for him to close the fund.

In our case, entering the stock market was also associated with attracting additional capital, but this additional capital was given not by one investor, but by several thousand individual investors and funds. This allowed us to maintain control over the company. If one of the investors subsequently wanted to sell his share, he could do it on the market himself.

In certain aspects, it is easier to work with an abstract public investor, because one person or fund does not have a significant voice in the company, and if they do not like something, they can vote with their feet by selling their market share, rather than hanging over the management’s soul.

The advantage of listing on the stock market is access to capital. For example, if someone wants to sell us their gaming business, worth, say, a billion dollars or more, we can buy it, unlike a private company, even if we don’t have a billion on hand. For example, we can borrow half of the required amount by issuing bonds, and print shares for the other half of the amount and pay with them, or sell them on the market and pay with money.

So we can be a consolidation point or an exit point for other companies (including those that are larger than us in size and/or capitalization). Now in Sweden, Embracer and Stillfront are very actively consolidating the PC \ console and mobile games industry just by making purchases, whose size is often larger than themselves. This is an interesting development strategy, which is also interesting to us.

I’m talking about the fact that we are also now looking for owners and investors of gaming businesses who want to completely or partially exit the business or convert their illiquid shares into public and liquid ones.

Star Wars: The Empire Strikes Back (2007)

From an investment point of view, Russian companies are considered high-risk due to the unstable political situation. Does it have a big impact on the stock price?

Vlad: We are not a Russian company. However, being on the stock market and openly saying that our development offices are located in Eastern Europe, we greatly raise the profile of our industry.

In our reports, we write that we have world-class developers, that their prices are very reasonable, and that our countries have huge potential. Our reports are read by thousands of investors from the European Union and the United States, serious funds that are less involved in politics and look more at facts and figures.

In one of the comments for App2Top, you wrote that “Most investment funds operating on public markets, by statute, cannot invest in companies with a capitalization below $100M.” And because of this, you could not get a large capitalization at an early stage. Don’t you regret that you left so early?

Vlad: Yes, there is such a moment: the stock market is mainly run by funds that want to place capital in companies with high capitalization, $100 million is the minimum figure from which they look at you, so for micro—capitalization companies (below $ 100 million), the main investors are individuals, the so-called retail investors.

On the other hand, we can now observe a situation in large international markets when it is individual investors who “rule the ball” and set the trend, and not professional managers. Individual investors themselves are able to significantly raise the capitalization of the company. This is just an interesting technical point to keep in mind.

Managing a large company is a constant stress. A company on the stock exchange is doubly stressful, since the constant tracking of the value of shares begins, the race begins to ensure that revenue always grows on securities from year to year, quarterly reports to the owners of shares begin. So is it even worth it?

Vlad: If we were talking about listing in the United States, we could add to the list the huge overhead costs of maintaining the listing and the high probability of regularly receiving lawsuits from shareholders simply for not guessing your sales forecast for next year. In Sweden, everything is much better — and the costs are reasonable, and there are no age-old traditions to run to court if the coffee in the cup suddenly (!) turned out to be hot, and it was not written about it in large print.

Our professional financial and investor relations team in Stockholm helps me a lot, so publicity doesn’t take up a lot of my time. Of course, the stock market reacts to quarterly results, but the stock price as a whole does not affect the company’s work: do your job, implement a strategy, sooner or later the results will affect the value of the shares. And well-established mechanisms for reporting to shareholders are also needed in a large private company.

But a public listing of the company’s shares is the only way to get a liquid valuation of the company.

What are the assessments of private companies based on? Based on the value of public companies in the same sector or based on the data of public companies that buy these private companies or make them a purchase offer after detailed due diligence.

Everything else is such conditional estimates—fortune-tellers of investors in the expectation that one day this company will either become public, or it will be bought by a public company at a price that will exceed the amount of funds invested in it?

It is generally wonderful in the world of venture capital investments: for example, a new investor buys 0.1% of shares for a million dollars with secret additional conditions on exit preferences (that if the company is sold at any price, he will get a million back first). After that, everyone is informed that supposedly a billion capitalization has been achieved, they say, a new unicorn is on the market, although there has not been a billion, and there is not.

Now, in this way, any self-respecting startup becomes a unicorn as early as possible, because it is fashionable, although this is by and large fraud and should be prohibited.

As for the public evaluation of the company on the stock market based on the results of stock trading, it is a transparent and liquid assessment in real time, every day. At the same time, no one interferes when the market underestimates you, to assume that you are worth more and not to sell. And, conversely, buy when you think that the market underestimates the company.

You have now critically evaluated the listing in the USA, while most recently the G5 itself went on the stock exchange in New York. Why was this done?

Vlad: In the third quarter of 2020, 58% of our sales were in North America. In light of this, it seems normal to gain a foothold in this market, so we are trying to attract the attention of more American investors.

At the same time, we have not yet decided on a full-fledged listing of receipts or on the transfer of the headquarters to the USA. Our listing of F-Shares on OTCQX (a platform for “quality companies” on OTC) is an attempt to increase the visibility of the company for American investors. It’s inexpensive and not burdensome, so we took this step.

In the future, all options are open to us: we can stay on the Swedish stock exchange, we can list receipts in the USA, or we can transfer the listing to the USA, because they are the main market for us. We will look and decide, choosing the best way for us.

Let’s go back to the past, to 2006. In parallel with entering the stock exchange, you decided to enter the casual games market. To do this, I first had to go back to the PC. What was the casual games market like when you came to it?

Vlad: The casual games market attracted us a couple of years after we focused on mobile games. They had a lot in common with mobile titles:

- they were aimed at the widest possible audience;

- also took several months in development;

- they were not technically difficult;

- could be created by a small creative team.

Their advantages were not limited to this. They were also more interesting from a business point of view. The distribution of such projects went through several “portals” (mainly American and Japanese), which did not require IP rights and paid royalties from sales, which was not in mobile at that time.

Our first casual market game was Supermarket Mania, a casual supermarket simulator. It sold tolerably well, so we decided to develop a theme, made Virtual City, our casual city simulator with elements of transport strategy, it also went well on the casual market.

Inspired by the first successes, we continued with the purchase of a small studio Shape Games, which had several projects of varying success. So by 2008, in addition to our mobile business, we had a small portfolio of our own quite successful casual projects, which we, like everyone else then, distributed through PC portals, including Big Fish Games.

Supermarket Mania

At the same time, you remained a relatively small company, even though you were listed on the stock exchange. Do I understand correctly that the company’s rapid growth began after modern application markets appeared?

Vlad: At the end of 2008, the App Store was launched.

As part of the experiment, we decided to transfer Supermarket Mania from PC to iOS “as is”, without sacrificing any aspect of the game. It was an innovative approach, no one had done it before us.

The mobile version of the game was released in early 2009. The result pleasantly surprised us, so we started porting the rest of our library of casual desktop games.

As a result, the premium ports Supermarket Mania and Virtual City earned more than a million dollars each on the iPhone. Then we released their iPad and Android versions. After that, we released each of our new games on all major mobile platforms.

For at least a year, we were the only ones who did this.

Virtual City (2009)

Did the experience of working on java games somehow help when you started playing games for iOS and Android?

Vlad: The presence of an excellent team of specialists with extensive experience working with mobile devices and their inherent memory and performance limitations helped.

You said that for a while only you ported casual games to mobile. Why did this happen? Did the same portals and your colleagues not see the prospects of this market, did not try to enter it?

Vlad: At first there was a reverse story. Portals did everything to convince teams not to go to a new market. They claimed that there was no money on it.

There is nothing surprising in this position, because the main market for these portals was PC and they needed a stream of more and more new releases.

And did you see an opportunity for yourself in the fact that casual majors ignore the mobile market?

Vlad: Including.

We quickly moved the entire pool of our projects to mobile. Then our games ended. At the same time, we saw a demand that we could no longer satisfy on our own.

It seemed logical to us in such a situation to start communicating with other teams, to offer our publishing services on the mobile market. We were the first to do it, our offer was unique.

In fairness, over time, the platforms realized their mistake and rushed to develop their own mobile directions. After that, we had a harder time.

But at one time we were almost the only ones who, for example, at conferences on casual development, where Big Fish dominated as a key sponsor and participant at that time, said that you can earn money on the mobile market. I remember that among our listeners there were, among others, the then little-known studios MYTONA, Awem and Playrix.

After we managed to successfully implement the free—duplex version of Virtual City Playground in 2011 (the game earned a million dollars in a few months), we started encouraging everyone to switch to this model (including our partners – at the peak we worked in parallel with 80 studios).

I remember explaining from the stage at Casual Connect in Seattle in detail how we managed to make a free-play game from the premium Virtual City. Many casuals in the audience did not understand what it was all about, but the guys from Playrix, on the contrary, listened carefully and then asked clarifying questions.

I believe that we have made a great contribution to pushing our entire PC development ecosystem, which previously worked for American portals, to enter the mobile market and take up fritupley.

Virtual City Playground

How has the company’s transition to the publishing format affected business and processes?

Vlad: Before that, for eight years we were developers who did not publish their games themselves. In the new model, we had to “grow” the marketing and licensing department. At first, it consisted of me, who worked during the day on signing new games, and at night on their marketing.

When we got to the release of one new mobile game a week, there were already several dozen people in the marketing department, several people were engaged in licensing, who rarely appeared at home, but mostly lived in airplanes and hotels. We could afford such overhead costs due to the volume of games produced and sales. Our publishing business has been growing rapidly for several years.

Of course, as a result of the rapid growth of the publishing direction, the emphasis temporarily shifted away from development. But we continued to develop our own games, both casual and free-play.

Then you had a model with an emphasis on working with external partners. You released almost one game a week. When it became clear that the scheme was not working, what happened?

Vlad: It was all about monetization. From 2009 to 2012, our main format was premium games. He meant the frequent release of new games.

During these three years, the competition for licensing casual games for porting to mobile platforms has gradually grown. In the last year, portals have been particularly aggressively outbidding developers. There were a lot of games. And by the end of 2012, it became clear that the charts were no longer dominated by them, but by freeplay titles.

As I said a little earlier, at that time we had a successful experience of launching a Virtual City Playground. We were so impressed with the result that we decided to make a breakthrough into a new promising format of frituplays.

Has the business model changed because of this?

Vlad: No. The model remained the same: creating games within the company and creating games together with independent developers. We just changed the approach to products and the format of monetization.

But the process took a long time. Even in 2015, you continued to produce premium titles, although a clear course for frituplay was taken back in 2012.

Vlad: No, we quickly rebuilt as a company. Another thing is that the games themselves are not created so quickly. We could continue to release something premium simply because it was cheaper to finish and release than to cancel.

Here it is also important to announce what figure: if in 2012 90% of our income was accounted for by premium, then two years later 90% already accounted for fritupley. It was a very quick and impressive transformation.

What is the main problem you faced when switching from premium to frituplay? What were the costs?

Vlad: By that time, we already had our own development with successful experience in developing a fritupley. Plus, there were third-party teams ready to work with us.

But there was a nuance — third-party teams needed funds for development.

As a result, in 2013 we raised a certain amount, estimated in millions of dollars, financed several dozen studios. As a result, we have received a good portfolio of fritupley projects. Many titles from it still bring a solid cash register.

Among your key successes of the mid-tenths can be called The Secret Society. From the outside, it seemed that you were even a one-hit company at that time. Was there a problem with that?

Vlad: Having a company have a big hit is a good problem. We work precisely so that we have hits.

The Secret Society was one of the games that was part of our first fritupley product portfolio. It was also our highest—grossing game for about three years – from 2013 to 2015. Already in 2016, she lost the palm to Hidden City, and then quickly flew out of the domestic Top 10.

Again, it’s not worth saying that we were a one-hit company back then. Of course, if you always pay attention only to the most outstanding game of the company for a certain period of time, you can get caught in illusions, they say, nothing happens in the company. But you know perfectly well that this is far from the case.

Then, as now, we were actively operating our own large titles, earning millions a month, and also preparing new hits. One of such hits was the Mahjong Journey game, which, maybe, did not jump as high in the peak as The Secret Society, but according to the total box office, it did not go far from it.

The Secret Society

After The Secret Society, another hidden City became the highest—grossing game for G5. Did the company depend too much on its success at any time?

Vlad: Hidden City was developed by a third-party and very talented AB Games team. This game really became our next big hit, and much bigger than The Secret Society. To date, Hidden City has earned more than $350 million. Crazy success for the hiddenov niche: the market for such games is not very large.

As for addiction, I don’t agree with you here.

Our strategy has always been to develop a diversified portfolio of games. There are 20+ games in our portfolio at any given time that we actively support. Some of them are hits. Some were developed by us, some by partners:

- our first fritupley hit — Virtual City Playground — internal development;

- the second fritupley hit — The Secret Society — third-party development;

- the third box office blockbuster of the company — Mahjong Journey — internal development;

- the fourth large—scale success — Hidden City – third-party development;

- our fifth blockbuster — Homicide Squad — internal development;

- the sixth box office hit (responsible for 20% of the company’s sales today) — Jewels of Rome — is also an internal development.

The list goes on.

It is important to understand here: there is no dependence on anyone. It’s just that sometimes stars happen. And their appearance is a consequence of our strategy focused on maximum portfolio diversification.

The whole point of working with him is just not to depend on the fate of one game. Therefore, I don’t see the drama in the fact that in different years, different games were the first in sales.

But at the same time, it was the success of Hidden City that made it possible to break through the $100 million mark within the company’s capitalization. As a result, it grew by 898% in 2018. How did this affect the life of the owner of the company and, in general, the work of the company itself?

Vlad: Yes, the success of Hidden City has raised our company to a new level in terms of size and capitalization and has also earned a lot of money for developers and us.

As for your question, such growth has a positive effect on both management and the team. Option programs earn millions for management, bonus programs bring good bonuses to the team, everyone is happy. The main thing is not to get dizzy. Testing with copper pipes is, as you know, the hardest.

Hidden City

The peak of Hidden City sales, as well as the peak of G5 sales, was observed in March 2018. Around the same time, there was a peak in the value of the company’s shares. Then the sales of Hidden City began to fall and, as if synchronously, the value of the shares. Was it really connected?

Vlad: The peak of G5 sales, if we keep in mind the largest quarterly result in the company’s history, was quite recently — in the second quarter of 2020 (this is if we take into account the difference in exchange rates with 2018). We ended the second quarter of this year with record revenues, record profits and record margins, taking into account the difference in exchange rates. This was due to the rapid growth of a new generation of our own (made by our internal studios) games that have entered the market over the past 12 months.

Getting back to your question. In 2018, indeed, investors were upset that the main star of the past two years had slowed down the growth rate. There was quite a panic reaction on their part.

It also happens.

It seems that you have been explaining the same strategy to investors for years: you tell them about the portfolio, about the development, about the potential, and they still fall into the illusion that one game is the whole company. They shoot themselves in the foot. Panic is stupid. The long-term investor who does not succumb to it wins.

I watched the stock price fall with anthropological interest, because fundamentally everything was fine with us: we worked out the strategy, we could afford to implement all our ideas inside (just then we increased the staff from 200 to 600 people), created excellent strong teams to develop new games.

So while the drama was unfolding on the market, we were working on new interesting games that began to be released in the second half of 2019. For example, Jewels of Rome came out and immediately began to grow rapidly. It was followed by other successful titles. As a result, today we are setting sales and profitability records.

You need to have a little patience if you are an investor. We took advantage of the excessive negative reaction of investors and made a very profitable repurchase of shares (at minimum values).

I hope some investors have made conclusions for the future.

By the way, even despite the temporary decline in the value of shares until 2020, at the end of the decade our shares were recognized as the second most profitable in Sweden. Plus, we continue to enter the rankings of the fastest growing companies in Europe every year.

The moral of the story is do not buy our shares for speculation, but buy and hold for a long time as a long—term investment in the development of mobile games for a wide audience.

Jewels of Rome

It’s good that you’re talking about the present now. The company’s strategy when you first entered the frituplay market was to diversify the portfolio. Judging by what you’re saying now, she continues to be that way. But surely something in the strategy should have changed over the years?

Vlad: Since 2013, our strategy has not changed: we make free-play games for our audience.

But in the beginning we relied more on working with independent studios. There were a lot of casual teams, development was relatively inexpensive, quantity at the initial stage was more important than quality, time was running out.

At the same time, we have always created games in parallel with internal forces. Over time, we gradually increased the number of our own development teams. We wanted to be able to implement our ideas independently.

Now we have almost 700 employees. This amount is enough to implement almost all of our plans at the moment (we are very efficient, including thanks to our own engine and a number of platform solutions). Our monthly net profit is in the millions of dollars. That is, we can, if we wish, still grow (and are growing).

So we don’t have any critical need to work with independent developers. But we continue to work with them.

Why?

Vlad: Some of them are very talented studios, it’s nice to work with them, I want to work with them. With others, it’s just interesting, because you see the potential.

Is it possible to say that the focus on internal capacities is a safer model for a public company?

Vlad: Each company has its own path and its own strategy. Let the path to success may be different. In our case, we added a publishing model, which proved to be very successful.

The success of other companies with a different strategy does not negate the success of our company and our strategy. The mobile games market is huge, there is a place for different strategies, different genres, different developers.

What challenges does the company face today? How do you plan to solve them?

Vlad: The situation with the virus has led to the fact that people spend much more time at home, games have become even more in demand than before.

Of course, there are long-term concerns about the solvency of players in the event of a financial crisis, but even in this case, the gaming business has historically shown itself to be a sustainable investment: one hour of electronic entertainment is cheaper than any other type of entertainment. So the budget for games suffers last of all and often even increases in times of crisis. In this context, our strategy does not change: we continue to create and publish games aimed at a wide audience of players around the world.

Thanks for the interview!

Vlad: Thank you very much for the interesting questions!