Drake Star: Games industry saw over 1,300 deals in 2022, totalling $127 billion

In 2022, the global games industry set a new record for the number and value of closed or announced deals. All thanks to Microsoft’s historic bid to acquire Activision Blizzard, but there have been a few other noteworthy investments as well.

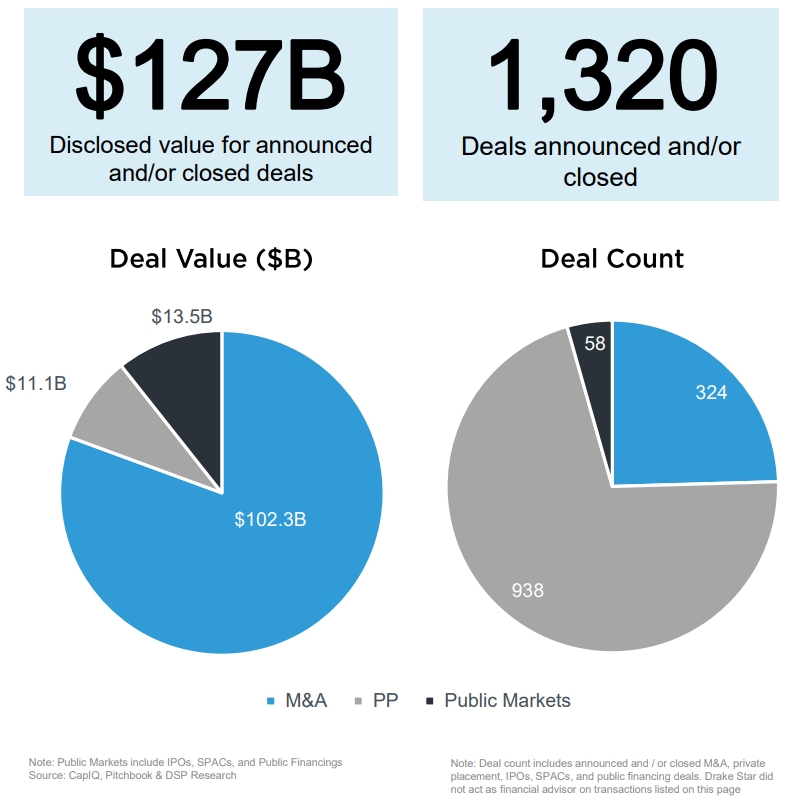

- According to a new Drake Star report, 2022 was the biggest year in gaming with 1,320 deals announced and/or closed deals. Their total value was $127 billion, up 78.8% year-over-year.

- Total value of M&A deals amounted to $102.3 billion, which is three times more than in 2021. Public placements and private funding amounted to $13.5 billion and $11.1 billion, respectively.

Drake Star: the number and total value of all gaming deals in 2022

- The PC and console market was the most active segment in terms of M&A deals, with 83 transactions announced or closed with $74.9 billion in total value.

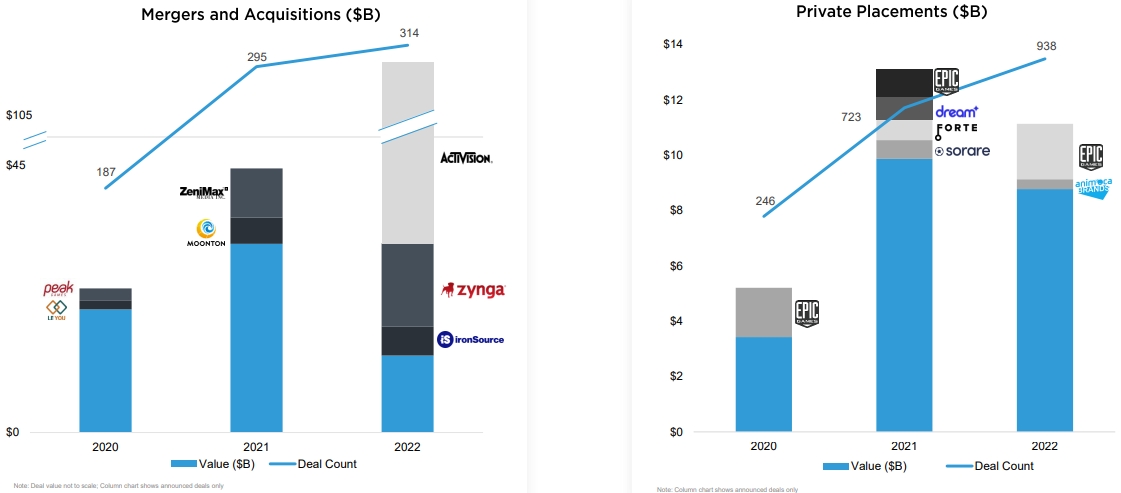

- M&A and private funding showed strong growth last year, with 314 (vs 295 in 2021) and 938 (vs 723 in 2021) deals announced or closed, respectively.

Drake Star: The number and total value of M&A deals and private placements in 2022

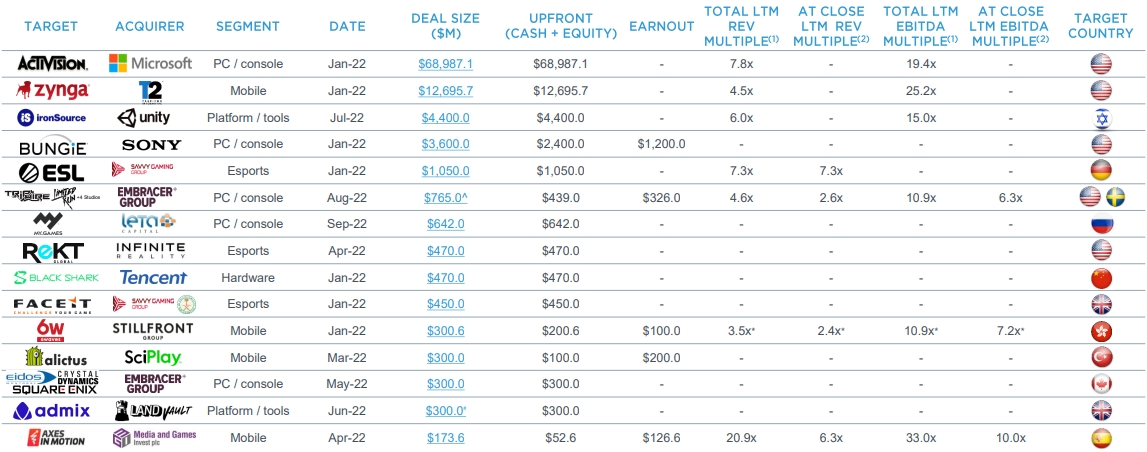

- Microsoft’s $68.9 billion acquisition of Activision Blizzard was the biggest M&A deal of 2022. However, the merger is still subject to regulatory scrutiny, with the US Federal Trade Commission trying to block it in court.

- It is followed by Take-Two’s $12.7 billion acquisition of mobile publisher Zynga, the $4.4 billion merger of Unity and ironSource, and Sony’s $3.6 billion acquisition of Bungie.

Drake Star: top 15 gaming M&A deals of 2022

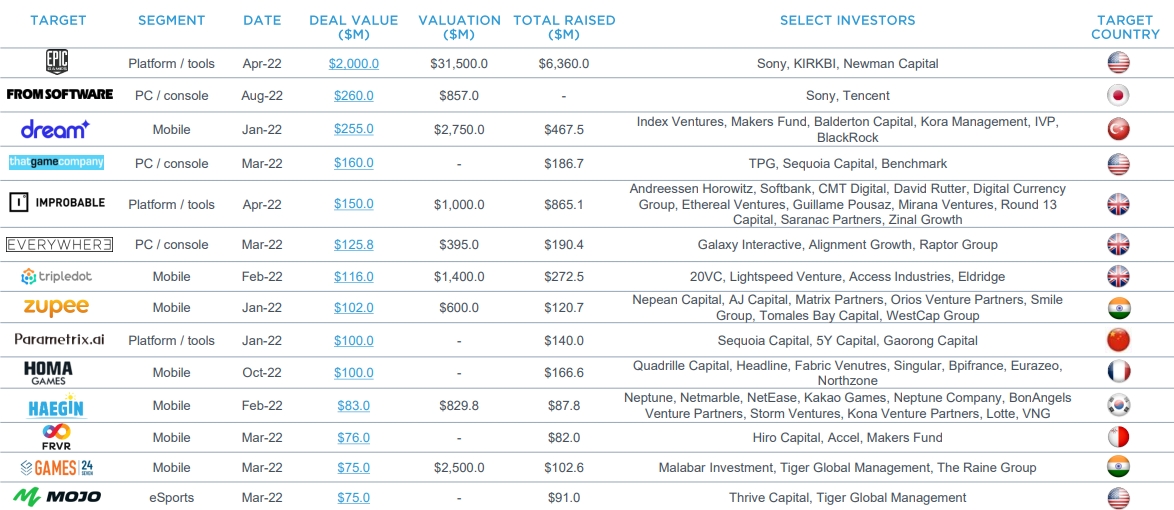

- Speaking of private investments, the $2 billion raised by Epic Games from Sony and KIRKBI was the biggest funding last year.

- Other deals in the top 10 also include Sony and Tencent’s joint $260 million investment in FromSoftware and the $160 million raised by Journey developer thatgamecompany.

Drake Star: top 15 gaming private placements of 2022

- Embracer Group was a leading strategic buyer in 2022, with 20 deals totaling $1.16 billion. It is followed by Tencent (9 deals), Animoca Brands (8), Keywords Studios (5), and Take-Two (4).

- Analysts expect the consolidation trend to continue in 2023, but at a smaller scale than last year. Embracer Group, Tencent, Sony, Microsoft, Take-Two, Netflix, Animoca Brands, and NetEase are named among top buyers.