Playliner: "competition for casual players will increase in the coming year"

How the cash game top is distributed between three types of genres (casual, midcore and hardcore), the startup Playliner told in its research.

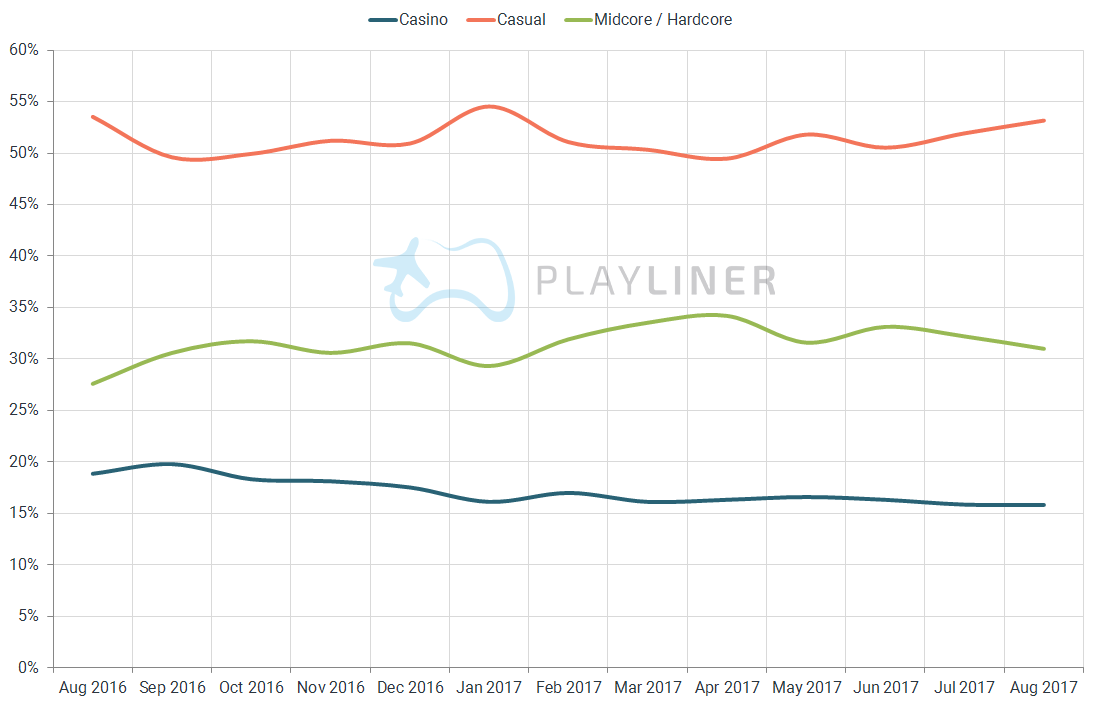

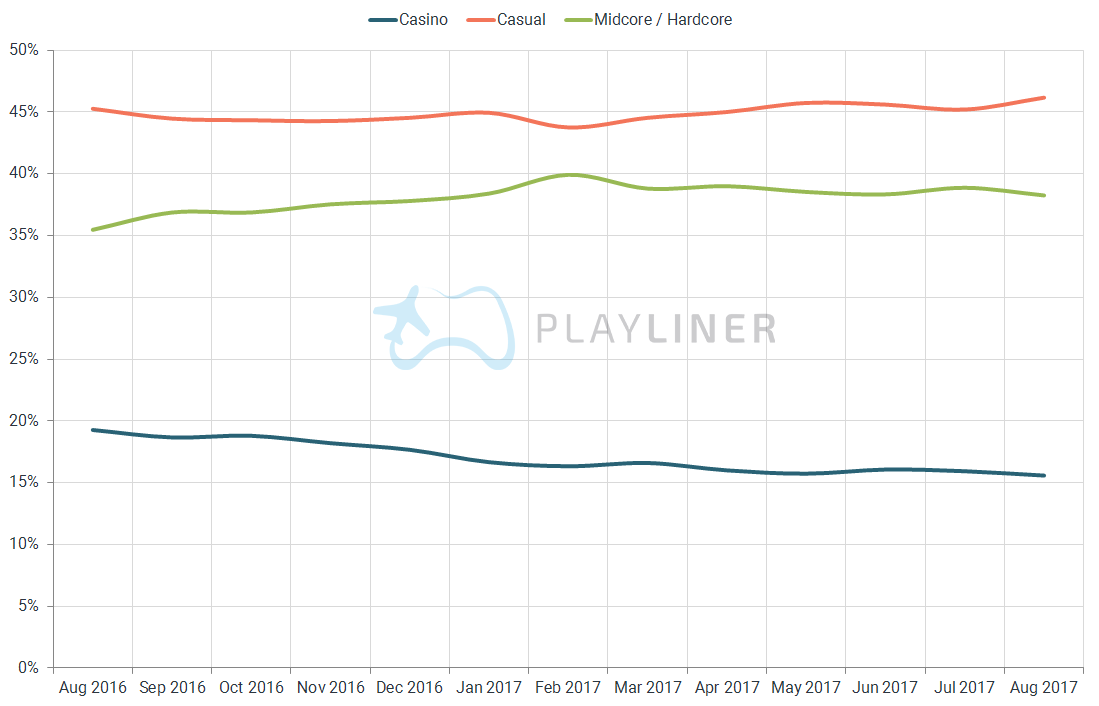

Most cash games are of the casual type

It turned out that most of the games in the US box office tops are casual. This type is followed by 50% of the top earning games from the App Store and 45% from Google Play.

The casual type of Playliner includes action (Action), Adventure (Adventure), Arcade (Arcade), family (Family), puzzles (Puzzle), simulators (Simulation) and sports (Sport).

Among the features of this type: ease of mastering, weak immersion and lack of competition (or its weak development).

In the box office tops, the total share of midcore and hardcore titles, which were considered by analysts in conjunction, is much less. On iOS, it is 30%, and on the Android platform – 35%.

By games of these types, we mean subcategories of role-playing (RPG) and strategic (Strategy) games, as well as all titles that can be attributed to battlers.

Playliner notes that all games related to midcore and hardcore require a lot of time to master, are characterized by long sessions and high competition between players.

The share of social casinos on the App Store and Google Play is approaching 15%.

The number of casual projects in the cash top will increase next year

Based on the results of the Playliner analytics research, I make a bold conclusion. They are sure that in the new year the market is waiting for an increase in the number of casual projects. This conclusion is based on two premises.

The first is the fall in the number of social casinos in the top box office games.

According to Playliner, games of this type are “inherently” close to casual projects. Since there is a drop within one segment, it is logical that another segment will take its audience.

The second premise: the growth of the midcore/hardcore games segment stopped six months ago.

Analysts believe that “the trend for the growth of midcore games is over.” Further, the market is waiting for the simplification of complex genres, a reduction in the number of mechanics in projects and a reduction in the entry threshold.

In other words, the growth of projects that can be attributed to the casual type.

Research methodology

As part of the study, the company studied 1,400 games that were included in the box office gaming tops of the US 300 from August 2016 to August 2017 on Google Play and the App Store.

See also: