Who is cooler: King, Zynga, EA Mobile, Gameloft or Glu?

Using open data on such public companies as King, Zynga, EA Mobile, Gameloft or Glu, our British colleagues from PocketGamer calculated whose indicators are better. We present a brief Russian version of the study.

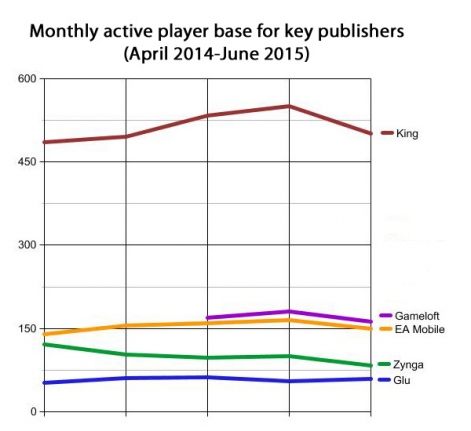

King has the largest monthly active player base among the games discussed: more than 450 million. And it has increased over the past year. Gameloft and EA are still “nose to nose” – they are followed by 150 million. Glu has the least so far.

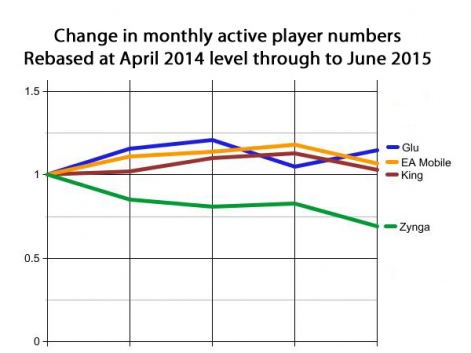

The picture below shows not the difference between the number of active players, but the dynamics of its growth / decline from April 2014 to June 2015. And here it is clear that Zynga is an outsider. The company only lost users during the reporting period. As a result, it has slipped to the Glu indicators – this is something about 78 million monthly users.

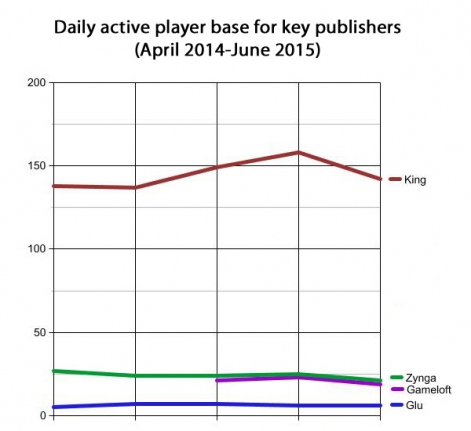

In the case of the DAU discussion, the situation changes somewhat. Of course, this does not apply to the unambiguous leader King, which boasts a 140 million DAU, but here, for example, Zynga comes after him. PocketGamer explains this by the fact that Zynga’s portfolio includes games in the genre of “casino” and “words”, which traditionally have a high level of engagement.

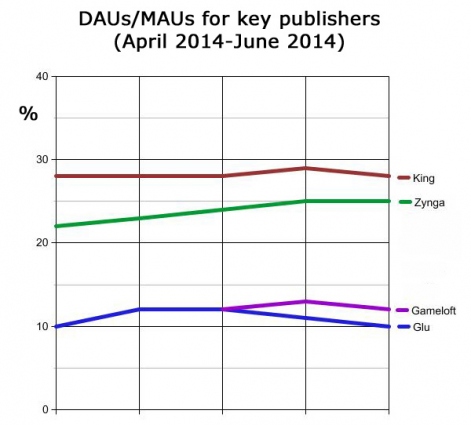

By the way, about engagement (aka, the stick factor obtained by dividing DAU by MAU). PocketGamer also decided to try it on. And here, curiously, the difference between King and Zynga is not so great. The first has about 28%, the second has about 25%. But Gameloft and Glu, whose portfolios traditionally consist of midcore products, on the contrary, noticeably lagged behind. These companies have involvement somewhere at the level of 10%.

Having the size of the audience on hand, as well as information about earnings, after all, we are talking about public companies, PocketGamer also undertook to calculate the approximate income of companies from the user.

In the case of American companies, an alternative non-GAAP accounting principle was used, which takes into account both cash income (revenue minus cash expenses, but before deducting non-cash expenses, such as depreciation) and operating profit (profit generated by all assets), EBITDA (earnings before interest and taxes) and projected income.

Our colleagues explain this by saying that they are closer to the French GAAP accounting system.

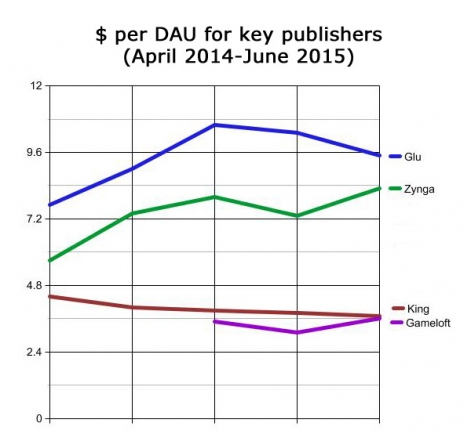

When comparing the data, this is what turned out: Glu and Zynga turned out to be the leaders in revenue for daily active users (and with a decent margin from competitors).

This point is explained in the case of Glu by the fact that, despite the low total DAU, the company’s key projects, like Deer Hunter and Kim Kardashian: Hollywood, are perfectly monetized.

The same is true with regard to Zynga, adjusted for the fact that the company, first of all, loses less involved players. Those who have previously spent in her projects remain for now.

In turn, King has such a large audience that it seems natural that it is monetized banally worse.

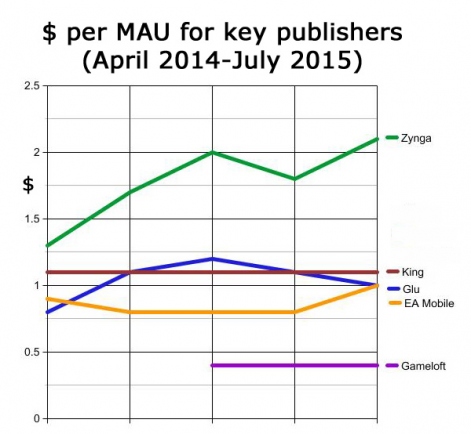

When calculating MAU, the general situation changes somewhat. The unambiguous leader turns out to be Zynga, which has about $2 per monthly active user, Gameloft is among the outsiders, not even reaching $0.5 (and this is far from a surprise, given, among other things, the news about the closure of seven studios this fall). As for King, Glu and EA Mobile, they have about one dollar from each monthly active user.

In general , the results are as follows:

- King is the leader in DAU and MAU, but he is not very strong in terms of monetization when calculating income from each user.

- Although Zynga is losing its audience, it is perfectly monetizing the one it has.

- Glu can’t boast of an audience, but it’s good at monetization.

- EA Mobile – there is no data on the company’s DAU, but PocketGamer considers the company to be such a strong middle man among the leaders.

- Gameloft is the weakest player in the discussed five.

Source: pocketgamer.biz