ChartLight: about yourself and your competitors

The service was launched last week ChartLight, which allows, as we wrote earlier, to show the frequency and duration of user sessions in third-party Google Play applications. In connection with the announcement, we decided to talk a little with its authors about the service itself and its competitors.

One of the founders of the service, Mikhail Yurov, answered our questions.

Hi, Misha. So, let’s clarify once again what ChartLight is.

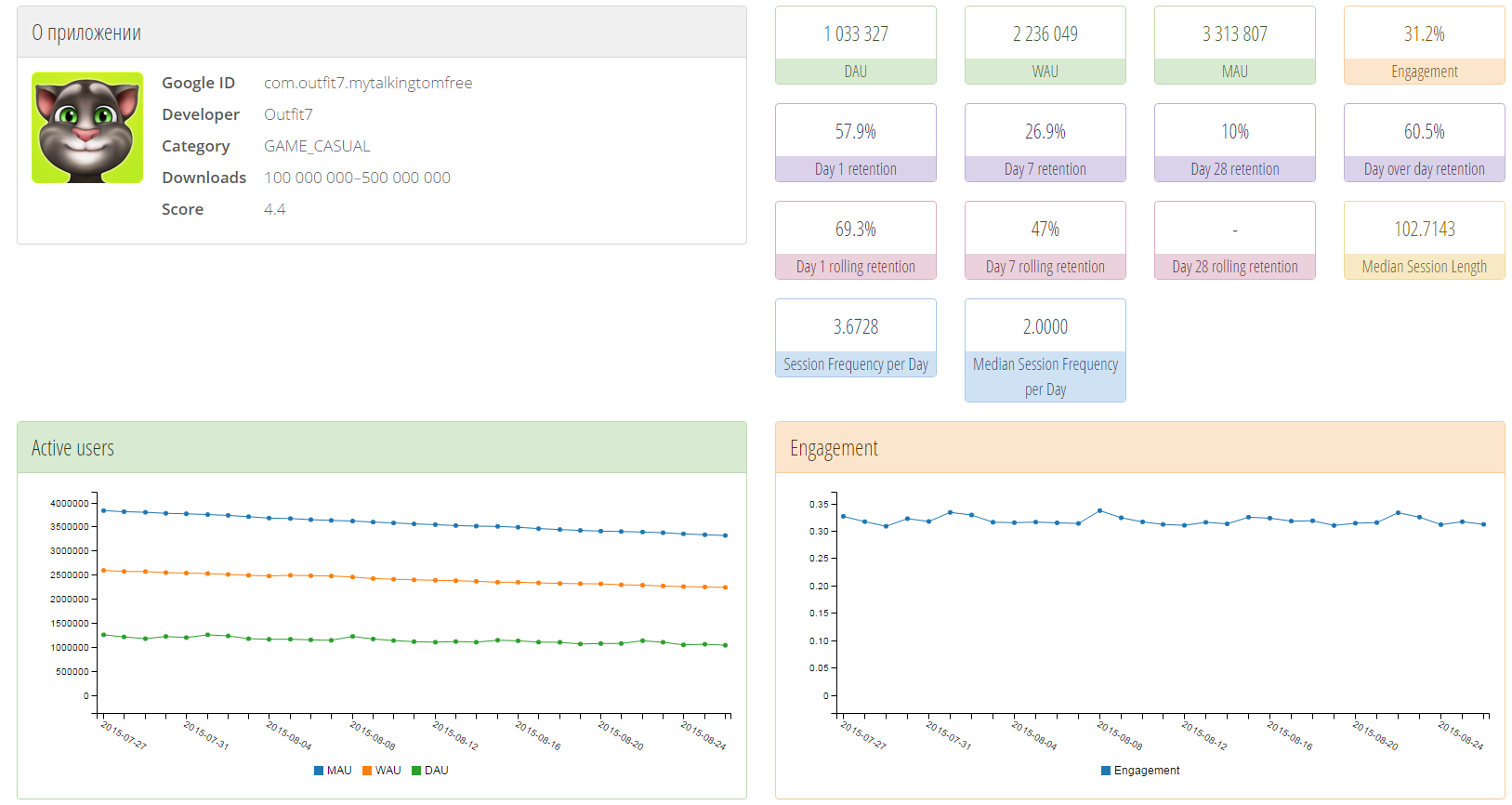

Hi! ChartLight is a mobile app usage analytics service on Google Play. We are able to estimate the size of an active audience, all types of retentions, the frequency and duration of application sessions. In addition, the top is available in terms of the size of the active audience both in general and by store sections.

How did the idea of creating a service come about?

The idea arose about a year ago. There were many analytics services for social games and websites, such as AppData and Semrush, but not a single, even paid source, where it would be possible to find out the size of the audience of mobile applications. At the same time, there were many solutions in Google Play for the request “app usage” that allowed the user to keep local statistics. The very fact of their existence confirmed the possibility of creating ChartLight.

At the beginning of the year, App Annie announced Usage Intelligence with similar functionality. How does it differ from ChartLight?

Despite the similarity of functionality, our data practically do not overlap. At the initial stage, we made a bet on Russia and the CIS, and by now the number of devices in our database in this region is already more than a million. It seems to us that this particular segment of App Annie is practically not covered.

Where does this information come from?

Judging by the information provided on their website, App Annie is now collecting data using the VPN Defender application, which has few installations and, judging by the reviews, there are practically no users in Russia. Plus, they use the newly acquired Mobidia application, which also covers mainly the English-speaking segment.

We should not lose sight of another player who also released a similar solution at the beginning of 2015 – Similarweb. They have invested many millions of dollars in this direction, which means that the niche is really promising. It should be noted that both App Annie and SimilarWeb position Usage Analytics as an addition to their main products. You can’t get these data separately, and the overpayment for unnecessary functionality will be significant.

And how do you collect data?

We have developed a special library that integrates into our applications or partner applications, collects information about running applications and installations and sends it to our servers. We strictly follow Google Play’s privacy policy: we ask for permission to send anonymous statistical data in the application itself, encrypt the data and allow opt-out. Now our database has already accumulated statistics for six months from more than a million devices, so all metrics can already be studied in dynamics.

Tell me, who is your potential client?

At the moment, our service is best suited for indie developers and small studios located in Russia and focused on the Russian-speaking market. These are precisely those who cannot afford the high costs of analytics at the initial stages. Moreover, now we offer very affordable prices.

How much does access cost?

The first five requests can be made for free immediately after registration. A monthly subscription costs only $19, which is less than the average developer earns before lunch. When paying for six months or a year – $ 99 and $ 149, respectively. This is much more affordable than the “thick” corporate tariffs that only large companies can afford. In addition, you can apply for a free semi-annual subscription. To do this, you will need to: write a review about the ChartLight service, which we could post on the site in the future, tell about ourselves or our company, and also inform us about problems and errors that arise. Separately, we will be grateful for any constructive suggestions for improving the ChartLight functionality.

The service is still raw. There is no segmentation by market (CIS only), the name of the categories is issued as GAME_CASUAL, unfortunately, many applications cannot be found. How soon do you plan to fix the current problems?

It all depends on the volume of our base in each country. First of all, we will try to cover as many countries as possible. Then we will increase the volume within each direction.

If developers want to contribute to the development of the service and are ready to install the SDK, how difficult will it be for them to do so?

We don’t have a ready-made affiliate program yet. But we plan to do it in the future. While you can write on support@chartlight.org . We will discuss the conditions individually.

How do you plan to develop the service in the future?

Now we are starting to collect data in more than twenty countries in Europe and America. In the medium term – the development of a library for data collection on the iOS platform. And, of course, we will listen to the wishes of our users. There are plans to add new metrics, identify similar applications, and have ideas on how to estimate application revenue by indirect signs. In general, there are many plans and directions – the service has a lot to develop.

Are you looking for an investor at the moment?

Not at the moment. But you can write to us with suggestions. We can always change our minds.

Can you tell us something interesting based on the data from the system?

It is interesting to observe the competition of games of the genre “three-in-a-row”. The undisputed leader in Russia is the “Planet of Gems” from Nevosoft. It is followed by “Cold Heart”, which is rapidly losing its audience, which, however, can be explained by the decline in interest in the cartoon and the “off-season”. Then comes Candy Crash Saga, the stability of which metrics can only be envied. Next, slightly inferior to CCS, is “Pirate Treasures”. But if the retention metrics of the leaders were about the same, then there is already a noticeable lag in retention. Other notable players are Farm Heroes Saga, Maleficento, Cinderella, Indie Cat, Fruitland. The last two, like “Planet”, are in the VK catalog. The laggards include Cookie Jam, Ice Age, two games from Social Quantum: “Magic Kitchen” and “Mysteries of Atlantis” and a number of others.

Each of our clients will be able to conduct a similar analysis for applications of their niche: games of different genres, antiviruses, maps, browsers, banks, etc.

I also want to add that especially for readers app2top.ru we provide a month of free access when registering with the promo code app2top. The code is active until the end of September and you can enter it either during registration or on this page if you are already a user.