Launching an IT business and receiving tax benefits in Georgia

Versus.legal continues a series of articles on preferential tax regimes for IT in neighboring countries. The new material is about Georgia.

Sergey Kovalkov, Senior Associate at Versus.legal

This material tells about Georgia’s preferential tax regimes. In it, we will go through the requirements for IT companies and consider the procedures for obtaining them.

The material is accompanied by comments from representatives of those IT companies who have experience working in Georgia. Elena Morina from Ravenage (publisher of video games) and Roman Shtykh from MetaLamp (developer in the field of blockchain technologies) shared their experience.

Our task was to take out the whole team. Cyprus and the Emirates are too expensive. We would not have been able to take the whole team there, only the leads. The Baltic States required visas, and most of the team members did not have them. As a result, we settled on Georgia.

CEO and founder of Ravenage

Initially, we did not consider Georgia for relocation. However, in the end, we felt that this was a good alternative to Europe, which had closed for us. Today Georgia is a comfortable country for opening and doing business with low taxes and a good banking sector.

CEO MetaLamp

There are two preferential tax regimes for IT businesses in Georgia.

I. Virtual Zone Face (VZE)

- 0% — income tax (the standard rate is 15%);

- 0% — VAT (standard VAT is 18%);

- 5% — withholding tax on dividends (no benefits);

- 20% — income tax on employees (no benefits).

Company requirements

1. The company must carry out activities in the field of IT

In the country, IT activity is understood as “the study, support, development, design, production and implementation of computer information systems.” The result of IT activity is the “creation of software products”.

Accordingly, in order to receive benefits, the company must create software (hereinafter referred to as software) or provide services for its creation, modification or implementation.

As for companies engaged in e-commerce, Internet marketing and IT consulting, they cannot claim benefits.

2. The sole proprietor is not equated with the company

An individual entrepreneur engaged in software development cannot claim benefits in the field of IT.

3. The company’s revenue must come from abroad

The benefit applies only to income received by the company from abroad.

4. The company must have a real economic presence (economic substance) in Georgia

In order to count on benefits, the company must have in Georgia:

- real office;

- employees (including developers);

- fixed expenses for maintaining the company’s activities in the country.

This requirement is not fixed in the law, but the tax authorities have recently been actively checking the real economic presence of the company.

The company will not be able to register a legal entity, get a certificate and apply benefits if at least part of the development is not conducted in Georgia.

Important: in order to receive benefits, it is not necessary that all development takes place exclusively in the country. It is also not necessary for the director of the company to reside in Georgia.

How to apply for a benefit?

First you need to register a legal entity.

Registration is fast, clear, there are no problems. The main problem is to find a company that will provide high—quality legal and accounting support. We succeeded only on the second attempt.

CEO and founder of Ravenage

The interaction with government agencies left a positive impression. Everything is very convenient: the procedure takes place in one window and quickly enough. There's not even anything to find fault with. It took several days to register, the company was registered without any problems.

CEO MetaLamp

After registering a legal entity, you need to go to a special website and fill out an online application in Georgian. In the application, specify information about the company, as well as about its IT projects (current or planned).

The application is considered for 10 working days (in practice, a delay of up to 30 days is possible). The Agency may request evidence confirming the implementation of activities in the IT field or the presence of developers in Georgia. There is no fee for reviewing the application.

Upon approval of the application, the office issues an electronic certificate. It is valid indefinitely. The certificate will be automatically received by the tax authority. After receiving it, you can enjoy tax benefits.

It took us almost six months to get the status of a virtual zone.

CEO and founder of Ravenage

II. International Company (IC)

- 5% — income tax (standard rate – 15%, VZE benefit – 0%);

- 0% — withholding tax on dividends (a benefit, unlike VZ);

- 5% — income tax on employees (a benefit, unlike VZE);

- 0% — property tax.

International companies are not exempt from VAT. However, if they export their services abroad, then, as a general rule, they do not pay VAT in Georgia.

For example, if a company licenses a game to a publisher in Cyprus, VAT is not applied.

However, there are nuances, and when the game is published through a Georgian company directly.

Company requirements

1. Work experience in the IT field – more than 2 years

As a general rule, a Georgian legal entity of an international company must exist and work in the IT field for more than 2 years in order to receive benefits. But it is possible that the founder of the company will be another foreign company that has experience in the IT field for more than 2 years.

If both options are not suitable, then you can establish a Georgian company that will be a representative of a foreign IT company. Then 2 years of experience will need to be confirmed in relation to a foreign company.

2. 98% of annual revenue should be from IT activities

At the same time, the legislation prescribes a specific list of suitable activities in IT. For example, software and game development, custom development services. The list of suitable activities is wider than that of the Virtual Zone status.

3. The company must have an economic presence in Georgia

This rule is clearly established by law. It is necessary to have a real office, employees in Georgia. In other words, the main activity generating income should be here.

How to apply for a benefit?

It is necessary to prepare a statement in which to indicate:

- company data;

- legal and actual addresses, place of service provision;

- type of activity in the IT sphere.

The application must be accompanied by documents that confirm two years of experience. These can be contracts with counterparties, bank statements, and so on.

The application can be submitted through the online portal of the tax authority. The review period is 10 working days. The fee is not paid. If additional information is required, the tax authority will request it itself.

If everything is in order with the application, then it is sent to the Ministry of Finance for final approval. In case of a positive decision, the status of an international company is assigned from the first day of the month in which the final approval was received.

Which mode should I choose?

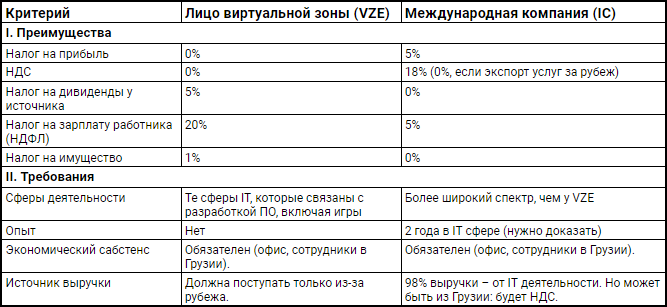

Each benefit has its own characteristics. The table below shows a visual comparison that will help you figure it out.

The only problem is opening a bank account. We applied in different banks, and everywhere we were refused without explanation. This problem still exists: in more than 50% of cases, applications for corporate accounts are rejected. Although with individuals, of course, it is easier. There are also difficulties in sending payments to Russia or receiving money from Russia.

CEO MetaLamp

CEO and founder of Ravenage

***

Georgia offers two preferential IT regimes. It is quite easy to open a legal entity here. If all the conditions are met, you can apply for a benefit and conduct business on international markets. However, before making a decision, it is important to take into account the risks associated with opening accounts and transferring payments.