How the 2025 Tax Reform Affected Tax Calculation in the IT Sector — A Detailed Review by Prospectacy

The tax reform of 2025 introduced a significant number of changes to Russian legislation, completely transforming the usual business practices. In their article for App2Top, lawyers from Prospectacy, Irma Novikova and Kristina Kurtaeva, vividly explored how the reform affected tax calculations in the IT sector.

Irma Novikova and Kristina Kurtaeva

The overview of changes in tax calculations was demonstrated using the example of a hypothetical developer named Ivan. Together with Ivan, we propose to explore the journey from software development without a special regime registration to establishing his own indie studio in Russia and abroad (controlled foreign company).

During this process, we'll observe how taxation changes for an individual, sole proprietorship, and company, depending on the selected tax regime and other factors. Additionally, we'll analyze potential additional taxes that may arise in Russia when interacting with foreign suppliers and clients, and we'll also review what's new for owners of CFCs in 2025.

1. Individual without a special regime registration

Let’s assume Ivan started his IT journey without registering as a sole proprietor, without a self-employed status, or setting up a company. This means he was performing work or rendering services solely as an individual without special regime registration.

In this case, every year, our developer must pay personal income tax (NDFL) on a progressive scale:

- 13% rate — annual income less than 2.4 million rubles;

- 15% rate — annual income from 2.4 to 5 million rubles;

- 18% rate — annual income from 5 to 20 million rubles;

- 20% rate — annual income from 20 to 50 million rubles;

- 22% rate — annual income over 50 million rubles.

Important: the higher rate is applied not to the entire income, but only to the amount exceeding threshold values.

For example, if Ivan earned 11,000,000 rubles in a year (let’s say he’s a Senior level programmer in a major game company), his annual tax would not amount to 1,980,000 rubles, but rather 1,782,000 rubles.

Why?

- On income up to 2.4 million, he pays 312,000 rubles (13%);

- On the income range from 2.4 million to 5 million, he pays 390,000 rubles: 5 — 2.4 = 2.6, from which 15% is calculated;

- On the income from 5 million to 11 million, he pays 1,080,000 rubles: 11 — 5 = 6, from which 18% is calculated.

In total, this amounts to exactly 1,782,000 rubles.

Moreover, if Ivan receives income from a legal entity, the tax will be withheld from his income and transferred to the budget by this legal entity as a tax agent. If Ivan receives income from individuals, then he will have to declare and pay the tax himself.

Individuals providing services under civil law contracts (GPC) and sole proprietors on the general taxation system also have access to a professional tax deduction for the amount of expenses incurred in providing services. However, if expenses cannot be confirmed, the legislation allows for a tax deduction of 20% of the income.

2. Self-employed individual

Later, Ivan decides to reduce his tax expenses by registering as a self-employed individual. Now he must pay tax on professional income (NPD).

The income limit for self-employed individuals is 2,400,000 rubles per year. If exceeded, it is necessary either to pay NDFL at regular rates or to register as a sole proprietor and choose a taxation system (USN, ESHN, PSN, or AUSN). The income of the self-employed must be registered in a special application upon receipt of income to the bank account and paid monthly. The program automatically calculates the tax.

Suppose, as a self-employed, Ivan also earned 11,000,000 rubles in a year.

Within the limit of 2,400,000 rubles, he will pay a 4% tax on income from individuals or a 6% tax on income from legal entities, i.e., 96,000 rubles or 144,000 rubles respectively.

If he has not registered as a sole proprietor, then he will have to pay NDFL on a progressive scale:

- On income from 2.4 million to 5 million – 390,000 rubles (15%);

- On income from 5 million to 11 million – 1,080,000 rubles (18%).

Thus, with an income of 11,000,000 rubles, the self-employed developer will pay a tax of 1,566,000 rubles or 1,614,000 rubles depending on whether he receives income from an individual or a legal entity as a self-employed individual.

Important: income exceeding 2,400,000 rubles received from an individual needs to be declared using the 3-NDFL tax form and submitted by April 30 of the following year after receiving the income. Meanwhile, the tax payment can be made by July 15 of the following year after receiving the income. Thus, for income received in 2025, Ivan must report to the tax authorities by April 30, 2026, and make the tax payment by July 15, 2026.

Taxes on income from legal entities are withheld by these legal entities as tax agents, so in this case, the developer does not need to declare anything.

3. Sole Proprietor (in Moscow)

Next, Ivan intends to optimize his work and tax obligations. In connection with this, he registers as a Sole Proprietor in Moscow.

Upon registration, Ivan chooses the simplified taxation system (USN) — 6% for USN "Income" or 15% for USN "Income minus expenses".

These tax rates apply to sole proprietors registered in Moscow. Regions may set reduced rates. For example, in St. Petersburg, the rate for USN "Income minus expenses" is 7% instead of 15% (under certain conditions).

To apply USN, a sole proprietor in 2025 must meet the following criteria:

- Income – up to 450 million rubles;

- Residual value of fixed assets – up to 200 million rubles;

- Number of employees – up to 130 people.

If these limits are exceeded during the year, the sole proprietor will no longer be able to operate under USN, and starting from the next quarter, he will have to pay taxes under the general taxation system.

Let's consider the calculation of the tax burden for a sole proprietor based on an income of 11,000,000 rubles. Depending on the USN object chosen by Ivan, the tax will be calculated as follows:

- If the USN "Income" system is chosen, the developer will pay a tax of 660,000 rubles (6% from the total income of 11,000,000 rubles);

- If USN "Income minus expenses" and the amount of expenses, for instance, 7,000,000 rubles, the tax will be 600,000 rubles ((11 million – 7 million) * 15%).

4. Employment with a Russian company while living abroad

Ivan decides to try himself in employment and gets hired by a company registered in the Russian Federation. Meanwhile, he chooses to live abroad and work remotely.

In 2025, personal income tax (NDFL) is calculated on a progressive scale from all worker incomes sourced in the Russian Federation. Notably, starting January 1, 2025, for employers who have signed civil law contracts with remote employees working abroad, there are new tax agent responsibilities for calculating and paying NDFL. These contracts involve services and work conducted over the internet using domain names and network addresses within the Russian national domain zone, or equipment located in Russia.

Thus, if Ivan’s annual earnings from employment through a labor or civil law contract amount to 30,000,000 rubles, the tax will be calculated as follows:

- On income up to 2.4 million – 312,000 rubles (13%);

- On income from 2.4 million to 5 million – 390,000 rubles (15%);

- On income from 5 million to 20 million – 2,700,000 rubles (18%);

- On income from 20 million to 30 million – 2,000,000 rubles (20%).

The tax will be withheld from the salary and paid to the budget by the employer company as a tax agent. Hence, 5,402,000 rubles will be deducted from Ivan’s income.

It's important to note that the 2025 tax reform does not nullify existing international double taxation treaties (DTT). Therefore, if Ivan has become a resident of a state with which Russia has a DTT that is not suspended, based on the relevant DTT article, there might not be any taxation of income in Russia. For instance, the DTT between Russia and Turkey allows a Turkish tax resident to exempt their labor contract income earned outside Russia from Russian NDFL, even though it is considered Russian-sourced income.

5. Legal Entity (in Moscow)

After some time, our hero returns to Russia and starts developing his own indie projects, leading to the establishment of a small indie studio with a team of employees and several contractors. Ivan registers a legal entity in Moscow (Limited Liability Company – LLC) with the following parameters:

- Founder – 1 Russian citizen (Ivan himself);

- Number of employees – 3 employees;

- Number of self-employed – 1 person;

- Number of contractors (sole proprietors) – 1 person;

- Company income in 2025 – 70 million rubles excluding VAT;

- Presence of foreign clients and suppliers.

A Limited Liability Company (LLC) can operate under the general taxation system (OSNO) and the simplified system (USN).

5.1 Working under the general taxation system (OSNO)

5.1.1 Working under OSNO without benefits

The main taxes to be paid in this case will be Value Added Tax (VAT) at a rate of 20% and corporate profit tax at a rate of 25%.

The conditional tax burden with an income of 70 million rubles, expenses of 50 million rubles, and a salary of 30 million rubles will look like this:

- Profit tax: ~ 2 million rubles;

- VAT: ~ 11.7 million;

- NDFL: 4.8 million rubles;

- Insurance contributions: ~ 4.6 million rubles.

5.1.2 IT regime

Within the framework of OSNO, if Ivan's company obtains accreditation as an IT organization, it may qualify for the IT regime.

If Ivan’s company receives such accreditation, then:

- The profit tax at a reduced rate will be 5%;

- The rate of insurance contributions for pension, medical, and social insurance will be 7.6%;

- The VAT exemption applies to the sale and transfer of software rights and their support, but only for software included in the register of Russian programs.

5.2 Working under the simplified taxation system (USN)

With the specified parameters, Ivan's company can work under the simplified system (USN). Accordingly, the tax burden for an LLC on USN will be as follows:

5.2.1 VAT

Starting January 1, 2025, all simplifiers are recognized as VAT payers, but those whose revenues do not exceed 60 million rubles can enjoy a tax exemption. Let’s assume Ivan's company’s revenues from January to October amounted to 61 million rubles, so starting November 1, his company becomes a VAT payer.

In practice, when a supplier becomes liable for VAT during the year, customers often refuse to cover additional VAT costs, believing that the contract price is final and that the supplier should pay any taxes from it. As a result, the supplier must pay VAT out of his own funds. We recommend including a provision in client contracts that allows the price to be increased by the VAT amount if the supplier becomes liable for VAT. In our calculation, we will consider VAT being charged on top of the contractual price.

Returning to the calculation: the VAT taxable income is 9 million rubles (70 million – 61 million). Ivan can choose the tax rate himself. The rates may be:

- General rate 20% (in certain cases — 10%, for exports, international transport 0%). When choosing general rates, the charged tax can be reduced by the "input" VAT on purchased goods (works, services). The tax amounts indicated in accounts and invoices issued by sellers and suppliers are accepted for deduction. Switching from general rates to reduced ones is possible from the beginning of a new tax period (quarter).

The tax at the general rate will be 1,800,000 rubles (9 million * 20%).

- Reduced rates: 5% — the rate is available for incomes from 60 million to 250 million rubles; 7% — for incomes from 250 million to 450 million rubles, and also if the right to the 5% rate has been lost in the current year due to exceeding the income level of 250 million rubles.

Reduced VAT for Ivan will be 450,000 rubles (9 million * 5%).

Reduced rates have their drawbacks.

1) Reduced rates do not allow for deductions — the tax cannot be reduced by the amount of "input" VAT, so the tax must be paid in full. However, for IT companies, this is usually not very relevant due to the low "input" VAT share.

2) The chosen reduced rate must be applied continuously for 12 tax periods (quarters) in a row, i.e., for three years. It is only possible to switch to general rates before this period ends if the simplified tax system is no longer applicable, or when the simplifier gains the right to an VAT exemption for income below 60 million rubles for the previous year (clause 9, article 164 of the Tax Code as amended by law No. 176-FZ).

3) If a 5% rate is chosen, but the income exceeds 250 million rubles in the current year, the simplifier must switch to the 7% rate starting from the first day of the month following the month of such excess (subparagraph 1, paragraph 8, article 164 of the Tax Code as amended by law No. 176-FZ).

5.2.2 USN

The USN tax depends not only on the USN tax rate itself but also on the selected VAT rate since the USN tax is calculated by deducting VAT from the income.

If Ivan chooses the USN "Income" (6% in Moscow), the tax will be:

- With a 20% VAT rate: 4,092,000 rubles ((70 million – 1.8 million VAT) * 6%);

- With a 5% VAT rate: 4,173,000 rubles ((70 million – 450 thousand rubles VAT) * 6%).

If USN "Income minus expenses" (15% in Moscow) with conditional expenses of 50 million rubles, the tax depending on the VAT rate will be:

- With a 20% VAT rate: 2,730,000 rubles ((70 million – 50 million – 1.8 million VAT) * 15%).

- With a 5% VAT rate: 2,932,500 rubles ((70 million – 50 million – 450 thousand rubles VAT) * 15%).

5.2.3 NDFL on salaries

If the total employee salary is, for example, 30 million rubles (10 million per employee), NDFL withheld from employees will amount to 4,806,000 rubles.

5.2.4 Insurance contributions on salaries

General rate:

- Pension, health, and social insurance contributions — 30%;

- Accident insurance contributions — from 0.2% to 8.5%.

The rate depends on the professional risk class: the more risky the field and the higher the class, the higher the accident insurance rate.

For small businesses, which Ivan’s company is likely to be classified as, a reduced rate of 15% applies to the part exceeding 1.5 minimum wage (MW). Each month, the part of the payments exceeding 1.5 MW needs to be separated and subject to the reduced rate. The portion within 1.5 MW is taxed at the general rate, but after the individual income exceeds the maximum limit (2,759,000 rubles), the part within the MW is taxed at a 15.1% rate.

The approximate annual insurance contribution will be around 4.6 million rubles.

5.2.5 Taxes for self-employed workers and sole proprietors

Since tax payments are made by the self-employed worker and sole proprietor themselves, this is not Ivan’s tax burden.

5.3 Working with a foreign company

5.3.1 Working with a foreign contractor

When purchasing goods, works, and services from foreign contractors, Ivan's company may become a tax agent for VAT and profit tax, even using USN and not being a VAT payer (if revenues are less than 60 million). Thus, analyzing each foreign company payment for potential taxes is crucial. Here's what to consider, with references to the Russian Tax Code.

For agent VAT, analysis should be based on the following criteria:

- The foreign contractor is a company, not an individual, and has no branch or representation in Russia (clause 2, article 146, articles 147-149, subparagraphs 1, 2, 5, article 161 of the Russian Tax Code).

- The service location is recognized as Russia. This point warrants special attention because for some services specified in article 148 of the Tax Code, the service location is always determined by the client’s location, in our case, Ivan's company in Russia. Such services include software development, consulting, legal, accounting, marketing services, etc. Consequently, when purchasing advertising from a foreign supplier, Ivan's company must pay the tax to the budget, either withholding it from the foreign company’s income at a 20/120 calculated rate or adding 20% VAT on top. This also depends on agreements with the supplier.

- The services purchased are VAT-taxable in Russia. If services are untaxed in Russia according to article 149 of the Tax Code, there won't be any agent VAT.

Agent profit tax occurs:

- For payments of the incomes listed in paragraph 1, article 309 of the Tax Code to foreign companies without permanent establishments in Russia (paragraph 1, article 310 of the Tax Code). For instance, paying a foreign contractor income from software rights usage requires 25% tax payment to the Russian budget.

- For payments of other incomes not covered in our article due to specificity, including government and municipal security interests to Russian organizations and foreign companies operating in Russia through permanent establishments (paragraph 5, article 286, subparagraphs 7, 8, paragraph 2, article 310 of the Tax Code), and other incomes per paragraph 3, article 275 of the Tax Code, paragraph 4, article 286, subparagraph 1, paragraph 4, article 282, paragraph 6, article 282.1 of the Tax Code.

If the foreign supplier is a resident of a state with a valid DTT with Russia, the DTT should be examined for profit tax liability, as it might provide a tax exemption or preferential rate in Russia.

For tax agent obligations, it's crucial at the contract stage to account for indirect taxes in Russia’s service costs, as failure to do so or a supplier’s refusal to reduce service prices by Russian taxes might mean the taxes are essentially covered by the Russian agent company.

5.3.2 Working with a foreign client

Let’s also consider an example of Russian VAT taxation when receiving income from foreign clients. For instance, this could be a situation where most of Ivan’s profits are consolidated in his foreign company, while part of this foreign income is allocated to Russia (expenses of the foreign company for development, which support the Russian company’s operating activity).

In this case, controlled foreign company (CFC) taxes may occur and there are offset procedures in Russia that effectively avoid additional tax burdens and depend on the CFC’s jurisdiction.

As an example, suppose Ivan’s CFC is registered in Kazakhstan. If Ivan’s company in Russia uses USN and does not exceed a 60 million annual limit, there won't be any tax in Russia, but if the income limit is exceeded or the company is on the OSNO, Russian VAT may arise.

The procedure for indirect tax collection for work performance and service provision among EAEU (Eurasian Economic Union) member countries (Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia) is regulated by Section IV of the Protocol on indirect tax collection procedures and control mechanisms during export and import of goods, work performance, and service provision (Appendix No. 18 to the Treaty on the Eurasian Economic Union). According to paragraph 29 of the Protocol “The place of work performance, service provision is recognized as the state-member’s territory if this state-member’s taxpayer acquires works, services for software and database development, adaptation and modification, support of such programs and databases.”

Thus, the place of work/services realization is recognized as the Republic of Kazakhstan and such a payment is taxed on the Kazakhstani company’s side according to Kazakhstan's legislation. There won’t be any tax in Russia.

5.4 Table

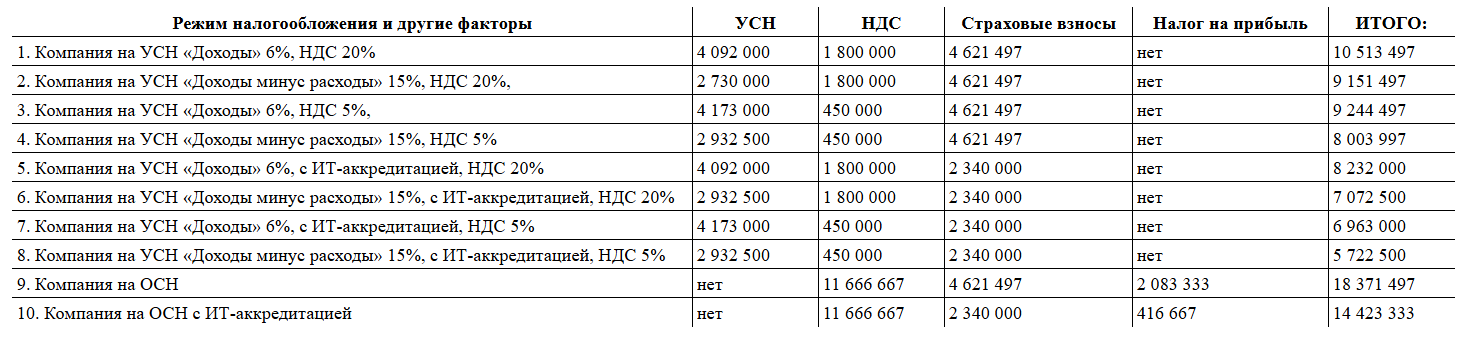

Ivan’s tax burden when opening his company depends on many factors, including the chosen taxation system, income level, selected VAT rate, expense amount, client contract terms for year-appeared VAT addition, and more. The table below summarizes available tax scheme options and tax burden sums, allowing comparison to determine the most advantageous scheme for Ivan.

NDFL is not listed in the table, as it is withheld from employees and its rate depends only on the physical person’s income level.

In our opinion, given the example parameters used in our calculation, scheme 8 would be the most beneficial for Ivan, where the total tax burden would amount to 5.7 million rubles. To apply this tax scheme, Ivan needs to:

- Obtain IT accreditation and pay reduced insurance contributions.

- Choose USN "Income minus expenses" — 15%.

- Select a 5% VAT rate.

- Agree with clients that VAT will be added on top of previously agreed costs.

5.5. Dividends

At the end of the year, Ivan also plans to distribute dividends to himself in the amount of 5 million rubles.

If Ivan is a Russian tax resident, the tax will be:

- On income up to 2.4 million – 312,000 rubles (13%);

- On income from 2.4 million and no limits – 390,000 rubles (15%).

If Ivan does not reside in Russia and is not a Russian tax resident, the entire income tax rate will be 15% — 750,000 rubles.

6. Controlled Foreign Company

Time has passed, and our developer Ivan decided to expand his business and enter the international market by opening two companies in other countries for himself. For instance, one in Europe and one in the CIS.

Ivan notified the Federal Tax Service of the controlled foreign companies (CFC) by sending notifications of participation in the CFC. Now, every year, he is required to report to the FNS about his foreign companies (including their financial results) and pay tax on the CFC’s profits as his personal income in Russia if the CFC’s profits exceed 10,000,000 rubles for a reporting year.

Furthermore, Ivan can either calculate the tax from the CFC profits based on factual data or opt to pay a fixed-income CFC tax on personal income. Usually, when choosing the "fixed tax", Ivan should use this regime for at least five tax periods, starting from the period he notified about such a transition.

From January 1, 2025, for tax periods beginning 2025, the fixed profit sum is set based on the number of controlled companies.

Thus, with two CFCs in 2025 and paying a fixed-income CFC tax on personal income, Ivan will have to pay 9,999,960 rubles of tax in Russia, submitting a 3-NDFL tax return by April 30, 2026.

If Ivan chooses to calculate the tax based on actual profit data, as the "fixed" tax regime suits large companies with high profits more, then real CFC profit data will be used for the calculation, applying progressive NDFL rates from 13% to 22%.

***

The 2025 tax reform significantly changed taxation rules for both individuals and legal entities, including IT companies, altering rates, limits, and tax obligations. IT business owners now need to consider the progressive NDFL scale, mandatory VAT when exceeding income limits, new profit and insurance contribution tax rates, as well as potential tax obligations when working with foreign clients and contractors. Mistakes in choosing a tax regime can lead to significant additional costs. Nevertheless, with wise tax planning and current realities, it is possible to select a beneficial business strategy. However, to minimize tax risks, only rely on trusted lawyers and experienced consultants.