How much taxes do you have to pay if you own a foreign company in Russia?

The law firm Prospectacy has prepared a large-scale material on the taxation of foreign income in Russia. It touches on the topics of controlled foreign companies, how to calculate profits on them and pay tax (as well as what changed in these rules in March).

Kristina Kurtayeva — Senior Tax Adviser at Prospectacy

Today, almost every Russian entrepreneur, in one way or another connected with foreign capital, faces questions about the taxation of foreign income in the Russian Federation. In the last 5-6 years, Russia has taken an active course to combat the withdrawal of funds abroad and tax evasion. The tax authorities are paying particularly close attention today to those who own controlled foreign companies. Legislation in this area is updated annually, requirements and liability for violations of the law are tightened, so it is extremely important to answer the question: how much taxes will have to be paid for owning a foreign business.

What is a controlled foreign company and a controlling person?

Let’s start with the basic concepts, namely, consider what a controlled foreign company is.

A controlled foreign company (CFC) is a foreign company or structure without the formation of a legal entity (legal entity) that is not a Russian tax resident, but controlled by a resident of the Russian Federation or in other words, a controlling person.

According to Article 25.13 of the Tax Code of the Russian Federation, a natural or legal person can become a controlling person if one of the following criteria is met:

- a resident of the Russian Federation has a stake in a foreign company, which is more than 25%;

- a resident of the Russian Federation has a share of less than 25%, but more than 10%, despite the fact that the total share of participation in a foreign company of other residents of the Russian Federation is more than 50% and the share of each of them is also more than 10%. It is important to note that the “participation share” can be not only direct, but also indirect. The calculation of the indirect interest is determined in accordance with the provisions of Article 105.2 of the Tax Code of the Russian Federation. Practical calculations of the share of indirect participation will also be presented in this article;

- a resident of the Russian Federation, does not have a stake in a foreign company, but exercises control over it in his own interests or in the interests of his spouse and minor children. In practice, this criterion is the most controversial, since it is clear from the definition that it is very subjective, therefore it is hardly possible to lose the status of a controlling person while exercising control over a foreign company. Due to the controversy of this criterion, the tax authorities have great opportunities to retrain individuals who are residents of the Russian Federation into controlling persons. In order to avoid unnecessary questions from the tax authorities, it is better to independently recognize yourself as a controlling person in the presence of any doubts and understand the responsibilities that this imposes.

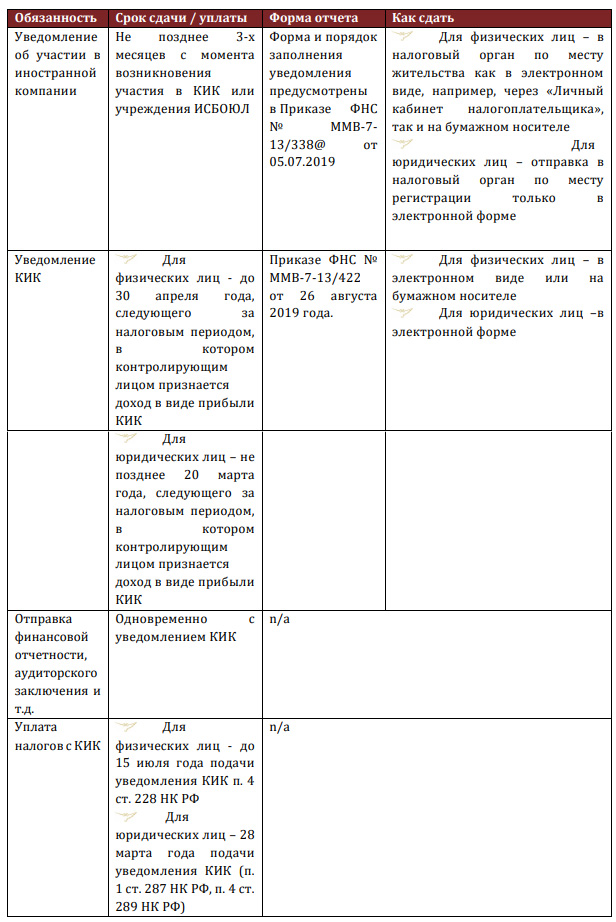

What are the responsibilities of the controlling persons?

The responsibilities of the owners of the CFC include:

- promptly inform the tax inspectorate about the beginning (completion) of participation in the CFC;

- promptly notify the tax inspectorate of the existence of a CFC and its activities;

- send the necessary documents to the tax inspectorate together with the notification of the CFC, in particular, financial statements or an audit opinion;

- respond to the requirements of the tax authorities and provide the requested reports;

- pay taxes on CFC profits on time.

In practice, most of the questions arise when submitting a CFC notification, since this report discloses information about profit (or loss) CFC and it is from this amount of profit that the tax inspectorate will wait for the payment of tax and in the share that the controlling person owns. One of the most important questions is when exactly is income recognized in the form of CFC profits? The date of receipt of income in the form of profit of a CFC is recognized as December 31 of the calendar year following the tax period, which accounts for the end date of the period for which financial statements are prepared in accordance with the personal law of a foreign controlled company.

Thus, if the financial year of a controlled foreign company ended on December 31, 2021, then income from activities will be recognized as of December 31, 2022, and a CFC notification must be submitted as early as 2023.

Below is a schematic representation of the algorithm of actions performed by the controlling person (a resident individual) from the moment of participation in the CFC.

How to calculate the profit of a CFC?

Article 309.1 of the Tax Code of the Russian Federation, which establishes the rules for calculating the profit of a CFC, will help answer this question. In accordance with this article, profit (loss) KIK is calculated:

- according to its financial statements prepared in accordance with the personal law of such a company for the financial year;

- or up to the rules established by this chapter for taxpayers – Russian organizations (we are talking about Chapter 25 of the Tax Code of the Russian Federation).

At the same time, in order to be able to calculate the profit of a CFC on foreign financial statements, one of two conditions must be met (Clause 1.1 of Article 309.1 of the Tax Code of the Russian Federation):

- the permanent location of the CFC is a foreign state with which there is an international agreement of the Russian Federation on taxation issues, except for states from the “black list”; or

- An auditor’s report has been submitted with respect to the financial statements, which does not contain a negative opinion or refusal to express an opinion.

Is it possible to reduce the profit of the CFC?

When calculating the profit of a CFC, it should also be borne in mind that the law allows you to deduct certain amounts from the profit of a CFC (Clause 1 of Article 25.15 of the Tax Code of the Russian Federation):

- the dividends paid by the CFC or the profit distributed by the CFC;

- dividends, the source of payment of which are Russian organizations, if the controlling person of this CFC has the actual right to such income;

- losses of previous years – according to Clause 7 of Article 309.1 of the Tax Code of the Russian Federation, losses can be transferred to future tax periods, but in order to apply this deduction, the controlling person must submit a notice of the CFC for the period in which the loss was received.

- in addition, Clause 3 of Article 309.1 of the Tax Code of the Russian Federation provides for other specific types of income that can be deducted from the profit of the CFC, namely:

- income in the form of amounts from revaluation and (or) impairment of shares in the authorized capital of organizations, units, securities, derivative financial instruments at fair value;

- income in the form of amounts of income from the sale or other disposal of shares in the authorized (pooled) capital (fund) of organizations, units, securities and expenses recognized at the disposal of these assets as part of profit (loss) CFC before taxation (taking into account Clause 3.1 of Article 309.1 of the Tax Code of the Russian Federation);

- income in the form of profit (loss) amounts of subsidiaries (associated) organizations (excluding dividends);

- income in the form of amounts of expenses for the formation of reserves and income from the restoration of reserves.

Important nuances in the calculation and payment of CFC profits.

- Conversion of profit into rubles. In the tax return, the profit must be indicated in rubles. The “average exchange rate” is used to convert foreign currency into rubles. In accordance with the explanations of the Ministry of Finance, the average value of the exchange rate of foreign currency to the ruble is determined by the taxpayer independently as the arithmetic average value of the exchange rate of foreign currency to the ruble of the Russian Federation, established by the Central Bank of the Russian Federation for all days in the corresponding period for which the financial statements were compiled (Letter of the Ministry of Finance of the Russian Federation No. 03-12-11/2/7395 from February 10, 2017).

- When submitting notifications, the controlling person is obliged to attach financial statements confirming the calculation of profit (or loss). If you do not attach the reports, penalties are already provided.

- The controlling person must attach supporting documents for the payment of taxes by a foreign company with a reduction in income tax in the Russian Federation.

- When applying the provisions of international double taxation treaties, Russian residents must also attach a certificate of residence of a foreign company and a certificate that the income of a foreign company is not passive.

Are there exceptions?

The exceptions provided by the legislation to the rules for calculating the profit of a CFC, which can significantly facilitate the life of the owners of a CFC, can be good news for interested parties. Within the framework of this article, we will consider the main 3 of them, the remaining exceptions can be found in Article 25.13-1 of the Tax Code of the Russian Federation. So, the main exceptions are:

1. Profit less than 10 million rubles.

This benefit directly exempts the owners of the CFC from paying taxes if the profit of the CFC was less than 10 million rubles (Clause 7 of Article 25.15 of the Tax Code of the Russian Federation).

However, this benefit does not affect the obligation of the controlling person to submit financial statements or an audit report to the tax authority to confirm financial performance. If it was not required to do this until 2021, then starting from 2021 it is mandatory.

The next exception is:

2. The effective rate is not less than 75%.

The profit of a CFC is exempt from taxation if the effective income (profit) tax rate for such CFC is at least 75% of the weighted average corporate income tax rate.

It is necessary to compare it with the weighted average rate, since, as a general rule, the corporate income tax in Russia is 20% (clause 1 of Article 284 of the Tax Code of the Russian Federation), but for income in the form of dividends the rate is already 13% (sub-clause 2 of Clause 3 of Article 284 of the Tax Code of the Russian Federation).

Given that Russia does not have the highest taxes, the application of this exception may be widespread.

3. Active company

The profit of a CFC is exempt from taxation if such a company is an “active foreign company”. To be such an active company, the share of passive income should not exceed 20%. The list of passive income is given in Article 309.1 of the Tax Code of the Russian Federation, where such income as:

- dividends;

- interest income on loans;

- license fees;

- income from equity transactions and real estate transactions;

- income from the sale of shares (shares) and (or) assignment of rights in a foreign organization that is not a legal entity under foreign law; Income from the provision of consulting, legal, accounting, auditing, engineering, advertising, marketing, information processing services, as well as from research and development work.

As you can see, the list of such passive income is quite wide, and in order to be considered active, the company must receive at least 80% of income from other sources. According to the residual principle, active income can include, for example, the sale of goods and the performance of works.

Payment of a fixed tax

Since 2021, individuals have the right to pay a fixed amount of 5 million rubles. instead of calculating and paying CFC profit tax. At the same time, the amount of tax does not depend on how many CFC an individual has.

To switch to the payment of a fixed CFC payment, you need to submit a notification to the inspectorate before December 31 of the year from which it was decided to accept a fixed tax.

It will be necessary to pay a fixed tax for 5 years (3 years for those who decide to switch to such a system in 2020 and 2021). After the specified period, it will be possible to return to the standard system by submitting a notice of refusal to pay personal income tax with a fixed profit of the CFC.

It is still difficult to judge whether this mode will be popular among entrepreneurs, but it is already possible to cite the pros and cons of using this mode:

We have considered the pros and cons of the CFC fixed tax payment regime, and now let’s look at the advantages of owning a CFC itself. Usually, the CFC regulatory system is treated as some kind of encumbrance that prevents business development, moving to more flexible jurisdictions with respect to taxation and unnecessary bureaucracy. However, there are factors that allow the CFC to become a very convenient tool for tax optimization in the Russian Federation, in particular for individuals. To the others

Advantages of CFC for individuals

- The opportunity not to pay tax if the profit of the CFC is less than 10 million rubles.

- The possibility of offsetting expenses by reducing the tax base of the CFC. The CFC has the right to deduct the expenses incurred for the purposes of calculating profits, while an individual is sufficiently limited in what he can take into account as expenses to reduce the base. In addition, the CFC has the right to transfer the loss of previous years to future periods, which an individual cannot do.

- Later terms of payment of tax in comparison with personal income tax. That is, as a standard, when receiving income in 2021, an ordinary tax resident of a non-CFC is obliged to pay tax by July 15, 2022, while a CFC will pay income tax by July 15, 2023 or even later if a foreign company has other deadlines for approving financial statements.

Let’s move on to practical situations:

Example 1. A software developer has 50% in a foreign company. Since he has more than 25% of the stake, we definitely conclude that he is a controlled person.

The company’s profit for 2020 amounted to 100 million steering wheels. Corporate tax amounted to 200 thousand rubles.

Decision:

- The profit must be distributed before 31.12.21

- The CFC notification must be submitted before 30.04.22

- The 3-personal income tax declaration must be submitted before 30.04.22

- The tax on the declaration will be:

50% * (100,000,000 rubles * 15%) – 200,000 rubles * 50 % = 7 400 000 rubles - It is necessary to pay personal income tax to the budget of the Russian Federation by 15.07.22

Example 2. The following practical example will be on the determination of indirect participation in the organization and the calculation of the corresponding tax.

An individual resident of the Russian Federation has shares in foreign and Russian companies, which in turn also have shares in a foreign company.

Decision:

To determine indirect participation, it is necessary to add up the sum of the products of direct participation shares in the sequence of organizations between the ultimate owner and the controlled company.

- 20% * 60% + 40% * 80% = 44%

- 200,000,000 rubles * 40% = 80,000,000 rubles – part of the profit attributable to the Russian LLC. This amount must be deducted from the calculation, as it is subject to taxation by a legal entity.

- 200 000 000 * 44% – 80 000 000 rubles * 80% = 24,000,000 rubles – the amount of tax payable, based on the share of indirect participation of individuals. faces. If we had data on the tax paid by the CFC, it could also be set off.

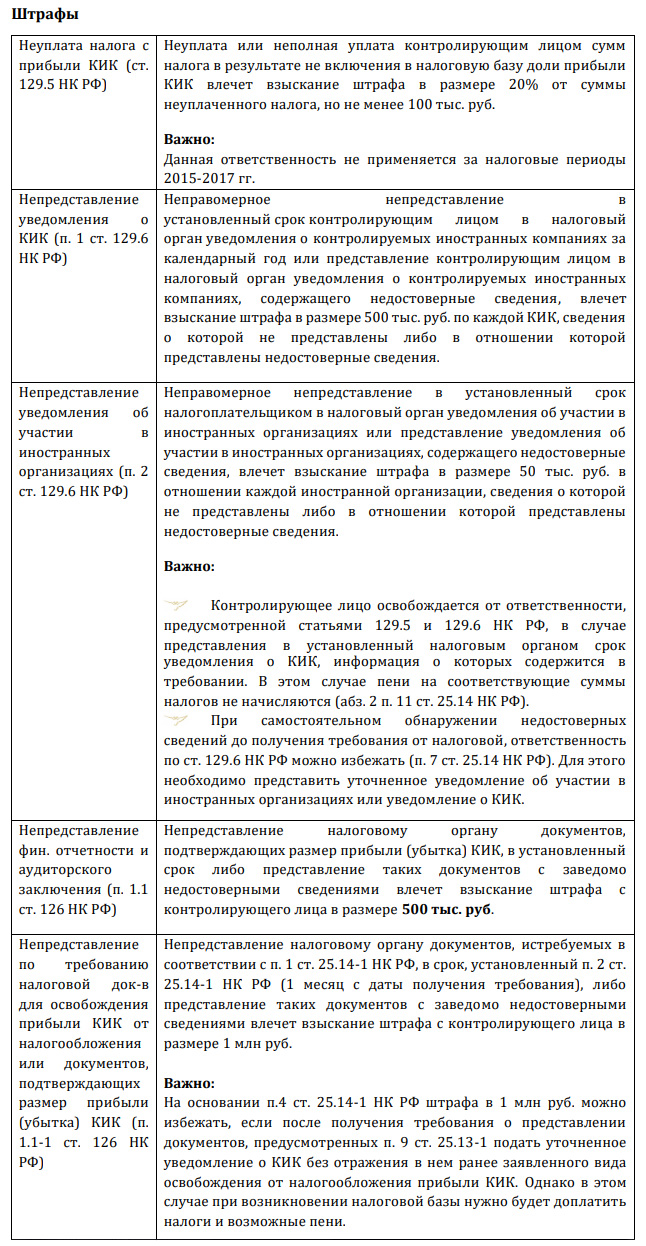

Responsibility for violations of the CFC legislation

At the end of the article, I propose to consider in more detail what penalties and liability are provided for violations of legislation on controlled foreign companies.

In case of receiving demands for payment of fines from the tax authorities, we recommend conducting a dialogue with them, since the procedure provides for the possibility of reducing the amount of fines in view of the mitigating circumstances contained in paragraph 1 of Article 112 of the Tax Code of the Russian Federation, the list is open. If there is at least one mitigating factor, the amount of the fine is subject to reduction by at least 2 times compared to the amount established in the Tax Code of the Russian Federation. In practice, mitigating circumstances may include:

- the offense was committed for the first time;

- no damage was caused to the budget of the Russian Federation;

- the commission of an offense due to a combination of difficult personal or family circumstances;

- commission of an offense under the influence of threat or coercion or due to material, official or other dependence;

- the difficult financial situation of an individual who is being held accountable for committing a tax offense;

- and other circumstances that may be recognized by a court or tax authority as mitigating liability.

Criminal liability

In addition to fines and penalties for violating tax legislation, individuals may also be held criminally liable under Article 198 of the Criminal Code of the Russian Federation (the “Criminal Code of the Russian Federation”) for non-payment of taxes in large (2.7 million rubles) and especially large (13.5 million rubles).

The maximum measure of responsibility under this article is imprisonment for up to 1 year (on a large scale) or up to 3 years (on an especially large scale).

Criminal liability can be avoided if:

- the person committed this crime for the first time;

- and such a person has fully paid the amounts of arrears and the corresponding penalties, as well as the amount of the fine in the amount determined in accordance with the Tax Code of the Russian Federation.

In addition, criminal liability does not occur for acts related to non-payment or incomplete payment of tax amounts as a result of non-inclusion of CFC profits in the tax base of the controlling person:

- in 2016 and 2017 – if the controlling person is an organization and the damage caused to the budget system of the Russian Federation as a result of the commission of a crime is fully compensated;

- in 2016-2018 – if the controlling person is an individual and the damage caused to the budget system of the Russian Federation as a result of the commission of a crime is fully compensated.

The heads of organizations or other persons authorized to submit documents to the tax inspectorate on behalf of the organization may also be brought to criminal responsibility. Such liability is provided for in Article 199 of the Criminal Code of the Russian Federation. The thresholds for recognizing unpaid amounts of taxes as large and especially large differ from Article 198 of the Criminal Code of the Russian Federation and are, respectively, 15 million rubles and 45 million rubles.

The maximum measure of responsibility under this article is imprisonment for up to 2 years (on a large scale) or up to 6 years (on a particularly large scale).

Liability can also be avoided if:

- the person committed the crime for the first time;

- and this person, or the organization itself, has fully paid the amount of arrears and the corresponding penalties, as well as the amount of the fine in the amount determined in accordance with the Tax Code of the Russian Federation.

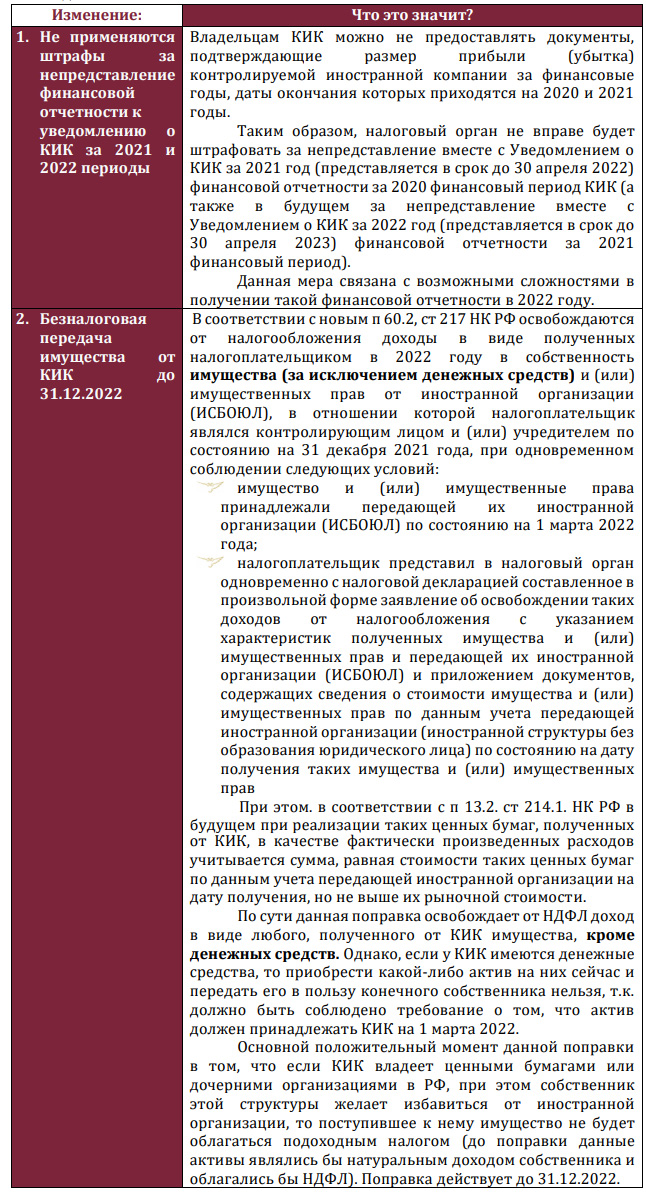

Recent changes in CFC legislation:

According to Federal Law No. 67 of 26.03.2022, the following amendments have been made to the legislation on CFC: