Why Raising Investments in Mobile Game Development Became More Difficult in 2024 — A Column by Azur Games

What is the cost of developing a mobile game today and what kind of margins can one expect from it? Dmitry Yaminsky, co-founder of Azur Games, discusses in his column.

Dmitry Yaminsky

During the pandemic, margins in the mobile games market continued to grow, outpacing trends. The market remained attractive even after the growth rate declined somewhat, allowing for high margins or significant returns when selling shares. However, the situation is not as clear-cut now. Everything has changed.

It would seem that the hyper-casual games market (hereafter — HC) still commands a huge share of installs, despite persistent predictions of its demise. In 2023, this segment accounted for 26% of all mobile game downloads. However, unlike a few years ago when nearly every project had a chance to succeed, today, out of 1,000 new games, there may not be a single hit. Moreover, if you look at the distribution of installs, the lion's share belongs to older projects that continue to evolve and be supported by publishers, following a model similar to GaaS. Yes, you can and should work in this market—our HC division alone received over 2 billion installs last year. However, it is also important to have a sober assessment of the profitability in this area.

A similar situation is seen in the casual market—previously, obtaining funding for a prototype without metrics was relatively easy. The success rate among such projects was 1 in 10-15. Now, it's rare for companies to invest in projects without initial metrics. The exceptions are teams with substantial experience, but that doesn't negate the extremely high competition in the market.

All this means that a small, young team has an almost impossible task of launching a successful project. While there are success stories, relying on them would be a classic case of survivor bias. The market's growth has slowed, advertising efficiency has decreased, and margins have become ordinary and market-driven.

From now on, developing a successful casual project requires allocating for a team of several dozen people, remembering that it might take several attempts before releasing a project that is ready to scale.

Let's delve deeper into how business has changed over the past few years in terms of costs and profitability. We’ll consider both the HC segment and the business models of casual and mid-core segments, which have now become top priorities for further development.

What Has Changed

Three to five years ago, HC games were at their peak and often developed by teams of just one or two people. A simple core mechanic with relatively basic visuals was enough to top the charts and achieve margins greater than 50% considering revenue share. At that time, little attention was given to effects, production quality, details, UI, etc.

HC games then and now (Rise Up: Balloon Game and Merge Archers: Bow And Arrow)

This spurred a wave of developers who became pioneers in this direction, capable of succeeding in business with relatively small investments. They only needed to spend 2-5 thousand dollars, mostly reclaimed by the publisher, to have a 1 in 20 chance of launching a project that not only justified the time spent but could also scale to several hundred thousand dollars in purchases per month.

By 2023-2024, the HC team composition underwent significant changes and typically looks like this:

- 1-2 programmers;

- game designer;

- art manager;

- VFX specialist.

This is the minimal team working on a single prototype. In some cases, the size of an HC unit today can reach up to 10 people. Remember, out of 20 projects, there might not be even one that succeeds or at least breaks even. Thus, studios have to increase the number of such units, which further reduces margins.

The result? We often see studios with 3-4 such units developing multiple projects in parallel while maintaining a high quality standard. Studios can also hire modelers, artists, and level designers for specific positions. It’s challenging to reach the top with just a single mechanic—there's a need to develop the shell for the core gameplay, work out monetization points, build a level funnel, polish effects, and animation.

Moreover, many publishers bring in their own specialists to work with partner studios. These include producers, game designers, marketers, analysts, sound designers, ASO specialists, and more.

As a result, the average development cost for a project that shows decent metrics, considering all iterations, easily exceeds $20,000, which again needs to be multiplied by the number of attempts needed to release another hit. We end up with a typical VC story, where only one out of dozens of projects might become successful.

Margins and Costs

Now for the most interesting part—the current average margin for HC projects stands at around 10-15%. The team composition usually looks like this:

- one or two programmers;

- game designer;

- art manager;

- VFX specialist;

- possibly, studio head.

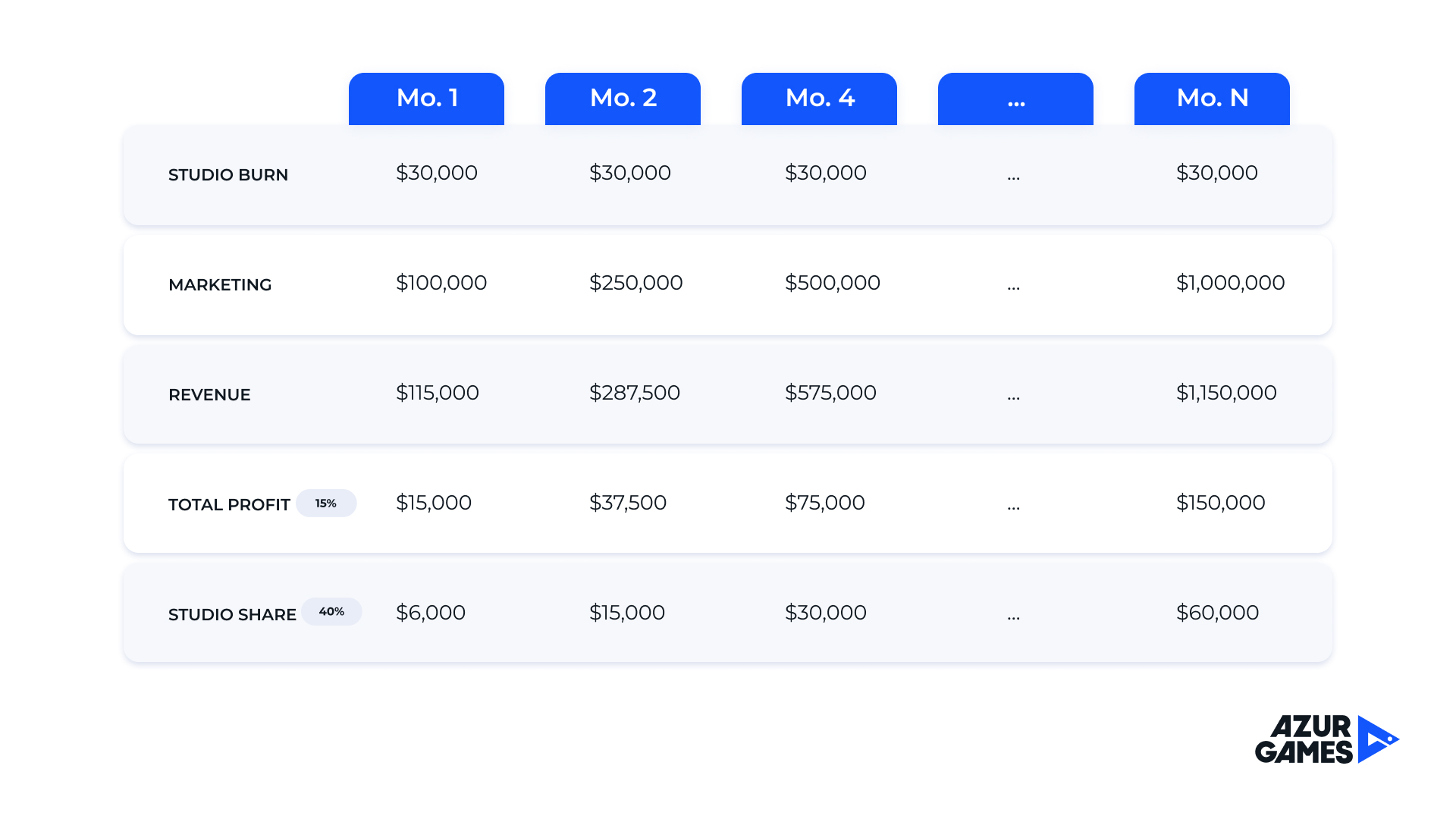

Maintaining such a team, taking into account average salary expenses and additional costs, will cost about $30,000 per month, considering the revenue shared between the developer and publisher. It's important to recognize that without a publisher, maintaining the team becomes exponentially more expensive due to the need to hire marketers, legal counsel, etc., but this scenario is not being considered right now.

Ultimately, to break even with such a team, you will need:

- a project with marketing spend starting from $500,000 per month with a margin of at least 15%;

- to consider the need for recurring investments to maintain or grow the current turnover;

- to reinvest in developing new projects to keep growth.

We should not forget about the previously invested funds because they are also deducted from the revenue share until the total profit reaches a full 0; only then is any profit realized.

Not such a rosy picture of a successful entrepreneur, right? In fact, it turns out to be not very high-margin, akin to a traditional offline business. On average, investments in this direction pay off in 1.5-2 years, after which they start generating market profits.

Developing an HC game now takes 2-4 months, and during all this time, you also need to pay salaries. Moreover, even if you successfully reach the release and start acquiring, you can't attract users for $500,000 in the first month. Spending will need to be ramped up gradually.

Consequently, here are the approximate figures for a team with a burn of $30,000 after several months of development and with a successful product with a margin of 15% (taking the typical profit-sharing model for hyper-casual as 40/60):

This means you will hardly break even immediately, and there's no guarantee that the initial months spent on the prototype won't be wasted. Most likely, you'll have to start over until you manage to create a working product.

Casual and Mid-core

Railroad Empire

Here, the math becomes even more interesting and often depends on the project itself. But the most intriguing aspect for those investing in the project is the average chance of project success. On average, 1 out of 10 projects succeeds, covering all the investments in the other nine projects over 2-3 years.

The cost of investing in the development of one casual project ranges from $500,000 (initial investments) to $2-3 million (if the project reaches a release stage). At some point, it may become clear that the project could not find its market fit, meaning that the invested funds effectively multiplied to 0.

Let's dissect where these figures come from and what main stages a casual/mid-core development goes through. The minimum requirements:

- Assemble an initial team of 15-20 people (again assuming that the studio works with a publisher, not independently).

- Create the first game prototype within a year.

- Collect basic metrics (at this point, the decision is made whether to continue development or write off the primary investments).

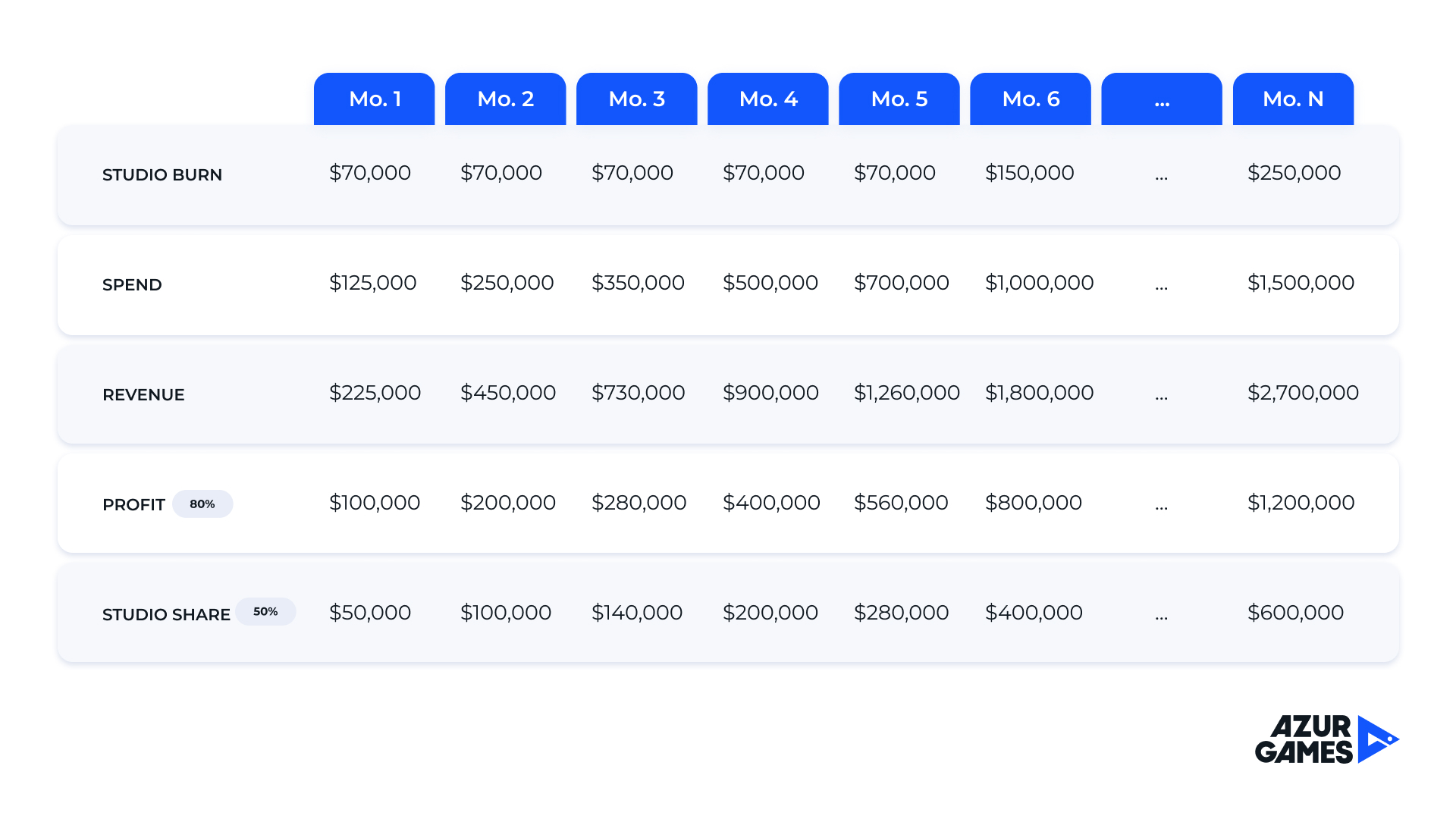

- If all is well, the project has potential and the spend is at least partially covered, — the team is scaled up for comprehensive work on the project (by this time, the studio’s monthly burn rate would be at least $70,000).

- Develop a full-fledged game through multiple iterations until a full-scale release (this may take another two years).

This means the margin of a successful casual/mid-core project should cover an average of $10-15 million in unsuccessful investments. Of course, the success rate can vary, but the overall industry picture is approximately like this. It’s also important to understand that spending on these projects also grows gradually; therefore, for a while, even with a spending over $300,000, a company may operate at 0, reinvesting all funds into development and increasing marketing spend.

Summarizing the numbers again, but now for a casual/mid-core project for a team with a burn of $70,000 after a couple of years of product development, which eventually reached release. We assume a feasible margin figure of 80% considering the organic reach, which in casual/mid-core games can be about 30%. The studio's share of profit is 50%.

With mid-core, there’s another interesting aspect. The last columns show that the team's burn rate increases. The numbers vary for everyone, but the point is that the team should be gradually expanded in line with spending. Sometimes costs are inflated to catch up with growth, leading to problems that are addressed by hiring additional specialists. However, immediately forming a large team makes no sense, as it's too expensive given the high risk of project closure.

Is It Time to Consider Diversification?

The mobile game development sector, like the IT industry in general, is no longer a goldmine where you can immediately jump in and make huge profit multiples in a growing market. Now it's not such a high-margin story; it's a mature industry for serious players with a comprehensive approach, accumulated expertise, and low chances of success in terms of individual companies. To work in it, you need not only to know how to make games but also to love what you do.

Why has the process of obtaining the first round of investment become more difficult now? Investors are primarily concerned with the return on investment. Global goals never change, so your studio must offer a market return on investment. That's why the volume of investments and deals involving major players has significantly decreased in recent years.

Game studio founders must understand that their projects need to generate similar profits to those in other industries. Offline business is traditionally seen as "not cool" for those working in IT, but that's only until it demonstrates a higher margin.

Take a simple example—the restaurant business. To illustrate, let's imagine opening a restaurant in the UAE—it's easier there because of nearly zero taxes, making calculations simpler. The budget for opening a high-level restaurant would range from $3 million to $6 million, with a break-even period of 2 to 4 years.

A common scenario is when revenue is distributed as follows: 25% goes to food, 25% to staff, 25% to the premises, and 25% of revenue is net profit. This is an average figure since this business has high seasonality.

Let's assume a common revenue of $500,000 per month and we get:

- food - $125,000 per month;

- staff - $100,000 per month;

- premises - $150,000 per month;

- net profit - $125,000 per month.

Meanwhile, the chance to create a food establishment (or store) that yields any profit is higher than creating a profitable game. Yes, the restaurant business cannot scale to the same degree, but it is much more stable.

In mobile game development, the profitability of projects has generally declined, and successful launches are far fewer. As a result, young teams without accumulated expertise find it more challenging, and large publishers and developers are forced to adapt and stop expecting extraordinary profits in the short term.

Quality of product and long-term operation come to the forefront. Here, developers sometimes have to forgo their dream game to focus on the business. Sometimes, teams lack the desire to manage a studio's operations, making it ideal to enlist a strategist’s help, who would provide all the infrastructure and can precisely assist with the business component.

Everyone makes their own choices, but it's crucial to remember— the market speaks the language of finance, and this should be the foremost consideration in any investments. This means the companies that thrive in the industry are not only those who create games but also those who understand all business aspects.