Microsoft paid $117 million for Ninja Theory, according to its pitch regarding potential acquisition of SEGA

More and more internal documents are becoming public during the ongoing FTC v. Microsoft hearings. This time, let’s take a look at Xbox’s M&A activity and the companies it has chosen as its potential targets over the past few years.

Microsoft’s previous plans to acquire Sega and new details about the Ninja Theory deal

One of the latest FTC filings revealed an internal email sent by Xbox head Phil Spencer to Microsoft’s CFO Amy Hood and CEO Satya Nadella on November 10, 2020 (via IGN). It contained a pitch to “approach Sega Sammy regarding a potential acquisition of their Sega gaming studios.”

- On page 10, Microsoft listed “precedent transactions” detailing previous M&A deals made by different game companies, including Sony, Tencent, Take-Two, Electronic Arts, and Microsoft itself.

- It appears that Xbox paid $117 million to acquire Ninja Theory. Although the deal was publicly announced in 2018, its financial terms remained undisclosed until that point.

- The UK studio is now working on Senua’s Saga: Hellblade II, which is expected to come out on Xbox Series X|S and PC next year.

- Regarding the then-considered acquisition of Sega’s video game business, Spencer cited potential growth in Game Pass subscribers and additional monetization opportunities through distributing games from the Japanese company as the main value drivers behind the deal.

- Microsoft was also interested in Sega due to the company’s global catalog of PC games and mobile presence in Asia.

What other game companies did Microsoft consider acquiring?

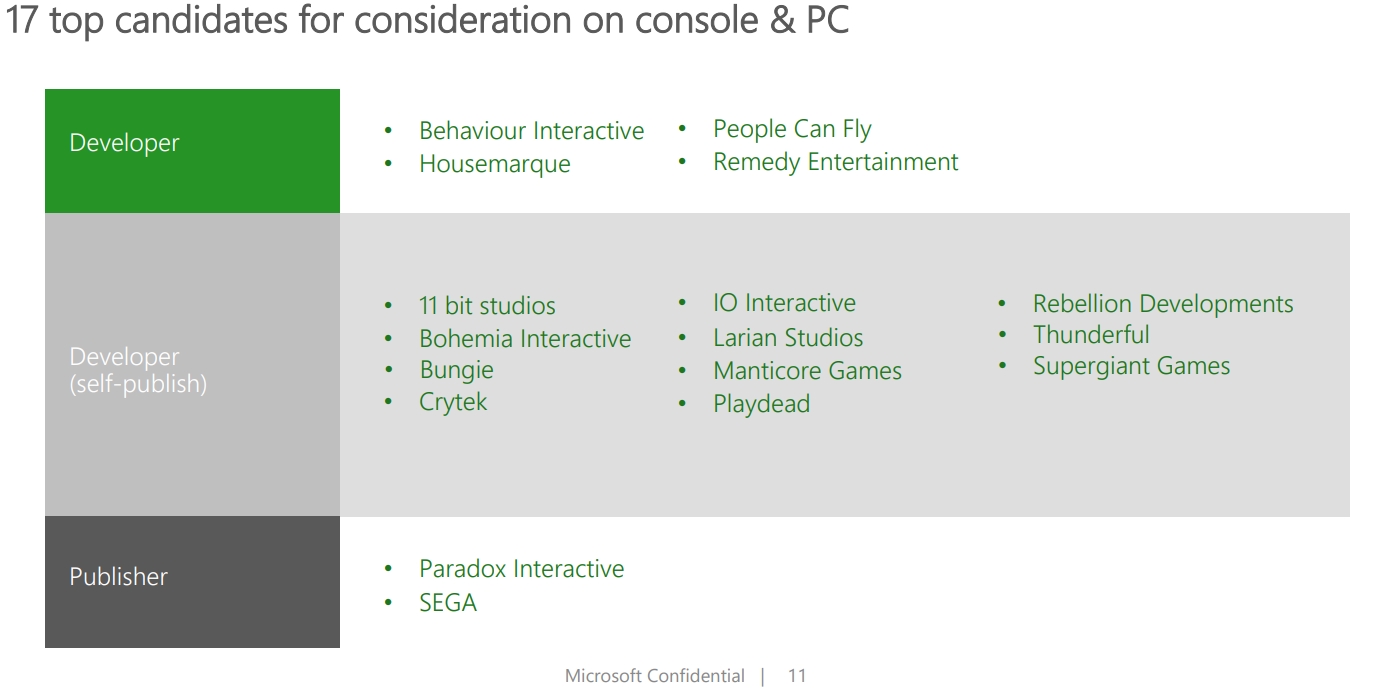

According to Microsoft’s quarterly M&A strategy review from April 2021, the corporation had over 100 game companies on its consideration list as part of its PC and console expansion. There was also a set of 76 M&A targets in the mobile games market.

Most of them were filtered out, but here are some of the top candidates on PC and console (as of 2021):

- People Can Fly (Bulletstorm, Painkiller, Outriders);

- Housemarque (Returnal) — eventually acquired by Sony;

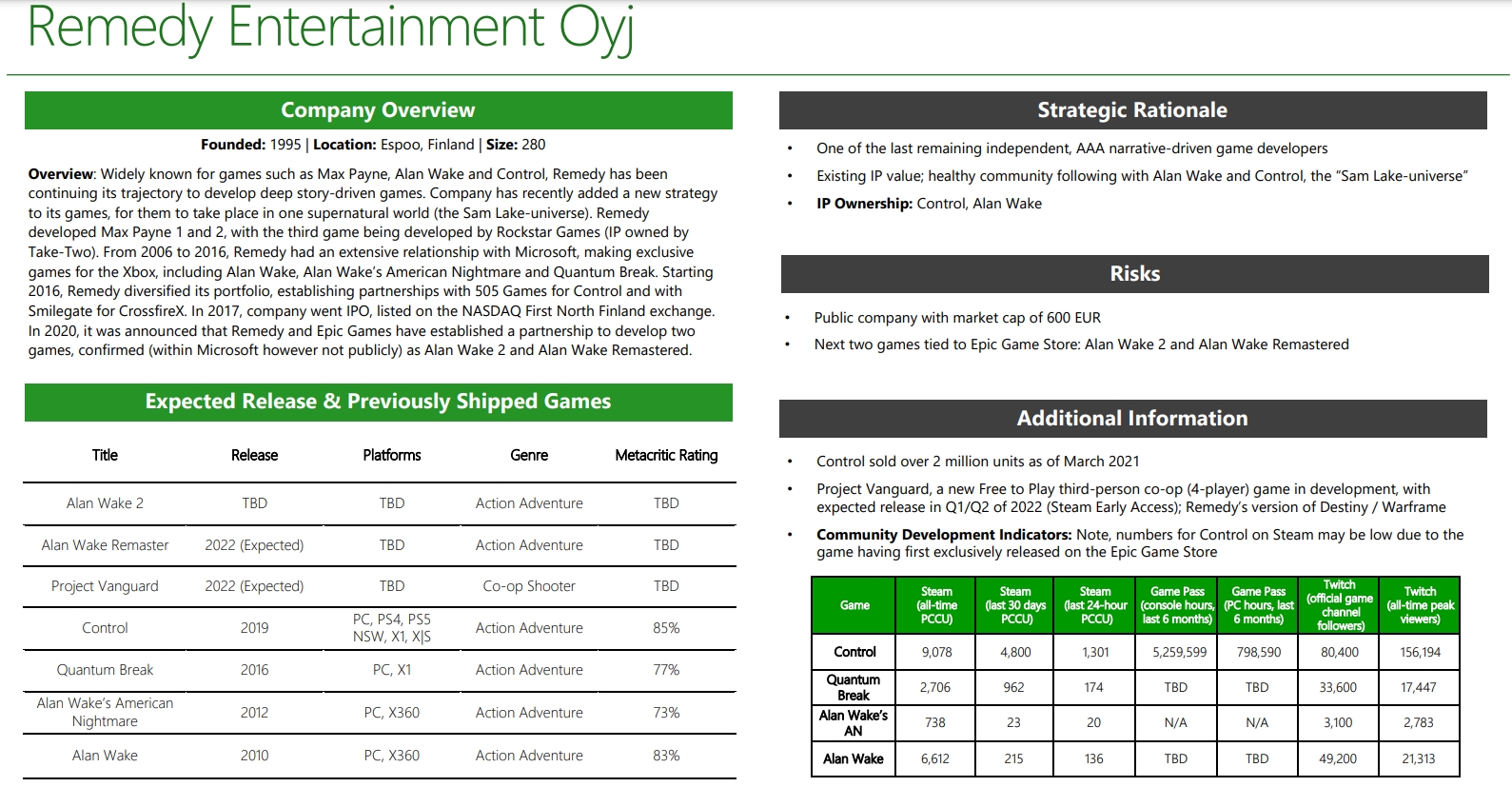

- Remedy Entertainment (Control, Alan Wake, Max Payne);

- 11 bit studios (Frostpunk, This War of Mine);

- IO Interactive (Hitman);

- Larian Studios (Divinity, Baldur’s Gate III);

- Bungie (Destiny) — eventually acquired by Sony;

- Supergiant Games (Hades, Bastion);

- Paradox Interactive (Stellaris, Crusader Kings);

- SEGA (Sonic, Yakuza, Total War).

Microsoft also noted that Bungie, IO Interactive, Supegiant, and Thunderful will be able to “add the most value to the Xbox ecosystem” in terms of social engagement and audience expansion.

In the mobile market, the corporation considered dozens of companies, but reduced the list to:

- Playrix (Gardenscapes);

- Zynga (FarmVille) — eventually acquired by Take-Two;

- Netmarble (Marvel: Future Fight);

- Niantic (Pokemon GO);

- Scopely (Marvel Strike Force) — acquired by Saudi Arabia’s Public Investment Fund;

- Glu Mobile (Kim Kardashian: Hollywood) — eventually acquired by Electronic Arts;

- GAMEVIL (now Com2uS Holdings).

The presentation also contains the “Developers to Watch” list, which includes studios like Mundfish (Atomic Heart), Moon Studios (Ori), Hazelight Studios (It Takes Two), and Ghost Ship Games (Deep Rock Galactic).

It is also interesting to see overviews that Microsoft made for each company on its consideration list. For example, it was interested in IO Interactive due to their rich experience, proprietary engine Glacier, and ownership of the Hitman franchise, but cited “repeated pattern of overextending company size then downsizing” as one of the potential risks.

The rationale behind the consideration of Supergiant Games was the studio’s track record of innovative and high-quality games, as well as its strong creative vision and technical capabilities. However, its “strong historical relationship with Sony (post-Bastion)” and lack of experience with Xbox platforms and tools were listed as potential risks.

Microsoft’s overview of Remedy Entertainment as one of its potential M&A targets

This presentation is not the last confidential information to be revealed during the FTC v. Microsoft case. The hearing continues, and new testimonies from Jim Ryan (SIE) and other witnesses are expected today.