Who are indie game buyers: play 14-18 hours per week, value innovation, prefer PC and $15-25 games

Who are indie gamers and what do they like the most about these titles? Humble Games, publishing arm of Humble Bundle, has conducted research to answer these questions and better understand the audience.

Image: Forager, Signalis, Stray Gods, Unpacking (all published by Humble Games)

Phil Hofman, product marketing lead at Humble Games, shared the research findings at Game Developer Conference 2023. A video was uploaded to the GDC YouTube channel last week, and here are the key takeaways.

Humble Games, together with research firm Interpret, surveyed over 4,800 gamers aged 18-45 across eight countries, including the US, Germany, and Brazil. And the study itself was primarily focused on PC and console games.

The company segmented respondents into three groups:

- Regular indie buyers — purchased 5 or more indie titles within the prior 12 months from when the study was run;

- Light indie buyers — purchased 1-4 indie games within the prior 12 months;

- Traditional game buyers — purchased 0 indie titles, but bought at least one AA/AAA game within the prior 12 months.

40% of respondents purchased at least one indie game within the prior 12 months

Speaking of how gamers define the term “indie,” Hofman noted that responses ranged from size of the team to budget, to whether or not a game has a publisher. For the purposes of its study, Humble decided to focus more on the price point to differentiate premium indie titles from other categories, also providing respondents with examples.

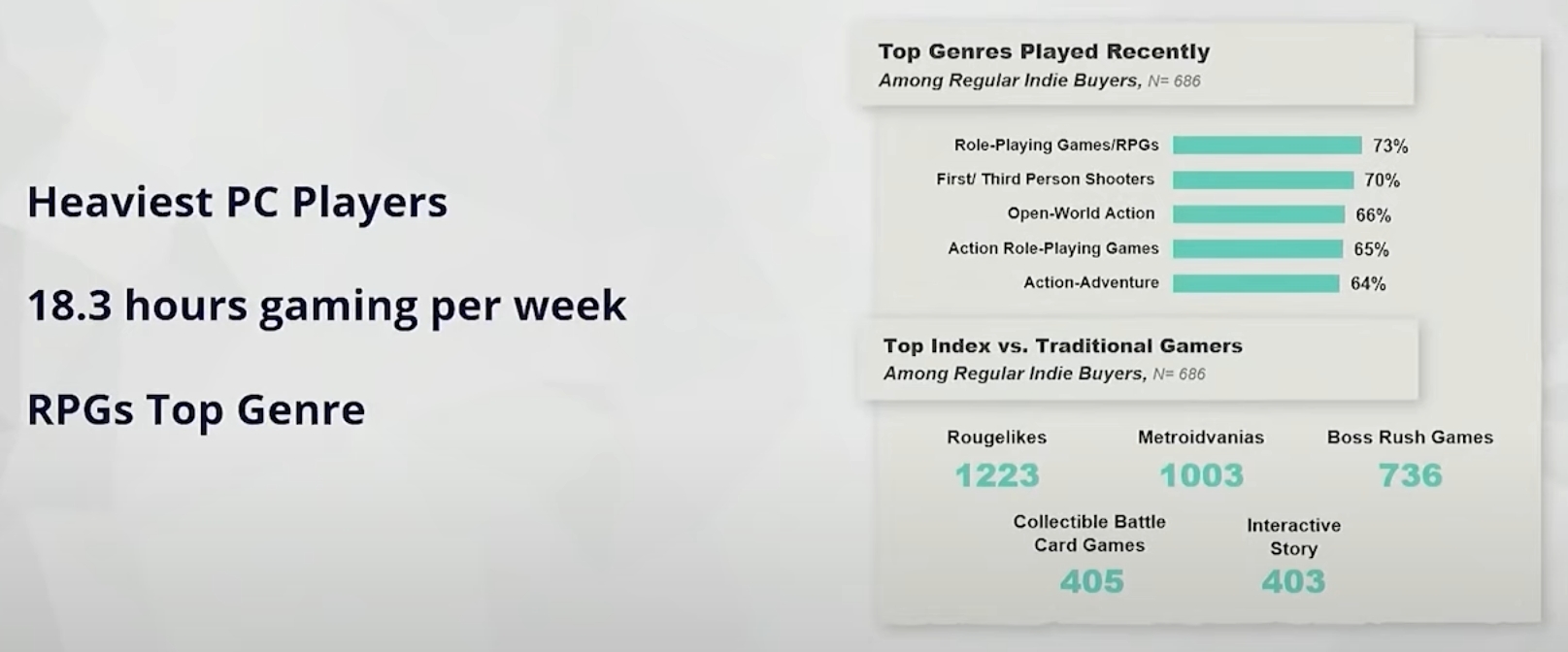

- Regular indie buyers are the most active players of the three groups, with an average playtime of 18.3 hours per week. They are followed by light indie buyers (14.9 hours) and traditional game buyers (12.3 hours).

- Light indie buyers and traditional game buyers have many overlapping genres among their favorites, with shooters taking the top spot. However, indie gamers are more likely to play roguelikes, metroidvanias, card games, and interactive story titles — categories that traditional gamers, who primarily play on consoles, don’t pay much attention to.

- Regular indie buyers stand out the most, with their top genre being RPGs. They also tend to play on PC the most among the three groups.

Gaming habits of regular indie buyers

- Interestingly, indie gamers buy more AAA titles than traditional gamers. This is true at least for the Western territories.

- Within the prior 12 months from when the study was run, this group of gamers bought an average of 14 indie games, seven AA games, and seven AAA games. For comparison, traditional gamers only purchased five AA titles and five AAA titles.

- But why don’t traditional gamers buy indie games? “They view AAA and AA as higher quality and better value than indie titles and they generally like playing big franchises,” Hofman explained.

AAA/AA/indie game purchases by player group

- Both light and regular indie buyers describe indie games with words like “Unique,” “Experimental,” “Innovative,” and “Passionate.”

- Traditional game buyers are much more muted when asked to describe an indie game, with some of them viewing these titles as lower quality products.

How different player groups describe indie games

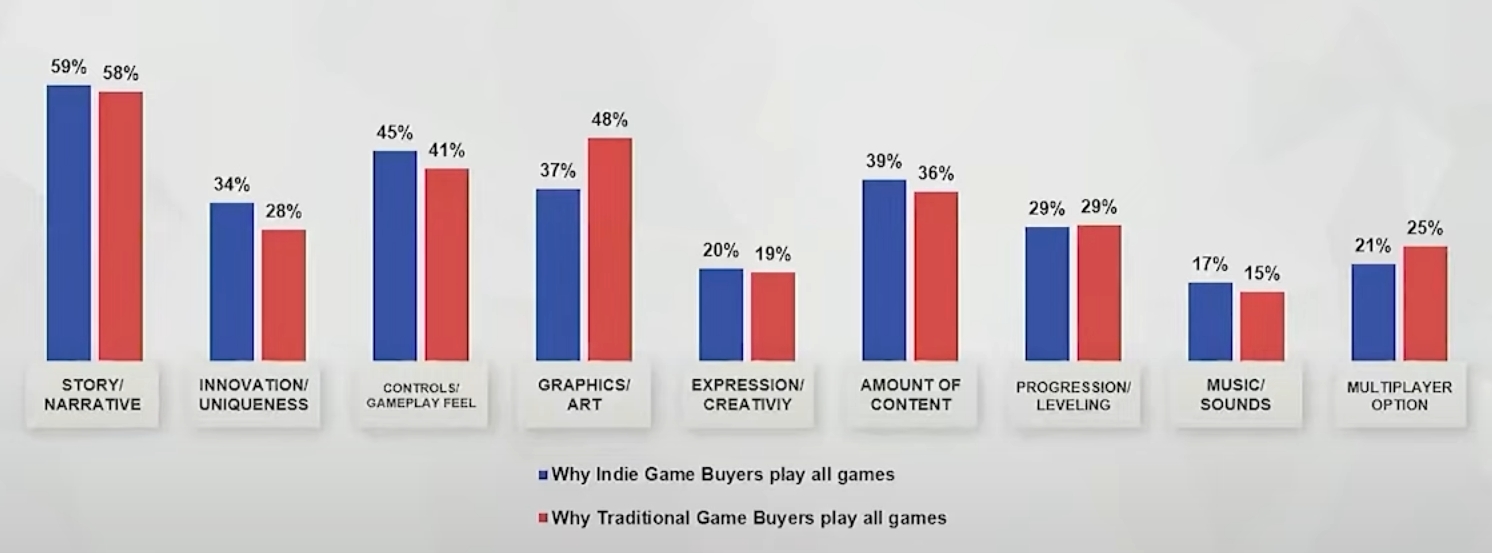

- For most players in all groups, the number one driver to play a game, regardless of its category, is story/narrative. A significant part of both indie and traditional gamers are also motivated by the gameplay feel and the amount of content.

- However, indie gamers are more likely to focus on innovation and uniqueness (34% of respondents vs. 28% for traditional gamers), while traditional gamers put a much heavier emphasis on graphics and art (48% vs. 37% for indie gamers).

Why indie and traditional buyers play games

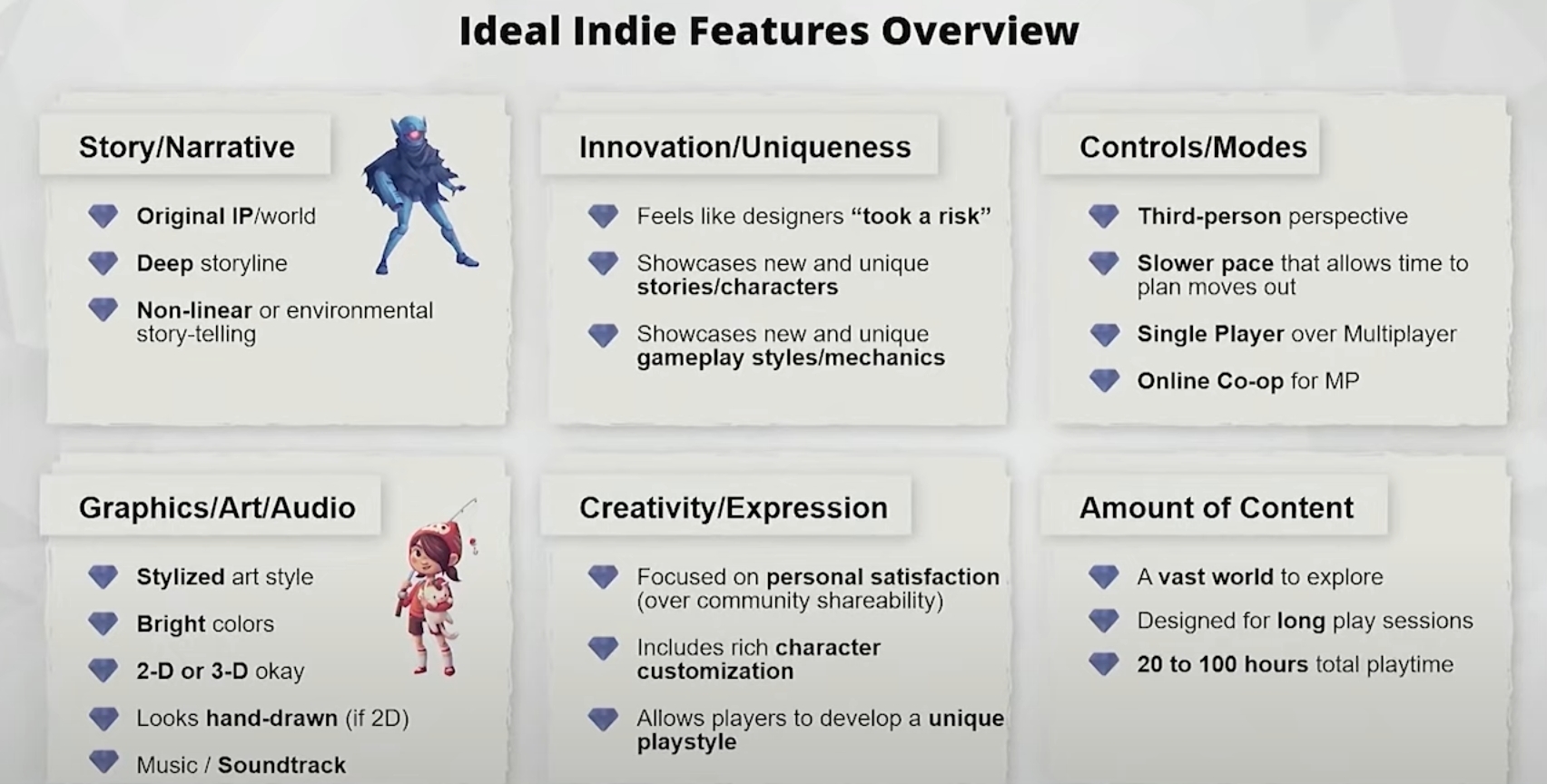

- Humble Games also found out what the ideal set of features an indie title should have, including the original IP, creative risks, single-player over multiplayer, 20 to 100 hours of total playtime, and more. The full list can be seen in a slide below.

- “This doesn’t mean that your game has to have all these features otherwise it’s doomed to faliure. That’s not the case,” Hofman noted.

- When it comes to monetization, most players in all groups — 58% of traditional gamers and 71% of regular indie buyers — prefer full-paid premium games. They also don’t mine free-to-play with cosmetic-only microtransactions.

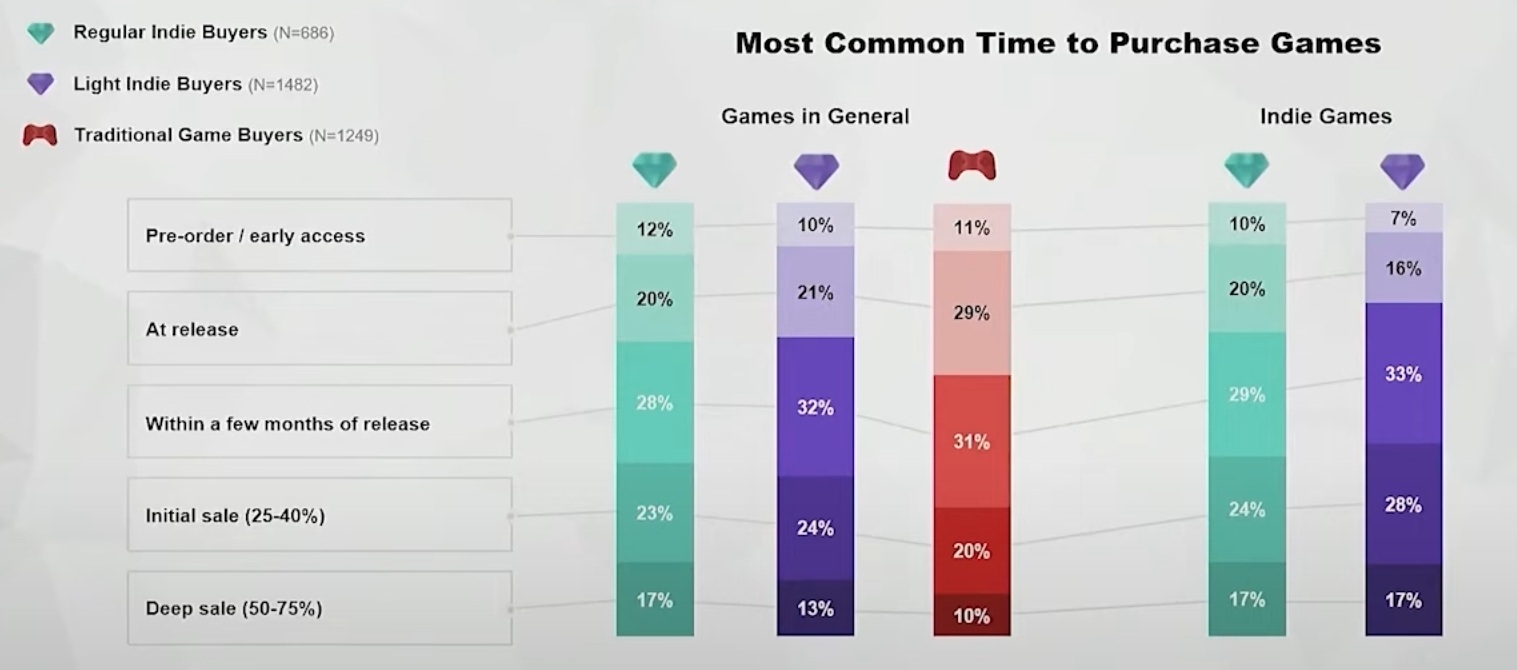

- Indie gamers are less likely to purchase a game at launch, preferring to wait a few months of release or when the title goes on sale. It is also worth noting that very few players pre-order: 10% of light indie buyers, 11% of traditional game buyers, and 12% of regular indie buyers.

- According to Hofman, one of the reasons that indie gamers are less likely to purchase a game at release is that they tend to play multiple titles at once and have stuff on their backlogs, so they are okay to wait. The second reason comes down to price sensitivity.

- Hofman elaborated: “We asked about if there’s a sweet spot for pricing your game. Certaintly, there are exceptions, but we did see between $15 and $25 was kind of a sweet spot. When you go below, there can be questions about quality of the game. […] And when you go above $25, we do see a little bit more of a focus on content, so you’re starting to compete with some of those AA and AAA titles. So expectations around the amount of content will go up as that price point does go up.”

When indie and traditional gamers prefer to buy games

- 31% of indie gamers find out about games on YouTube, followed by Steam (15%) and friends/family (13%).

- 54% of them pay attention to gameplay videos, while also looking at in-story gameplay screenshots (28%) and official trailers (27%).

- When it comes to things that trigger the purchase, gameplay videos motivate 30% of respondents, followed by sale/discount (12%) and player reviews (10%).

Paul Hofman’s talk in full can be viewed below, with more information about different audience groups, as well as their preferences and behavior.