Ubisoft reports 1,700 layoffs in 18 months and record net bookings, plans to focus on open world and GaaS games

Ubisoft has published its financial report for FY24 ended March 31, 2024. The French company posted strong revenue and profit growth, while continuing its cost-cutting program.

XDefiant

Financial highlights

- According to its earnings release, Ubisoft reached €2.3 billion in annual revenue, up 26.8% year-over-year.

- Net bookings reached record-high €2.32 billion, up 33.4% year-over-year. North America accounted for 50% of the total, followed by Europe (32%).

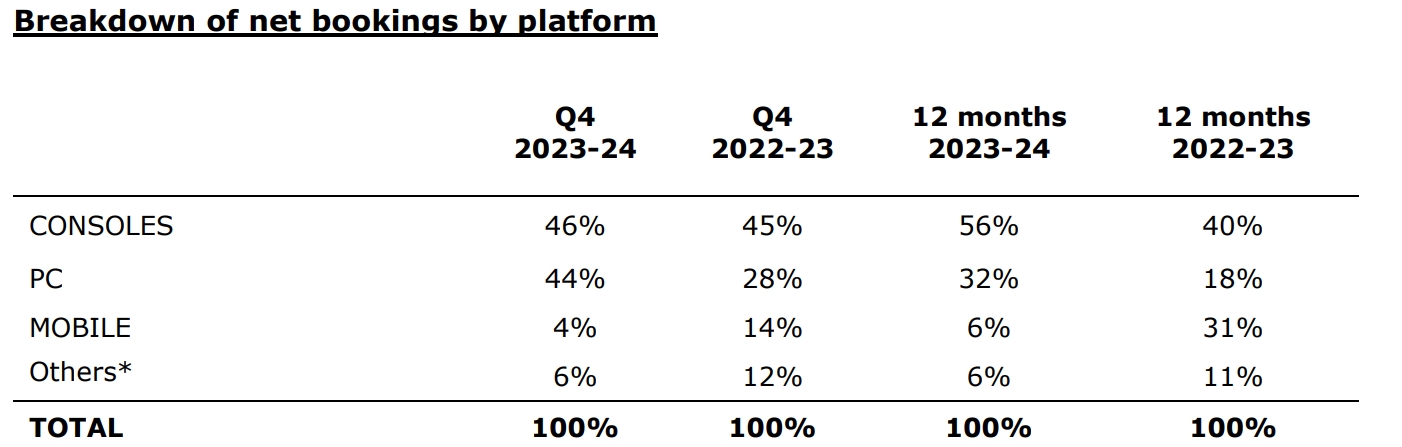

- Consoles remained the number one platform by net bookings, accounting for 56% of the total, followed by PC (32%). The share of mobile net bookings decreased by 25 percentage points to 6%.

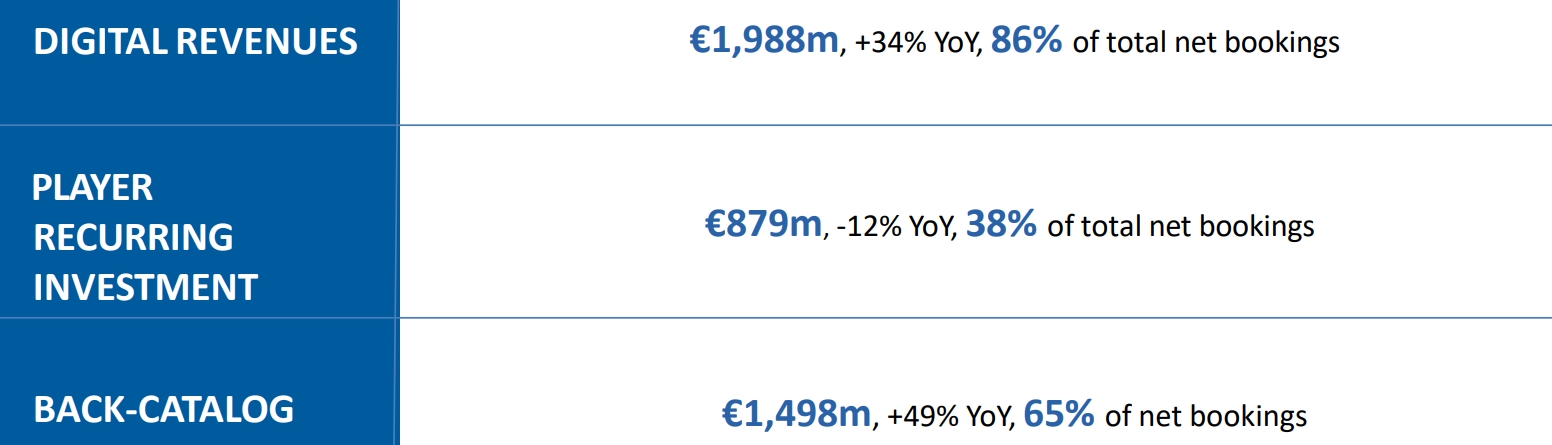

- Digital revenues grew 34% year-over-year to €1.98 billion, accounting for 86% of total net bookings, while player recurring investment (in-app purchases, DLC, subscriptions, etc.) fell 12% to €879 million. Back catalog sales accounted for 65% of the total, or €1.49 billion.

- The company’s operating income on an IFRS basis was €313.6 million, compared to an operating loss of €500.2 million in the previous fiscal year.

- Net income totaled €157.8 million, compared to a net loss of €494.7 million in FY23.

- For FY25 ending March 31, 2025, Ubisoft expects “solid net bookings growth” and a slight increase in non-IFRS operating income.

Cost reduction program continues

- Ubisoft said its cost reduction program is “well on track” as it managed to reduce its fixed cost base by around €150 million in FY24.

- The company expects to reach its goal of reaching the annual cost reduction of €200 million by FY26 (April 1, 2025 — March 31, 2026).

- Since September 2022, Ubisoft has laid off more than 1,700 employees. As of March 31, 2024, it employed 19,011 people.

- In FY24, Ubisoft reorganized its Global Publishing teams at the APAC region into three “engagement hubs.”

- The company also stop development on The Division Heartland, redeploying resources to “bigger opportunities” (XDefiant and Rainbow Six).

Key games and their metrics

- Ubisoft’s gaming portfolio reached 138 million unique active users on consoles and PC, up 4% year-over-year. MAU was 37 million.

- Rainbow Six Siege’s net bookings grew more than 50% year-over-year, with sessions days growing 38%. “The game boasts excellent results in terms of acquisition, activity, viewership and monetization this year,” Ubisoft noted.

- Quarterly active users in the Assassin’s Creed franchise grew double-digit year-over-year, with its net bookings up 30% from FY23.

- “The Assassin’s Creed and Rainbow Six franchises each benefited from solid fan bases of above 30 million unique active players over the year,” the company said.

- Skull and Bones reached the “second-best daily playtime for a Ubisoft game, with an average of 4 hours in the first weeks following launch.” It also had a “solid D-28 retention,” but its sales and other metrics remain undisclosed.

Focus on open world games and live services

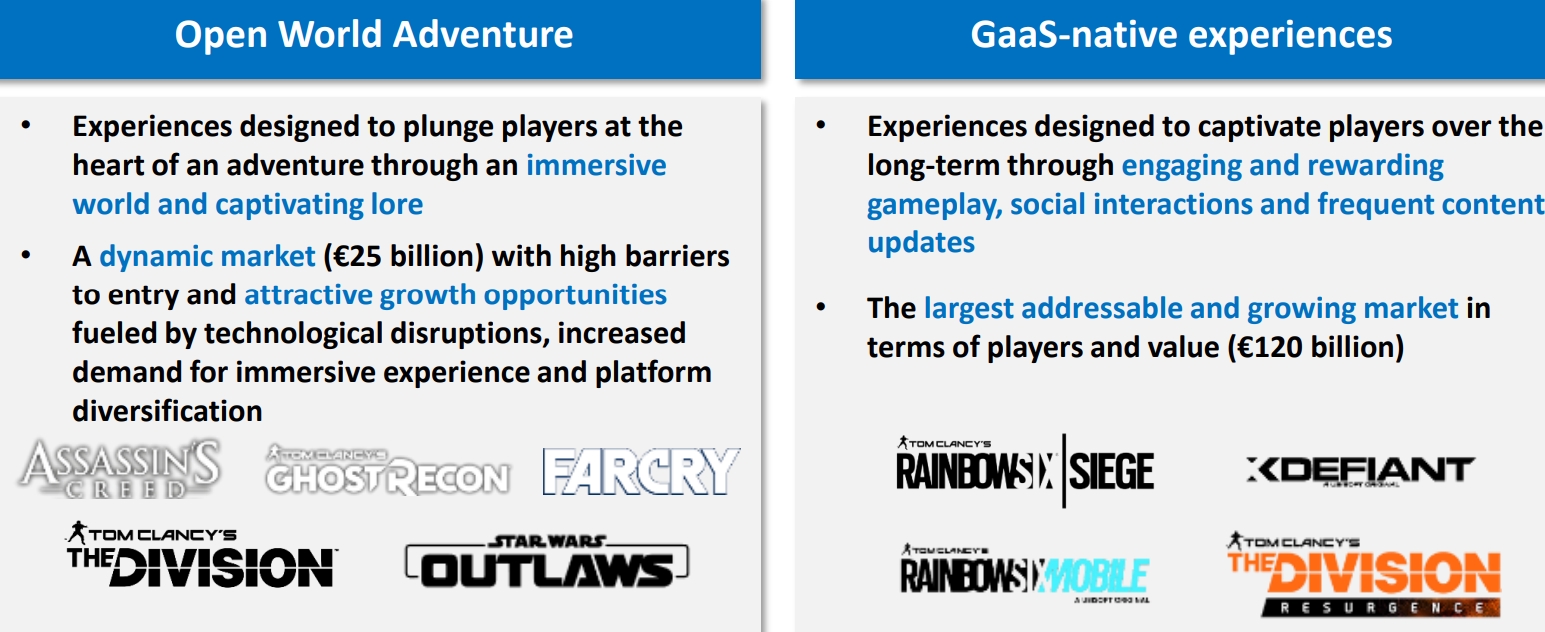

Ubisoft’s strategy is currently focused on two pillars:

- Regaining leadership in open “Open World Adventures” — the company estimates this market at €25 billion, saying that it can rely on its core franchises, new titles like Star Wars Outlaws, as well as multiplayer and mobile to attract more players;

- Expanding its footprint in “Games-as-a-Service (GaaS)-native experiences” — Ubisoft estimates its market at €120 billion, planning to grow its existing live service games like Rainbow Six Siege and launching new titles such as XDefiant, Rainbow Six Mobile, and The Division Resurgence.

“With these core verticals, and leveraging ongoing investments in our technologies to reach and maintain a competitive advantage, we aim to drive growth and recurrence with the objective to gradually expand operating income and generate robust free cash flow,” Ubisoft CEO Yves Guillemot said.

The company believes that focusing on these markets will allow it to ensure profitable growth by capitalizing on its brands and building a “sustainable competitive advantage” through leveraging proprietary technologies.