Embracer sees 91% drop in new PC and console game revenue, plans to focus on key IPs to improve profitability

Embracer Group has reported financial results for the first quarter ended June 30, 2024. The Swedish posted a decline in revenue, but outlined a plan to improve the profitability of its PC/Console Games segment.

Kingdom Come: Deliverance II

Financial highlights

- According to its Q1 interim report, Embracer Group’s net loss narrowed from SEK 4.44 billion ($423.7 million) in the same period last year to SEK 2.19 billion ($209.3 million).

- The company reached SEK 7.9 billion ($755.7 million) in net revenue, down 24% year-over-year.

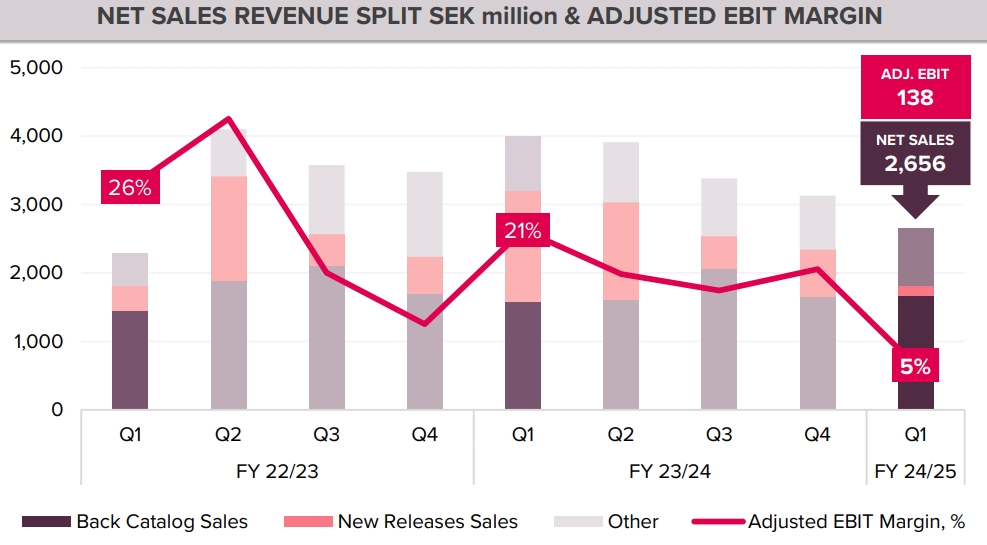

- Despite a 3% decrease, Tabletop Games remained the top segment by revenue at SEK 3 billion ($289.5 million). It is followed by PC/Console Games (SEK 2.65 billion | $253 million, -34%) and Mobile Games (SEK 1.38 billion | $132.3 million, -3%).

- Embracer noted that the spin-off process of splitting its business into three public companies is progressing according to plan. Asmodee will be first up, with the listing of “Coffee Stain & Friends” shares scheduled for 2025.

Game results and focus on key IPs

- Net sales of new games for PC and consoles fell 91% year-over-year to SEK 146 million ($13.9 million). The main revenue drivers were Homeworld 3, MotoGP 24, Gigantic: Rampage Edition, and Oddsparks: An Automation Adventure.

- Embracer attributed the decline in the PC/Console segment by a lack of new major releases and a “tough comparison” with the same period last year, when the company launched Dead Island 2.

- Back catalog sales grew 5% to SEK 1.66 billion ($158.6 million). They were driven by Remnant II, Dead Island 2, Star Trek Online, Deep Rock Galactic, Neverwinter Online, Welcome to Bloxburg, Kingdom Come Deliverance, Marvel’s Guardians of the Galaxy, SOUTH PARK: SNOW DAY! and AEW: Fight Forever.

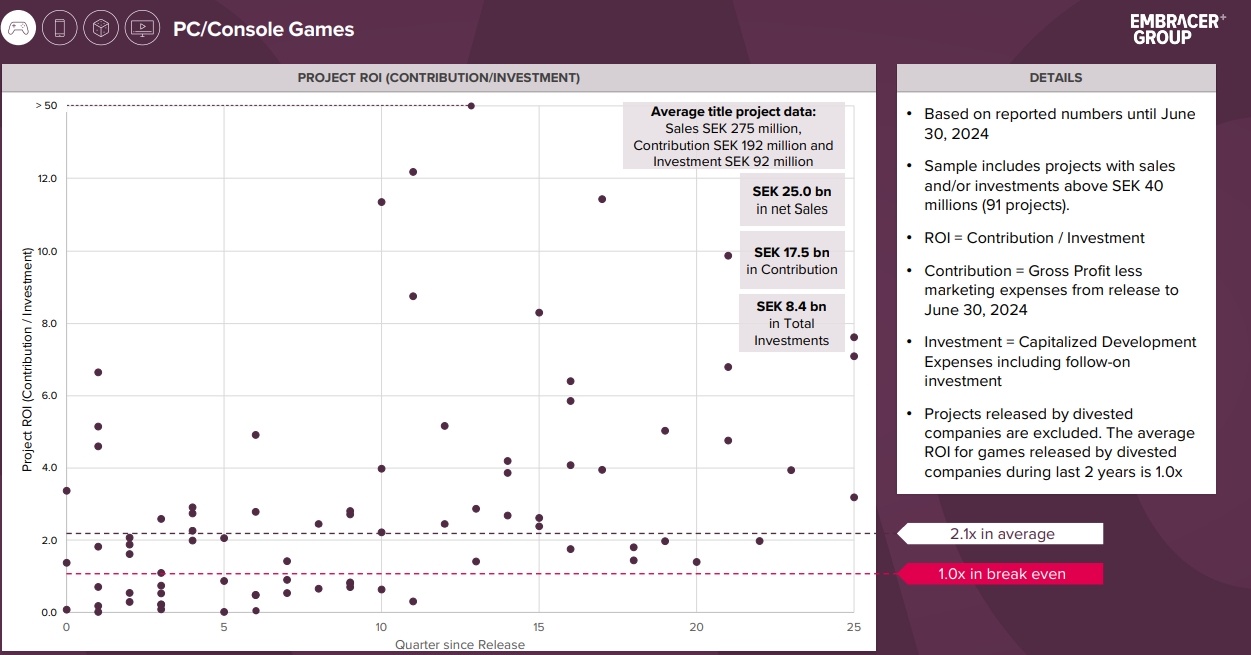

- The average ROI of Embracer’s PC and console titles surpassed 2x, with the average sales of SEK 275 million ($26.2 million). The average gross profit less marketing expenses was SEK 192 million ($18.3 million), while investment amounted to SEK 92 million ($8.7 million).

- The Swedish company plans to improve the profitability of its PC and console business by focusing on “own and controlled IPs, which typically have better unit economics.”

- CEO Lars Wingefors noted that “through this year and next, we [also] expect our updated capital allocation process, with improved standards for new and continued investment to improve ROI from new game releases as our pipeline increasingly consists of higher quality games.”

- Speaking of its IPs, Embracer said it is now “actively testing and prototyping multiple new game concepts” based on the Lord of the Rings franchise.

- “We are confident in our pipeline for the financial year, and still expect the value of completed game development for the year to be around SEK 3.9 billion [$371.5 million],” Wingefors said.

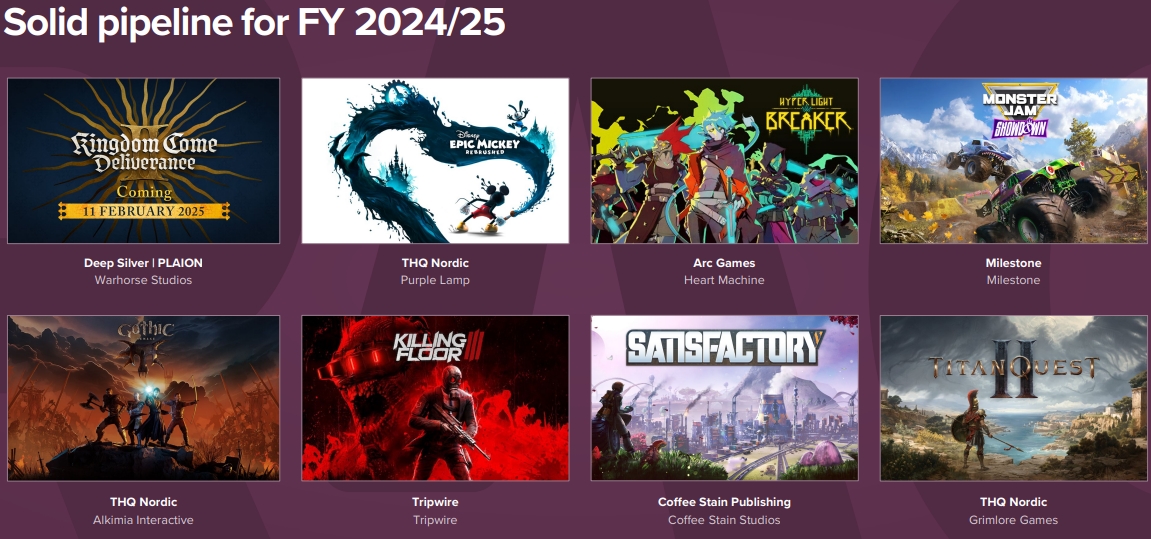

- In the current fiscal year ending March 31, 2025, Embracer plans to release games like Disney Epic Mickey: Rebrushed, Titan Quest II, Killing Floor III, Gothic 1 remake, Hyper Light Breaker, and Kingdom Come: Deliverance II. The latter was recently delayed to February 11, 2025.

- Other games in the company’s pipeline include Marvel 1943: Rise of Hydra (developed externally, Plaion will serve as a publisher), a Tomb Raider project (will be published by Amazon), Perfect Dark (developed by Crystal Dynamics and Microsoft’s The Initiative), and The Eternal Life of Goldman (developed externally by Weappy Studio).