Revenue growth, falling stocks and postponement of game releases are the main things from Activision Blizzard's quarterly report

Activision Blizzard reported for the third quarter of 2021. Despite the ongoing discrimination scandal in the company, the publisher’s income is steadily growing. In the period from July to September, Activision Blizzard’s earnings exceeded $2 billion.

Activision Blizzard’s current quarterly report begins not with financial results, but with a statement of what measures the publisher is going to take to combat discrimination and harassment in the company. Activision Blizzard posted a similar statement in the previous report, but now the list of things that should change has grown. For example, the company promised to increase the proportion of women and non-binary people by 50% within five years. She also recalled that she will soon launch an $18 million fund for payments to affected employees.

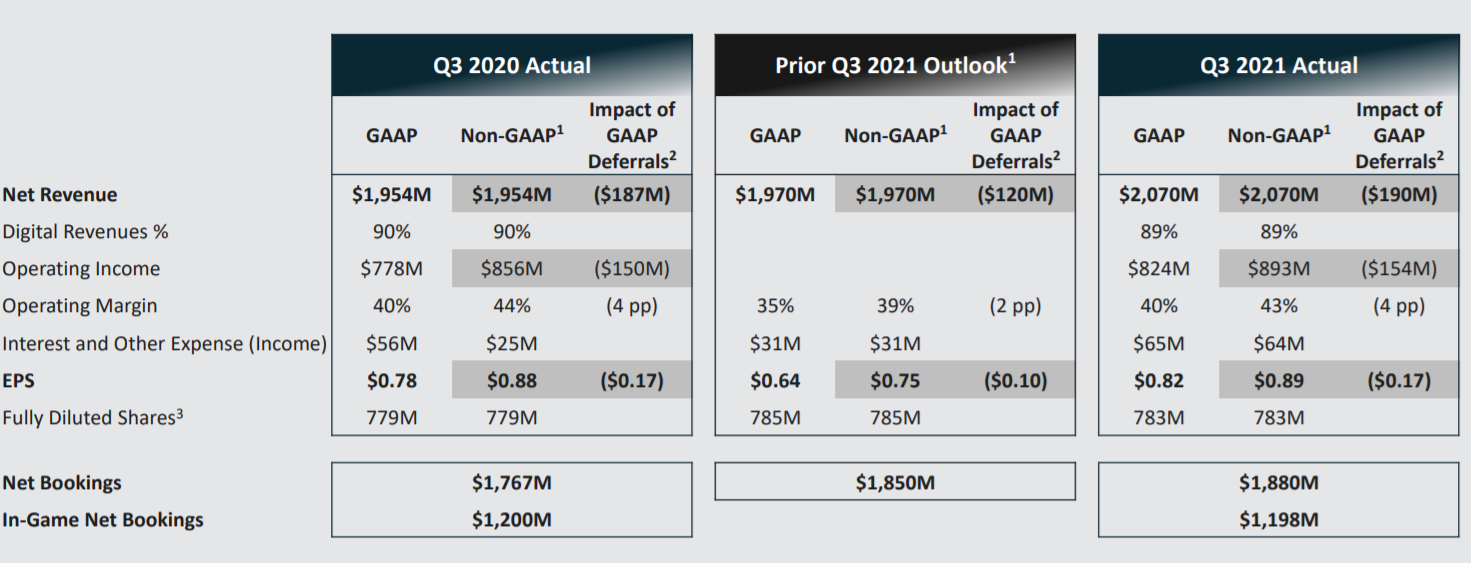

Key figures:

- In total, Activision Blizzard earned $2.07 billion in the third quarter — 6% more than last year and 5% more than planned;

- operating profit was $824 million. Growth by 8.2% in annual terms;

- In-game receipts (In-Game Net Bookings) decreased compared to the third quarter of 2020, but only slightly — by $2 million. They amounted to $1.19 billion;

- 89% of Activision Blizzard’s earnings came from digital sales — $1.84 billion;

- the total MAU of the company’s games amounted to 390 million people. The same number was a year ago, but last quarter there were 18 million more monthly active users.

Activision Blizzard once again called the expansion of the audience the main drivers of growth (although the MAU of games fell, they were played by people from new regions and on new platforms), increased engagement and the willingness of gamers to spend more money.

Activision Metrics:

- the division’s revenue for the third quarter was $641 million. This is less than last year by 20.6%;

- The company explained the drop in revenue by the fact that Tony Hawk’s Pro Skater 1 + 2 and Call of Duty: Warzone were released in 2020. In addition, Activision’s revenue jumped sharply last year due to the pandemic;

- The total MAU of Activision games is 119 million people. Growth by 8.1% in annual terms;

- The Call of Duty franchise continued to show success. Its monthly active audience has grown on mobile (although it has not changed on consoles and PCs). She also has “significantly” increased net receipts compared to the period before the release of Call of Duty: Warzone;

- net receipts of Call of Duty: Mobile increased by 40% in annual terms.

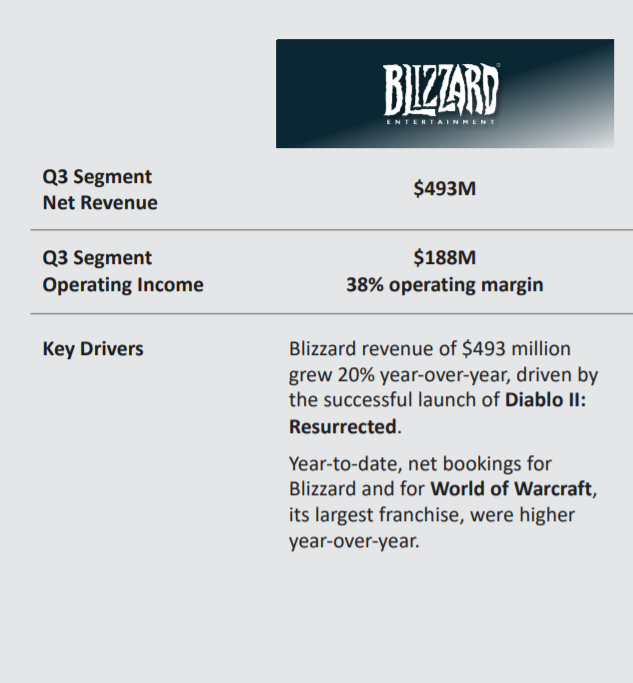

Blizzard Metrics:

- Blizzard earned $493 million in July-September — 20% more than a year ago;

- the number of monthly active users in the division’s games was 26 million. This is 23.4% less in annual terms;

- The company attributed the revenue growth to the release of Diablo II: Resurrected. Sales of the title in the premiere week were higher than any other Blizzard remaster;

- World of Warcraft has increased revenues compared to last year;

- Blizzard has postponed the releases of Overwatch 2 and Diablo IV indefinitely. According to the report, these games will not be released in 2022. The company noted that their developers “have achieved great results”, but they need more time and resources to finalize the titles. Perhaps the delay is partly due to the departure of Jen Oneal, Blizzard’s co-CEO, from the company. Now the division is headed only by Mike Ybarra (Mike Ybarra).

King Indicators:

- In three months, King earned 22% more than in the third quarter of 2020 — $652 million. This is also more than in any other third quarter in the company’s history;

- The total MAU of the division’s games amounted to 245 million — 1.6% less than last year. But at the same time, players spent more time playing King games. How much is not specified;

- Candy Crush continued to carry the title of the highest-grossing King franchise in the American market. In-game receipts increased by 20% year-on-year;

- The division’s second—highest—grossing franchise, Farm Heroes, also showed good results. Its in-game receipts also increased by 20%.

Note that after Activision Blizzard published its quarterly report, its shares fell by 10%. Analyst Daniel Ahmad attributed this to the postponement of Overwatch 2 and Diablo IV releases.