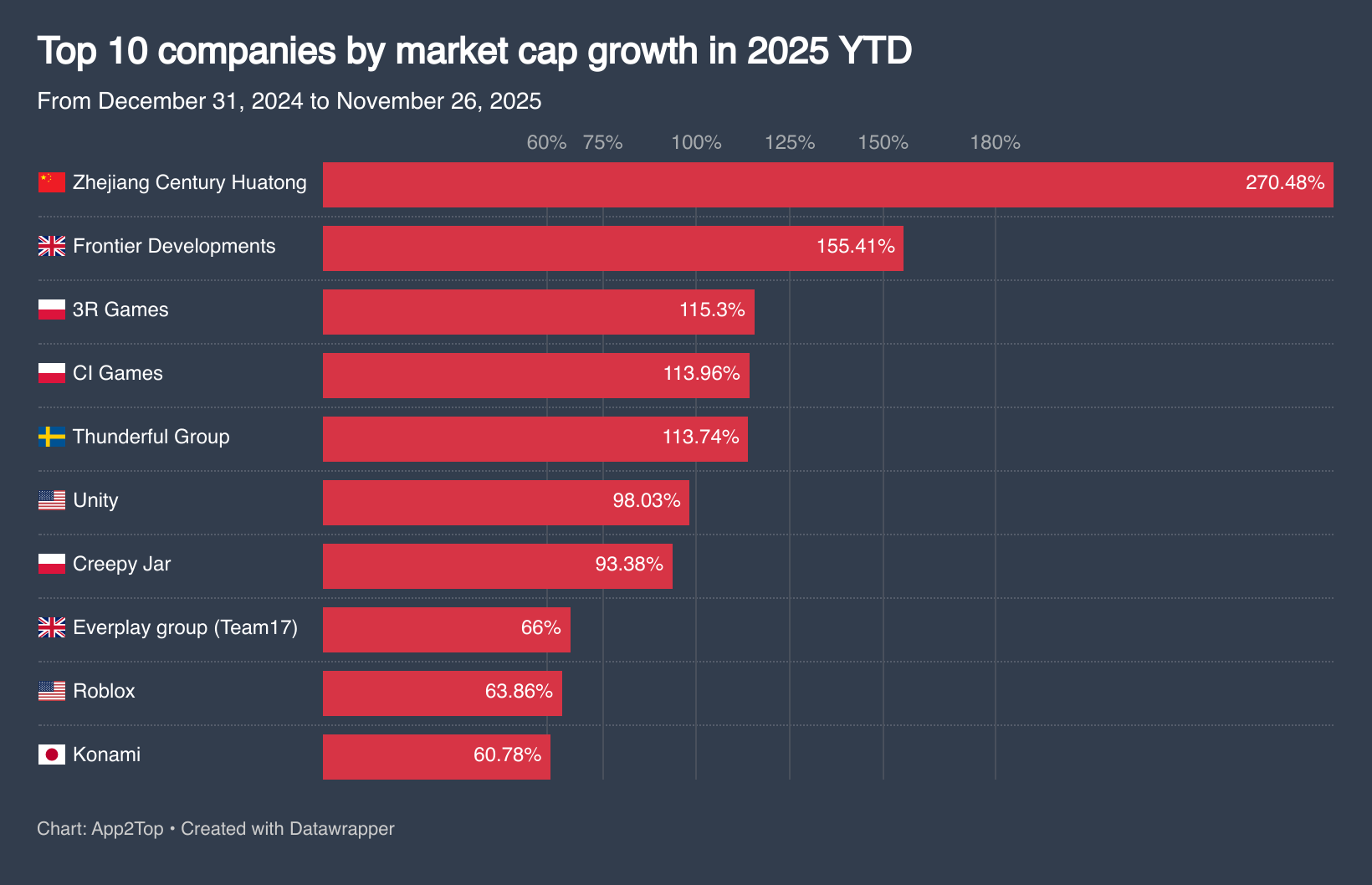

What's happening with gaming company stocks at the end of autumn: growth in China, faith in Unity's AI strategy, and other trends

At the end of the summer, we compiled a comprehensive report on the gaming stock market situation. To update the data and identify trends, we reanalyzed the status of more than 60 public companies and studied how their positions have changed since the beginning of 2025. Inside, there's the usual abundance of charts, numbers, and information across different markets.

Note:

- all data on market capitalization and stock price changes are current as of November 26, 2025 — as of the article's publication date, some figures have changed, but insignificantly;

- the phrase "since the beginning of the year" describes percentage changes from the close of trading at the end of 2024 (the last days of December) to the present (November 26, 2025);

- in general lists, figures like capitalization and stock prices are converted to US dollars for consistency, but in specific cases, we also provide data in "original" currencies (yen, yuan, zloty, etc.);

- for convenience, some terms use abbreviations — for example, YoY (year over year), YTD (year to date), etc.

As was the case three months ago, the global leader in market capitalization and stock price growth remains the Chinese holding company Zhejiang Century Huatong. In terms of percentage change, it far outpaces all other companies on the list.

Other noteworthy observations:

- key Chinese companies are on the rise, whereas Japan experienced an expected correction after an overly rapid growth in the first half of the year;

- investors still have strong faith in small Polish studios;

- the dire situation of Swedish companies has not only failed to improve but has worsened;

- Unity exceeds all expectations thanks to strong confidence in its company strategy related to the new AI-based advertising platform.