Unity: over the past year, IAP revenue of hyper-casual games increased by 162%

Unity has published a large-scale 40-page report for 2021. It is dedicated to how things are with games developed on Unity. There is also about the dynamics of hyper-casual titles, and about the difference in retention in different genres, and much more. We tell you about the most interesting of it.

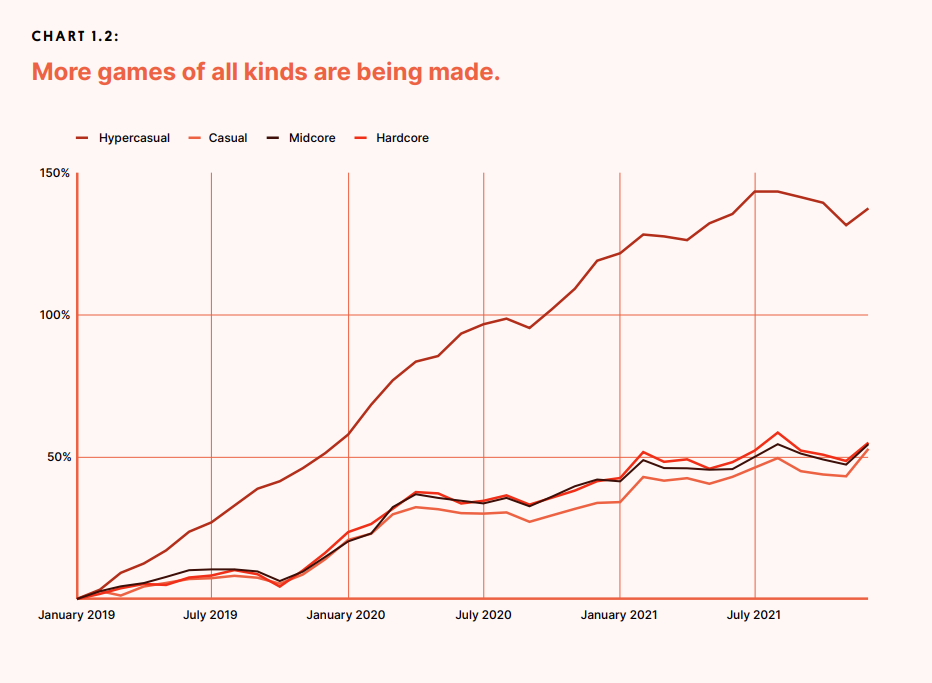

- Over the past year, the number of Unity developers (it is not specified whether people or teams) increased by 31%;

- The number of games developed on Unity has increased by 93%;

- on average, the number of games developed in each niche (casual, midcore, and so on) has grown by 50%;

- the number of hyper—casual games developed on the engine has grown the most – by 137%;

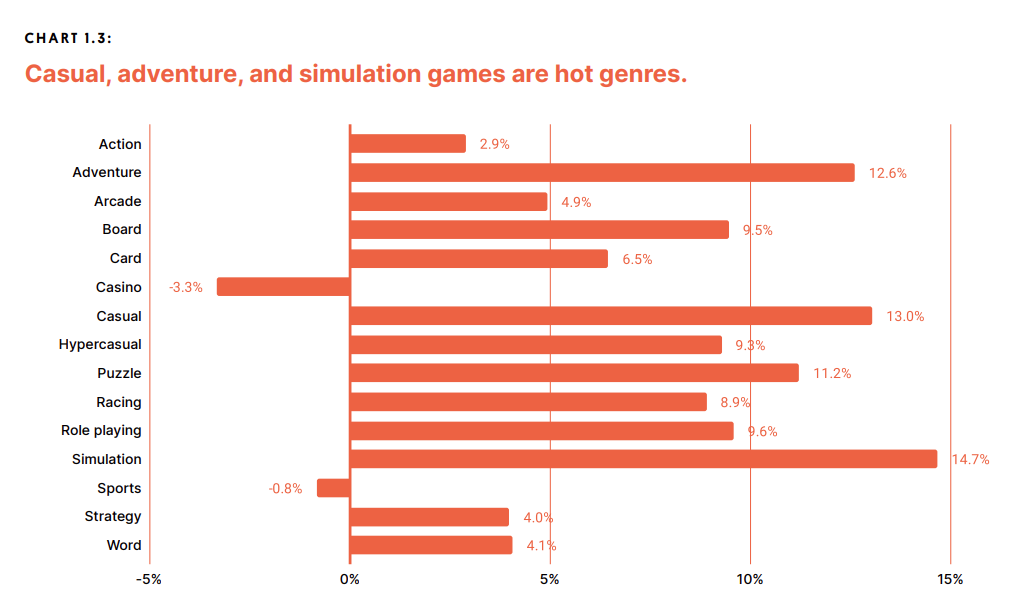

Dynamics of Unity game releases by nicheif you look not at the general situation, but focus on games-services broken down by genre, then the situation is less rosy: there is also an increase in the number of new titles, but it rarely exceeds 10%, and the number of releases of some of the genres has fallen (for example, casinos have begun to bring to the market less often);

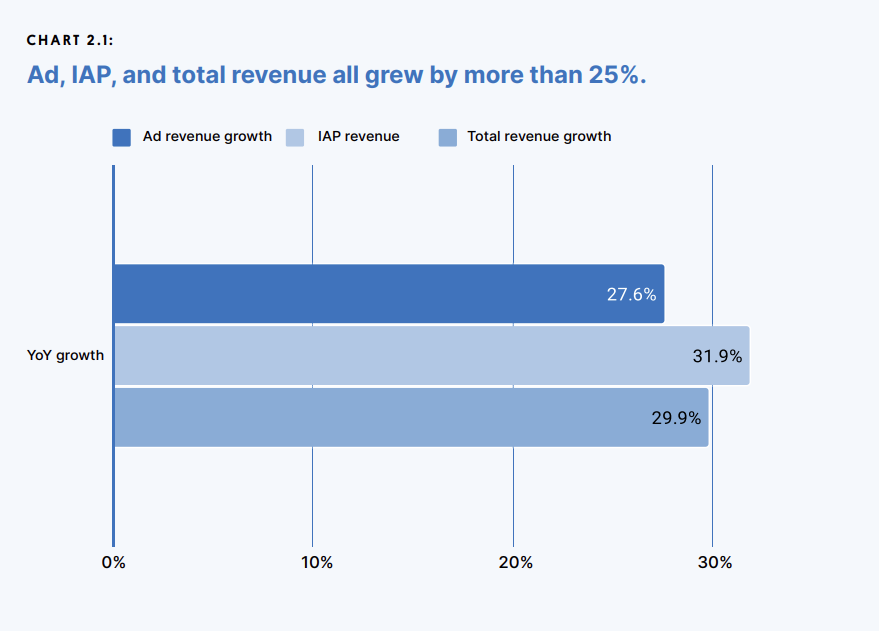

Dynamics of releases by genre among games-servicesThe revenue of games developed on Unity grew by almost 30% last year as a whole%;

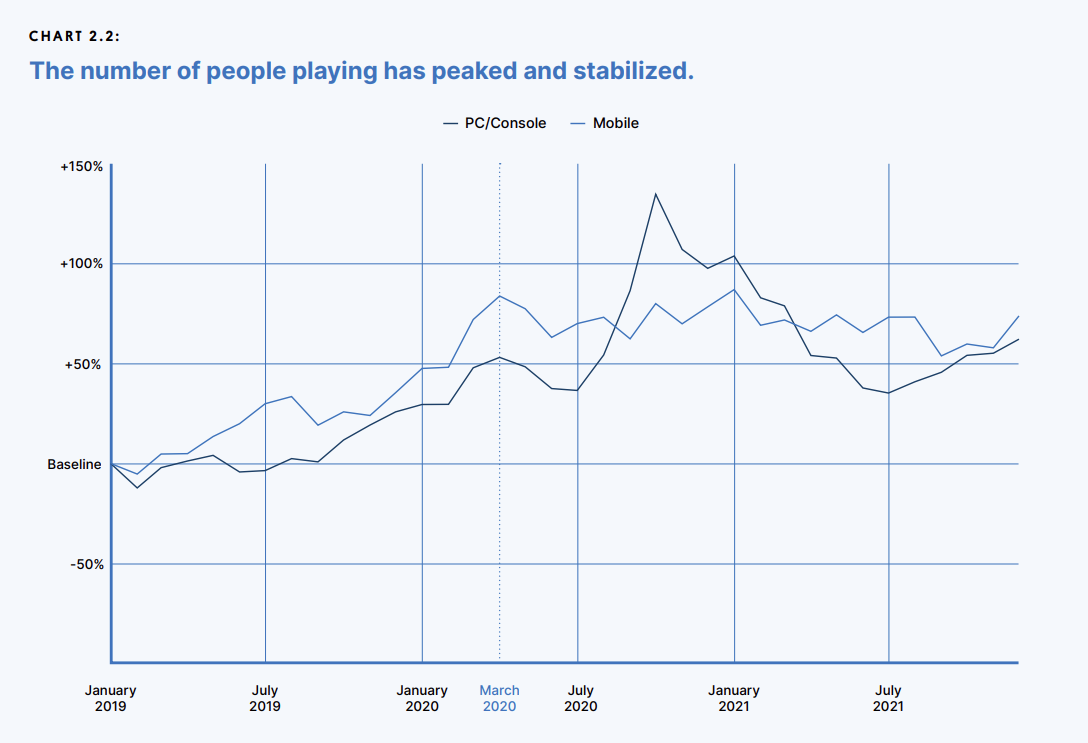

Growth of gaming revenue of Unity games by type of monetizationThe DAU of Unity games fell after March 2020, but it is still consistently higher than the pre-pandemic indicators;

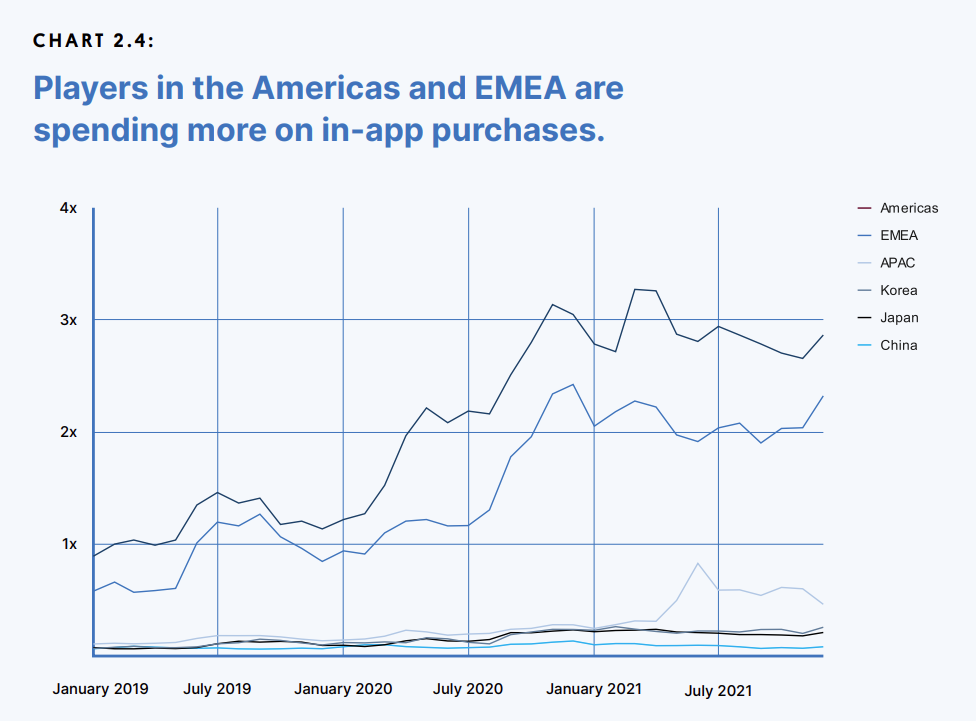

Dynamics of the total DAU of Unity games over the past two yearsThe main IAP revenue comes from the American markets and EMEA;

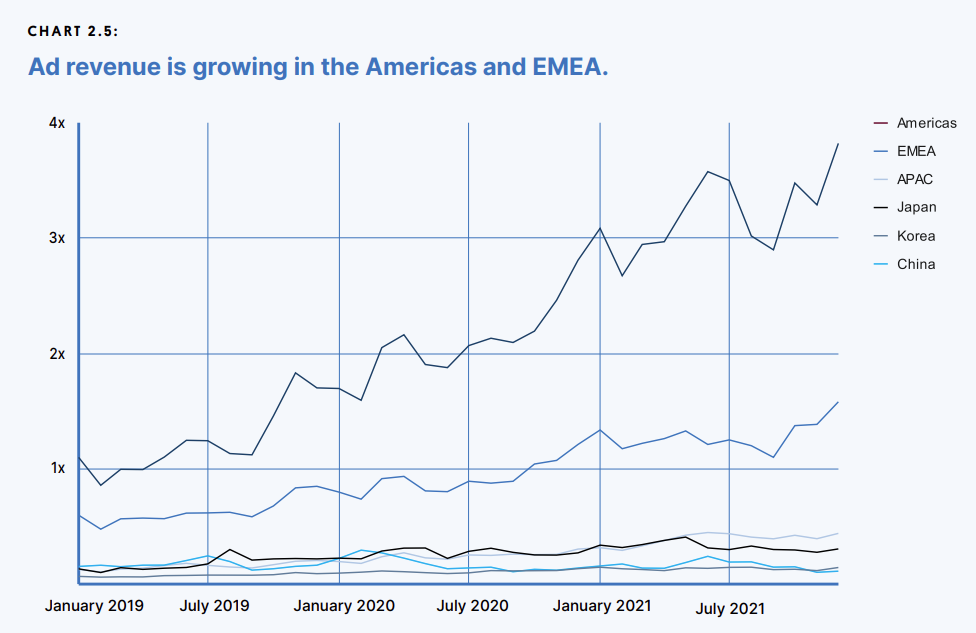

Dynamics of total revenue of Unity games with IAPthe main revenue from advertising also comes from the Americas and EMEA, but there is a significant increase in indicators (earnings of the Americas from mobile advertising tripled over the year);

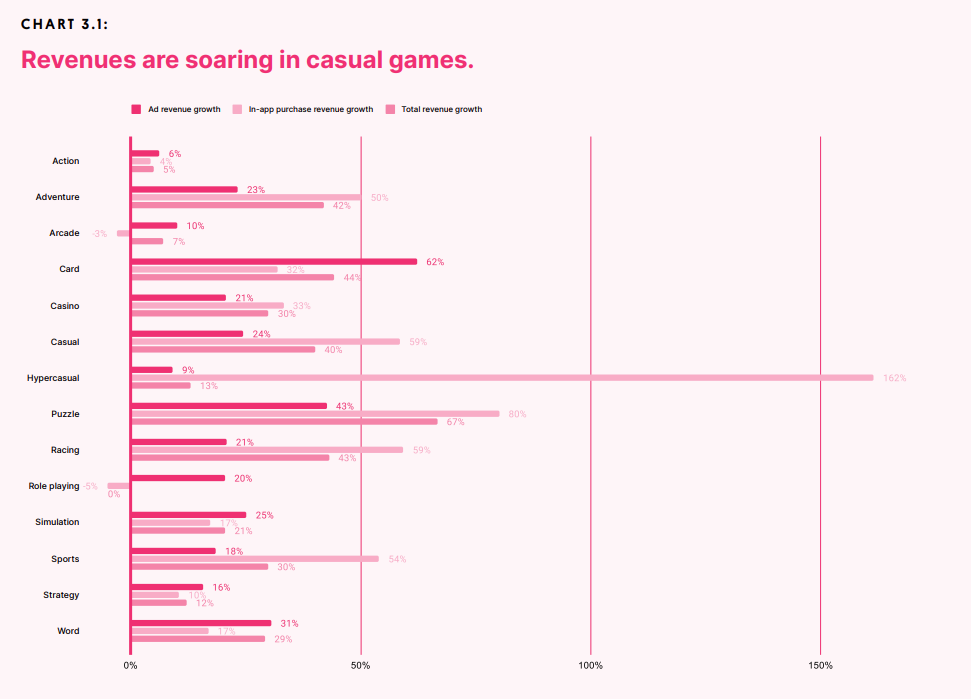

Dynamics of the total revenue of Unity games from advertisingover the past year, IAP revenue in hyper-casual games developed on Unity increased by 162%, and revenue from advertising — only by 9%;

- IAP revenue from puzzles has also grown significantly — by 80%;

- but role-playing games have a drop in IAP sales by 5%;

Revenue dynamics of Unity games by genre and by type of monetization for 2021if we segment games by DAU, then casual games in any of the segments account for 40% of the market;

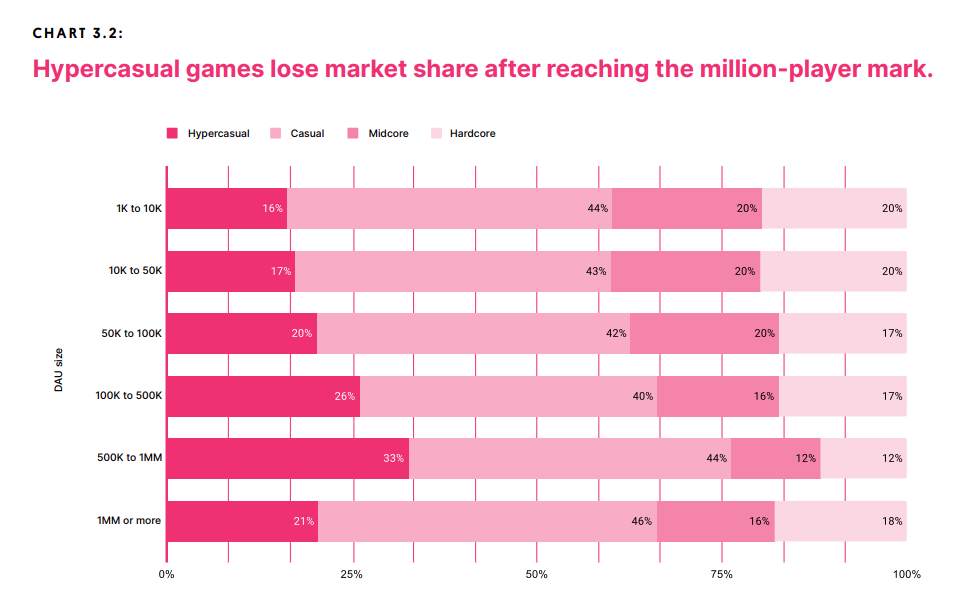

- hyper-casual games are losing market share among games with more than 1 million DAU;

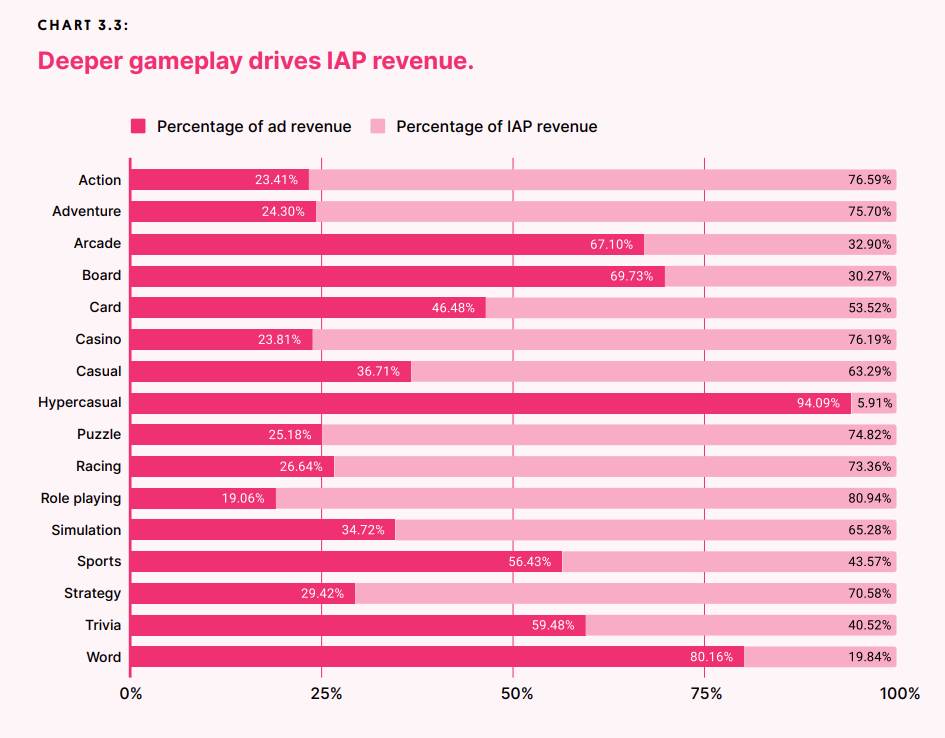

Distribution of gaming niches by DAUdespite the growth of IAP revenue, 94% of the hyper-casual segment’s revenue comes from advertising;

- casual and strategy games have the opposite situation (in the region of 70% of revenue they receive from IAP);

The ratio of revenue from IAP and revenue from advertising by genreplayers began to spend more money in a single payment (on average for the market, not for all genres);

How the check for the year by genre in Unity games has grownThe ratio of DAU to MAU (stickiness) in China has fallen significantly after children were banned from playing more than three hours a week in the country;

Dynamics of stickiness of games in the world and China

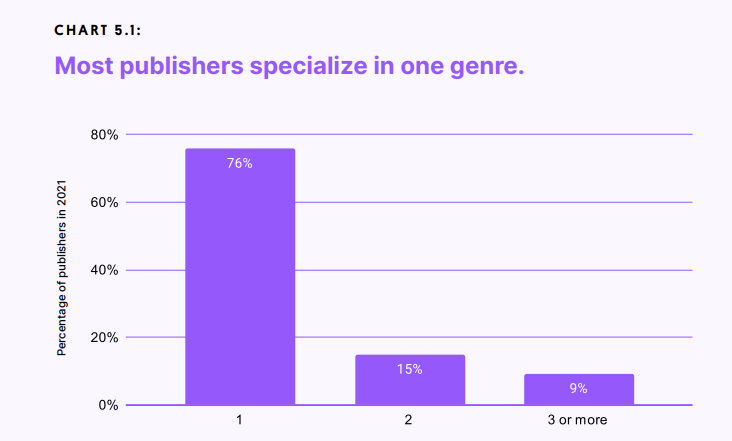

most publishers specialize in one game;

Segmentation of publishers by the number of genres they work withhowever, those who diversify their business earn much more;

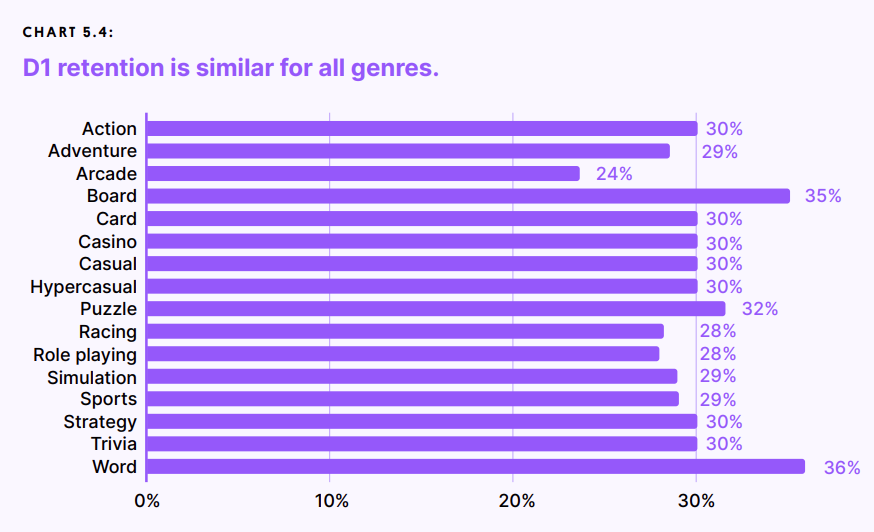

Distribution of daily revenue (with IAP and advertising) by publisher typesthe average D1 is common for all genres (with the exception of arcade games and word games);

Average retention of the first day by genrethe average D7 is already very different depending on the genre;

Average seventh-day retention by genreThe average D30 differs even more from genre to genre.

Average retention of the thirtieth day by genre

Information is collected on 750 thousand Unity applications from 230 thousand developers.

The full version of the study can be found here.