Everything you wanted to know about bizdev, but were afraid to ask

Epic Games Licensing Manager Alexey Savchenko explains the meaning of the business developer’s work, talks about the types of investments and gives advice for successful negotiations.

Alexey read this report at White Nights St.Petersburg 2018. The video of the report can be viewed at the link.

Alexey Savchenko

About me

My name is Alexey Savchenko, I work at Epic Games as a licensing manager. I am the person who signs the Unreal Engine 4 licensing deals in the CIS countries and Eastern Europe. In addition, I have been developing the company’s infrastructure projects for two years.

Before that, I worked at Boolat Games, GSC Game World, Vogster, Black Wing Foundation. I have been in the industry for about 19 years: I worked as a game designer, producer, worked in business development, communications, PR. I’ve tried almost everything.

3.5 years ago, I started working at Epic Games as a technical evangelist. Two years ago I took up my current position and moved to England.

Why is it important to discuss business development and investments?

One of the infrastructure projects in which I am engaged is that we at Epic Games help developers find capital from publishers and venture investors as part of their partner programs. We help to find a common language and facilitate transactions.

This process is rather rough, the conversion rate is low. There is a lot of money in the industry, but most developers either do not know how to properly arrange a submission and a deal, or they approach this process incorrectly, and everything fades at some stage.

On the part of the funds, there are problems both on the side of the operating system and on the side of understanding processing, content processing. Funds often do not understand what the gaming industry is and how it works.

The more we discuss the specifics of investing and consider successful cases, the higher the conversion rate in the industry will eventually be.

I want to start the conversation with terminology, because there are often misconceptions here.

What is bizdev and who is a business development director?

The Bizdev director is a key actor in transactions. In general, a deal on the sale of a part of the company, equity or on raising money can best be done by either a funder or a business developer. Very often this is a founder who is himself a business developer.

Why is this happening? It is such people who assess the situation at a high level, see the future, understand the principle of business development, understand their product. They are the ones who are ready to discuss and make decisions necessary for large transactions.

What Hard Skills (skills and abilities) do a business partner need? This is an understanding of economics, tactics and strategy. This is market analysis, the ability to “package” transactions, putting all the components together and presenting them to a potential counterparty. It is also the ability to build a system with a high win-win potential for all participants in the transaction.

As for Soft Skills (competencies), here, in addition to obvious communications and language, you need to understand cultural studies and even a little anthropology. After all, if you have an international transaction, then you need to understand the cultural implications: local customs, approaches, traditions. You need to know the geography and politics of another country, understand the local gaming industry and know the history of this industry.

This significantly increases your chances of selling. If you don’t know all this, if you forget about it, then the chances are less.

Cybernetics will also help. Cybernetics studies models, and any good deal is a model, it has entry points and exit points. In the middle is the market with all its actors, nodes, elements. Bizdev just connects the entry point (the desire to make a deal) with the exit from the system. And the way out is the emergence of new opportunities and communication channels for the company. The company earns resources in this way, and not always money.

The last area I want to draw attention to is linguistics, specifically semiotics. The language of any professional community is codified. Everywhere there are some terms, phrases that need to be understood. Semiotics studies just that. Roughly speaking, this is an aspect of linguistics that explains why a table is called a table and a chair is called a chair.

So, we have understood who a business developer is, now let’s see what exactly he sells.

What is for sale in bizdev?

It is very important to understand that bizdev is not sales, not sales. They are often confused, and such a misconception can lead to a broken deal. Because salespeople are responsible for tactical decisions, and they want to see the company’s strategy in the funds.

The key difference between sales and bizdev is that the salesman operates according to the “deal – sale – money” scheme, and the business developer is interested in other resources, not money. These are reputation, connections, relationships, favors. The Bizdev director can enter into transactions that do not bring direct profit, but which open access to other market segments.

These are resources that are not measured, but, in fact, they cost more than money. The more opportunities you have to develop your business, the greater the potential profit.

So, the bizdev director is eager to acquire new opportunities, but what is he selling? Usually in the development environment there is an idea that a particular game is the product of the company. But in the eyes of the funds, the product is the company itself, and specifically its founders, and the products or services that it offers.

Therefore, the bizdev director does not show investors a specific project, he shows them the company’s strategy. That is, it explains the company’s mission, its long-term goals. Explains what place the company is going to take in the market, how it is going to change the market for itself.

It is clear that 90% of all offers on the market are either a game in development, or an already released game that has collected some kind of primary traction. The task of a competent business developer who came to the foundation or to the publisher is to show how this game will look like as part of a strategy.

Because a model based on a one-time sale is not interesting from the point of view of investment. Investors are interested in the long-term perspective. Let’s see what this perspective can represent.

Investments, or why people invest money

Remember: money is never “given” unless it is charity. Money is invested in opportunities.

They will not invest money in you if you need them solely to solve internal problems. If a developer comes to an investor and says, “We need money to pay wages and finish the game,” then it’s just his, the developer’s, problems and money will most likely not be given to him. Investors invest money only in opportunities.

In a broad sense, any investment has two goals and two possible outputs. The first is an IPO. But in 99% of cases, this does not happen in local development yet.

The second way out is to build a so–called base business. A base business is a business that is ready for further rounds of investment, which can then be sold to some large fund, like Tencent or Nordic. In this case, money is invested to buy your product for a ruble, and then sell it for three.

And very often the following problem arises: you show your product to an investor and build a presentation around a specific game with its features, with pictures, with detailed descriptions. With a publisher, you can still imagine it. But if we are talking about investments, profile or venture, then it doesn’t matter to investors. They are interested in your entire business as a single product.

Investors are also interested in risks, and I want to focus on this point separately.

If a company makes games that duplicate existing projects on the market and do not carry any interesting additional potential, this is a problem. The game should have innovative elements, it should be different in some way. Projects that are too repetitive of others are in a highly competitive field. And there are often more risks with them than in the case of unique games that can change the market.

Now let’s look at what formations you may be dealing with if you decide to look for investments.

What are the types of investments and money in the market?

The first formation is publishers. They take up to 75% of the royalties from the product, but their advantage is that they provide distribution, logistics, marketing and localization. Plus, publishers provide advances. And although this is, as they say, very “expensive” money on the market, but developers are encouraged to work with publishers.

If you are building a business that is going to attract investments elsewhere, there is a little more “cheap” money from Private Equity. These are companies that distribute private funds and private capital at the expense of management, which distributes this money to different businesses.

It’s hard to get money from Private Equity. The “Two and twenty” rule often works here. This is a common practice for hedge funds. For example, there is a billion-dollar fund. There are about ten people working in it as operational managers. The payments of these managers are formed as follows: they receive 2% of assets as wages plus 20% from any profit received.

Managers are not very interested in their base salary, which means investing in highly volatile markets, which includes game development. After all, when investing in them, there is a high risk that they will not receive their 20%.

Venture funds are a good option for finding investments, they are very active now. We cooperate mainly with them ourselves. Some funds will allow you to build, in fact, the very base business, that is, to develop infrastructure, to open an international representative office.

But the “cheapest” money on the market is from banks. Only developers usually don’t know how to take them. Credit lines are rather operated by publishers.

There is also such a thing as non-core private capital. This is when you receive money from a family member, friend, acquaintance. All these sources are ambiguous. It happens that a person who does not understand development begins to interfere in your work on the grounds that he gave money. Or he may, on the contrary, be too passive.

Such sources of capital tend to change decisions, which is also bad, especially when it is impossible to predict. Probably, you can use this money, but you need to do it very carefully and, if possible, look at other sources.

Now I will tell you about the inner kitchen, that is, about what happens when you send an application to the foundation or publisher.

How to qualify your product

All relevant sources of investment have a so-called “qualification”. Whether you qualify depends on:

- types of products that investors are interested in;

- of what budget grids there are for such products;

- background checks conducted by investors.

Here are the data that should be indicated in the application in any case.

By company: information about the founders, team, footprint (your past games, projects that you have done), indicators of previous products and current ones, if any, mission, strategy and business model.

By product: presentation, a short video with gameplay, the ability to give access to the game in its current state, a normal business plan, a document about risks and a development schedule (if the product is still in development). Detail all planned tactical decisions and methods in advance – many investors, especially Private Equity and private traders, will have to chew out how the industry works.

I will clarify about the business model and business plan, many of these concepts are incorrectly interpreted. A good business plan is a large Excel spreadsheet that shows in detail the conditional five years of operation of the company. A business model is a single page that shows how you are going to make money. There should be nothing superfluous in these documents.

Also, the structure of the transaction must be spelled out in the application. This, by the way, is not in 90% of applications!

Here is a typical example: a certain company with a good product is looking for 10 million. We are talking. They tell me: “Here we want to sell 25% equity for this 10 million. We need this money.” At first glance, the transaction is quite complicated. But we start talking, and suddenly they say: “Actually, we potentially have 5 million if money comes from another industrial group.” That is, this deal is actually matching, although there was not a word about it in the presentation!

We talk further. I say, “OK, we can bring in a second investor, we’ll pool the money. And what is the task – IPO or base business”? They don’t understand and ask what it is in general. I have to explain to them. And then they say: “A… Base business! Further investments! So we have already talked with Tencent, Index, and a bunch of other companies. They said that if we build a base business for 10 million, they will give such and such an amount.”

And for these two turns, about which there is not a word in the presentation, the deal turns from a rather risky investment simply into closing a gap of 5 million. If there is a participant for another 5 million, followed by a tail in the second round. And this company, of course, immediately it was worth offering its product in this form.

I want to give some more recommendations on the negotiation process.

How to negotiate?

Prioritize the question of why potential counterparties need a deal. Do not waste someone else’s time and money by sending out cold applications. If the publisher is clearly engaged in the fact that he releases shooters on Switch, and he wrote about it everywhere, do not send him three-in-a-row! Believe me, you will be remembered with this application. This will come back to you the next time you claim something different. People tend to remember when someone does irrational actions. When it comes to money, it’s very bad.

The “push and push” approach does not work in negotiations in the Western world. Everyone here wants to work according to a win-win scenario. An attempt to bargain, to get more money out of the investor, will turn out to be quite painful for you. This will also be remembered.

Don’t rush your partners. Every second developer, having sent out their applications for funds, starts writing angry letters the very next day and demanding an answer. Think about how the work of an investor works. On average, a large venture fund receives from 80 to 120 applications per week. The foundation has no more than ten people working in the operating system. It is impossible to process such a volume in a short time, even after preliminary screening. The normal response time is two weeks. A good deal generally takes six to nine months.

Know the transaction triggers. I remind you again that knowledge of cultural studies and semiotics is needed in Bizdev.. Very often you are told “no” without even saying “no”. Or the situation develops in such a way that one of the parties understands that there is no point in continuing negotiations. This happens a lot. Therefore, study the crowd, study the context in which you are and the people with whom you are talking in their language.

Do not allow passive-aggressive behavior. No one likes this, but it happens very often, unfortunately: people take offense, verbally attack, leave, then come with new claims.

Take decisions and their consequences seriously. Decisions must be irrevocable. If you have made a decision in the business process, notified, agreed, you should not come and say: “We have changed our mind, we want to roll back.”

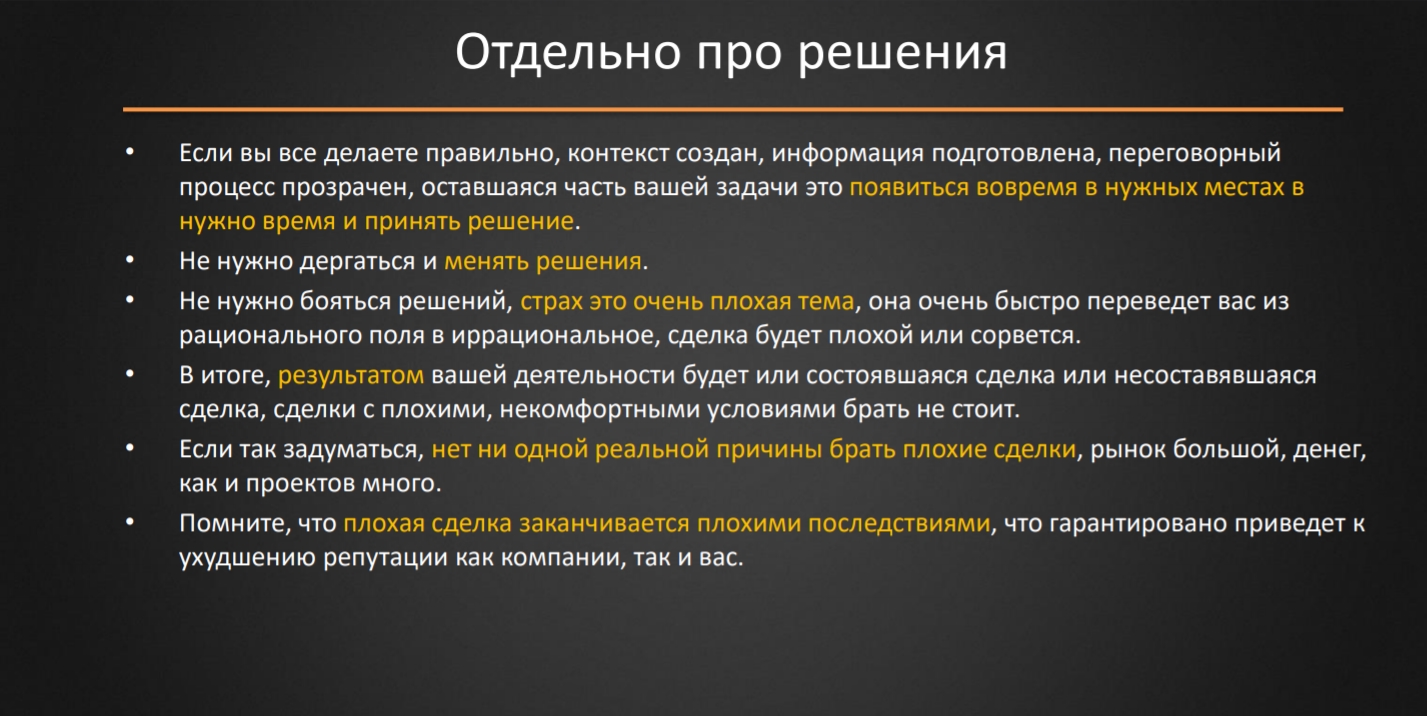

Solutions are just solutions

In general, what are the solutions in bizdev, I want to tell you on the example of golf.

When someone is playing golf, by and large, it all comes down to showing up at the right place, at the right time and choosing the right putter. The putter is the solution. There is no way you can influence the grass, the wind speed, the physics of the impact. So don’t make a fuss.

Solutions are just solutions. There is no need to be afraid of them. Because fear leads your decisions from a rational plane to an irrational one. If this starts happening in the negotiation process, you end up with a bad deal.

And there is no reason to agree to bad deals. People who sign them under the pressure of some circumstances make a mistake with long-term consequences. You need to try to set yourself up in this way: I sign good deals or look for others.

The last thing I will say is directly related to good deals. It’s your reputation.

Working for reputation is the most important thing

Reputation in the negotiation process, in the financial world and especially in game development is a key factor, without which it simply becomes very sad to live.

A bad reputation does not come from the fact that you failed a project or closed a business. It’s okay, we waited and opened another one.

A good or bad reputation appears depending on the quality of your decisions. If these are bad and impure solutions, people will find out about them anyway, and you will have problems. Good business development opens up new niches, market spaces and opportunities for transactions. And actions that lead to a bad reputation close these opportunities – and everything becomes more expensive and more complicated.

It is a good tone in any professional community, especially in the West, to work on the formation of a positive market infrastructure, work on infrastructure projects. Even if they are not rated, but they bring quite a lot of bonuses.

Remember: we need to build, not climb. Make good win-win deals – and then everything will be fine.