"We are pleased that among the top 150 most anticipated games, there are five projects from companies in our portfolio," said Kirill and Roman Gursky from GEM Capital about the results of 2025

We continue to review the outcomes of 2025 with experts from the gaming industry. Next up is an interview with Kirill and Roman Gurskiy, managing directors of the gaming division of the investment group GEM Capital.

This material was originally published on Game World Observer.

How did 2025 turn out for your business? What key results, both successful and unexpected, would you highlight?

Kirill: This year was eventful. Many of our portfolio companies achieved excellent results. Mundfish released the third DLC, "Charms of the Deep Sea," for Atomic Heart, which was enthusiastically received by players, earning a Steam rating of about 95%. Admittedly, the song "In the Blue Sea, in the White Foam" ("Stay with us, boy") was on repeat for me all year. In 2025, the Atomic Heart soundtrack showed impressive results: more than 1.1 million listeners from 177 countries spent over 630,000 hours listening to the tracks on Spotify alone!

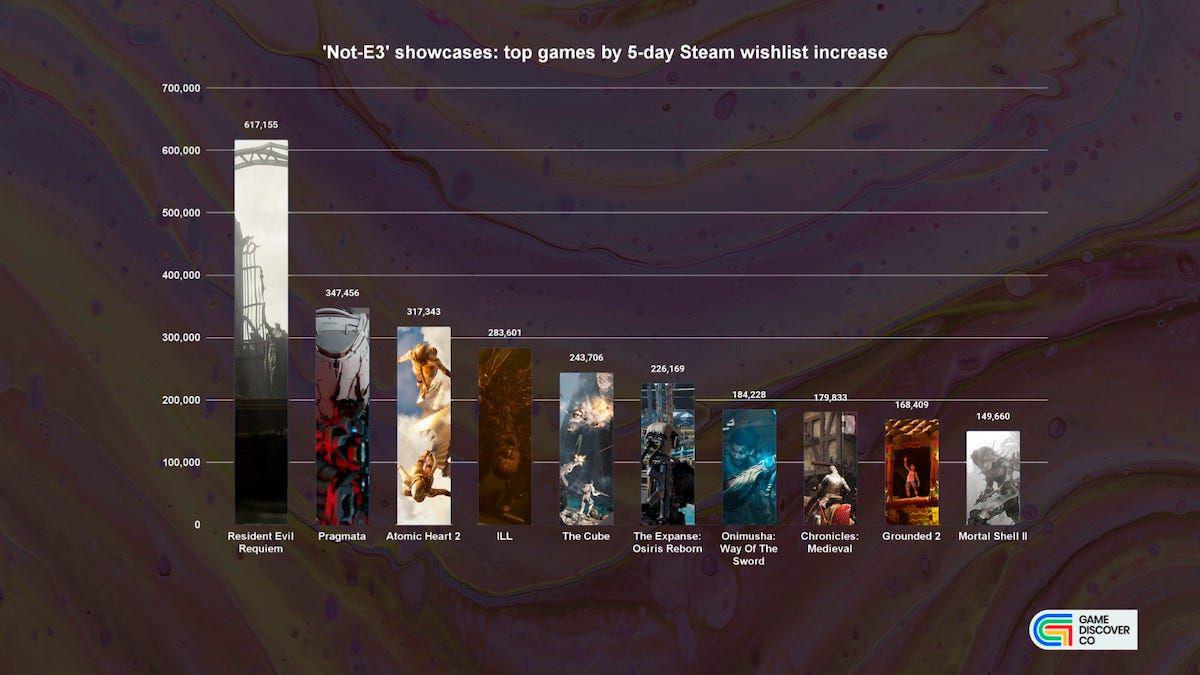

Mundfish also stole the show at the Summer Game Fest, announcing the launch of Mundfish Powerhouse and showcasing trailers for three of their upcoming major games: the MMO RPG shooter The CUBE, the horror game ILL (in collaboration with Team Clout), and of course, Atomic Heart 2. All three games made it into the top 5 most wishlisted games among all those showcased this summer.

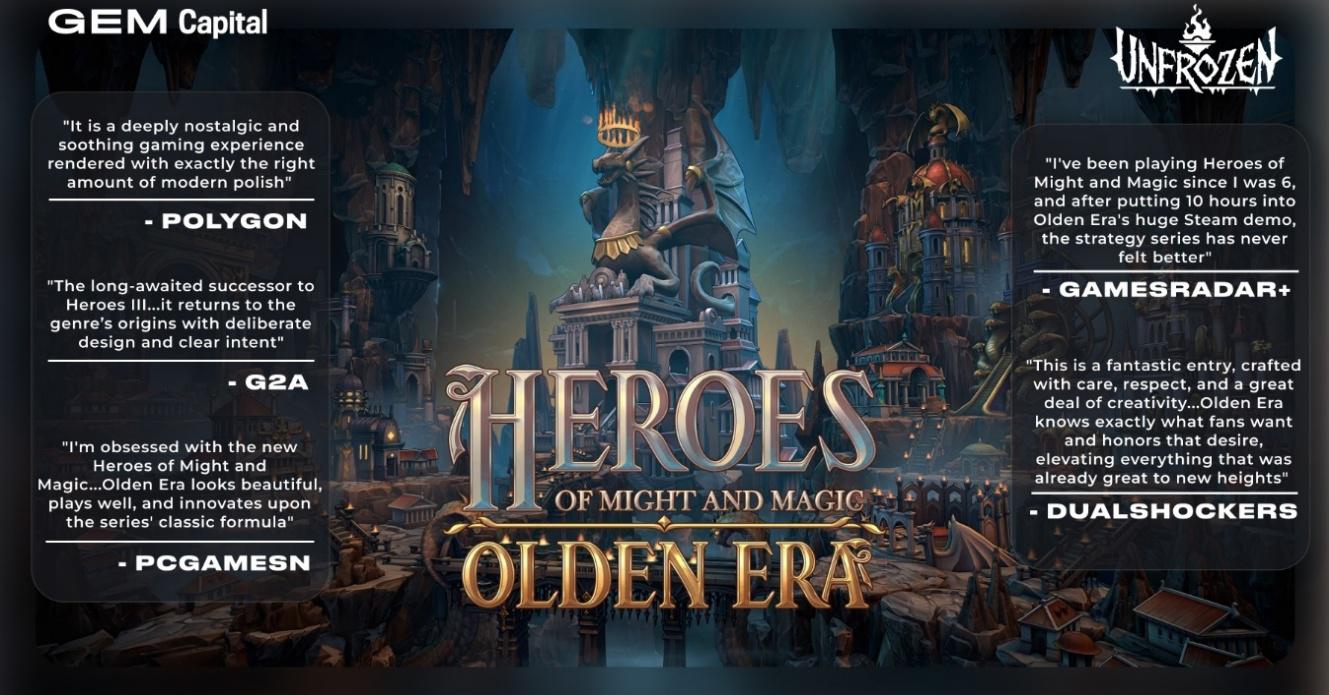

Roman: Unfrozen released the demo of their game Heroes of Might & Magic: Olden Era, which became one of the most popular at the October Steam Next Fest. At its peak, more than 24,000 people played it simultaneously. This places Olden Era in 16th position in popularity (between Stellar Blade and Monster Hunter Rise) among all demos ever released in the history of Steam observations. These would be great metrics for the full release of any game... but Olden Era achieved such numbers not at release nor in early access, but in demo form. A fantastic result!

Game journalists appreciated the game:

- "I've been playing Heroes of Might and Magic since I was six, and after spending 10 hours in the massive Olden Era demo on Steam, I can say: the series has never felt so cool," — GamesRadar+;

- "It’s a magnificent entry crafted with care, respect, and immense creativity by developers who know the series inside and out,” — DualShockers;

- "Olden Era is a deeply nostalgic gaming experience crafted with the perfect touch of modern polish," — Polygon.

The game surpassed one million wishlists and currently holds the 11th spot among the most anticipated games worldwide.

This year, we also achieved a publishing deal with Hooded Horse alongside Unfrozen. We are thrilled with their collaborative work with the Olden Era team! All partners – Unfrozen, Ubisoft, Hooded Horse, and GEM – are passionate about the game and are doing everything possible to earn the trust of fans and light up the strategy horizon with the new star Olden Era! We are glad to assist our portfolio companies in closing deals important not only for them but for the entire gaming market. This is not the first, and certainly not the last time we do this.

Kirill: Sad Cat announced that their highly anticipated cinematic 2.5D platformer REPLACED will be released on March 12, 2026. As they say, save the date! We can't wait for all players to appreciate the creation into which the team poured their soul. As IGN put it, "REPLACED is something that might become an enduring classic of indie games alongside Limbo, Braid, Inside, and Balatro."

Currently, REPLACED has over 600,000 wishlists, ranking 60th in Steam wishlists. We are proud that among the top 150 most anticipated games, there are five projects from our portfolio companies:

- Heroes of Might & Magic: Olden Era (11th place);

- ILL (16th place);

- REPLACED (60th place);

- Atomic Heart 2 (104th place);

- The CUBE (138th place).

This is despite the fact that only one trailer has been shown for Atomic Heart 2 and The CUBE so far. We expect that all games from our portfolio companies will climb even higher in this ranking as they approach release.

Roman: Weappy released their game Hollywood Animal, a Hollywood studio management simulation, into Early Access, and it has already surpassed 3,500 reviews on Steam. The project continues to gather a devoted audience.

reviews on Steam. The project continues to gather a devoted audience.

The journalists are also pleased:

- "Hollywood Animal looks like a blockbuster in the making," — Destructoid;

- "Hollywood Animal makes you the god of an early 20th-century movie studio, and I need the full version of the game right now," — TheGamer;

- "Hollywood Animal is a nifty and detailed Golden Age simulator populated with eminently hireable alcoholics," — RockPaperShotgun.

Weappy has also unveiled its beautifully hand-drawn platformer The Eternal Life of Goldman. Game media that experienced the project were absolutely delighted. As Everyeye wrote, "What we have here is a creation of astounding work."

Kirill: Our mobile and adjacent gaming companies also showed great progress. For instance, Hypemasters attracted a new investment round from Impact46 from Saudi Arabia and announced an expansion of its presence in the MENA region and the opening of an office in Riyadh. We put a lot of effort into this deal and are happy it worked out! AppMagic, on the other hand, announced that their revenue doubled over the past year. The company also launched Steam analytics, whose accuracy and depth were highly praised by clients and the gaming community. Besides revenue and installation data, AppMagic provides information on DAU/MAU, Average Daily Playtime, Daily CCU, Retention, etc.

This is an important step for the company towards its long-term strategy of creating a unique cross-platform analytics system covering the entire ecosystem of games and apps. Steam analytics is just the beginning. AppMagic is already working on similar solutions for Xbox and PlayStation. I must say that being able to analyze the game metrics of our portfolio companies with data from another of our portfolio companies is a moment of pride for any investor.

Roman: Overall, it's no wonder AppMagic received an Honourable Mention at the Mobile Games Awards 2025 in the Best Analytics/Data Tool category. As did another of our portfolio companies, the alternative mobile game store Skich, which was recognized in the Best App Store category. Skich notably outpaced Samsung Galaxy Store, Oppo Software Store, and TapTap.

The gaming community has duly recognized the progress that the Skich team achieved over the past year. In March 2025, Skich became one of the first alternative stores on iOS in Europe (TechCrunch), and by August, it became available to Android users (GamesBeat). It's safe to say our prediction about the future of alternative mobile stores made in a similar interview at the end of 2024 has come true.

Kirill: We are also very happy that Studio 42, founded by former top managers of Belka Games (GamesIndustry), has joined our GEM Family. Thanks to the founders and team for your desire to build the future with us!

How, in your opinion, has the gaming investment market changed in 2025—both in terms of interest in segments and the structure of deals?

Roman: We see a strengthening trend for the consolidation of the gaming industry. According to Aream & Co., in just the first nine months of 2025, there were announcements of 130 M&A deals totaling $65 billion, including the acquisition of Electronic Arts. This is the largest leveraged buyout deal in history! Strategic investors from Asia remain the most active in terms of the number of deals.

Kirill: At earlier stages, especially at Series A, the market remains challenging. The volume of investments in the first nine months of 2025 significantly decreased compared to the same period last year ($1.5 billion vs. $4.2 billion). The highest concentration of investments is in AI and mobile studios from Turkey. The number of successful Series A rounds has been declining for five consecutive quarters. Against this backdrop, the achievements of our portfolio companies that we mentioned earlier are especially valuable!

What has changed for those who want to attract investments for development? Have the evaluation criteria, requirements, approaches changed?

Roman: The volume of investments has decreased, making it harder to attract funds. Consequently, competition among developers has increased significantly, and so have the demands on them. The more track record a studio can show, the higher its potential for attracting an investment round. Teams that can demonstrate metrics increase their chances accordingly.

The rising competition for capital among developers leads to lower valuations. For investors in the gaming industry, now is a good time for new investments.

Have there been any new "red flags" in 2025, or have some become more common in project evaluations?

Kirill: Yes. I’ll give an example. We’re seeing some gaming startups, which raised funds several years ago, closing down now. Not all venture capital cases are successful, and that’s normal—high risk, high reward. But it's always telling how a company closure was managed and how founders, investors, and employees parted ways. In such cases, we always seek feedback from previous company participants. If we get negative feedback, that's a "red flag" for us.

Which gaming genres and platforms have become the most promising in terms of investment today?

Roman: Genres and platforms are important elements of the puzzle in making investment decisions, but they aren't paramount for us. There have been times when we were sure we'd never delve into a particular genre, but then we met a superb team working precisely in that genre. Venture capital is predominantly about people. We don't invest in games; we invest in the teams creating these games.

What changes do you anticipate in the gaming venture market in 2026?

Kirill: Much will depend on the results of gaming companies and startups that have attracted investments over the past few years. In 2026, it will have been about five years since the surge in gaming investment (around 2020-2021) on the wave of the COVID pandemic. It's time to gather the stones. If the market sees success stories of companies backed by VC, it will boost investor optimism and encourage new investments.

What are your plans for 2026? Perhaps you're ready to announce a future number of deals or upcoming releases from your portfolio companies?

Roman: We look forward to 2026 with hope and cautious optimism! This year will be filled with game releases from our GEM Family, which we eagerly await not only as investors but also as gamers.

One thing will remain unchanged—we will continue to invest in the best founders and teams in the gaming market. We will announce one of our new deals very soon. Stay tuned!