Digi-Capital: the mobile market has destroyed the gaming market

Yesterday, Digi-Capital published the Global Games Investment Review 2013, taking into account data for the third quarter. The main conclusion of the study: mobile/social segments have blown up the gaming market.

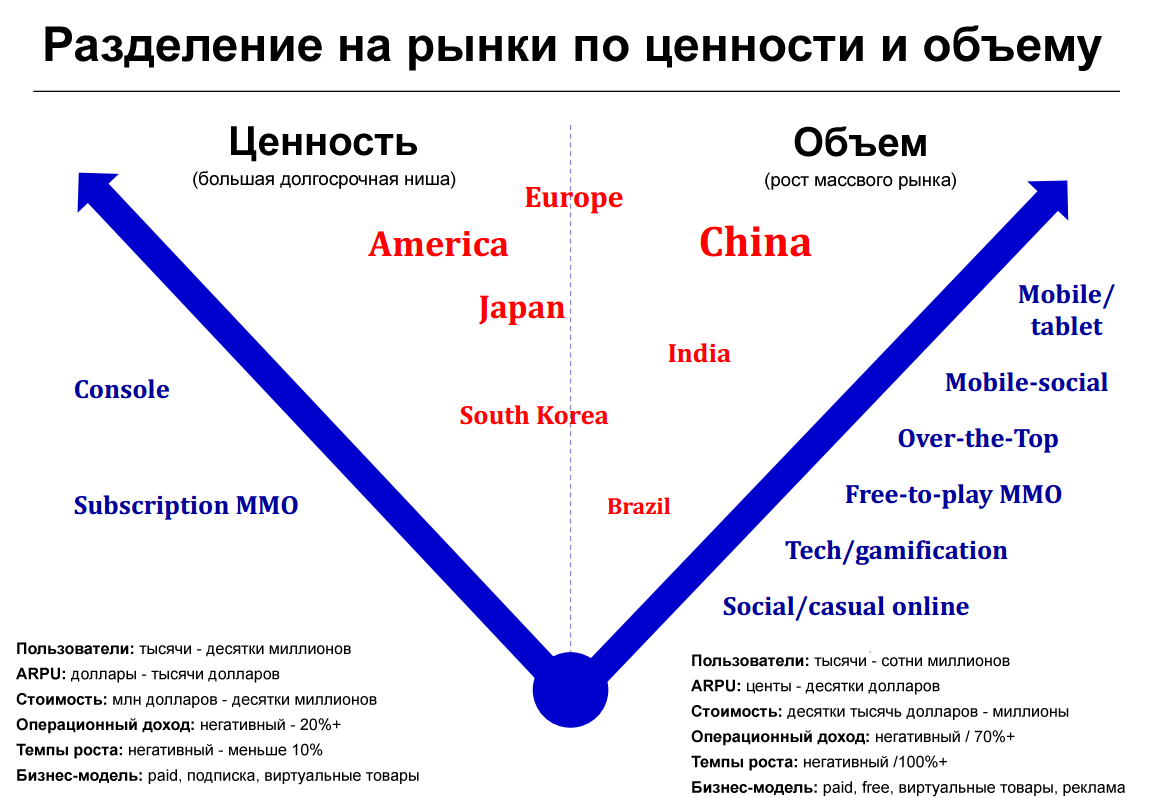

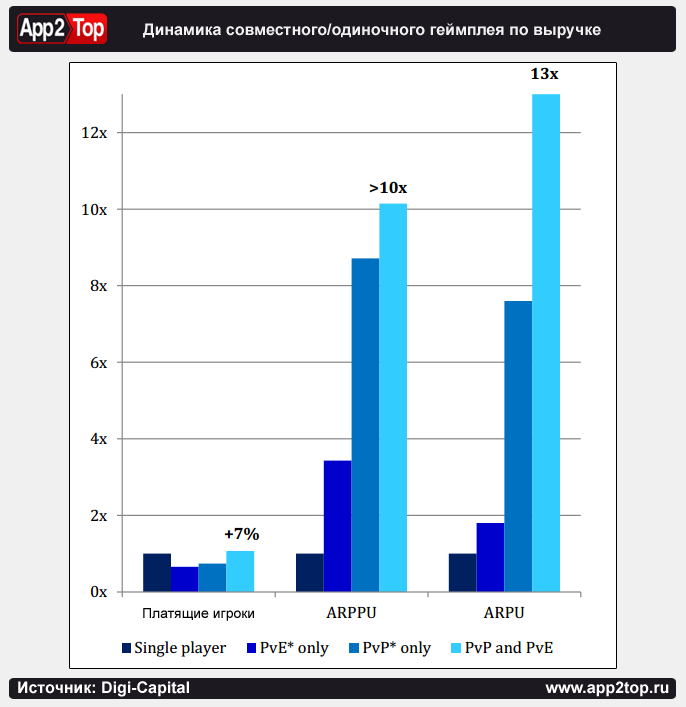

The transition to free-to-play and cooperative play has seriously changed the growth dynamics and stratification of the games market, increasing the revenue of market leaders by 10-20 times. The gap in earnings between the top engaged in “free” games and the top engaged in paid projects is gigantic. And this, by the way, is the reason for the disappointment in the mobile market of small teams focused on creating paid projects, whose tail of sales in the current conditions tends to zero. This does not mean that it is easier in other markets. It’s just that now it’s really hot in the mobile segment.

Games are launched by 43% of iOS/Android smartphone users and 67% of tablet users. In other words, this category of applications is the most popular on touch devices, which are becoming as familiar things as a TV and a personal computer (and, rather, even more common).

Mobile games account for 72% of all app revenue (in 2010, this figure was 40%) and account for 40% of all app downloads. That is, if a company wants to make money on mobile content, the most obvious step for it is to go into game development. By the way, mobile games are monetized 4 times more efficiently than all other categories of applications together.

Mobile/online games are capable of bringing the total volume of the video game market to an astronomical $83 billion by 2016, earning $48 billion. According to the results of 2012, mobile and online games earned $32 billion (49% of the gaming market).

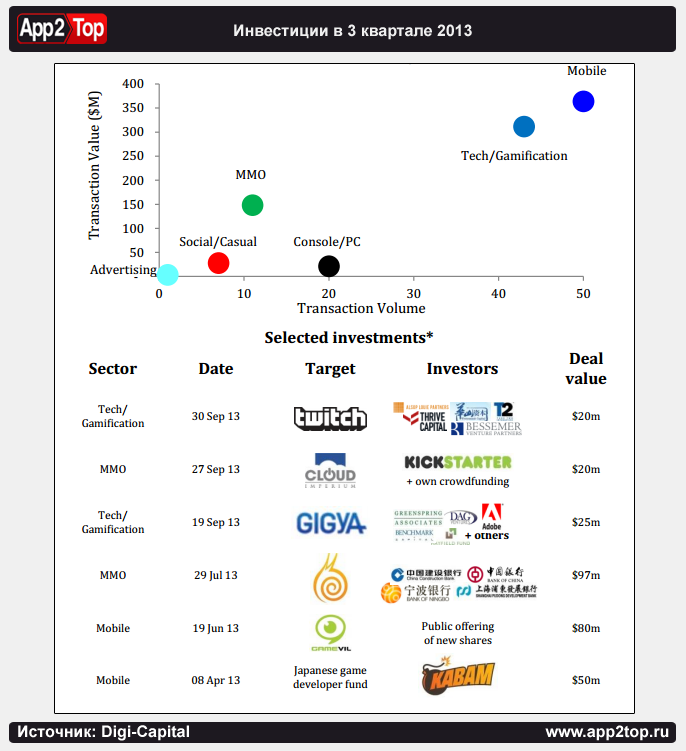

The total volume of mergers and acquisitions in the gaming sector as a whole increased to $3.3 billion.

The average transaction today is estimated at $45 million. 8 of the 10 largest transactions in the third quarter of this year were carried out by Chinese, Japanese or South Korean investors.

However, after the story with Zynga, many venture capitalists completely left the gaming market. But everything can change very soon, if, of course, King successfully shows itself on the stock exchange.

But at the moment, as Digi-Capital notes in its report, there is a discrepancy between the number of teams that require financing and the number of investors willing to provide it. Given the rapid growth of the market, it seems strange, but caution in this matter is quite understandable.

And it’s not that “wallets” are afraid that the mobile market will turn out to be a soap bubble (the fact that it is serious and for a long time is clear to everyone today), it’s about the extremely dynamic market (yesterday’s stars fade very quickly) and the inability to predict whether a particular project will fire. That is, it is not clear whether a particular game is good or bad, namely, whether it will hook and whether it is able to pull money from consumers.

Yes, we were very confused by this graph, which compares the number of paying users with ARPU. We didn’t quite understand how this is possible, but we really liked the comparison of ARPU by types of monetization.

The full version of the report can be downloaded here.

A source: digi-capital.com