Casual Connect 2012: App Annie reveals the ins and outs of the mobile market (Part 2)

In his speech at Casual Connect 2012, Bertrand Schmidt, executive director of App Annie, spoke about the impact of device releases on downloads and revenue from apps in the App Store, and also shared interesting “comparative” statistics on the two leading app stores.

According to App Annie, long–term seasonal trends are the key to strategic planning in the mobile games market. In total , the company identifies three main trends:

1. Launching devices or a whole line of devices can potentially increase the number of your downloads and the amount of revenue in the App Store by 50%.

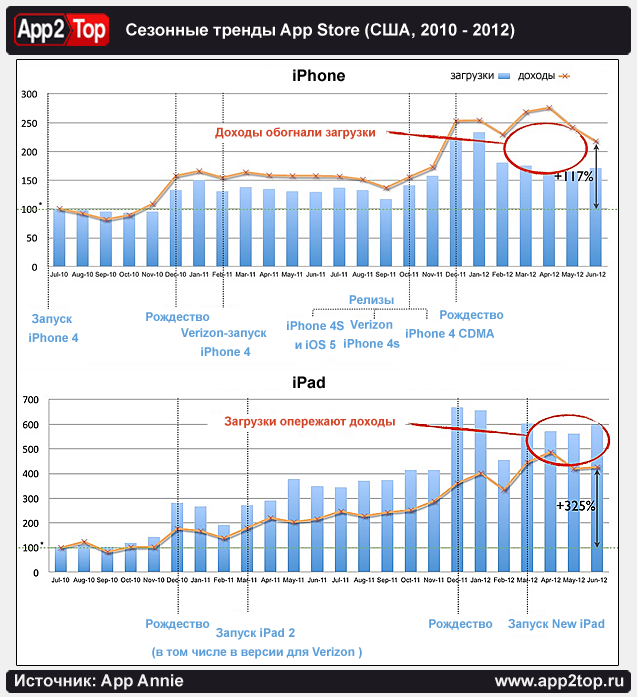

In the two graphs just below, App Annie shows how the launch of devices affected the number of downloads and the amount of revenue from the App Store.

2. During the Christmas period, there is a 50% increase in income.

3. In the last two years, the growth rate of iPad revenues has been twice the rate of the iPhone (to be more precise, in two years the growth rate of the iPhone has doubled, and the iPad has quadrupled).

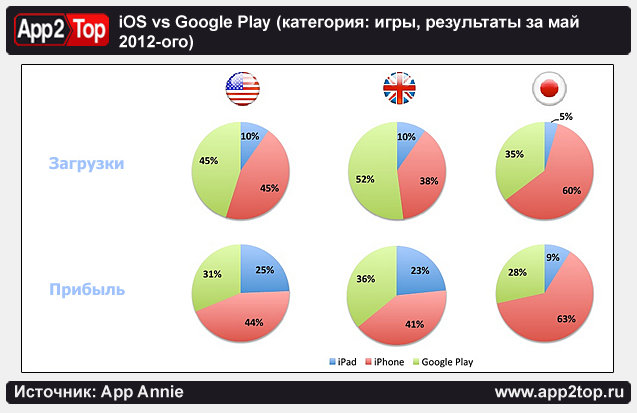

Using the example of the American, British and Japanese markets, App Annie also demonstrated the download/revenue ratio between the iPad App Store, iPhone App Store and Google Play. There were no surprises. The Android app store in Western markets is leading in game downloads, but noticeably lags behind iOS when it comes to app revenue. Curiously, in the Japanese market, the iPhone surpasses Google Play by a large margin in downloads, but this has little effect on the proportion of revenue.

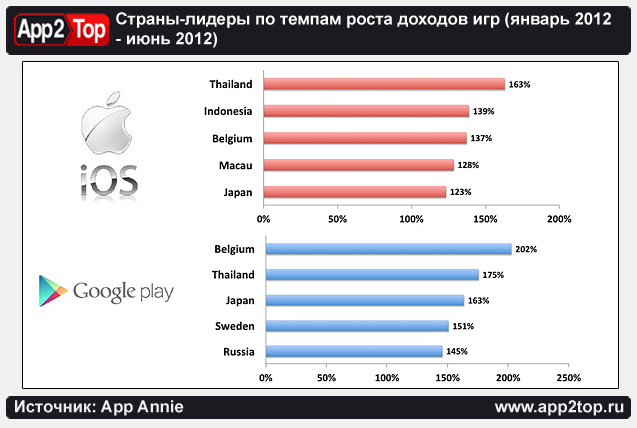

If we talk about revenue growth rates, then iOS has it mainly in Asia, and Google Play in Europe and Japan. In both top 5 countries-leaders in terms of growth rates are present: Thailand, Japan and Belgium.

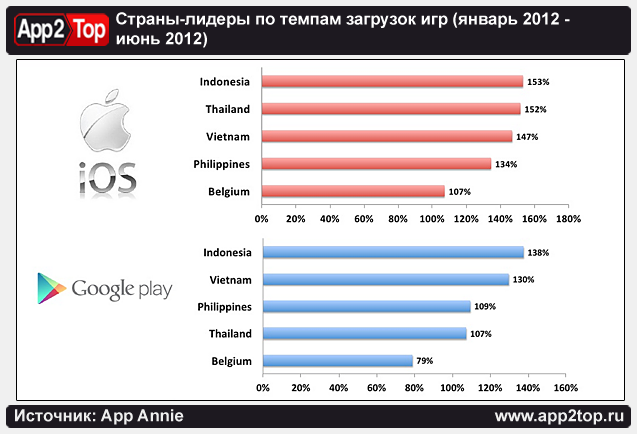

As for the growth rates of downloads, the leaders there are the same: Indonesia, Thailand, Vietnam, the Philippines and Belgium.

Curiously, the most profitable games on Android are maps, puzzles and arcades. As for the iOS platform, more complex simulation games and role-playing projects, quests and strategies dominate here.

The conclusions of the report are as follows: Google Play still generates only 1/3 of revenue; iOS is particularly strong in monetization and demonstrates excellent growth rates in Asian markets; and iOS monetization can and should be implemented in complex projects.