In 2025, gaming companies made deals amounting to nearly 80 billion dollars, according to analytics

This is 3.3 times more than in 2024.

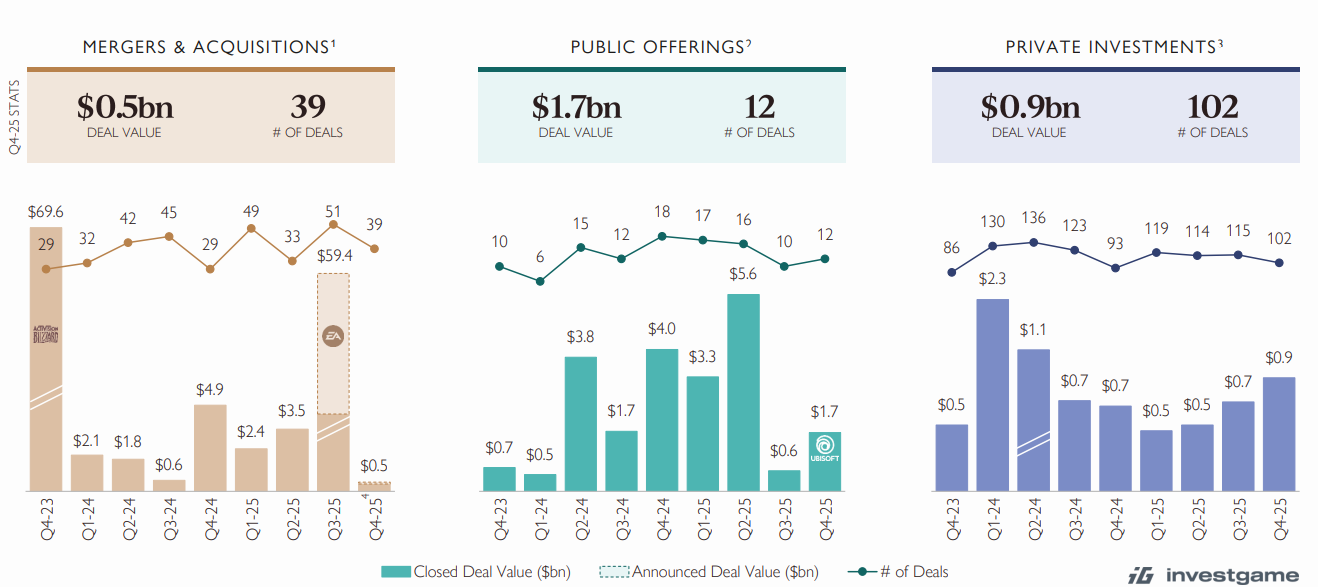

The number and volume of gaming deals (M&A, public offerings, and private investments) from October 2023 to December 2025

These figures were reported in a recent study by Aream & Co., based on data from InvestGame. The firm analyzed three types of deals involving gaming companies: M&A, private investments, and public offerings. Below are more details on each type.

- In 2025, most of the money was in M&A deals—mergers and acquisitions—which totaled $65.8 billion. For comparison, the previous year saw only $9.4 billion worth of deals. This significant increase is largely due to the high-profile sale of Electronic Arts, valued at $55 billion alone. Without this sale, the gap would not be as pronounced.

- The second-largest category was public offerings, with a financial volume of $11.2 billion by the end of 2025, which is a 12% increase compared to 2024. The most significant event was GameStop's issuance of senior convertible bonds totaling $3.55 billion.

- As for private investments, they notably declined by 45.8% to $2.6 billion in 2025. However, by the end of the year, the situation began to stabilize. The most substantial investments were attracted by Turkey's Good Job Games, which secured $83 million through two funding rounds.

- In total, last year gaming companies concluded 677 deals: 450 (-6.6%) were private investments, 172 (+16.2%) were M&A, and 55 (+7.8%) were public offerings.