In the first quarter of 2025, the volume of gaming deals reached $12.1 billion

The consulting company Aream & Co. analyzed the gaming deals market from January to March 2025. In its report, it used data from InvestGame.

According to the figures provided by Aream & Co., the situation in the market remains ambiguous. Compared to the previous year, the total volume of quarterly gaming transactions increased by 120%, reaching $12.1 billion, while the number of deals decreased from 167 to 135.

Mergers and Acquisitions (M&A)

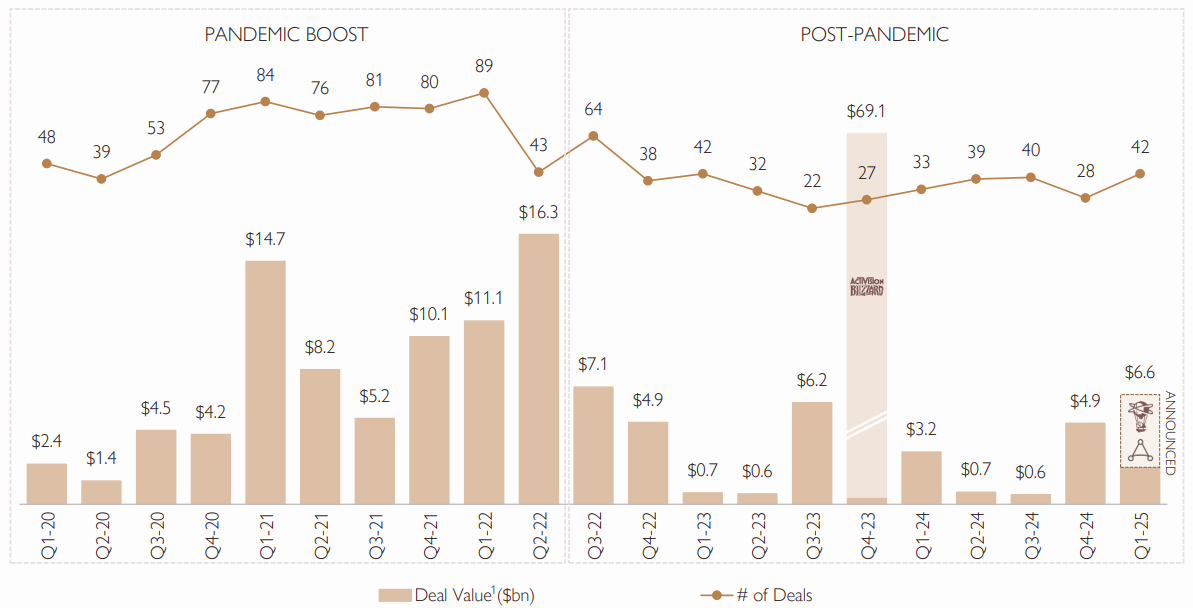

M&A transactions from the first quarter of 2020 to the first quarter of 2025

- From January to March 2025, gaming-related companies conducted 42 M&A deals. This is the best result since the third quarter of 2022, when 64 such deals were announced.

- The total volume of concluded or announced M&A agreements over three months was $6.6 billion.

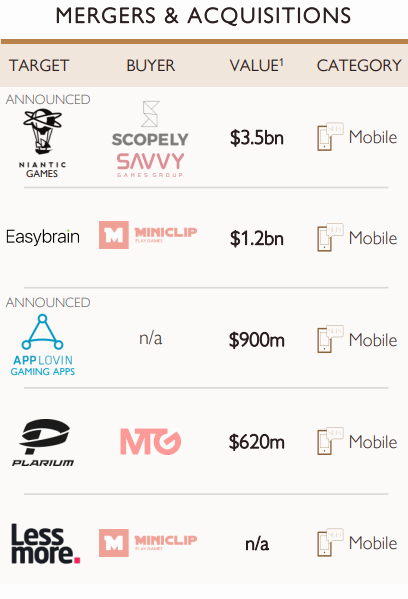

- The largest deals of the quarter pertained to mobile games. The top three included the sale of Niantic's gaming division to Scopely for $3.5 billion, the sale of Easybrain to Miniclip for $1.2 billion, and the sale of AppLovin's gaming studios to an undisclosed buyer for $900 million.

The largest M&A deals in the first quarter of 2025

Private Investments

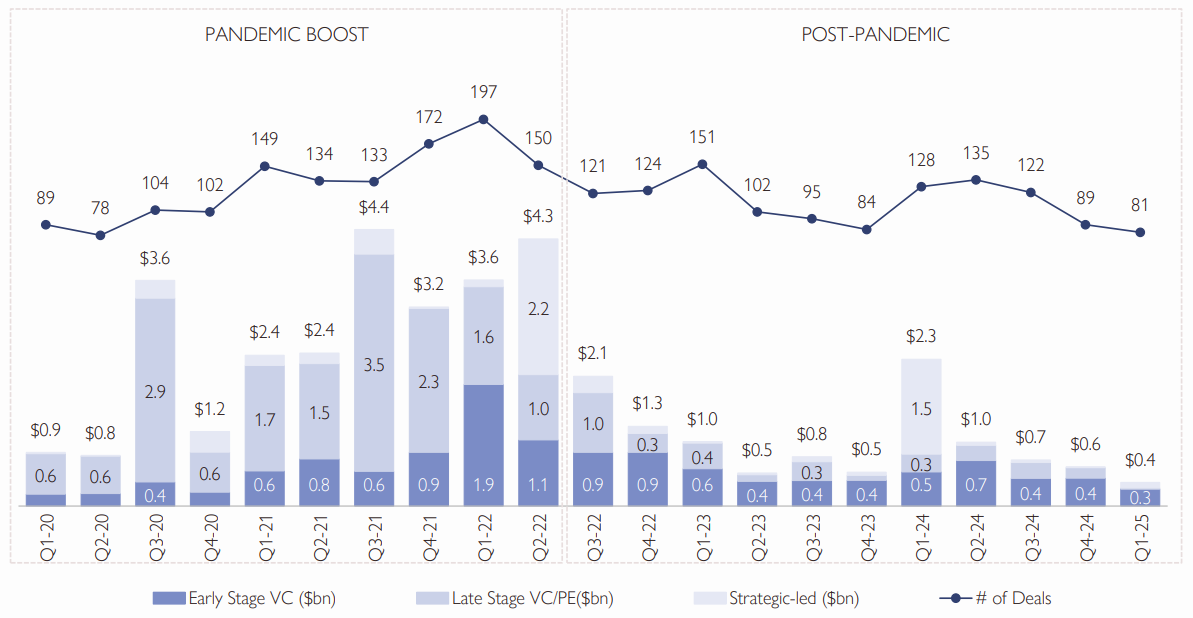

Private investments from the first quarter of 2020 to the first quarter of 2025

- In the first quarter of 2025, there were 81 private investments in the gaming industry, marking the worst result in several years. The last time fewer private investments were made was in the second quarter of 2020 — 78.

- The volume of private investments also significantly decreased, totaling $0.4 billion. This is 82.6% less than a year ago.

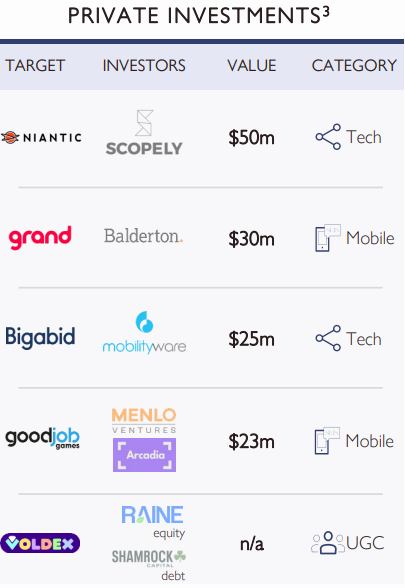

- The largest investment went to Niantic Spatial — $50 million from Scopely.

The largest private investments in the first quarter of 2025

Public Listings

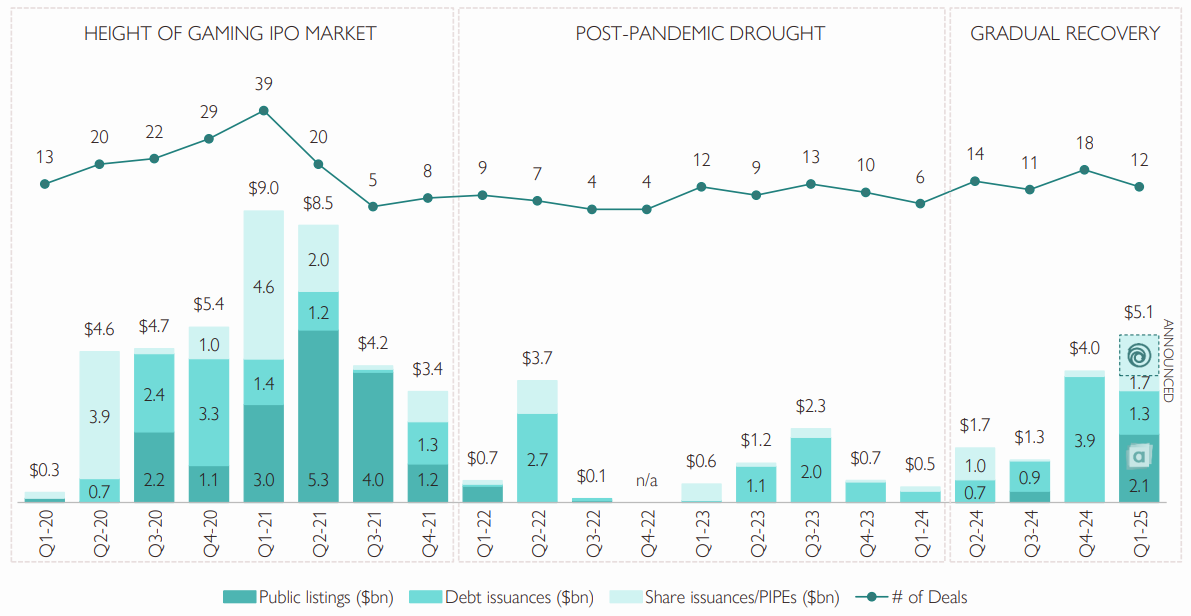

Public listings from the first quarter of 2020 to the first quarter of 2025

- During the quarter, companies listed or announced the listing of their securities on the stock exchange 12 times. Compared to 2024, the number doubled.

- The total valuation of completed and announced public listings for the quarter was $5.1 billion.

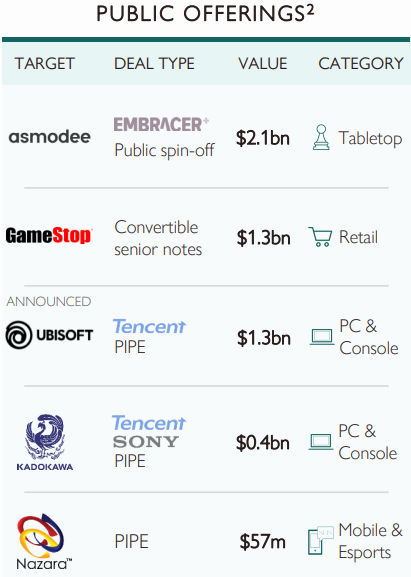

- The largest event was Asmodee's market debut (a subsidiary of Embracer Group) as a separate public company valued at $2.1 billion. Also among the top were PIPE investments by Tencent in Ubisoft's new subsidiary, totaling $1.25 billion.

The largest public listings in the first quarter of 2025