Why Sensor Tower Acquired VG Insights and How Aggressive Consolidation Might Harm the Gaming Analytics Market

Last week, Sensor Tower announced the acquisition of the Video Game Insights platform to enhance its product with data on console and PC games. This raises the question: what are the consequences of consolidation in the gaming analytics sector? Today, we will take a close look at the objectives of Sensor Tower's M&A strategy and the potential risks to the market.

Contents:

- Sensor Tower is on a consolidation path: what goals does the company pursue;

- VG Insights' position in the analytics market: what its acquisition means for Sensor Tower's business;

- Monopolization of data analytics channels: the downside of Sensor Tower's expansion.

Sensor Tower is on a consolidation path: what goals does the company pursue

Consolidation in the gaming analytics market is quite rare. Most companies prefer to develop alongside one another. A notable exception was the acquisition of SuperData Research by the analytics giant Nielsen in 2018, aimed at strengthening Nielsen's position in the esports data collection sector. However, less than three years later, management closed SuperData as a standalone structure, citing market saturation in gaming analytics as one of the reasons.

Against this backdrop, Sensor Tower is following a much more aggressive strategy. The acquisition of VG Insights marks the company's third M&A transaction. Previously, it made the following acquisitions:

- 2021 | Pathmatics — a marketing platform that expanded Sensor Tower's functionality with analytics tools for mobile advertising and services like TikTok and YouTube;

- 2024 | data.ai (formerly App Annie) — a direct competitor in the mobile analytics market, whose acquisition provided Sensor Tower with new tools for data collection and systematization, substantially increasing its corporate client base.

Announcement of the integration of Steam, Xbox, and PlayStation market analytics into the Sensor Tower platform

Sensor Tower has not publicly disclosed the amounts paid for each of the three companies. The acquisitions of Pathmatics and data.ai were partially funded by Riverwood Capital, a majority shareholder of Sensor Tower, which first invested $45 million in it back in 2020. Joost van Dreunen, co-founder of SuperData and now CEO of research firm Aldora, has estimated the acquisition of data.ai at around $300 million, based on its annual turnover of $100 million.

It's worth noting that at the time of the deal, data.ai was a much larger company compared to Sensor Tower, as indicated by not only its staff size and estimated revenue but also the amount of raised capital. According to Crunchbase, the firm completed several rounds totaling $157 million. Hence, many were surprised not just by the acquisition itself but by the fact that Sensor Tower was the buyer.

In addition to investments from Riverwood Capital, a loan was taken out from Bain Capital Credit for acquiring data.ai. This subsidiary of Bain Capital specializes in mezzanine loans, among other things. It provided Sensor Tower with the main funds for the purchase, but the size and terms of the loan are undisclosed.

Considering the relatively small size of VG Insights, which still positions itself as a startup, its acquisition likely required far fewer resources.

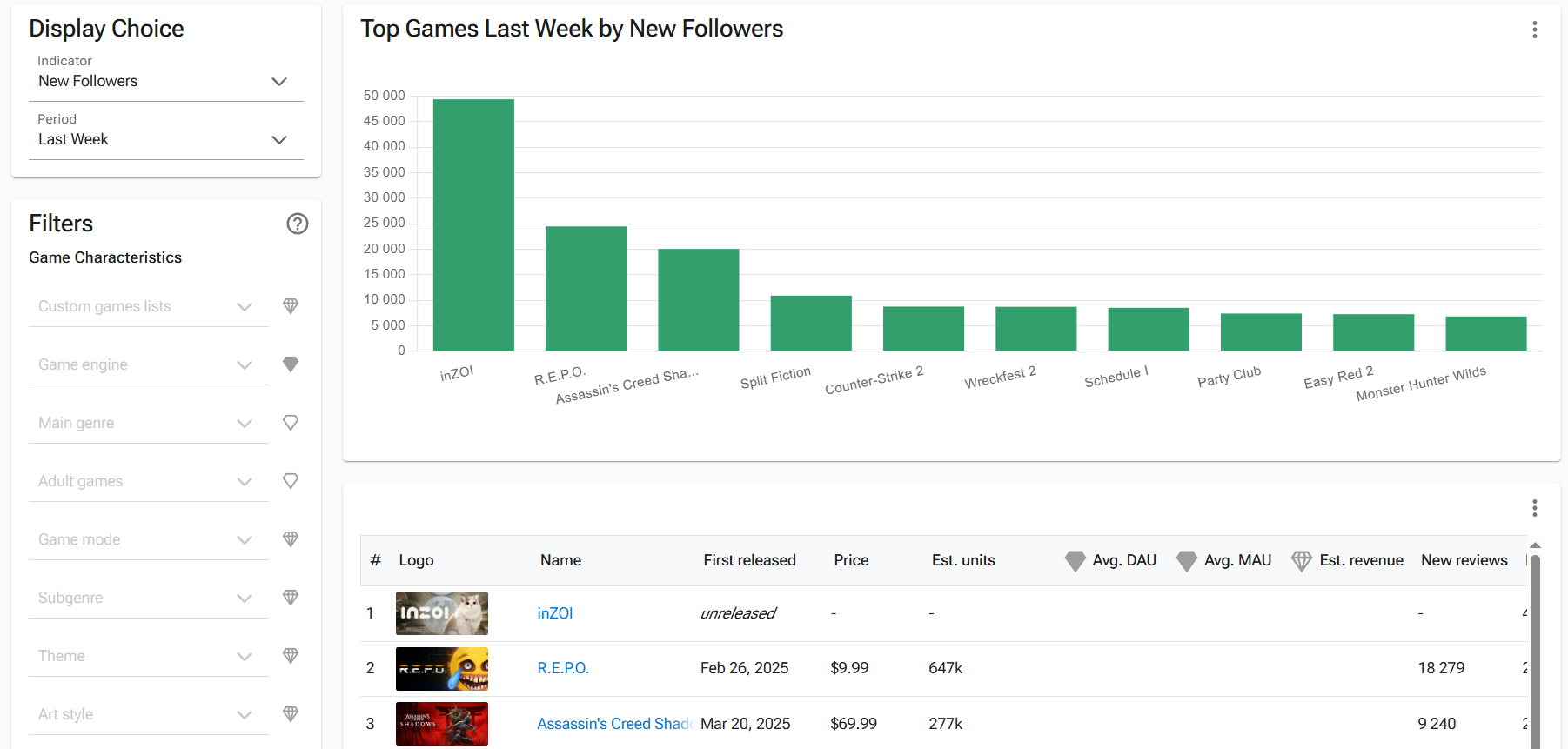

One of the many dashboards available in the VG Insights service

Nonetheless, dependence on major shareholders could eventually place Sensor Tower in a vulnerable position. On one hand, it still operates as a private company. On the other — as investor influence grows, so do their expectations for business growth.

One possible strategy is acquiring competitors instead of developing the product independently. By gaming analytics market standards, the approach seems radical, but it's exactly what Sensor Tower's COO, Tom Cui, publicly stated shortly after the data.ai acquisition. The main goal is to demonstrate growth by any means, both organic and inorganic.

The acquisitions of data.ai and VG Insights were announced just a year apart — both were publicly disclosed during the Game Developers Conference (GDC). Whether Sensor Tower will continue its M&A expansion at the same pace remains unknown. One thing is certain: the company is firmly pursuing the expansion of its offered analytical tools, aiming to become a universal platform for analytics across all segments of the video game market in the long term.

The aim is to integrate solutions for data collection and processing for mobile devices, the web, PCs, and consoles. The company wants every market participant to think of Sensor Tower as the ultimate tool for solving their challenges. "It will take us years to achieve this goal. But we are confident we can do it with the combined resources [of the acquired companies] and additional human capital," Cui believes.

VG Insights' position in the analytics market: what its acquisition means for Sensor Tower's business

From a business development perspective, acquiring VG Insights is a logical step. After the deal, Sensor Tower publicly positions itself as an "exclusive source of gaming analytics," now also covering the PC and console markets.

VG Insights has been around since 2020. Its co-founder and CEO, Karl Kontus, developed it while simultaneously working at the London division of 2K (he left there only in April 2024). He noted that the project's idea emerged due to the lack of comprehensive analytics tools for indie developers on PC.

If you're a mobile game developer, you're in luck when it comes to working with data. If you have enough money to buy a subscription to Sensor Tower or App Annie, you have access to almost unlimited data. However, the PC segment had significant issues in this area.

CEO of VG Insights