Study: How Interested Are Game Development Specialists in Further Education

App2Top, with the collaboration of the educational platform WN Academy, conducted research dedicated to education in game development. Here are the results.

Respondent Profile

The majority of respondents are men (66%). The primary age group of those surveyed is between 25 and 34 years old (58%).

Most respondents work in areas such as game design (32%), management (16%), programming (14%), and art (12%).

The survey saw a higher participation rate from Middle and Junior-level specialists, with them accounting for 31% and 21% of the completed questionnaires, respectively. Another 14% each were Senior and Lead level specialists. Head and C-level specialists together accounted for just over 18%.

When They Face a Lack of Professional Knowledge

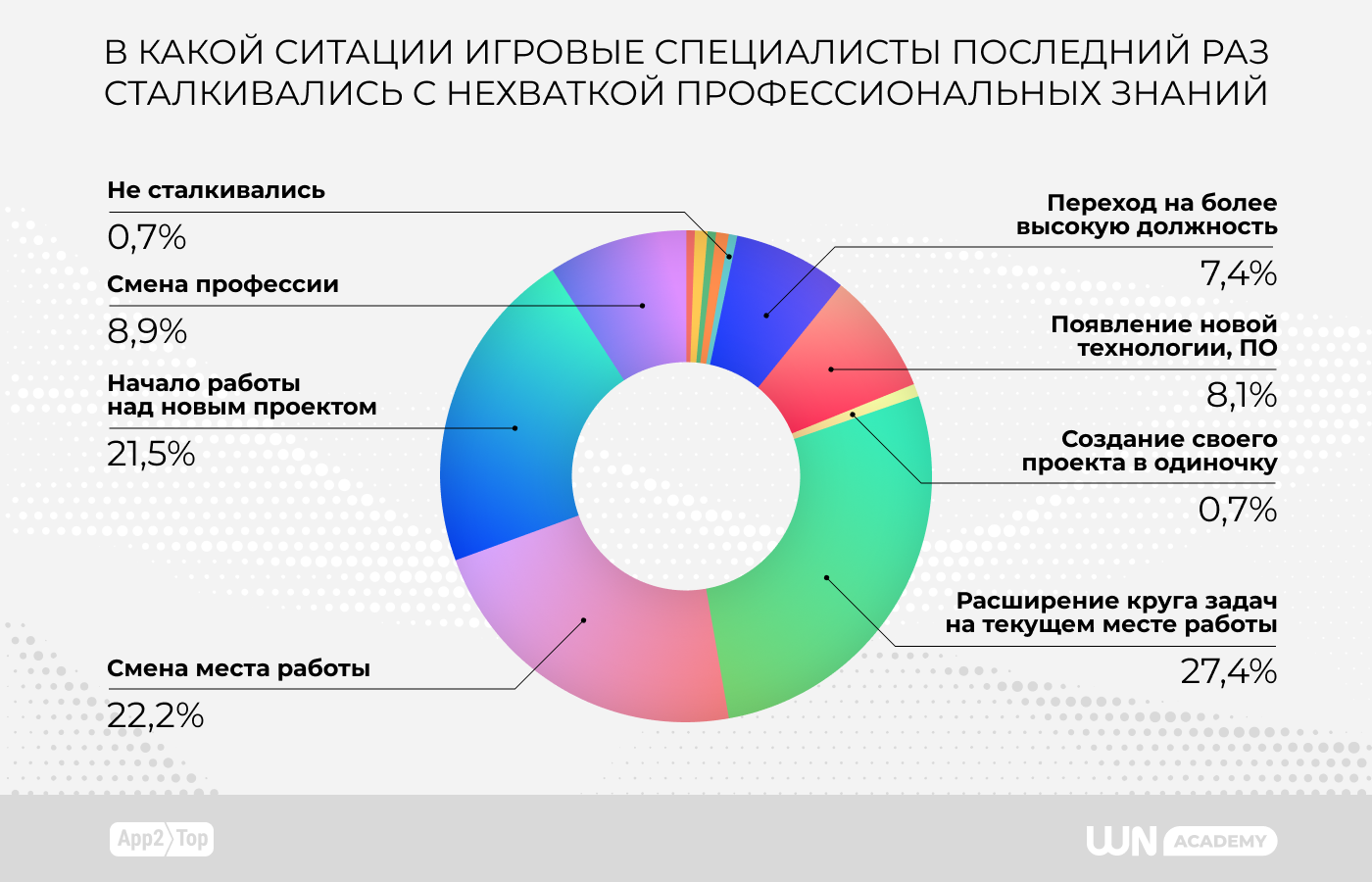

There are three common scenarios when specialists lack knowledge:

- expansion of tasks (27%);

- changing workplace (22%);

- starting a new project (21%).

Only 7% of respondents noted that they last faced a lack of professional knowledge when transitioning to a higher position.

How Do They Develop Their Professional Skills?

The most popular tools for improving personal qualifications are work tasks and internet searches. In response to the question, "How do you develop your professional skills?" 82% of respondents answered, "I try to understand through current tasks at my workplace," and 80% said, "I look for free information online and figure it out myself."

Only 12% of respondents pursue higher education in the relevant field. Meanwhile, 36% of specialists regularly enroll in courses to improve their professional level. The least common practice for development is using mentors, with only 4% of specialists doing so.

Experience with Courses

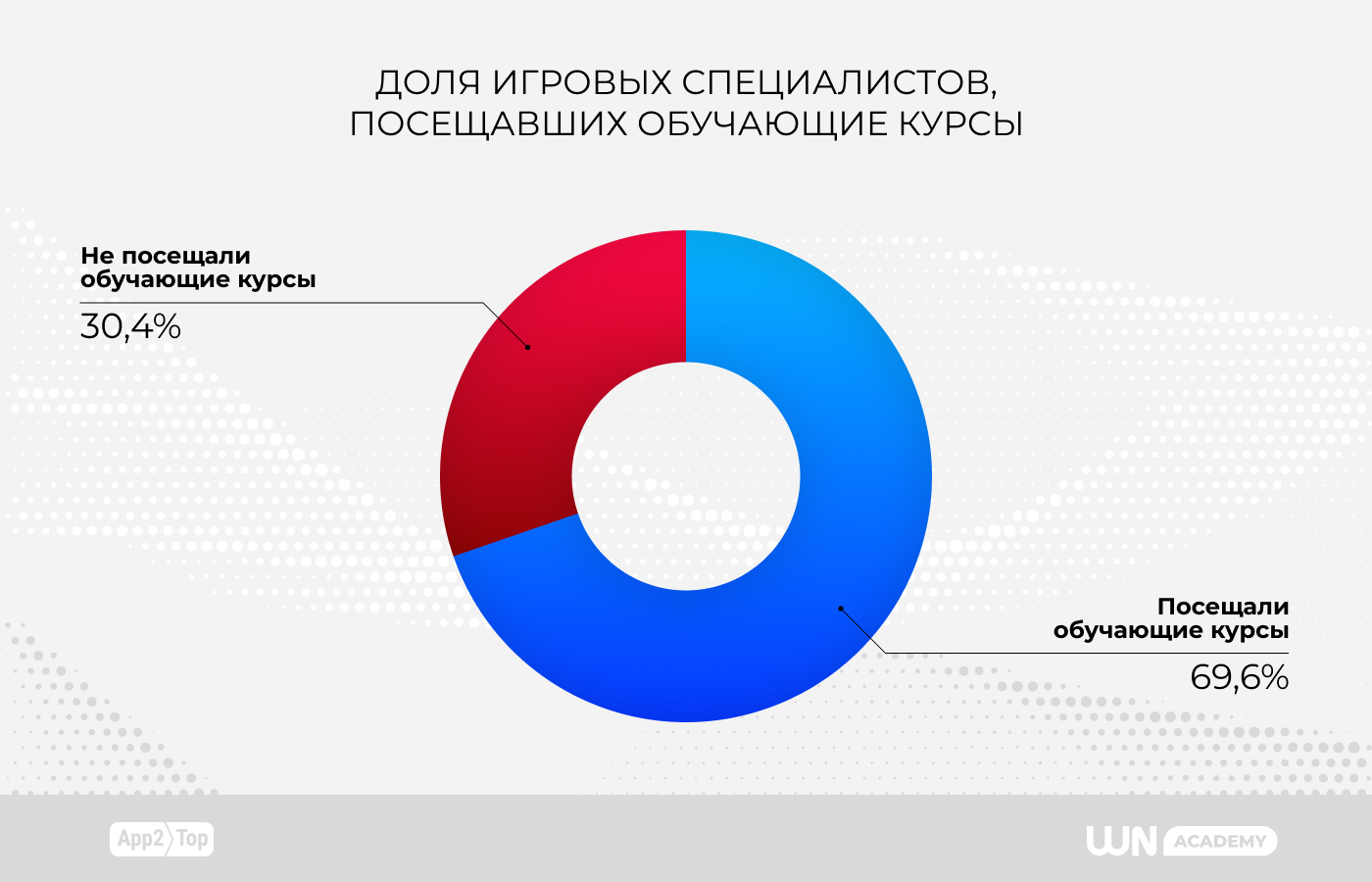

Despite only 36% of respondents regularly attending courses, the majority of surveyed game specialists have taken such courses. Nearly 70% of respondents said they attended training courses.

The courses attended varied based on specialization.

For example, game designers usually attended courses in game design (71% of specialists within this field), and many also enhanced their qualifications in management (44%).

Another example is that half of the mid-level managers attended courses not only in their specialty but also in analytics.

The responses revealed a surprising diversity of existing schools and courses attended by game specialists. Respondents mentioned 35 educational brands they used, with no dominant player among them. No school even received 20% of mentions.

“This indicates that in the realm of courses geared towards specialists already working in the game industry, there are currently no leaders or truly strong players to which experienced professionals would go for qualification improvement,” explained Magdalena Stryevski, a manager at WN Academy.

Duration of Training

Most game specialists took courses that were of average duration—between one and three months (36%). Many also had experience with courses available as recordings (19%).

There is a direct correlation between the course duration and the amount paid for it. Short courses, less than a month long (likely a couple of introductory or promotional sessions), were often taken for free or a nominal fee by respondents.

The situation with longer programs is entirely different. They are commercial in 85% of cases.

43.3% of the courses taken by respondents cost them $750 or more.

Course Evaluations

Most respondents—50%—indicated that the courses they took only partially met their expectations.

Only 35% were fully satisfied with their course experience.

8% were entirely dissatisfied with the courses.

The level of satisfaction hardly depends on the price. The aforementioned percentages vary slightly across each payment segment, but overall the situation is consistent: most are only partially satisfied, the next largest group is content, and a minority is unhappy.

“This situation can hardly be called healthy. On one hand, we see that the number of specialists who had a completely negative experience is relatively small. But, on the other, the fact that in half of the cases students have many questions about the courses negatively impacts the educational sector. It might deter them from working with other educational brands and continuing interaction with courses in general,” Stryevski fears.

Company Support in Education

Only 48% of respondents working in companies noted that their studios reimburse educational expenses. Thus, the majority of game specialists have to pay for professional development programs themselves.

Of those whose companies provide such reimbursement programs, 47% used this benefit.

“Nearly half of the specialists whose companies were willing to pay for their education took advantage of this opportunity. It’s a great indicator of the desire for professional skill development among game specialists. The problem is that not every industry worker has this opportunity. Not many companies pay for upgrading their staff’s qualifications,” concludes Stryevski.

Marina Lopatina, Business Development Director of the recruitment agency WN Talents, agrees:

“Our clients often complain that they have nowhere to find new Senior-level specialists and above. This is a current issue for everyone. However, those companies with a well-built competency enhancement institute, which includes paying for external courses, suffer from this less. In extreme cases, they can always take a Middle-level specialist and help them grow.”

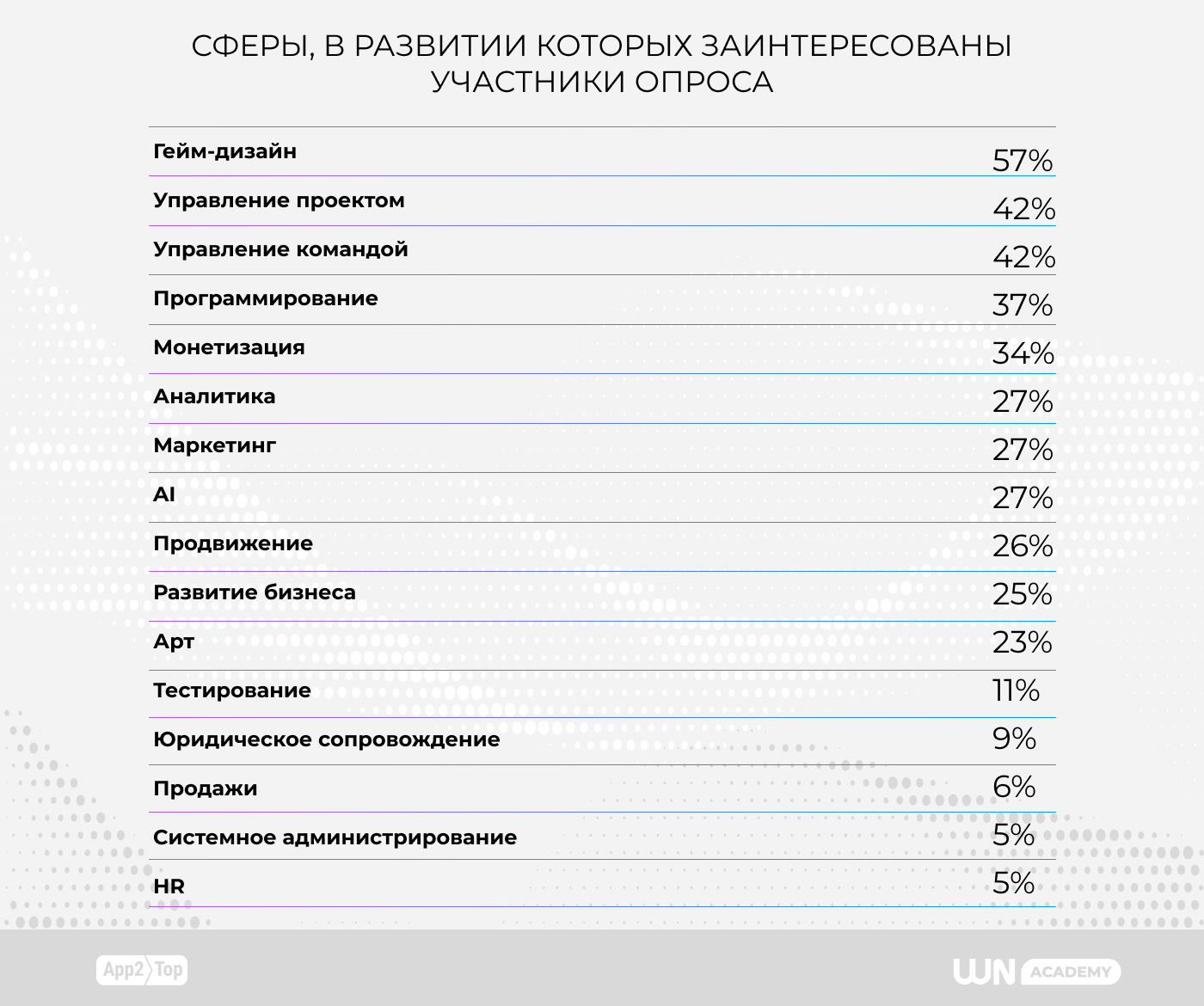

Where Game Specialists Want to Develop

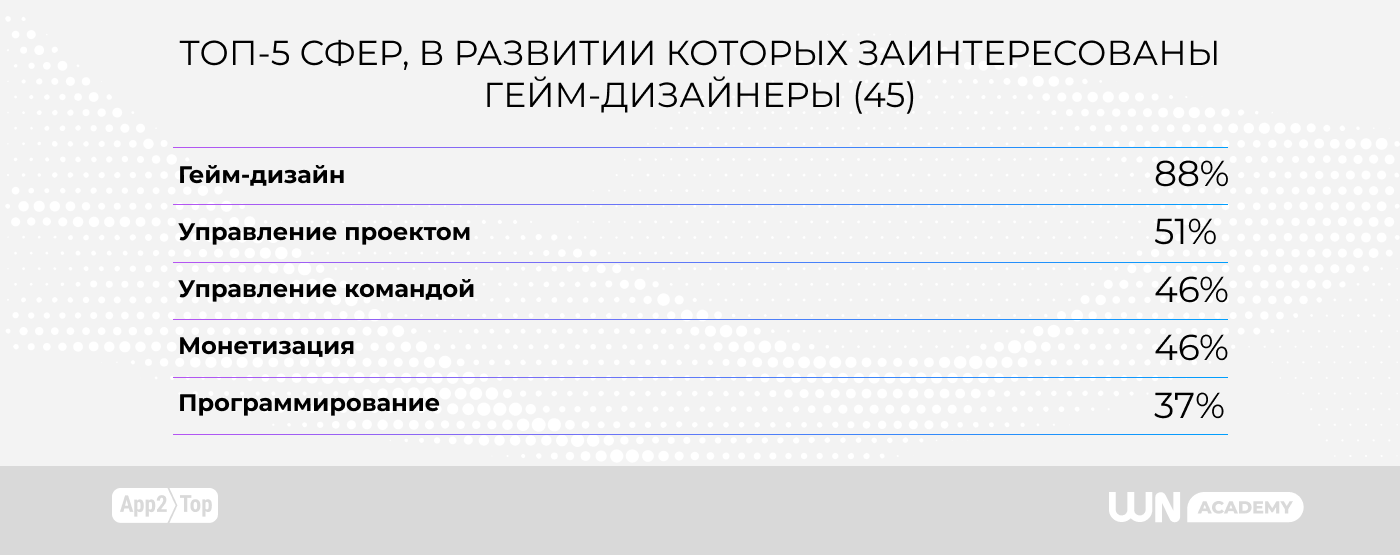

The most desired field is game design, due to the prevalence of game designers among the respondents.

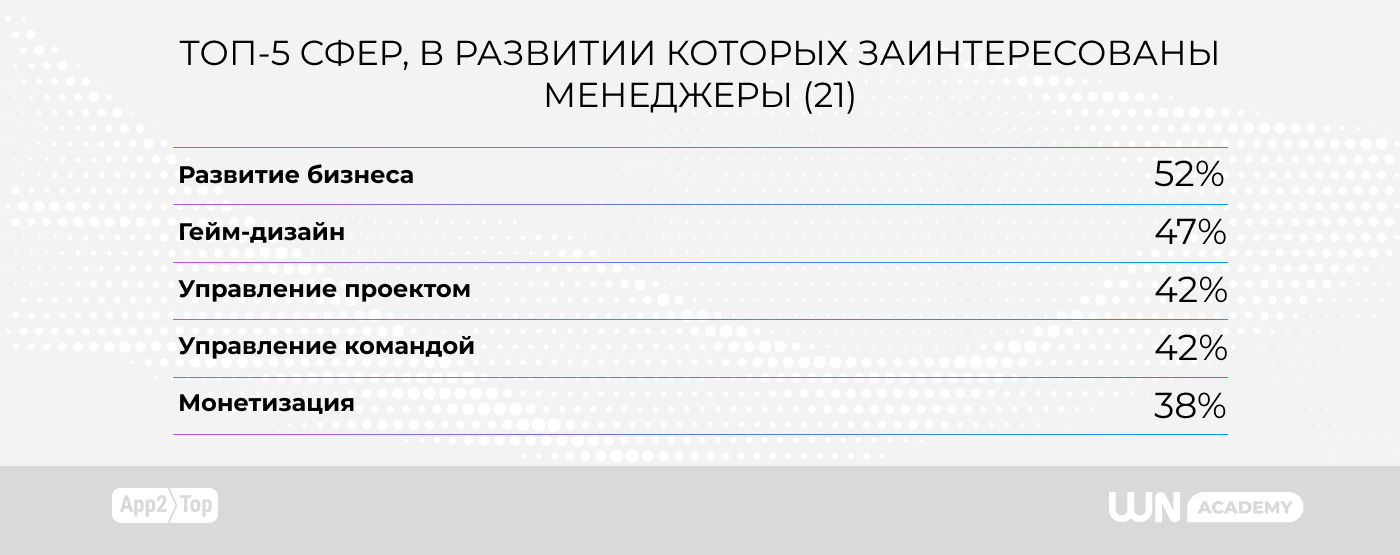

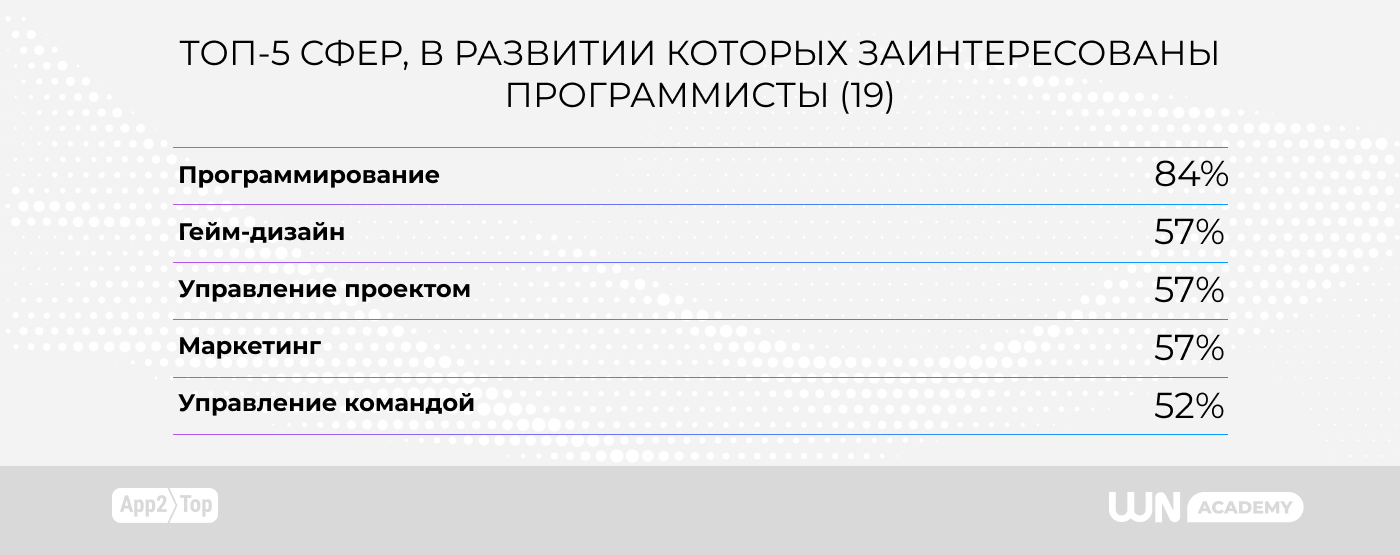

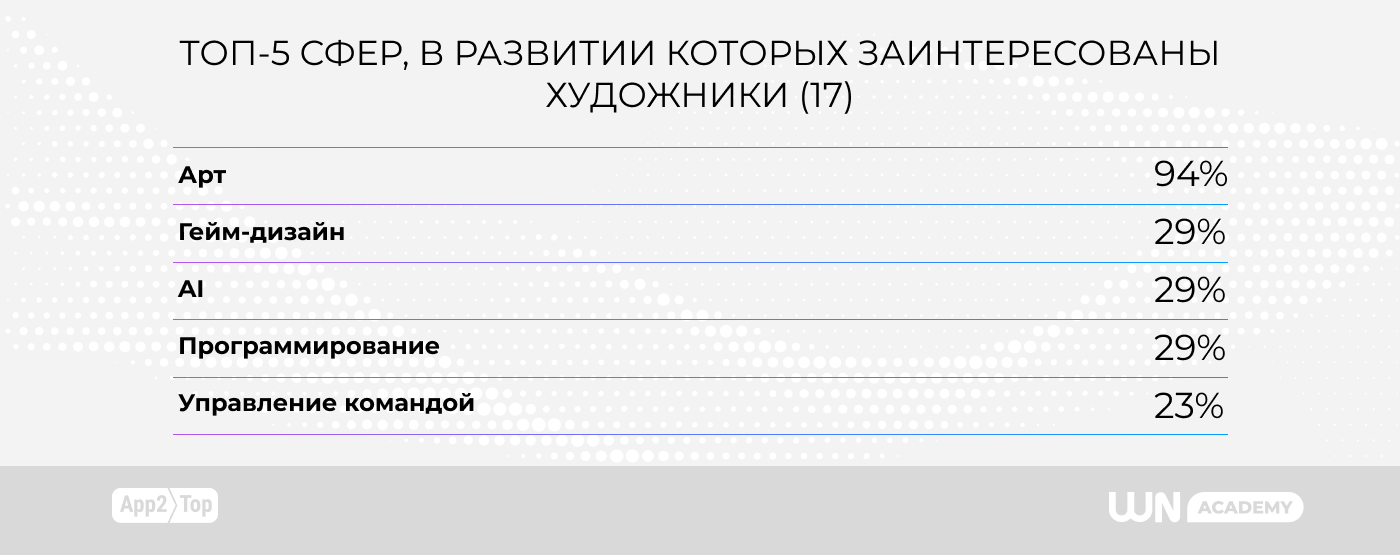

Therefore, for accuracy, besides the table presented above, here are the main requests relevant for:

- game designers;

- managers;

- programmers;

- artists.

Conclusions for this section:

- specialists in respective fields prioritize their main areas;

- regardless of their field, specialists are very often interested in expanding their knowledge about game design;

- the top 5 in-demand areas across all mentioned fields include team management.

Attitude Towards Knowledge

100% of respondents noted that they consider it important to develop professional knowledge.

However, a quarter of those surveyed stated that they have no desire to acquire or develop professional knowledge in the game industry.

“It’s normal for a small portion of specialists to be satisfied with the status quo and their level of expertise. But in the IT industry, which undoubtedly includes game development, we rarely hear this. This is due to the fact that working on a product involves the constant need to master new tools, and because we, as an agency, specialize in recruiting experts for high-level positions. These people are constantly learning, they are aware of new technologies and trends, and they already successfully apply these in practice. Other people are not of interest to our employers,” explains Lopatina.

Overall Conclusions of the Study

The majority of industry participants strive to gain new knowledge within the industry. However, the predominant number of specialists limit themselves to self-directed work—searching for answers online in various forms. Only about a third of surveyed respondents regularly "boost" their knowledge through live interaction, including courses.

This does not mean the respondents lack such experience. Most specialists have acquired knowledge in some form. However, for those who, for instance, attended courses, half were only partially satisfied, while a tenth were disappointed. This situation may be one of the factors reducing the demand for specialized education.

An aspect worth particular attention is the response to the question "In what situation did you last face a lack of professional knowledge?" The answer "When transitioning to a higher position" is one of the least popular (this also applies to managers, for whom it is also among the less popular). Meanwhile, the answer "Expanding the range of tasks" is among the top three most popular. This could indicate either a formalization of job roles or that new positions are granted after a specialist has already adapted to the responsibilities they entail.

Data Collection Methodology

The survey was conducted in March-April 2024. Respondents answered questions independently via a Google form. The link to the form was distributed through App2Top's tools (publications, banners, social networks, newsletters).

A total of 135 questionnaires were collected.