Sensor Tower shared a report on the state of the mobile games market at the beginning of 2024

Sensor Tower has published a study of the mobile games market. Among the key trends are falling downloads and cash registers.

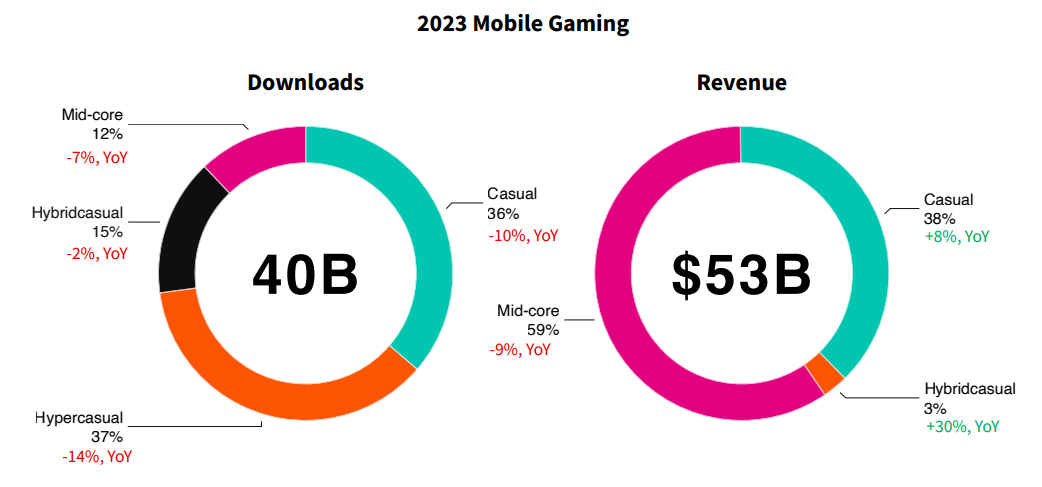

Last year, 40 billion game downloads were made on mobile, most of which were for hyper casual games — 37%.

As for revenue, mobile games earned $53 billion in 2023. The bulk of the money was earned by midcore titles — 59%.

Downloads and revenue of mobile games in 2023

Note that this is much less than Newzoo's estimate, according to which mobile game revenue last year amounted to $ 90.5 billion.

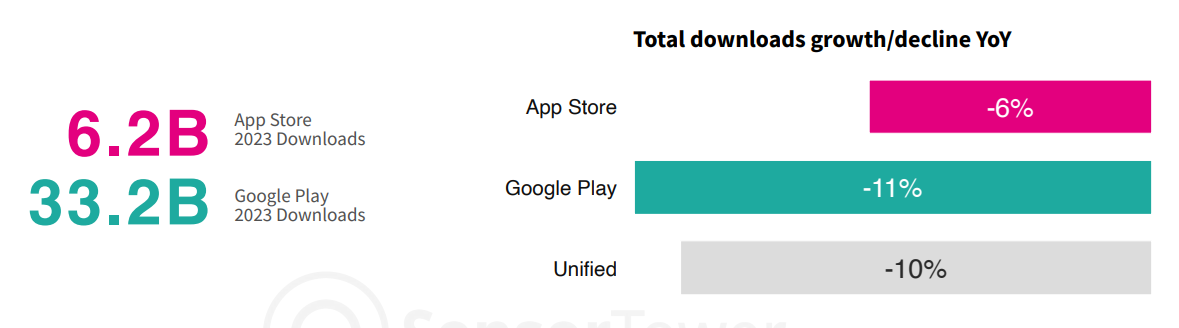

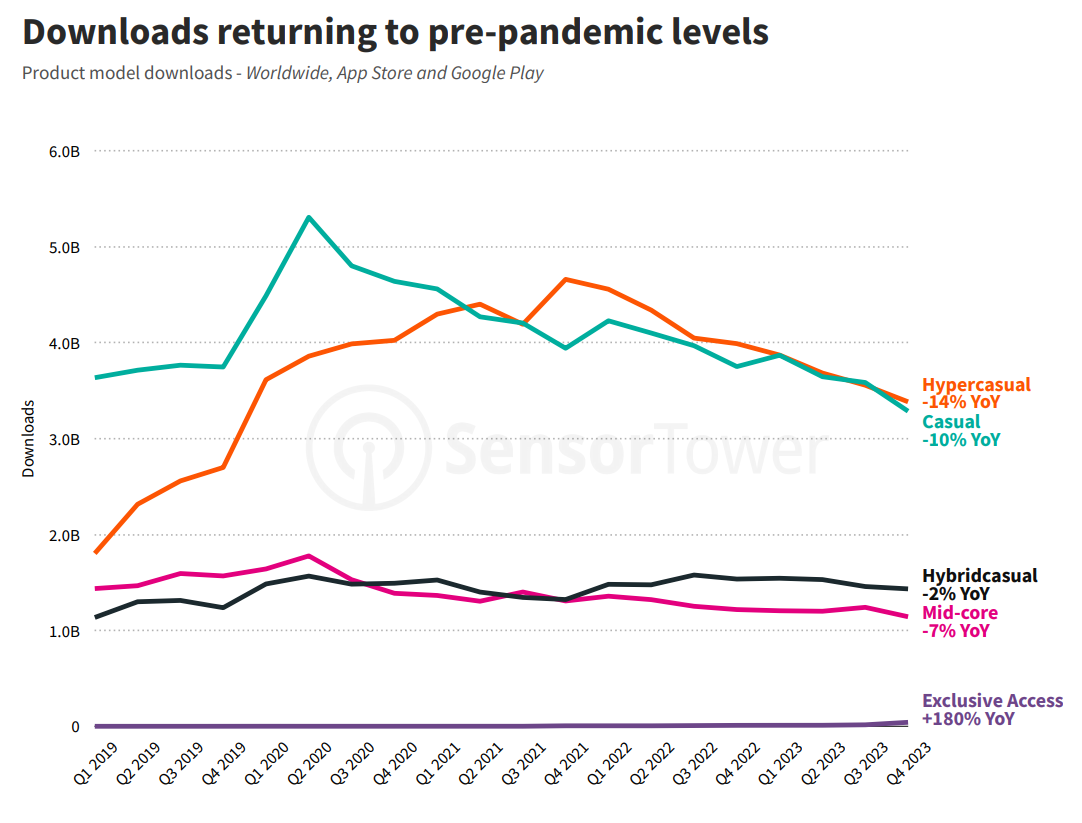

The number of game downloads fell by 10% last year relative to the year before last.

The behavior of mobile game downloads in 2023 relative to 2022

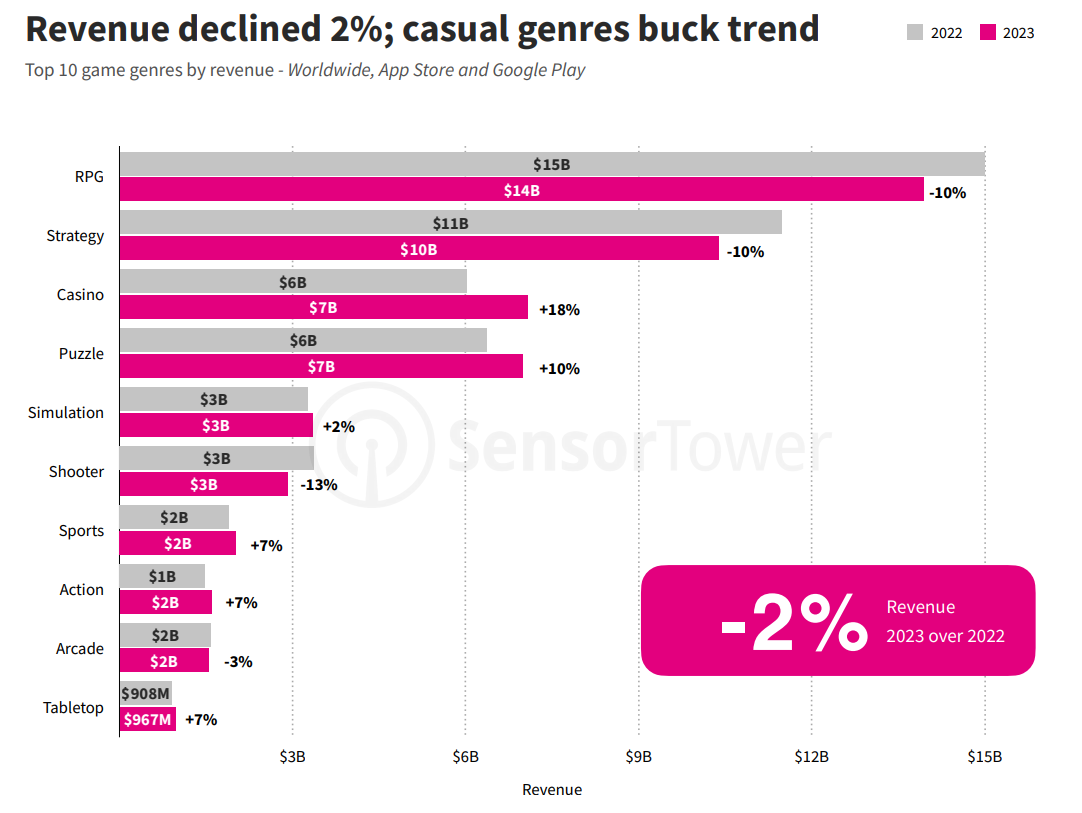

Mobile game revenue also fell. However, not so significantly — by 2%.

The behavior of the mobile game sales register in 2023 relative to 2022

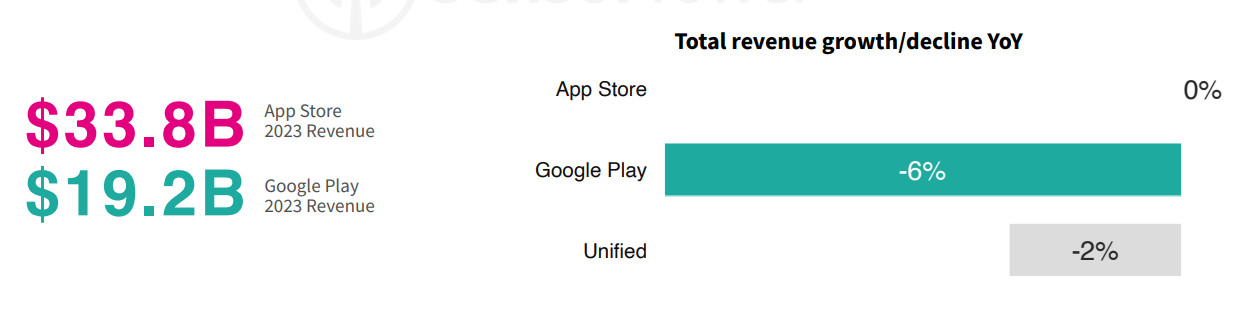

The drop in the number of downloads in Sensor Tower in 2023 is associated with an increase in the cost of traffic. The company's specialists also showed that the degree of decline depended on the game genre. Some suffered more (arcades and action games), some - less (board games and strategies).

The behavior of mobile game downloads in 2023 relative to 2022 by genre

Of the genres that have shown excellent dynamics in downloads, Idle RPG is mentioned in the report. The annual increase in downloads of such games amounted to 60% in annual terms.

If we return to more general figures, the drop in downloads had the strongest effect on hyper-casual games. The number of downloads decreased by 14%. At the same time, hybrid-casual titles lost only 2%.

Dynamics of mobile game downloads by niche (2019 — 2023)

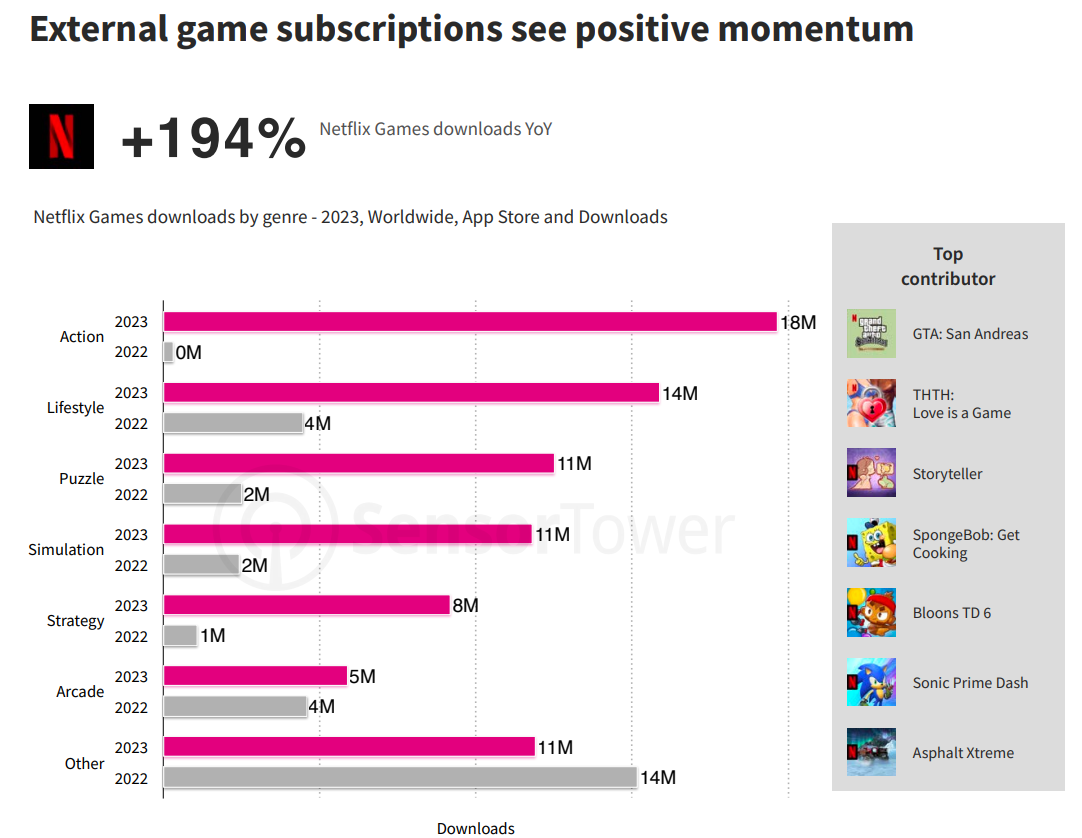

Games that can only be downloaded by subscription (for example, on Netflix) turned out to be the only niche that showed significant growth — by as much as 180%. The growth driver was games from the Netflix library, whose total downloads jumped by 194%.

The behavior of downloads of mobile games distributed by Netflix in 2023 relative to 2022

The most popular subscription was GTA: San Andreas. It was downloaded 18 million times in a year. In second place is the Netflix exclusive THTH: Love is a Game, and in third place is Storyteller from Annapurna.

Despite the significant growth of the segment, its future remains in doubt. The fact is that the promotion of titles within this model is often unprofitable.

Now let's talk about the annual revenue of mobile gaming. The situation here is less straightforward than with downloads. There is nothing common in almost all genres of falling. On the contrary, many genres have shown growth. However, they could not compensate for the drop in earnings of role-playing games (by 10%) and strategies (also by 10%).

The behavior of the mobile game sales register in 2023 relative to 2022 by genre

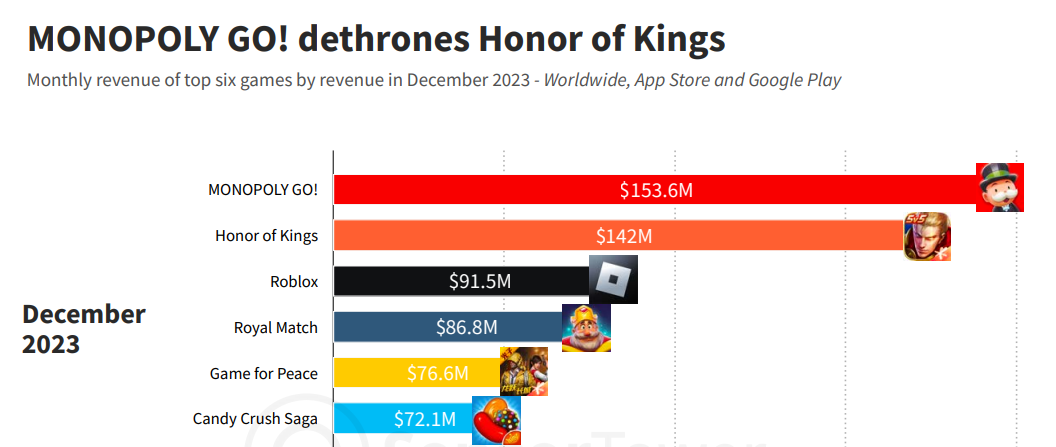

Against this background, the growth of income from social casinos stands out. Thanks to the success of MONOPOLY GO! The genre's annual revenue grew by 18%.

The situation with MONOPOLY GO! in general, it is amazing for the market. In December 2023, the game surpassed Honor of Kings in monthly revenue, earning $ 153.6 million.

Revenue of the top mobile games in December 2023

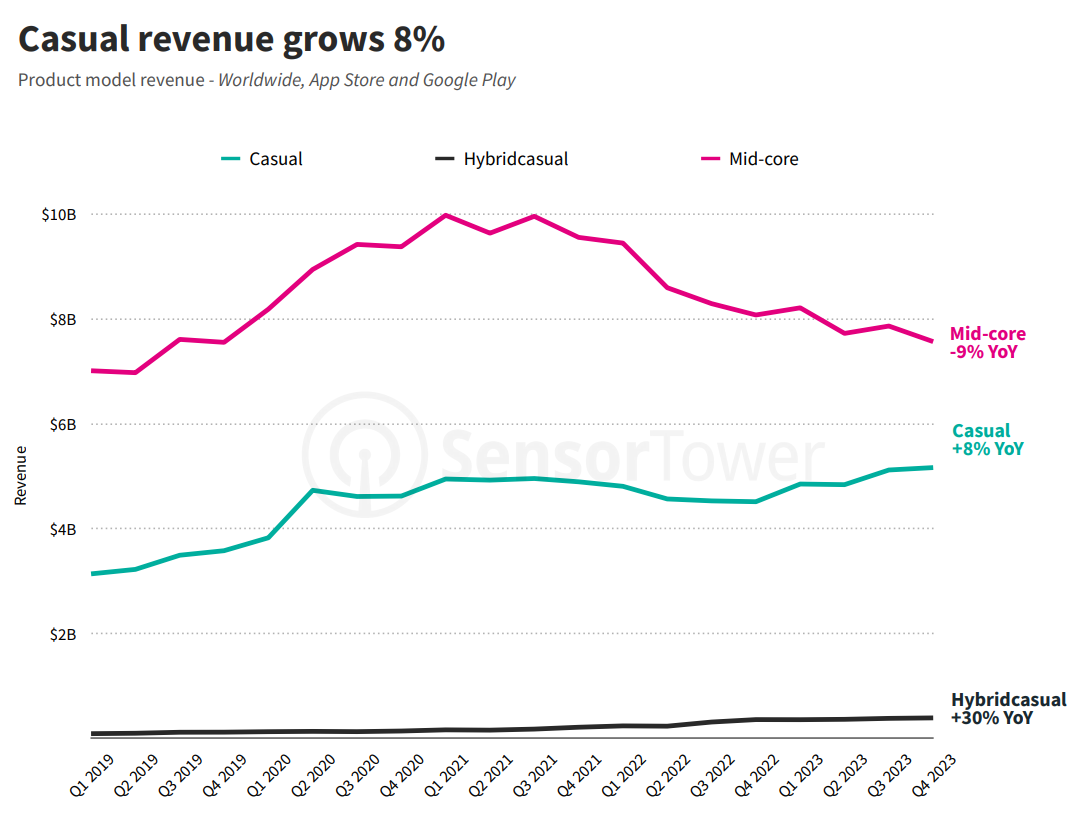

When considering revenue by niche, it can be seen that 2023 turned out to be unsuccessful in terms of dynamics specifically for the midcore sector. At the same time, both casual games and hybrid casual projects have shown steady growth.

Dynamics of the mobile games box office by niche (2019 — 2023)

Analysts attribute this to the ongoing changes in the advertising market. Midcore players spend more time and spend more money than casual ones. However, today it has become more difficult to attract them. Because of this, there has been a shift towards attracting a casual audience and, as a result, to the growth of one segment while the other is falling.

Immediately, Sensor Tower provides figures indicating the cost to mobile companies of increasing or at least keeping revenue at the same level.

In April 2023, Gardenscapes downloads were 270% higher than in April 2022, but revenue did not grow so significantly — by 64%. The situation was similar with World of Tanks Blitz. Its downloads peaked in December 2023, being 75% more than those in December 2022. That's just revenue for the same period increased by only 6%.

Comparison of download growth and revenue growth at Gardenscapes and World of Tanks Blitz

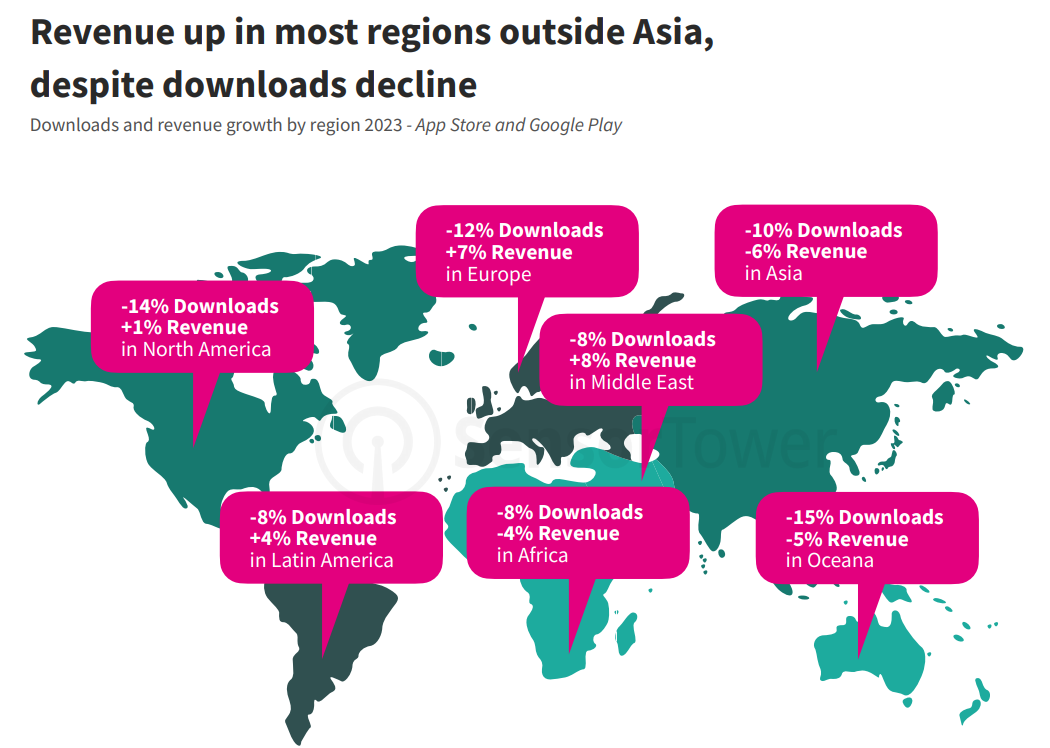

If we consider the situation separately by region, it will be even more difficult. On the one hand, there is a drop in downloads everywhere. But the nature of revenue behavior is different.

Mobile game download and checkout behavior in 2023 by region

The sales drivers vary greatly depending on the region. For example, in the Middle East, revenue increased due to midcore strategies, and in Latin America — due to midcore shooters.

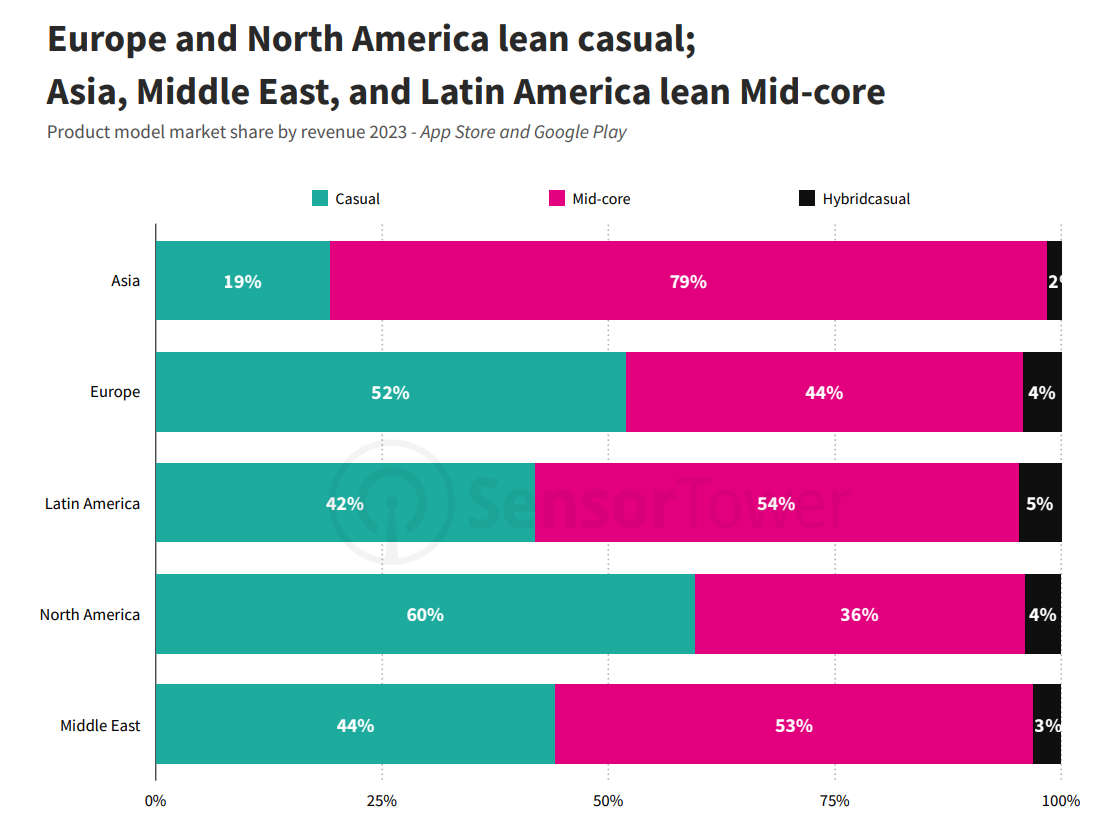

Accordingly, the distribution of revenue between niches depends on the region. In Europe and North America, casual games earn more money, and in Asia, less than a quarter of all revenue is earned for similar titles.

Distribution of revenue by niche depending on the region in 2023

Therefore, it is not surprising that the regional tops of the highest-grossing games of last year differ significantly from each other.

Mobile game sales charts by region

What else is interesting about the study?

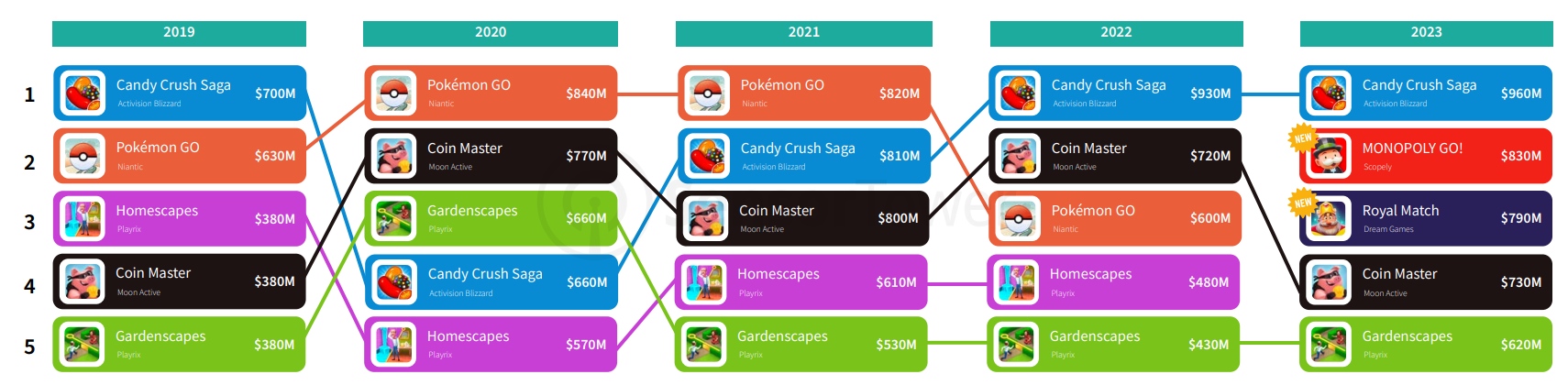

- The year 2023 can be called a turning point for the casual niche. For the first time in five years, the top 5 grossing casual games have changed significantly. MONOPOLY GO! and Royal Match, which had not previously been included in it, was kicked out of the Pokémon GO and Homescapes charts.

How the global box office top 5 casual games have changed (2019 - 2023)

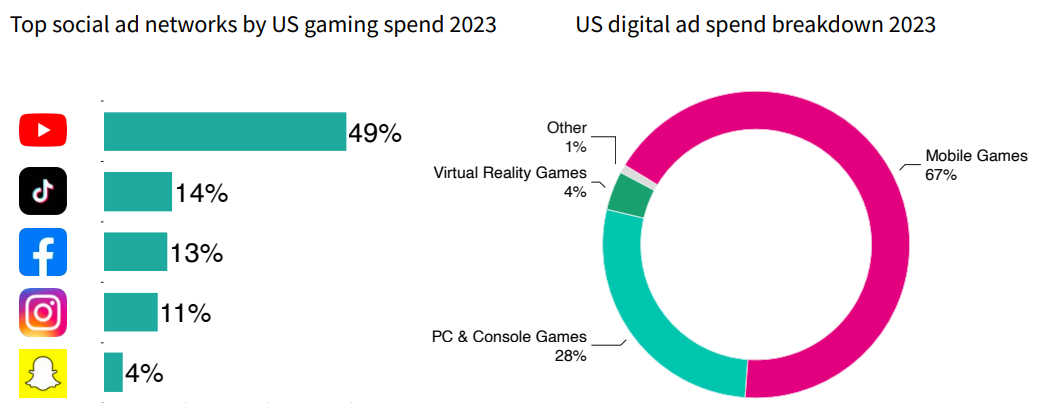

- In the United States, mobile games account for 67% of the advertising budget allocated to video game promotion. YouTube accounts for 49% of the video game advertising budget in general.

Distribution of recreational spending on video games in the United States in 2023

Also, from the interesting things in the study, we will highlight a fragment about what top gaming products are betting on when promoting today. Actually, on:

- collaboration with high-profile brands and franchises (for example, Roblox managed to collaborate with Lamborghini, Nike, Gucci, Walmart, NFL, Adidas, H&M and a dozen other names in 2023);

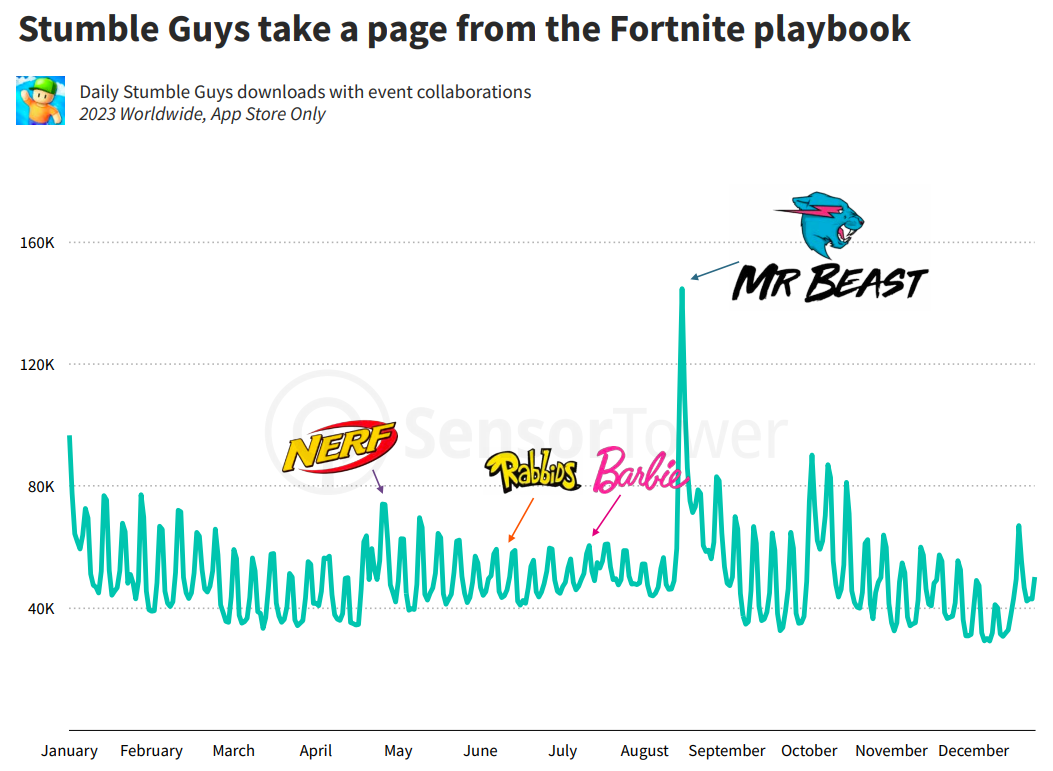

- working with top influencers (for example, Stumble Guys had numerous promotions throughout the year, including with Barbie, but cooperation with Mr. Beast turned out to be the most effective, thanks to the download of the game jumped by 600%);

The dynamics of Stumble Guys downloads in 2023

- the use of UGC content in creatives (this practice is most often resorted to by Royal Match);

- re-engaging the audience (some of the most popular viewing banners from Gardenscapes and World of Tanks Blitz in 2023 were just part of the reengagement campaigns).

We recommend that you personally familiarize yourself with the study. This time it turned out to be really programmatic. You can download it from the link under the material.