AppMagic on mobile games in 2021: The most notable trends and releases

The most ambitious gaming companies focus on the biggest genres — in terms of their audience and their cumulative revenue. Here is where the money lies, at least for those who dare play big. AppMagic founder Max Samorukov shared handy conclusions based on the most important changes that happened in the Western mobile games market in 2021.

Max Samorukov, AppMagic CEO & founder

Terms

Tier-1 West region: a set of countries that includes the US, Canada, Australia, the UK, Germany, and France. It’s often employed when one wants to address a group of countries that can be considered homogenous in terms of solvency of the audience and their preferences.

Western releases: for the needs of this research, we only consider games targeting the global market. We view an app as “aiming global” when more than 30% of its revenue and downloads are generated in any region or regions other than China, Japan, Korea, Taiwan, Hong Kong, and India. The reason is, there are a lot of apps that are only oriented on domestic markets of the listed countries, and we want to filter them out, since current research is focused on the Western markets. We’ll only analyze games manually classified by genre by our specialists. They classify all the apps that either a) ever have a sum of their daily USD revenue and downloads exceeding 5,000; or b) are published by any one of the top 3,000 publishers.

Methodology

We leverage AppMagic’s prominent genre classification with over 150,000 top-performing mobile apps classified. In this article, we cover the Tier-1 West region. All the numbers you’ll find in this piece are calculated for these 6 countries cumulatively.

In the graphs below, the areas indicating cumulative revenue and downloads of different genres are sorted by the performance of each genre in December 2021 to highlight the latest situation. Therefore, a fast-growing genre may take a higher position compared to a genre that has better average performance throughout the whole 2021.

Every time we speak about revenue in this article, we imply in-app (IAP) net revenue, i.e. the revenue coming from in-app purchases (including subscriptions and paid apps) reduced by platform fees and inclusive taxes. In-app ads (IAA) revenue is not considered.

Revenue-based analysis

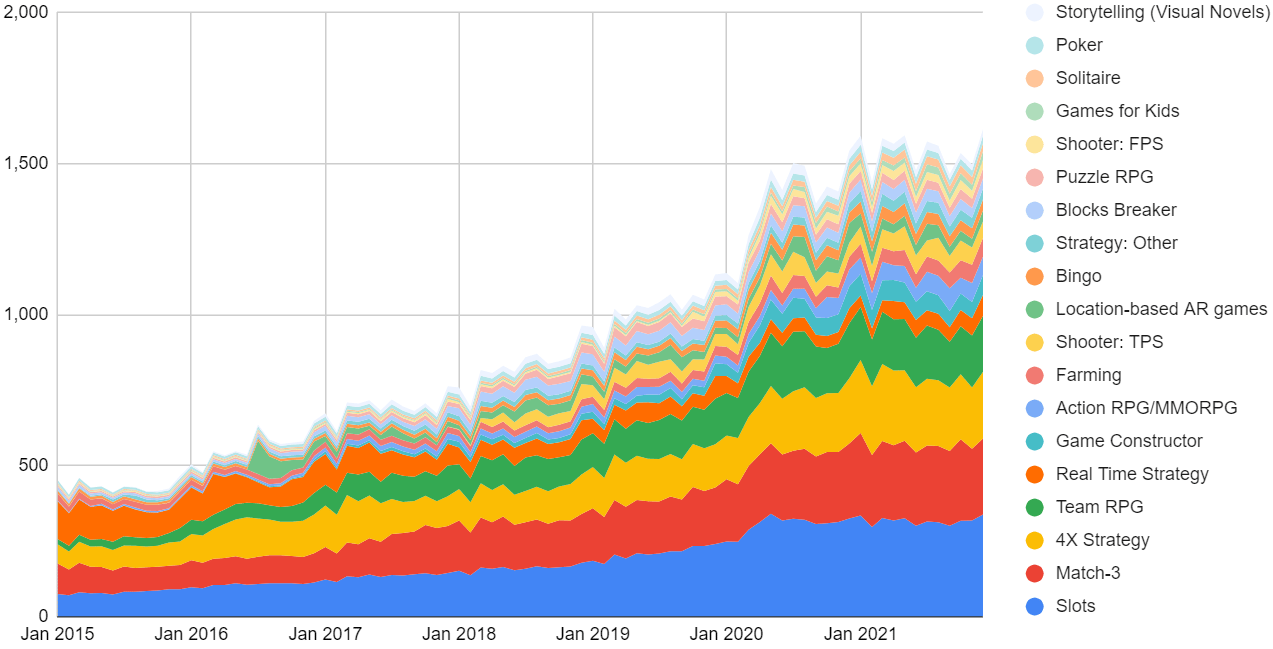

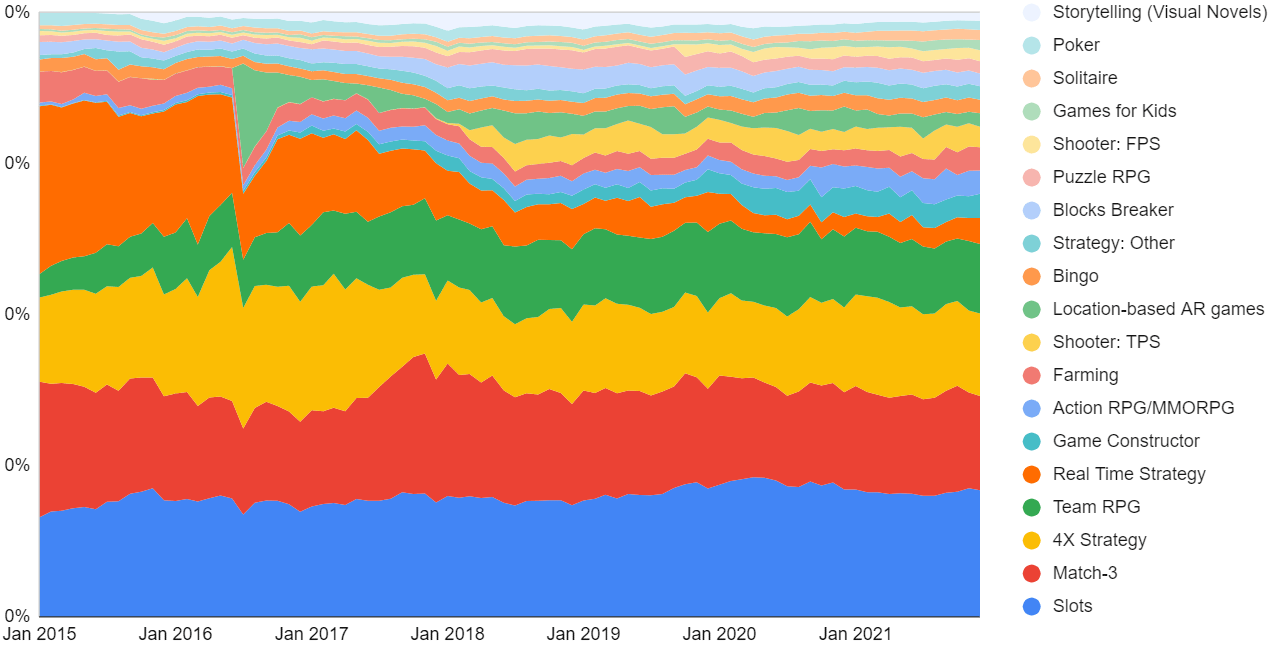

In the graphs below, you see how cumulative revenues of the top 20 mobile game genres (according to their performance in Dec 2021) were changing in 2015-2021. Their positions change rarely, and when they do, it’s usually a big sign for many.

REVENUE: TOP 20 GENRES (millions USD)

REVENUE: TOP 20 GENRES (normalized to 100%)

#1: Slots

The genre has dominated the revenue rating of game genres for many years, and its position didn’t dip in 2021.

This year, we’ve discovered 63 new Western releases of this kind (see the beginning of the article for definitions). Some of them perform well, but none of them even made it to the top 20 Slots games.

Slots have been long considered a very specific and extremely hard-to-enter market segment.

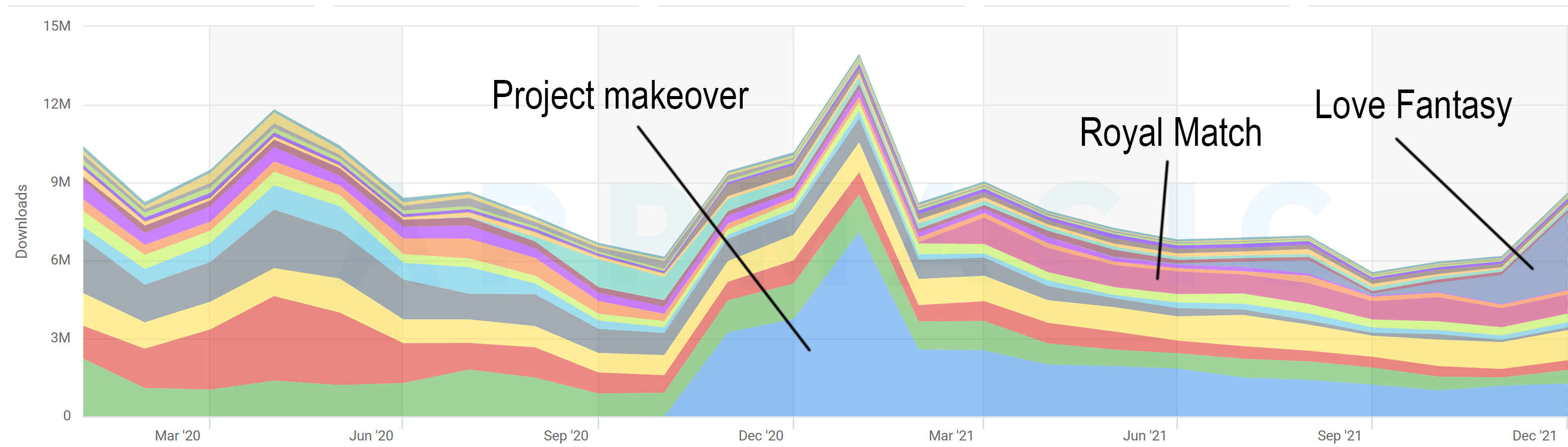

#2: Match-3

The situation on this market has also been stable with the only disruptor: Royal Match. The game was initially published in 2020, but it started operating in the Western market only in February 2021, so we consider it a new release. Now it’s accounting for about 9% of the Western market, coming in 3rd in the genre chart there, and it’s the best debut in Match-3 we’ve seen in many years.

We have counted 50 new Western releases in the genre in 2021. Many followed Project Makeover’s product paradigm, but no one has succeeded yet. We didn’t notice new games that employed Royal Match’s main ideas yet, but they are probably to come.

There was one noteworthy phenomenon though, but it’s not quite a Match-3 game: Zen Match – Relaxing Puzzle. We call this genre Match-3: Tile. It’s a mix of casual Mahjong with an element of a Match-3 game. Zen Match also leverages a metagame typical for classic Match-3 titles: room renovation. So what’s the catch? It’s the revenue: the app is currently generating more than $6M monthly. At the same time, the game looks much simpler in terms of production compared to top-notch Match-3 games.

You’ll see another interesting finding in the second part of this study that looks into downloads.

#3: 4x Strategy

It’s curious to learn that ALL new 4x Strategies that perform somewhat well in the Western market are made in Asia (mostly in China). Western developers rarely even try to accept this challenge.

We’ve detected 24 Western releases in 2021, and some of them were pretty strong. Here are a few absolute must-mentions: The Ants: Underground Kingdom, The Lord of the Rings: War, The Walking Dead: Survivors, and Warhammer 40,000: Lost Crusade.

The first one came up with a very innovative setting: the world of ants. The way it’s designed, you won’t even realize it’s a 4x Strategy in the first 30 minutes of gameplay. Probably, the charm and freshness of this game world is what helped it attract and engage users that could get somewhat bored of the FTUE (First Time User Experience) of conventional 4x Strategies. Currently the game generates $11M in net revenue monthly.

The Ants: Underground Kingdom. Click on the image to see the gameplay

Can’t help noticing that 3 of the top 4 new games mentioned employ major Western franchises. Publishers from Asia, who used to focus on their domestic markets, seem to be getting very serious about securing positions in the global market.

#4: Team RPG

The industry genre taxonomy isn’t quite specific here. Talking about Team RPG, we mean battlers where you engage into a series of brief encounters managing a party (team) of 3-6 characters. This includes such games as RAID: Shadow Legends or AFK Arena. This genre is the last of the big four in terms of their revenue, and this big four stands far apart from its followers. This genre is very rich in new Western releases: we’ve counted 142.

Despite its high newcomer count, this market is pretty stable, and the vast majority of revenue is being generated by titles that were published a long time ago.

One of the new titles stands out though. And a lot. It’s Cookie Run: Kingdom by a Korean developer Devsisters. In December 2021, it generated $21M in net revenue with 60% of it coming from Tier-1 West countries.

Cookie Run: Kingdom. Click on the image to see the gameplay

The game is unique in many ways: the setting, the art style, the kingdom-building component. But we can’t state with certainty that those are what made the game so successful; yet it definitely deserves further professional deconstruction. If you are into battler games and haven’t played it yet, you should give it a shot.

#5: Real-Time Strategy

The boundaries of this genre are also blurred on mobile platforms. We attribute it to games with brief separate battles with a top-down view where you have to design your own strategy to wisely manage multiple military units in real time. Take Clash Royale or Clash of Clans, for example.

For many years, 95% percent of the genre used to be defined by the games by Supercell; however, its market share out of the top 20 game genres in Tier-1 West has been steadily declining since 2016, shrinking by 11 times from its peak of 28% in Jan 2015 to 2.4% in Jan 2021; again, that’s mostly due to Supercell games’ revenue going down while the global market was growing fast.

However, this year has seen a tipping point: since Jan 2021, the cumulative revenue of the market segment has doubled from $35M to $70M in monthly net revenue! Curious as to why? Again, thanks to Supercell alone! Clash Royale grew 4 times in revenue, from $7M to $27M (still talking Western markets). Clash of Clans spiked in revenue up to $34M in Dec 2021 from $22M in monthly revenue in the beginning of the year.

Out of the 8 new Western releases in the genre in 2021, no one claims to be a new super hit.

#6: Game Constructor

Here we imply apps like Roblox. And, as usual, Roblox accounts for 99.9% of revenue in the market segment. Not much going on here, though we’ve detected 4 new Western releases of this kind: they all are super tiny compared to Roblox.

Curiously, despite this huge hype around metaverses, we don’t see strong new releases in this segment in Tier-1 West countries. Even if we have a look at games like Minecraft (that we classify as Build & Craft), we’ll see a lot of releases (70 in 2021 alone), but none of them growing big enough in the West to mention.

#7: Action RPG / MMORPG

For Action RPG (MMO or single-player), it’s just been the Genshin Impact that dominated the Western market: it generates about 50% of the cumulative revenue of the genre in Tier-1 West. It performed quite evenly throughout the year.

But who is behind the other 50%? The rest of the market is pretty diverse and, surprisingly, very dynamic.

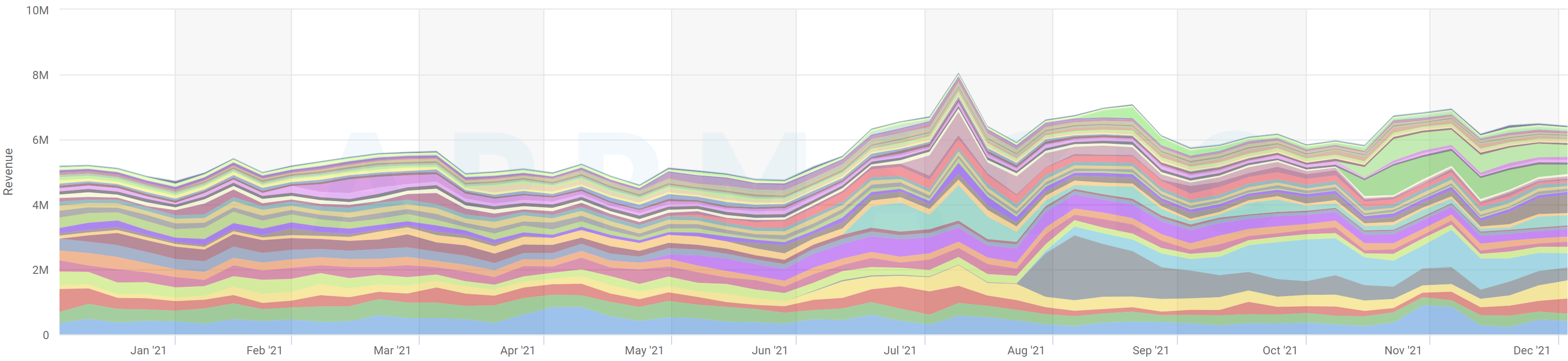

ACTION RPG/MMORPG, TIER-1-WEST, REVENUE

Click on the graph for more details

The graph tells us that new games pop up and disappear very quickly. It demonstrates a very short lifetime of a typical product of the genre. It doesn’t match well with the costs of developing an MMORPG, right? So it looks like none of the new games can find their audience in the region — despite the fact that this genre is one of the richest in terms of new Western releases: we have detected 110 for 2021.

That being said, developing an Action RPG / MMORPG looks like a very dangerous idea.

#8: Farms

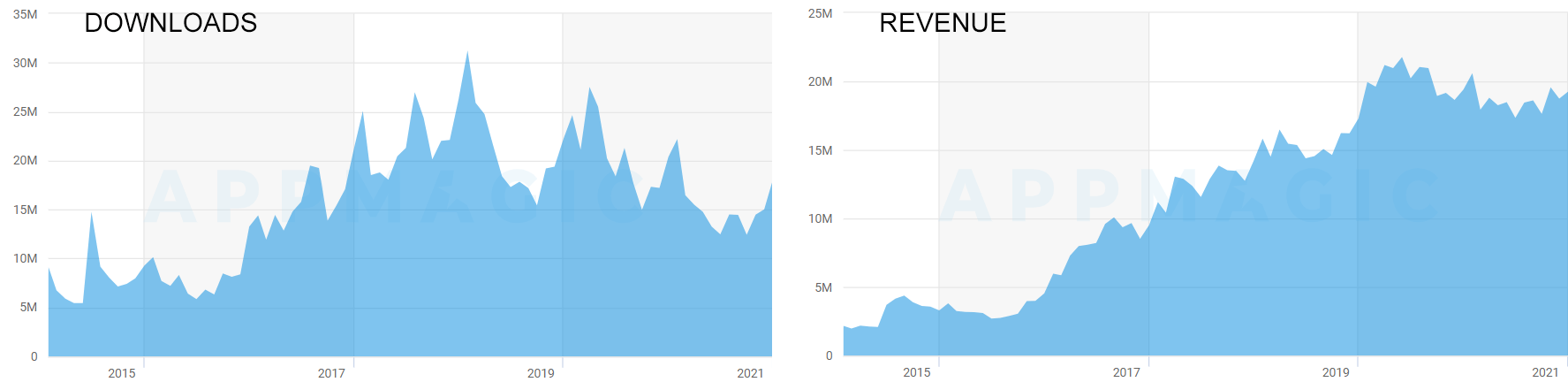

This block is probably the most interesting part of our research. Farms really stand out from the genres we’ve already mentioned.

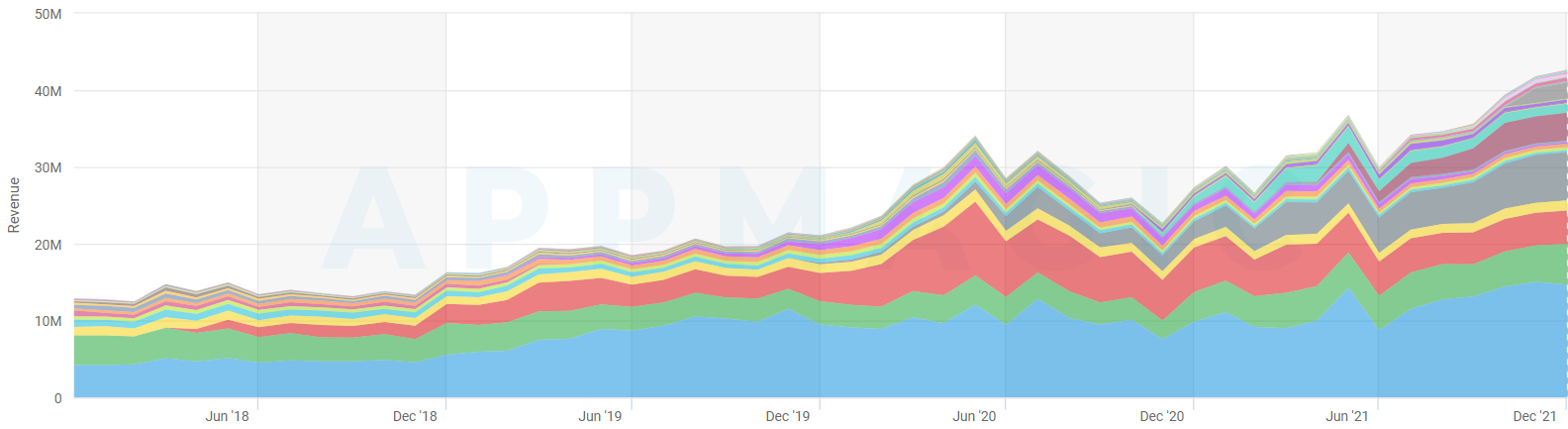

FARMS, USA, REVENUE

Click on the graph for more details

Firstly, the market has been steadily growing over the last several years. Secondly, major contributors to this growth are new titles. These are strong titles that are here to stay: they keep on growing for months in revenue and maintain a high pace of acquiring new users. We are talking about a genre that is traditionally monopolized, where market leaders emerge and change each other extremely rarely. At least, it used to be so for many years (have a look at the graph above).

One of the heavy contributors to the growth of the farming games market is Family Island by a Belarusian studio Melsoft Games Ltd. It’s a conventional farm game with an exploration mechanic and a solid storyline, somewhat similar to the hit farm game that set this standard, the Klondike Adventures by another Belorusian studio Vizor Games.

Klondike Adventures

Another major contributor is Family Farm Adventure by China’s Century Games Publishing. It can also be called a follower of the Klondike Adventures’ paradigm. It’s a debutant in the top charts; it was released this very year in February and has already managed to grab 8% of the farm games market in Tier-1 West in terms of revenue in Dec 2021. The cumulative revenue of farm games in the region was $62M monthly by the end of the year.

The last noteworthy fact about Farms is that the number of new Western releases is small: just 9 new Farms this year. This number also used to be small in previous years. So it looks like there’s much less competition compared to other top grossing genres. That’s something to think about.

#9: Shooters

The Shooters market segment was stable in 2021: it didn’t move up or down significantly during the year, and no new hits have appeared. Even the new game by Krafton, PUBG: NEW STATE, didn’t show the performance we could have expected from the company.

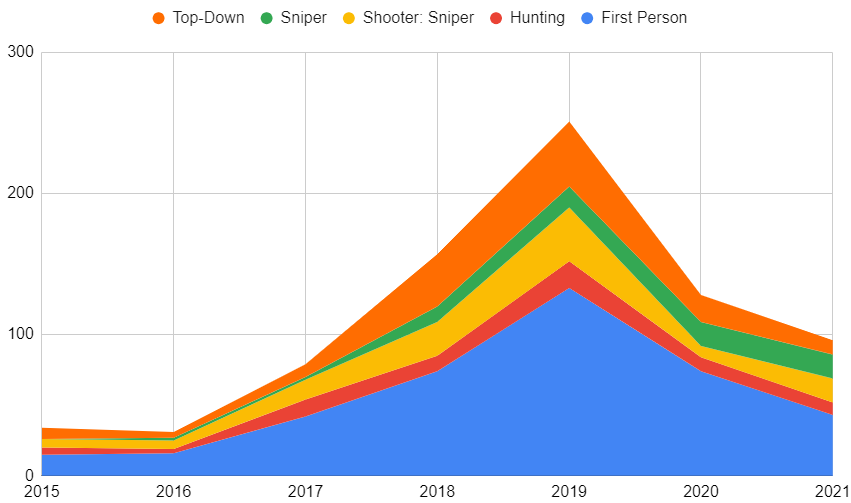

Despite the fact we still see a lot of new Shooters coming out every year, the pace is declining.

NEW WESTERN MARKET-ORIENTED SHOOTER RELEASES

#10: Location-based AR games

It’s the last of the top 10 revenue-generating genres in the Tier-1 West region. Again, in 2021, 95% of the overall revenue was generated by Pokémon GO alone. The game is still performing amazingly, having generated $320M in net revenue in 2021, which is just 9% down compared to 2020.

There was one interesting release in the genre in 2021 — by Niantic themselves: in October, they published Pikmin Bloom, but it’s currently popular only in Japan, and the game’s revenue and downloads have been declining from the very start. Now it has less than $1M monthly inflows.

Downloads-based analysis

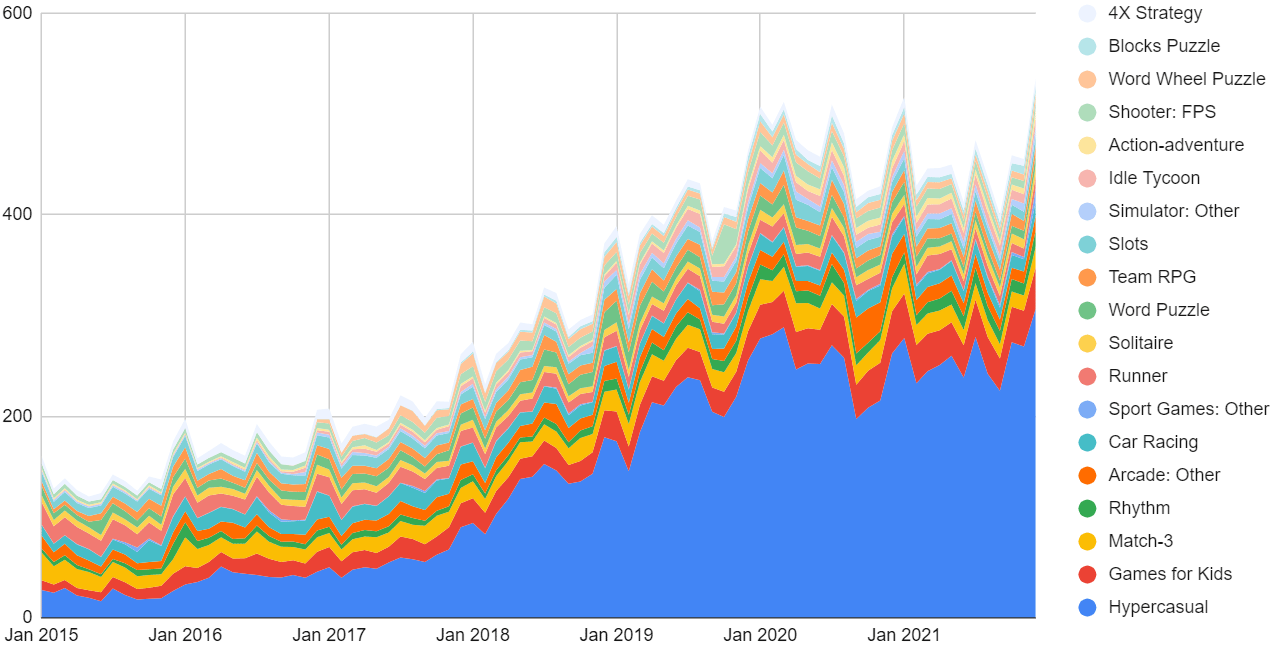

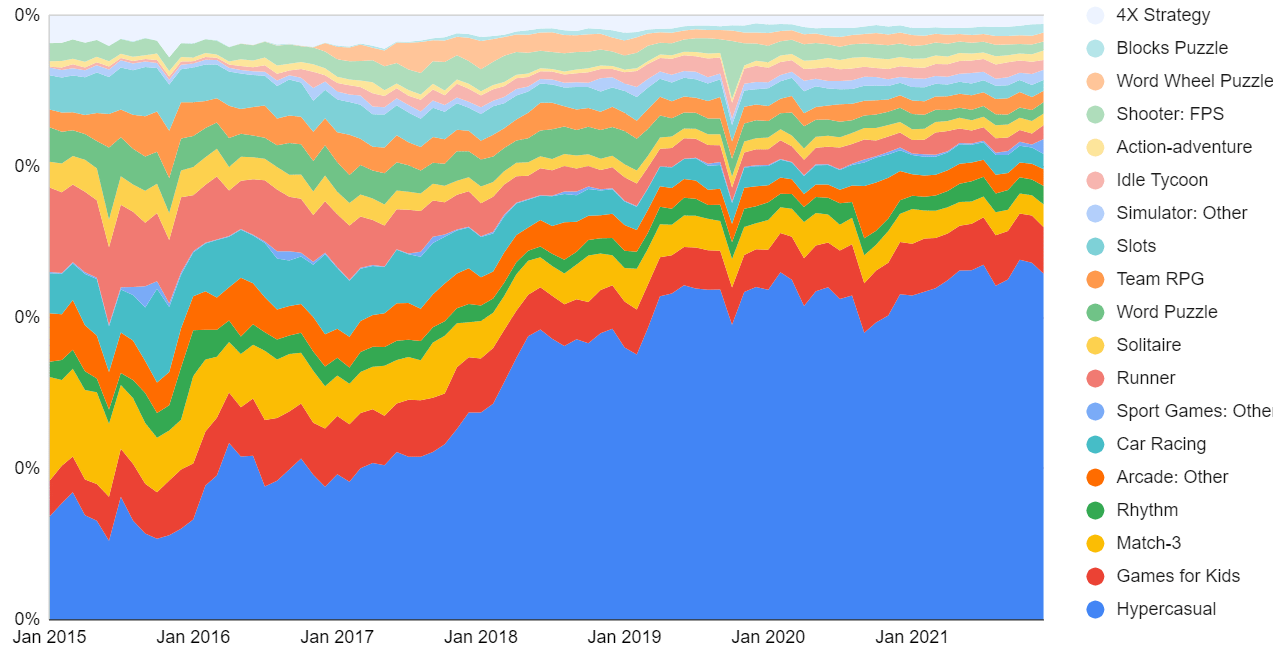

This part of the study is similar to the previous one, but we will now focus on the top 20 genres of mobile games in terms of the cumulative downloads of titles representing them.

DOWNLOADS: TOP 20 GENRES (millions)

DOWNLOADS: TOP 20 GENRES (normalized to 100%)

#1: Hypercasual

The genre is huuuge in terms of downloads compared to other genres. It’s not growing that fast as it used to in the Tier-1 West region. However, in many other regions it’s still gaining momentum.

It’s hard to do a brief overview of the genre: it’s very dynamic, and the number of new games here is tremendous: we have detected 2,700 new Western releases in 2021, and that is 3 times more than in 2020. We’d like to recall the definition of Western releases given in the beginning of the article: we only count apps that managed to hit a certain level of performance and are oriented on the global market.

If you are interested in getting an overview of the Hypercasual games market, please check the specialized quarterly reports in our blog.

#2: Games for Kids

Games for Kids is a pretty broad definition that includes multiple subgenres. But none of them is currently dominating the others; the market for the games of this kind is very versatile; and the number of apps that perform pretty well is very large here. The number of new Western releases is also very large: 302 in 2021.

Despite the large number of new games that came out, there were not a lot of them that managed to grow big and maintain their positions. We’d only like to highlight two: PAW Patrol Rescue World and YOYO Doll: Dress up games.

On the whole, the genre was doing quite stable in 2021 in the Tier-1 West region, averaging about 40M monthly. For comparison, the worldwide numbers are 10-fold.

#3: Match-3

We’ve already covered Match-3 in the revenue section. But if we focus on downloads, we’ll notice one interesting newcomer: Love Fantasy: Match & Stories. The game was originally released in Mar 2021, but only started scaling in Nov, and by the end of the year became #1 in the genre in Tier-1 West, leaving behind King, Playrix, Magic Tavern, and others!

What’s even more astonishing is that the game leverages the IAA (in-app ads) monetization and doesn’t really count on IAP (in-app purchases). That’s very interesting: how come a game that relies on IAA can snatch traffic away from the Match-3 market leaders with their insane LTVs of $15-$20, all the way staying ROI-positive? Btw, Love Fantasy employs the same old ad creative ideas that had been in use in the genre for a long time.

MONTHLY DOWNLOADS, MATCH-3, TIER-1 WEST

#4: Rhythm

The Rhythm games market segment was pretty balanced in 2021, demonstrating no explicit uptrends or downtrends. Though a couple of strong new titles did appear: Beatstar – Touch Your Music and FNF Beat Battle became #3 and #4 in terms of downloads in Dec 2021 in the Tier-1 West region. Beatstar became a new superleader in terms of revenue, too: by the end of the year, it was generating the same amount of revenue as all other titles of the genre in the region combined ($3M monthly).

#5: Arcade: Other

This ambiguous genre name is used for a swarm of Arcade games that can’t be attributed to any explicit subgenre of the whole Arcade games market. This group of games is very plentiful and diverse, with no visible leaders. None of the titles from the top 10 in terms of downloads really stand out. The latest big thing in this category was Among Us.

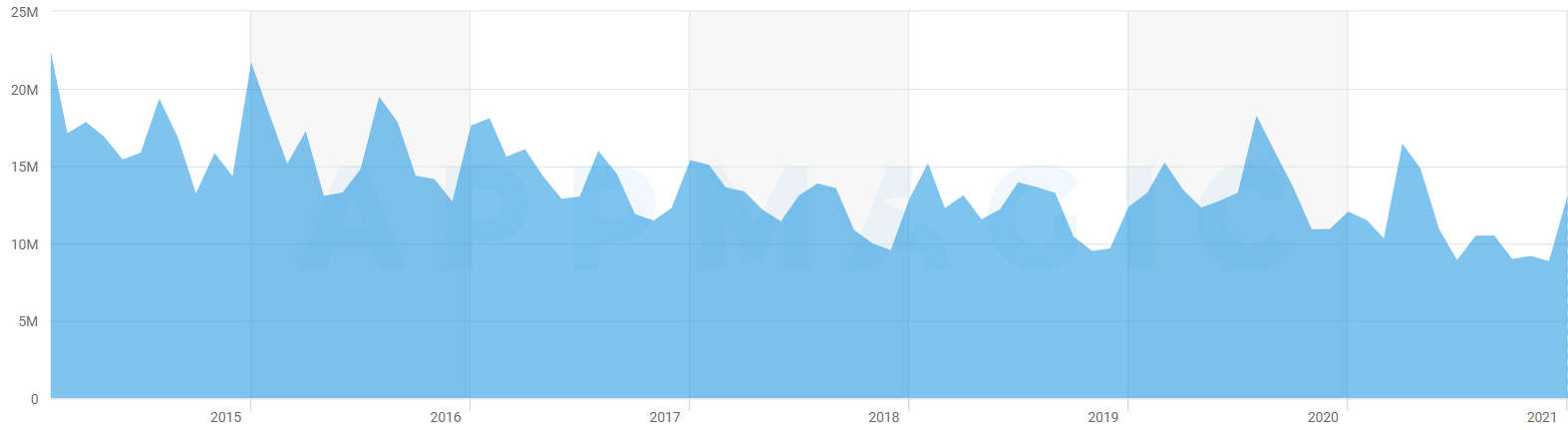

#6: Racing

This genre has been declining slightly for the last couple of years. Rare releases of super hits, such as Mario Kart Tour, give it a temporary boost from time to time, but the overall trend is still downward.

There was one notable newcomer in 2021 though: No Limit Drag Racing 2, whose name clearly indicates its subgenre and the fact that it’s a spin-off. The game managed to maintain a high level of both revenue and downloads for the rest of the year and took the second position in both charts in the Drag Racing subgenre.

The number of new Western releases in the Racing genre is pretty high: 130 in 2021. It used to be even higher though, having peaked with 367 games in 2019.

#7: Sports Games

The genre also did quite typically, with no special ups and downs, but take note of several very big phenomena.

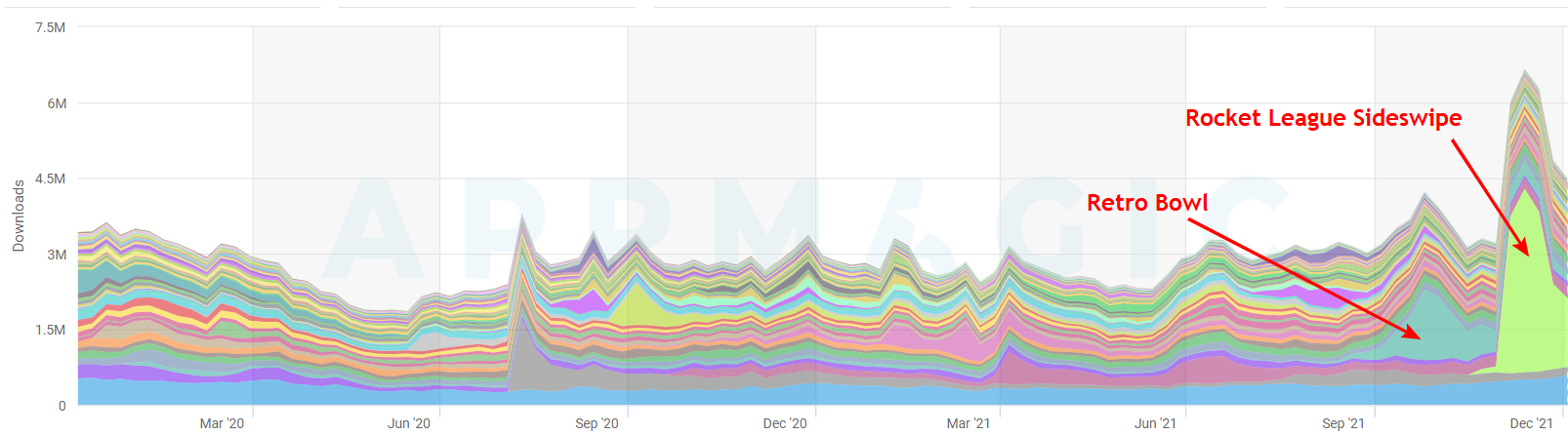

Firstly, Retro Bowl. The game was originally released in Jan 2020, but it didn’t get any visibility until Sep 2021 when it suddenly boomed: it started growing very fast, having generated 4M downloads in October alone in Tier-1 West (actually, 95% of downloads came from the US). These numbers don’t look outstanding for Hypercasual games and some other genres, but Sports Games hadn’t seen such numbers in the region for a long long time.

Its rate of new downloads then went down quite fast, but this case can still be called outstanding.

In late November, we saw another rocket of the same scale: a newly published Rocket League Sideswipe showed an even more phenomenal growth with 12M downloads in December 2021 alone in Tier-1 West (24M worldwide).

Rocket League Sideswipe. Click on the image to see the gameplay

The game doesn’t actually refer to any real sports game, but resembles soccer. Instead of human players, you control flying cars. Doing a good shot requires some skill and thinking. The game can be played 1 vs 1 or 2 vs 2. All these make it feel like an actual sports game.

The number of new downloads started declining right in December. Nevertheless, the introduction of Rocket League Sideswipe will remain a notable mark in history, together with Retro Bowl: just look at them in the Sports Games track record!

Click on the graph for more details

#8: Runners

It is surprising that such an unsophisticated genre as Runners is so conservative and static: most titles that are now big in Tier-1 West have been there for many years.

There are a lot of new games coming out every year (about 50), and some of them start brightly, but it’s a very rare event when a new title manages to force itself in between those that hold tight and don’t lose their positions. All of them are based on strong franchises.

In other words, Runners is one of those market segments that look easy to enter, but in fact only admit the chosen.

MONTHLY DOWNLOADS, RUNNERS, TIER-1 WEST

On the whole, Runners have been somewhat losing momentum for many years as of now.

#9: Solitaire

The Solitaire games market differs from Runners: with a similar number of new Western releases in the genre (46 in 2021), about one third of them manage to survive. They don’t grow really big: in 2021, the most successful launch in the genre — MONOPOLY Solitaire: Card Game — generated 900K downloads in the Tier-1 West countries and 1M worldwide. Nevertheless, one third of new releases managed to survive and maintain the pace of several hundred downloads a month for a long time. So this niche appears friendly and worth a closer look for smaller game developers.

#10: Word Puzzle

The genre looks friendly for smaller companies: many of the newcoming titles manage to hold their positions for months and years. Their absolute numbers aren’t high, though; at least for those who debuted in 2021.

The Word Puzzle genre on the whole looks to be downtrending after its peak in spring 2020.

MONTHLY METRICS, WORD PUZZLE, TIER-1 WEST

The number of new games coming out every year correlates with this downtrend: it fell from its maximum of 79 in 2019 to just 42 in 2021.

Studying genre trends is always fascinating, as it provides a good understanding of how user preferences evolve over time, as well as pointing out any revolutions. Hope you’ve enjoyed reading the report as much as we’ve enjoyed writing it. Stay tuned for more insights from the AppMagic team!