Newzoo: Average playtime on PC and console decreased by 26% since 2021, new games have to compete with older hits

Newzoo has released a detailed report on the state of the PC and console games market. Here are the key takeaways, including revenues, growth rates, playtime, and more.

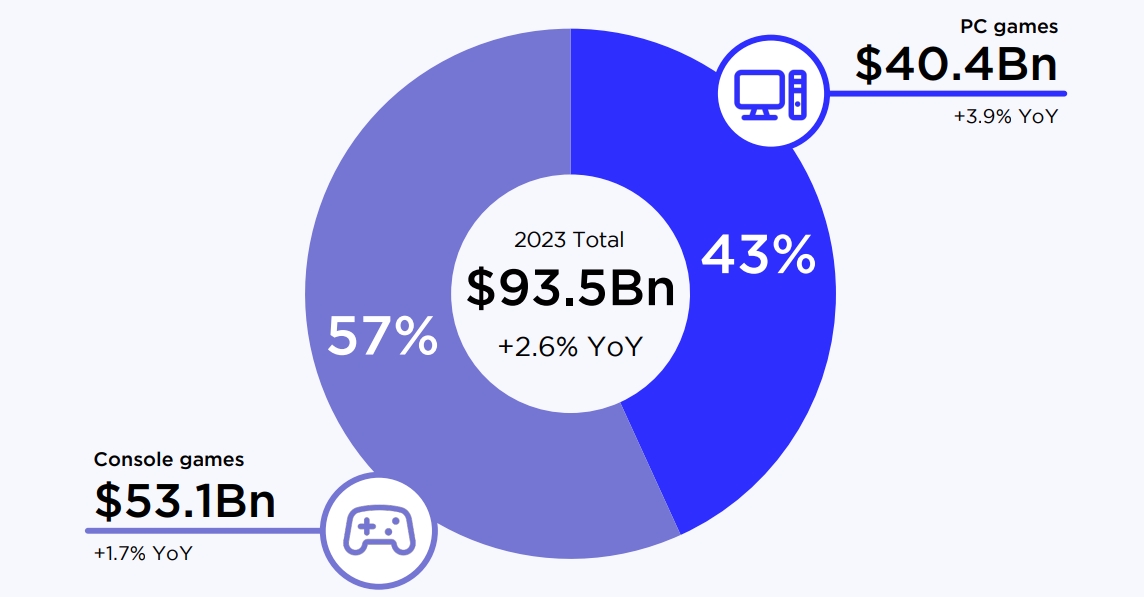

PC and console market revenues

- As detailed in Newzoo’s PC & Console Gaming Report 2024, the market reached $93.5 billion in revenue last year, up 2.6% year-over-year. The PC segment was the main driver, growing 3.9% to $40.4 billion.

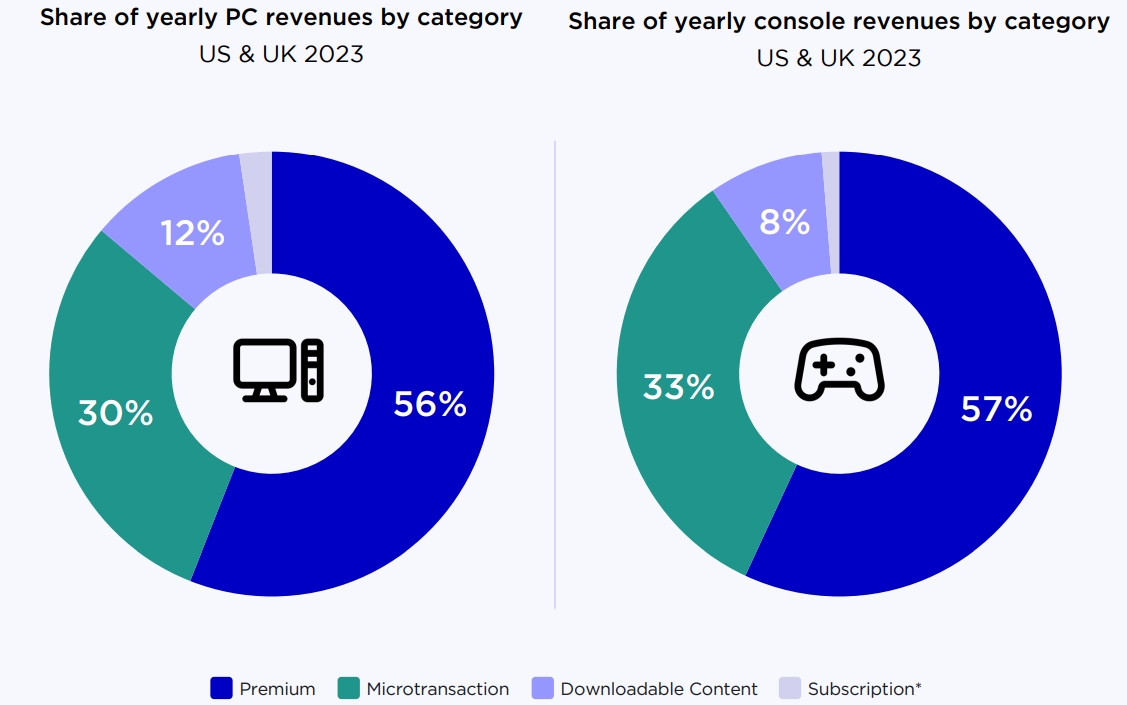

- In the US and UK, Premium spending (sales of traditional pay-to-play games) accounted for 56% of the total on PC and 57% on console, followed by microtransactions (30% / 33%), and DLC (12% / 8%).

- In-game subscriptions, excluding services like Game Pass or PS Plus, remained the category with the lowest revenue share on both platforms.

- According to analysts, a significant number of last year’ most successful titles were cross-platform releases. However, Newzoo noted that premium games also cannibalized time and revenues from live service projects, “highlighting that live service monetization tends to be somewhat zero-sum game.”

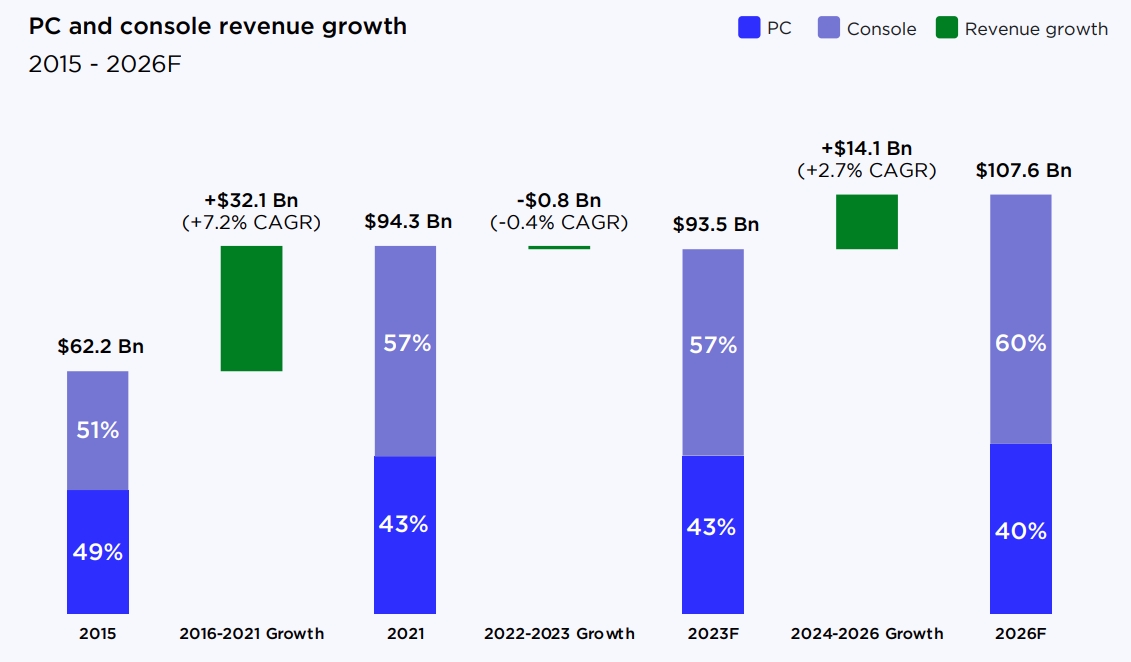

PC and console market growth continues to slow down

- From 2015 to 2021, the PC and console market experienced a rapid growth of more than 50%, but it then slowed down with no signs of returning to pre-pandemic levels in the near future.

- Newzoo expects revenues to increase by $14.1 billon from the end of 2023 to 2026 (at a 2.7% CAGR), with most of the growth coming from expanding console install base and the new Nintendo hardware.

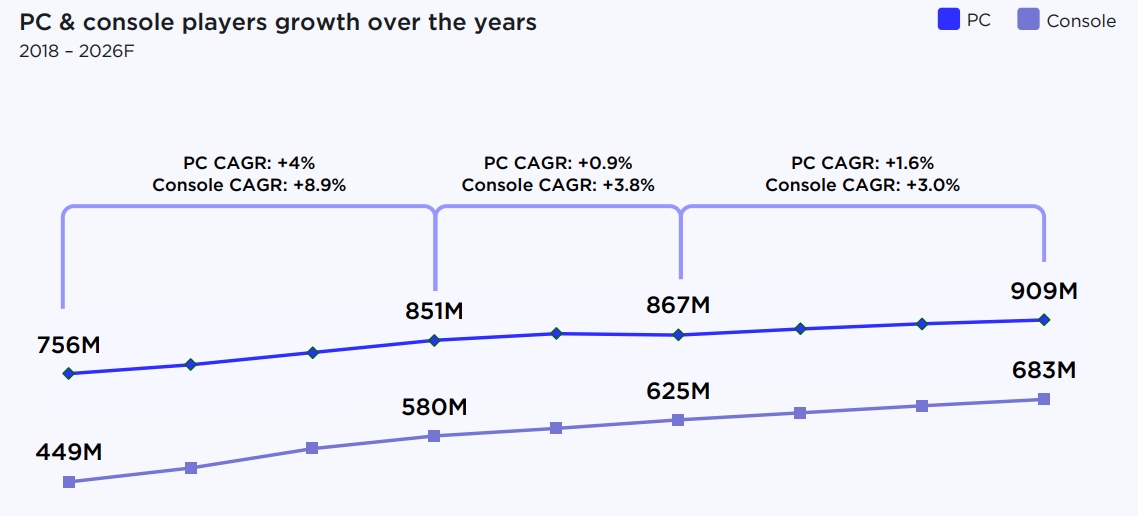

- The growth of the audience for PC and console games is also expected to slow down in the coming years. Before 2021, it grew on a CAGR of 8.9% on console and 4% on PC, having now fallen to 3% and 1.6% respectively.

- As a result, the number of players is projected to reach 909 million (PC) and 683 million (console) in 2026.

- “It will be increasingly challenging to grow a game’s player base, particularly in our current landscape, where evergreen titles and robust content pipelines reign supreme,” Newzoo noted.

New games have to compete with Fortnite and Roblox

- The top 10 games by MAU in 2023 were over seven years old on average. Fortnite remained the leader on PC, PlayStation, and Xbox, while Roblox landed in the top 5 on all platforms.

- Although these titles already have hundreds of millions of users, their MAU increases at launch of every major content update. Roblox and Fortnite are also full-fledged platforms that rely heavily on UGC. This allows them to dominate live service games that can’t produce content at the same pace.

- “It’s essential for studios to remember that they are competing with these platform behemoths for a share of limited player hours,” Newzoo noted.

Playtime on PC and console is decreasing

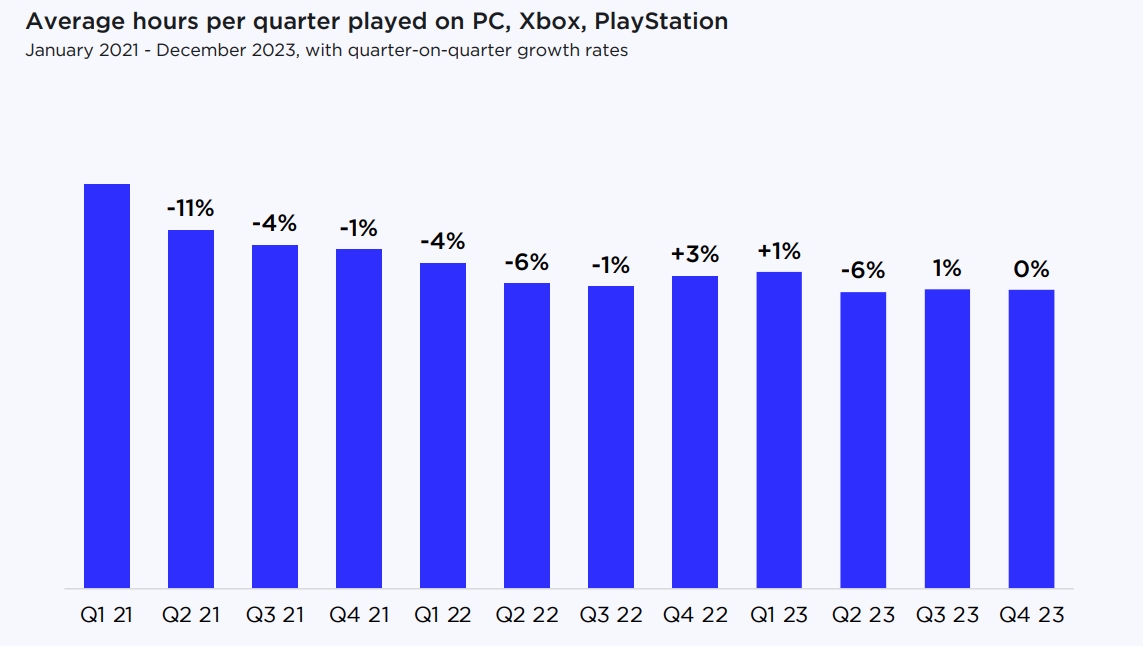

- Since Q1 2021, the average quarter playtime on PC and console has decreased by 26%. Given that in January 2024, playtime was down 10% from Q4 2023, Newzoo expects the trend to continue in the coming years.

- Almost all genres experienced a decline in engagement last year. The only exceptions were third-person shooters and action RPG, with their playtime increasing by 27% and 5% year-over-year, respectively.

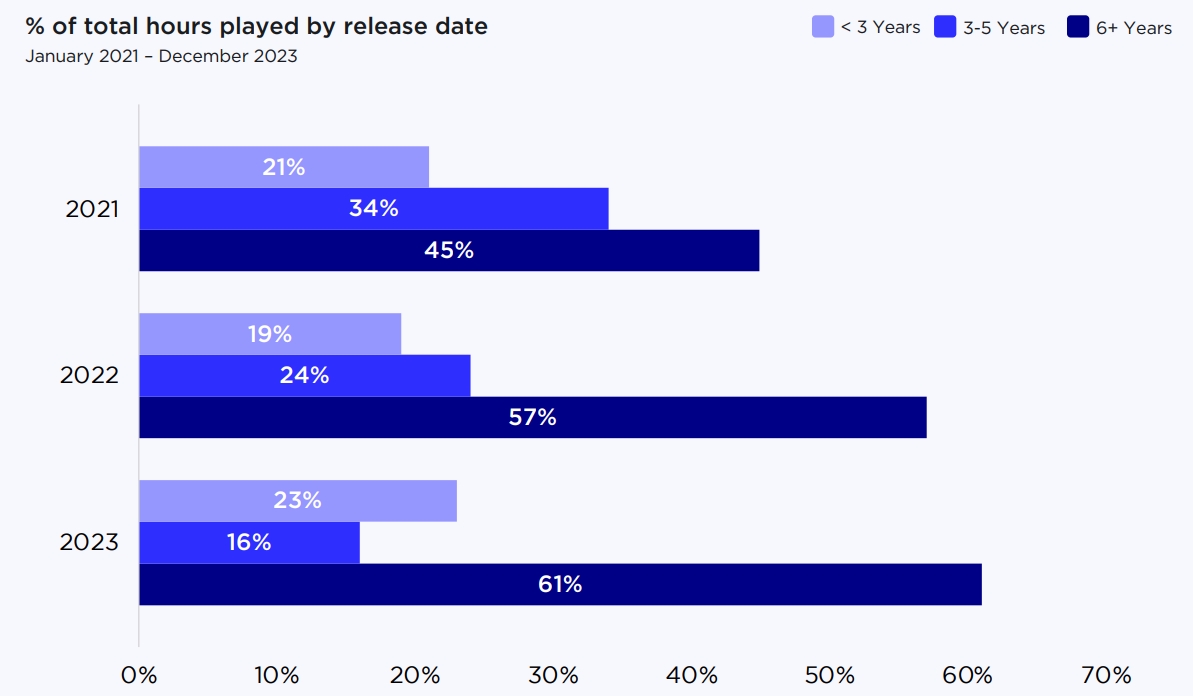

- Another trend is that users continue to spend more time in older games. Last year, titles released over six years ago accounted for 61% of total playtime.

- The top 5 games in this category accounted for 27% of total playtime across PC and console. These were Fortnite (8.4%), Roblox (5.9%), League of Legends (5.2%), Minecraft (4.3%), and GTA V(2.9%).

- On the positive side, the share of new games (launched after January 1, 2022) increased from 19% in 2022 to 23% in 2023.

- Of all titles in this category, yearly franchise releases accounted for 60%, or 15% of total playtime. These were Call of Duty (6.8%), FIFA (3.9%), NBA 2K (1.7%), Madden (0.8%), and The Show (0.4%). So it is incredibly difficult for new games to steal time from these established IPs.

- New titles that don’t fall into the annual releases category had a very small share of 3.5%. These were Diablo IV (1.4%), Hogwarts Legacy (0.8%), Baldur’s Gate 3 (0.6%), Elden Ring (0.3%), and Starfield (0.3%).

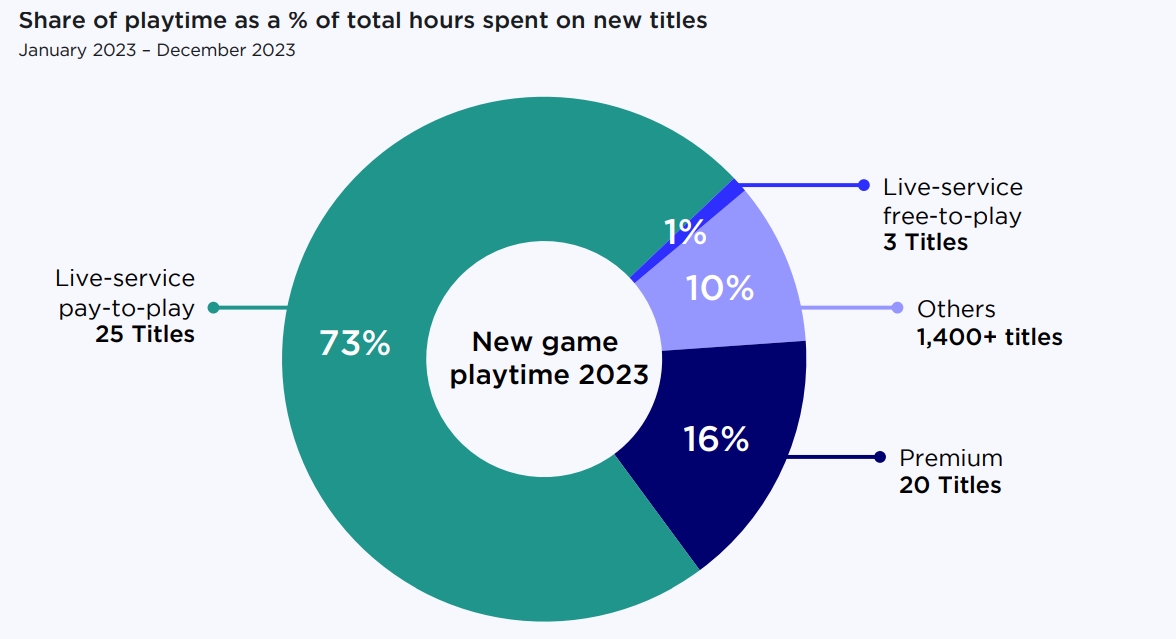

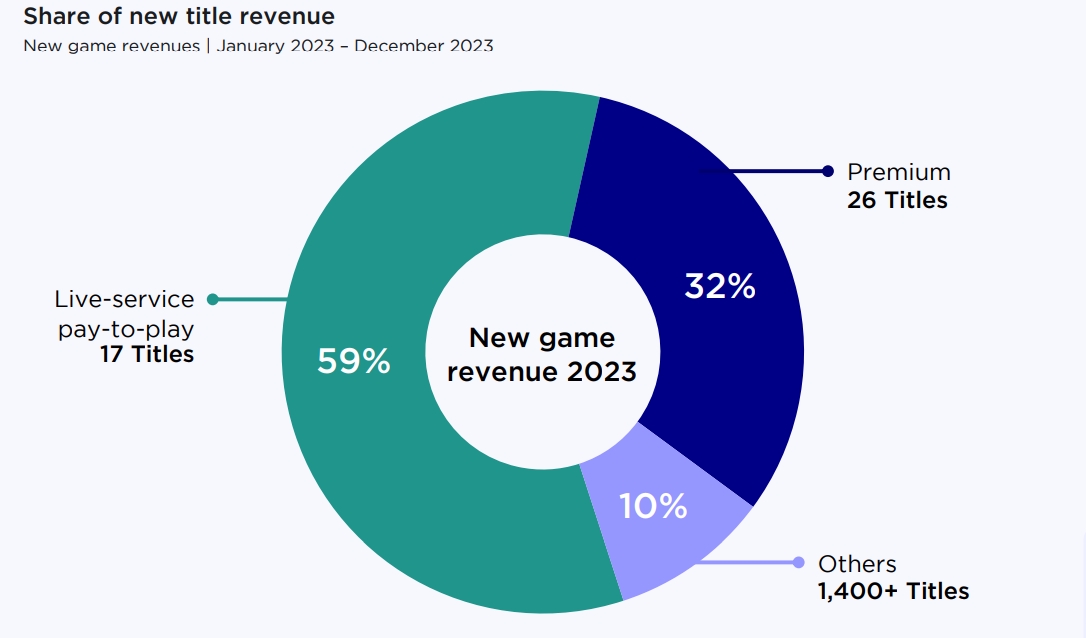

- When looking closely at new games (launched after January 1, 2022), 48 titles accounted for 90% of the category’s total playtime. Of them only 20 were premium products.

- The same applies to revenue, with 43 titles accounting for 90% of the category’s total player spending.

More data and insights, including information about the share of games based on new IPs, the impact of transmedia products on titles they are based on, and player growth in emerging markets, can be found in Newzoo’s full report.