Total value of closed gaming deals collapsed by nearly 90% in H1, with M&A landscape down 31x

Market intelligence platform InvestGame has shared a new report on deal activity in the games industry for the first half of 2023. Here are the key findings about the turbulent and generally deteriorating landscape.

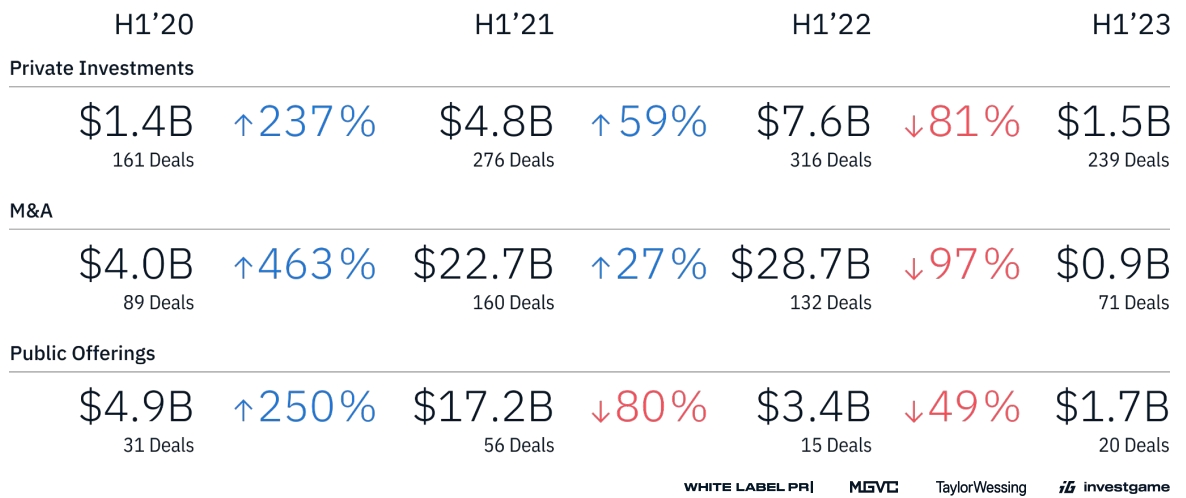

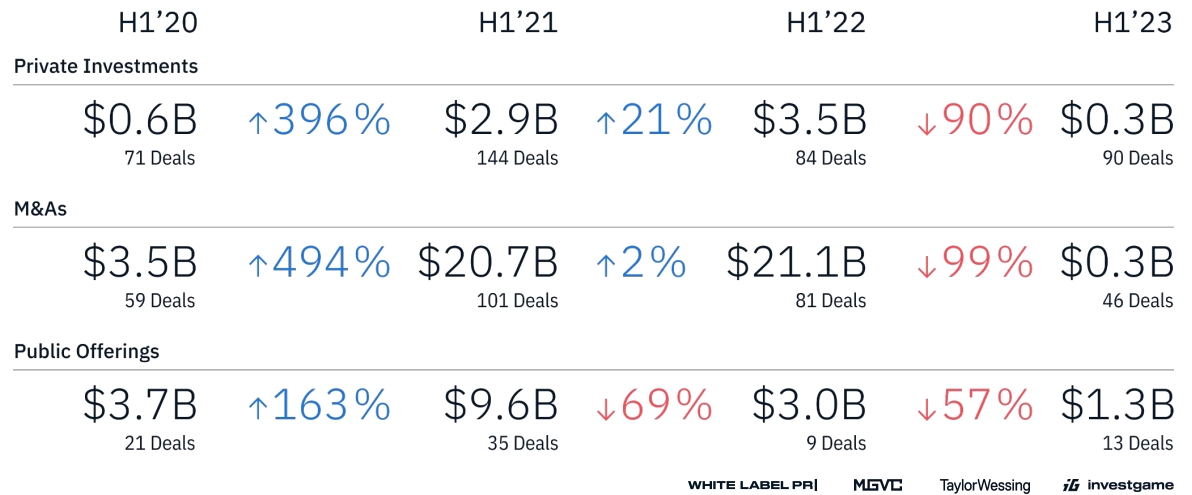

- There were 324 closed deals in the games industry in H1 2023, according to the InvestGame report. This is compared to 463 deals in H1 2022.

- Their total value was $4.1 billion, down 89.6% from $39.7 billion in the same period last year.

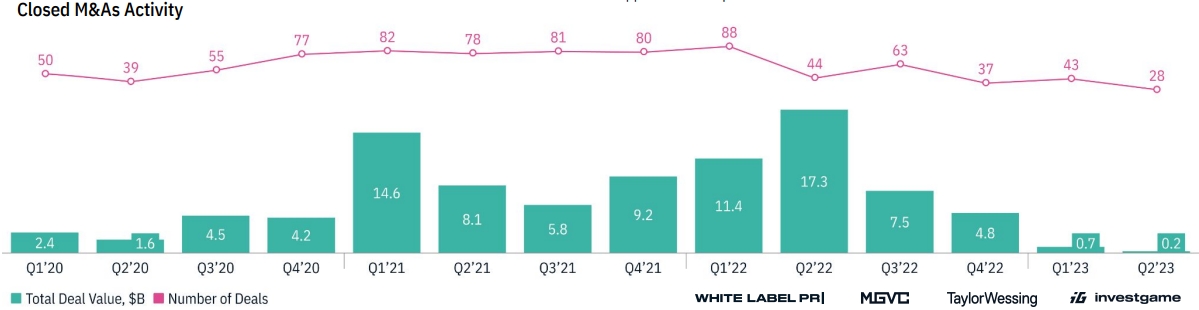

- The M&A landscape experienced the biggest downfall, with total value down 31x and the number of closed deals nearly halving year-over-year.

- InvestGame cited two major reasons behind such a decline: 1) strategic investors are currently reviewing their portfolios and diverting some assets; 2) more game companies announce layoffs or business restructuring like Embracer Group.

- However, analysts expect a large jump in the third quarter due to the recently closed acquisitions of Rovio ($800 million) and Scopely ($4.9 billion). On top of that, the $68.7 billion Activision Blizzard deal might also be approved during that period.

- Public offerings continue to decline as “private companies choose to postpone listing, while many public comps started buyback programs or became takeover targets.”

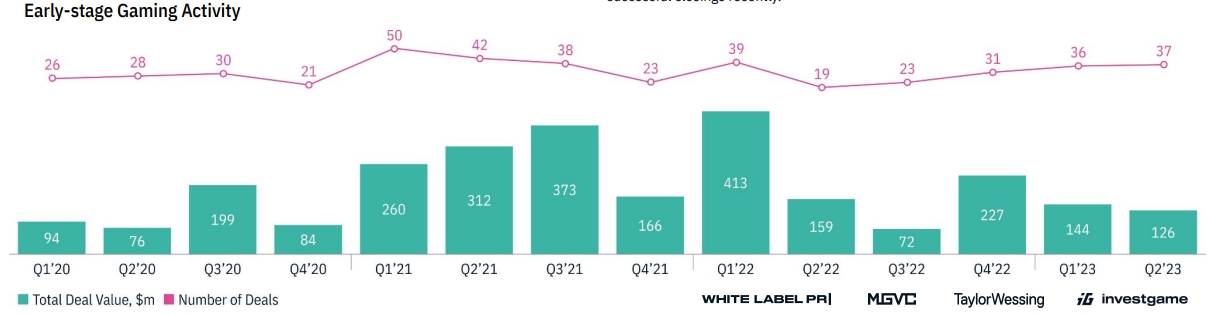

- Overall value of private investments dropped by 5 times year-over-year, with early-stage investments remaining the main contributor.

- When it comes to deals targeting game publishers or developers, there were 149 transactions (down 14% year-over-year) with a total disclosed value of $1.9 billion (down 93%).

- Analysts noted the number of VC deals reached 73 in the first half of 2023, compared to 58 in H1 2022. However, their total value declined by 53% due to the lack of large size rounds.

- “Many VCs have focused on supporting existing studios with follow-on/extension rounds and bridges rather than making sizeable investments into newcomers,” InvestGame explained, adding that despite the headwinds, it expects “early-stage VC activity to pick up through the end of the year.”

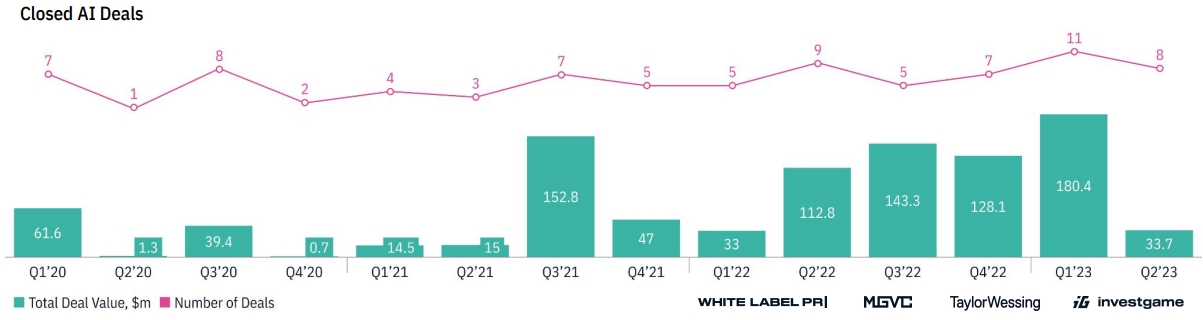

- InvestGame also noted that there was a “modest increase” in investment in AI game companies — 19 deals worth $214.1 million (vs. 14 deals worth $145.8 million in H1 2022).

- “Unlike the surge seen in blockchain gaming, the number of deals in AI hasn’t exhibited such a prominent growth in comparison to previous years,” analysts said. “Yet, with the substantial increase in allocated funds, we do anticipate a noticeable upswing in deal activity during the latter half of the year.”

- Andreessen Horowitz (a16z) was the number one VC fund both in terms of the number of deals (8) and total value ($105 million). Other active investors include BITKRAFT Ventures (4 deals, $37 million), Makers Fund (5 deals, $26 million), and Gem Capital (6 deals, $15 million).

- North America was the number one region by the number of closed early-stage VC deals with 24 (total value of $138.7 million), followed by Western Europe (15 deals, $57.4 million), MENA (15 deals, $26.8 million), and Asia (11 deals, $45.5 million).