SocialPeta on mobile games markets of China (mainland and non-mainland), Japan, South Korea, and Southeast Asia

SocialPeta has published a report of market features and preferred game types in different regional markets in Asia. Here are the key takeaways from the study.

Mainland China

- The mobile game market is oversaturated, competition is tough.

- Hits mostly come from local studios. You can only compete with them through innovation in either gameplay or marketing

- Regulations for game licensing are very strict, a lot of games easily fail to release.

- To enter the Chinese market, you should cooperate with a local partner. Previous successful games such as Angry Birds and Subway Surfers all have local partners in China.

- References to China’s traditional culture will increase the game’s chances to succeed, but you should also be aware of a lot of taboos. For example, elements related to national flags should be avoided.

- TikTok and Weibo are recommended for marketing.

Hong Kong, Macao and Taiwan

- Regulatory policy on mobile games is relatively loose in Hong Kong, Macao and Taiwan.

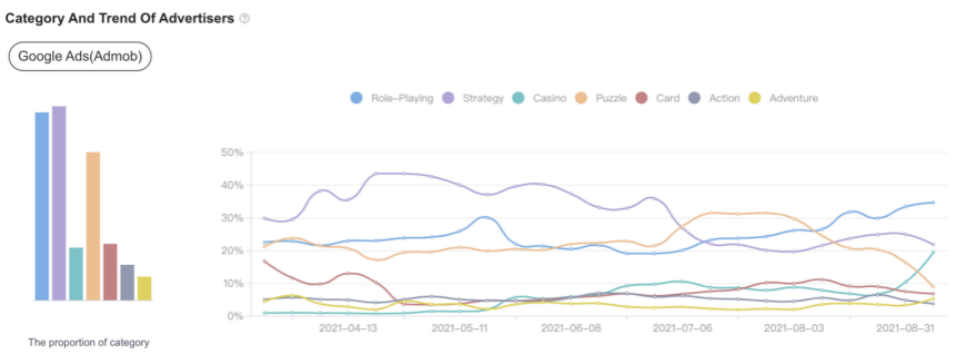

- According to SocialPeta, the top categories of advertisers are role-playing, puzzle and strategy games.

Japan

- Due to a strong cultural barrier, the Japanese gaming market exhibits the highest demand for localization.

- Japanese players are accustomed to playing games while commuting. They tend to choose a game based on the trends in large markets.

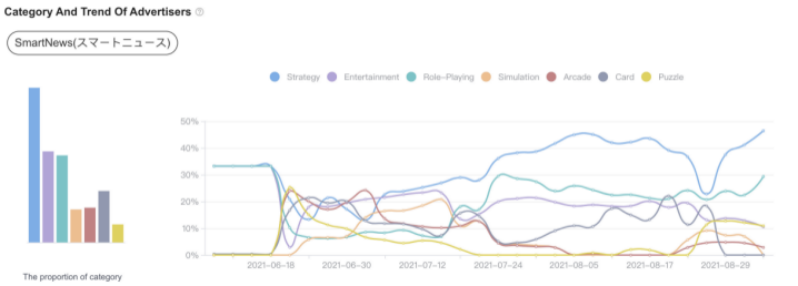

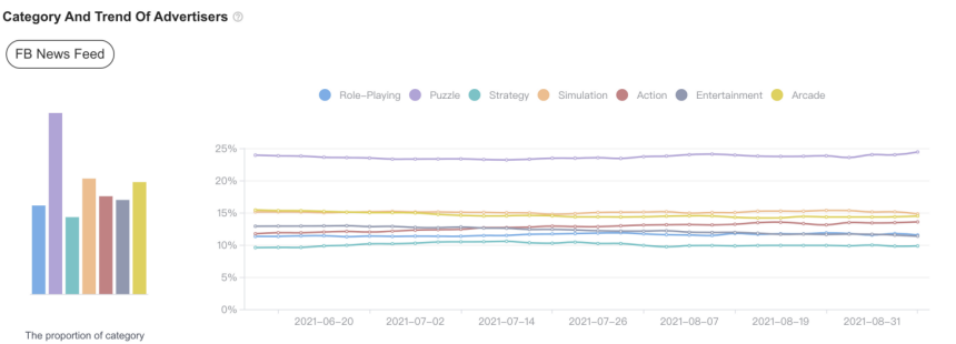

- According to SmartNews, role-playing games account for the largest amount of advertising (there are relatively fixed types of preferred mobile games in Japan). Through networks of FB News Feed, puzzle and simulation advertisers show better performances.

South Korea

- The region has the highest penetration of smartphones, and consequently, the highest penetration of mobile games.

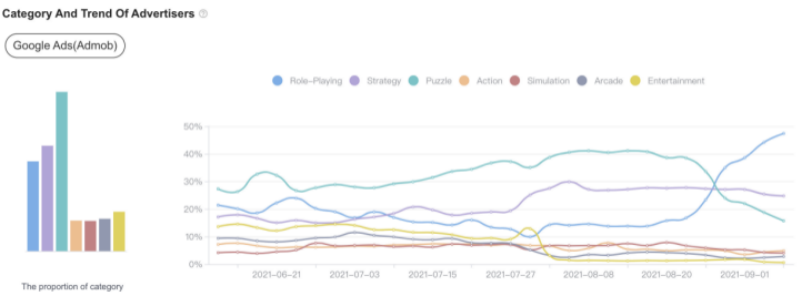

- According to SocialPeta, puzzle games are the most popular category with advertisers.

- Kpop idol groups are heavily featured in marketing.

Southeast Asia

- The majority of paying users are aged below 24 (the second biggest category is paying users aged between 25 and 39).

- Puzzle games are the most popular category.

- The region’s male users tend to play competitive games because of interest in esports competitions, while female users prefer casual games.

- Countries in Southeast Asia are often discussed together, but customs are quite different from country to country, and special attention should be paid to religious taboos.