Paradox Interactive kills nearly half of its games before launch, resulting in hit rate of 71% over past 10 years

Paradox Interactive has held a special event for investors where it opened up about its business strategy and approach to launching games. The Swedish company has also shared some data on hits and misses across its gaming portfolio.

Paradox livestreamed its Paradox Deep Dive event on May 23. The company’s executives shared some insights with investors and answered questions regarding their business strategy. Here are the key takeaways.

Paradox Interactive’s growth strategy

The publisher’s gaming business is built on three pillars:

- Dig in — focusing on core brands and adding player value to already launched titles through live game content (DLCs, packs, etc.) and new value propositions (e.g. DLC subscriptions on Steam);

- Stock up — extending the existing franchises and producing new IPs by studios with a successful track record;

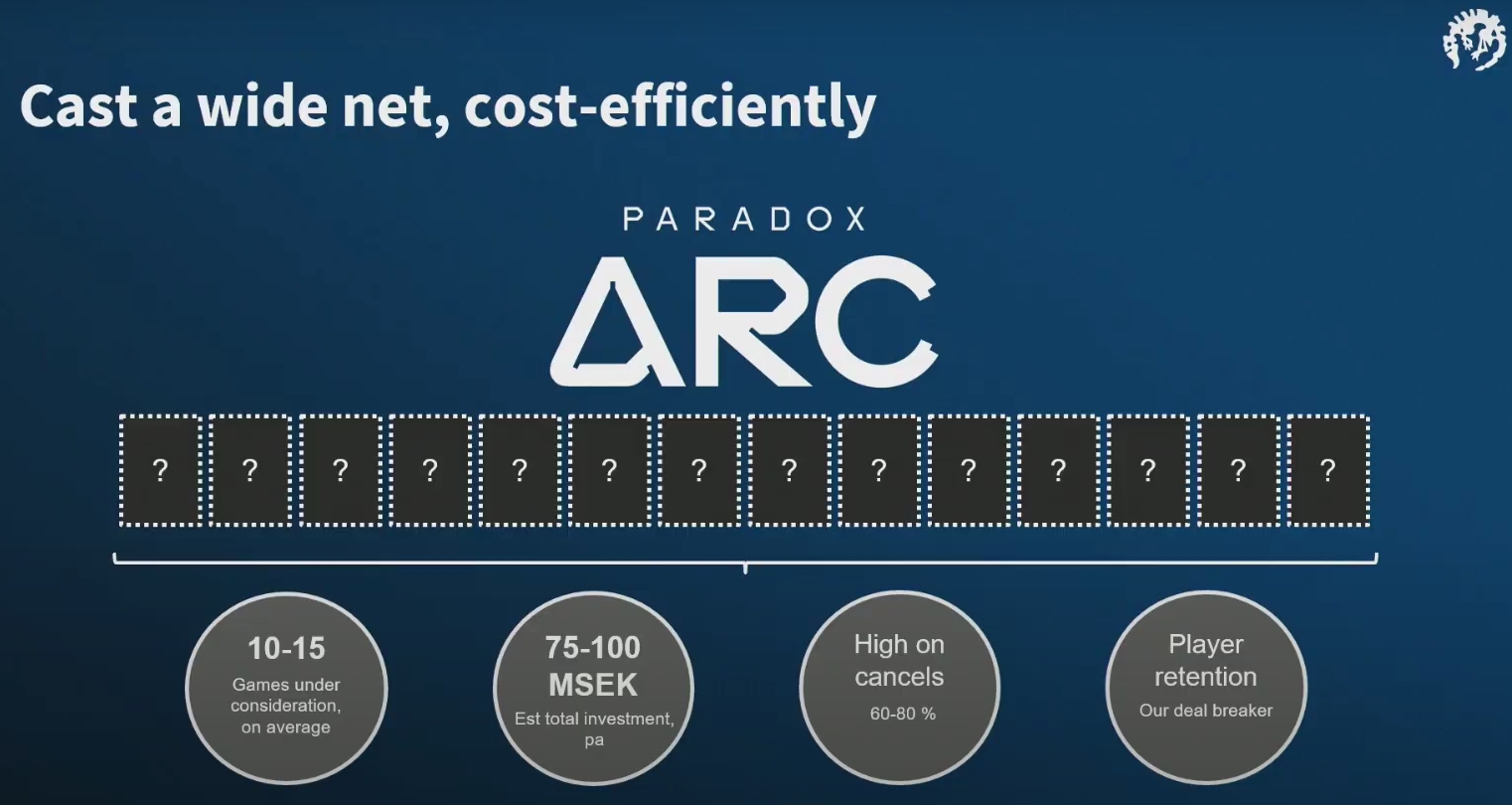

- Break out — finding promising games from third-party teams in the market to help them grow (e.g. Magicka, Cities: Skylines) and partnering with smaller studios through its new publishing label Paradox Arc.

More details about Paradox Arc: 10-15 games under consideration on average; $7-9.4 million — the amount of investment per year; 60-80% titles get canceled

“There are no shortcuts to solid organic growth, but we think we are on the right way there at least” Paradox Interactive CEO Fredrik Wester concluded.

Increasing playtime and killing games early

Paradox has a strong foothold in the grand strategy genre, with an average playtime of 60% higher than other games in the same category on Steam. But the company believes there is still room for improvement.

According to Paradox chief of staff Mattias Lilja, there are five drivers for increasing player value and engagement in the company’s live games: mods, DLCs, multiplayer, paid UGC (selling fan-created content and sharing revenue with them), and accessibility.

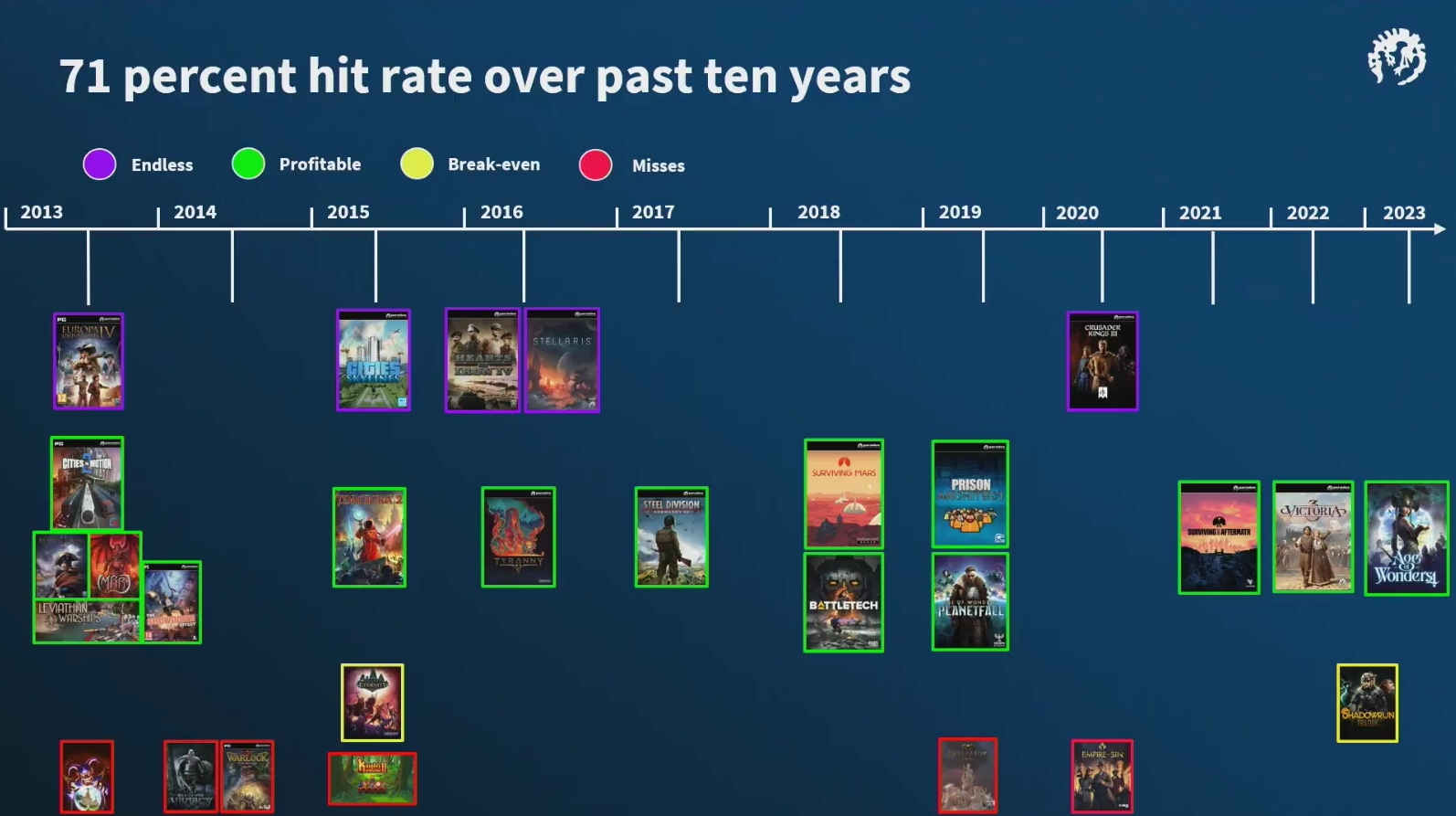

Since 2013, Paradox has killed 47% of games that were in development prior to their launch. Dozens of projects are usually abandoned in their early stages, some of them turn into write-offs in financial reports, but none of them will ever see the light of the day.

Instead, the publisher prefers to only bet on titles that have commercial and live service potential. That’s why 15 of the 28 games released in the past 10 years were profitable, and five of them became “endless” (with neverending content support).

How many hits does Paradox produce?

Over the past 10 years, 71% of games launched by the company have ended up being commercially successful. Paradox didn’t disclose exact revenue or sales figures, but named titles in each category:

- Among 15 profitable games are Tyranny, Magicka 2, Victoria 3, Steel Division: Normandy 44, Surviving Mars, Prison Architect, BattleTech, and Surviving the Aftermath. The recently launched Age of Wonders 4 has already fallen into this category, just a few weeks after its launch;

- Five “endless” live titles include Europa Universalis IV, Cities: Skylines, Hearts of Iron IV, Stellaris, and Crusader Kings III;

- Empire of Sin, Warlock 2, War of the Vikings, Knights of Pen & Paper 2, and Imperator: Rome are considered commercial failures;

- Pillars of Eternity and Shadowrun Trilogy broke even, but Paradox still considers them “misses” because the company had higher expectations and didn’t return its investments.

Paradox noted that its ultimate goal is to increase the number of “endless” games. To achieve it, the company must always focus on player value and make decisions that meet its core audience’s needs and desires.

More details, including Paradox’s approach to user research and data analysis, can be found in the full video below.