Valve might merge global and chinese versions of Steam in response to China's tightening regulations

Probability of merger and possible consequences

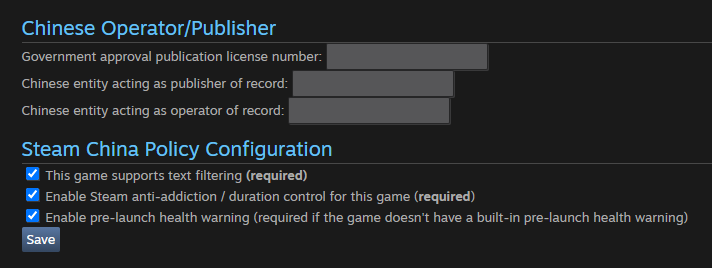

Pavel Djundik, creator of SteamDB, discovered a new interface for developers in the latest Steam code. It is a form that you need to fill out to release a game on Steam China.

Developers must include their license number and local publisher. To sell games on Steam China, you must also enable text filtering and a limit on play time.

New interface Djundik discovered

Discoverability expert Simon Carless believes that this may indicate a potential merger of the two versions of the store. This is also hinted at by the chat filtering beta test, which Valve launched in August and which, according to Carless, is one of the requirements for games to enter the Chinese market.

In the absence of official confirmation from Steam, how serious Valve is about it. However, in the event of a complete merger of the stores, most developers will face a difficult choice. They will either have to go through the grueling process of obtaining a license or completely abandon the Chinese market.

How does Steam China work now?

Valve launched the Chinese version of its store in partnership with publisher Perfect World in 2019. Steam China is separate from the international version and only includes games licensed by the local government.

At the same time, players in China can still use the global Steam, and overseas developers often prefer not to obtain the necessary licenses, mostly because of bureaucratic difficulties and additional financial costs.

Obtaining license and main difficulties

The license costs $5,000 and is issued by the National Press and Publication Administration (NPPA). As noted by Adria Carrasco, founder of Another Indie, it can take around 9-14 months to get an approval, all the while dealing with numerous rejections and censorship.

These conditions make it almost almost impossible for indie developers to obtain a license. However, even among large companies, the approval rate remains low.

According to Daniel Ahmad, senior analyst at Niko Partners, 1,385 local games were licensed in 2019, and another 1,350 will have been approved by the end of this year. This is across all platforms, including mobile.

The situation with foreign games is even worse. Last year, the NPPA only approved 185 games, including 32 PC titles. Ahmad notes that this year the total number of approved games from foreign studios will not even reach 100.

Considering that NPPA is now busy checking iOS games (42 thousand titles were deleted from the Chinese App Store this summer), most titles on Steam are now at risk of having to wait in the line or ending up without a license.

Share of revenue from China

Carless analyzed the revenue data of games on Steam which he has access to. If a game is localized, the share of the Chinese revenue usually fluctuates between 10-22% and averages 16%. In the case of text-heavy games without localization, Chinese users only generate around 1-2% of revenue.

It is important to consider that China has regional prices and games on Steam China are typically 60% cheaper than in the US. Carless also notes that Chinese users are twice as likely to ask for refunds.

Thus, the loss of the Chinese audience may not be quite as catastrophic as it seems at first glance. Carless cites Meteorfall: Krumit’s Tale as an example. With 27% of its sales in China, the country “only” accounts for 16-18% of the game’s total total revenue.