Fragmented reality of Android market in China

You might have already sensed from our earlier posts that publishing and monetizing your game in China is no walk in the park. But compliance with the local regulations is not the only challenge to overcome. Even if your game is approved, you still have to navigate China’s fragmented mobile market.

With Android devices accounting for 70 percent of the market, you would think you could easily tap into the country’s 700 million smartphone users by releasing your game on Google Play. Except, of course, Google has been blocked in China since 2010 (its store only technically accessible via VPN).

The bad news is there is no single Android store that everybody would use. Instead, Chinese Android space is divided between dozens of platforms. Typically, different device manufacturers install their own stores on their phones. So as a publisher, you have to navigate this multitude of stores to reach the relevant demographic.

Depending on the intended audience, you can choose a specific store.

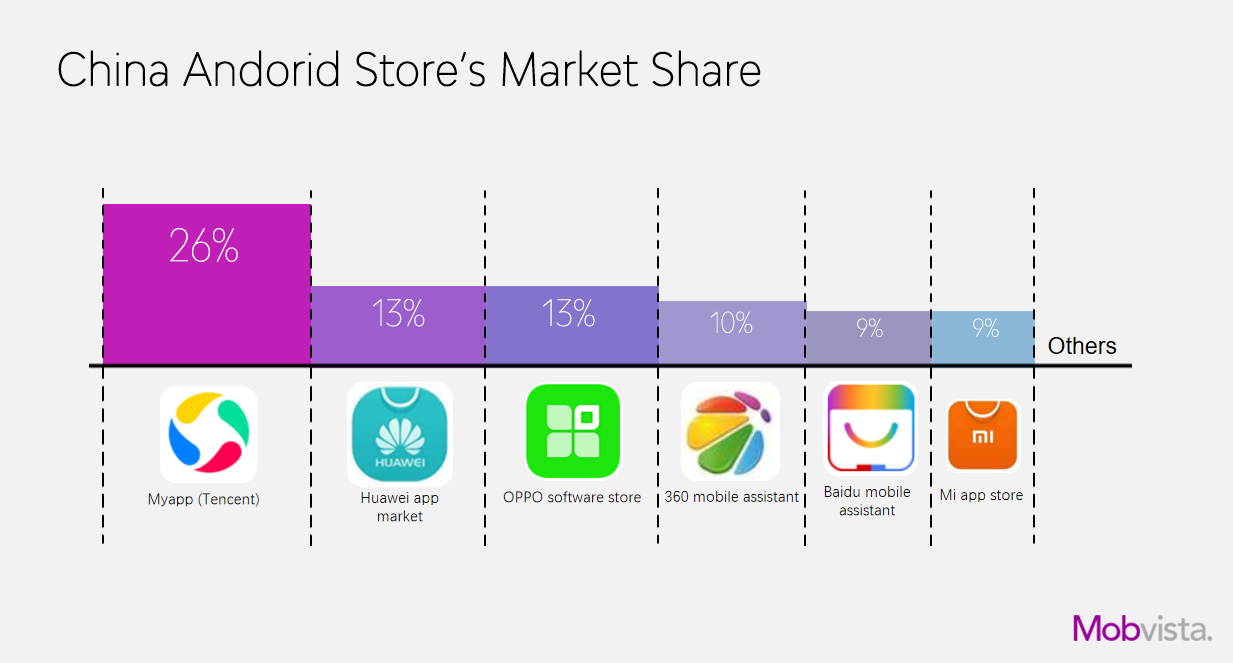

Analysts from Mobvista break down Top 5 Android stores in China (+ No 6 by Xiaomi):

Image Credit: Mobvista

Tencent My App by Tencent (26% market share)

My App by Tencent is the top app in the Chinese ecosystem. Many popular games in the country are available here. Plus, WeChat messenger is downloadable from My App. And WeChat is in itself something of a distribution platform with a potential to become the main app marketplace due to its mini-programs functionality. More on that in a minute.

Huawei App Market by Huawei (13% market share)

It’s the second most popular option in China since Huawei manufactures the most used handset in the country.

App Market appeals to the higher end demographics of the market. Mobivista suggests that it’s friendly towards Western developers.

Oppo Software Store by BBK Electronics (13% market share)

It’s the official platform on Oppo devices. It’s the fourth most popular mobile brand worldwide and the second after Huawei in China.

360 Mobile Assistant by Qihoo 360 (10% market share)

Formerly the second most popular Android store. But that was before Huawei and Oppo took over. Qihoo 360 is an internet security company that provides a popular web browser in China. It’s a well-established brand that enjoys a lot of trust.

Baidu Mobile Assistant by Baidu (9% market share)

Baidu provides the most popular search engine in China. This company reaches 1.1 billion monthly active devices with its services including searches, AI assistants, and an its own app store.

Oustide of Top 5 is MIUI App Store by Xiaomi with 9% market share.

The Xiaomi app store is installed on all Xiaomi devices. The popularity of the store is tied to the hardware sales. As of today, Xiaomi is the fifth most popular smartphone brand in China. It’s target audience are consumers from developing parts of the country and the rest of the wolrd.

Mini-programs

In addition to various platforms, there’s also a variety of social media to choose from. Here’s where you can benefit from WeChat as its ecosystem includes mini-programs. Originally, mini-programs were basic versions of full apps. Right now, there’s almost no difference in functionality, with mini-programs being small apps of 10 megabytes running on WeChat interface. They offer smooth loading speed and all the social features. Mini-programs are located outside the app store system, downloadable directly through WeChat. As a developer, you might want to make sure that your game is adaptable to the mini-program format.

The abundance of opportunities and the fragmented nature of the Android scene might be challenging for Western developers to infiltrate it effectively. Whatever strategy you decide on, it would be wise to work with a local partner.