How strong is the impact of mediation networks on the size of CPI?

Why is mobile traffic so expensive? How do mediation networks charge up the prices and why? We’ve asked these questions to Head of Marketing at ComboApp Nadia Matukhno.

Everyone who has ever dealt with attracting user base to mobile apps is aware that an install can be rather costly. And when we say ‘costly’, we mean that for many apps it is virtually impossible to get a return on the CPI.

As it turns out, most of the apps from the paid Top-300 in US App Store cannot afford to buy installs while remaining profitable. According to the March figures of Fisku Indexes, the cost of a loyal user amounts to $3.21. This is how much you pay a marketer to attract a user, who will open your app at least three times. But it provides no guarantee that this user would remain loyal after a month and eventually pay at some stage.

So what drives the CPI to its heights? While commenting on the cost of user acquisition, experts from the industry normally refer to the market saturation and the competition for the user attention as well as loyalty.

In total, the leading app stores feature over 3 million apps. And this number is growing every day (App Store alone releases over 500 games daily, not to mention apps in other categories).

Despite the fact that a user downloads dozens of apps on a smartphone, he is actively using only a few of them, as Pew Research Center reported. 46% of all smartphone owners use only from 1 to 5 apps weekly.

Large and prominent publishers operate huge marketing budgets and launch high-scale campaigns for attracting new users. Small app developers are forced to spend good money in order to be visible among big competitors in the markets. All of it pumps up the prices.

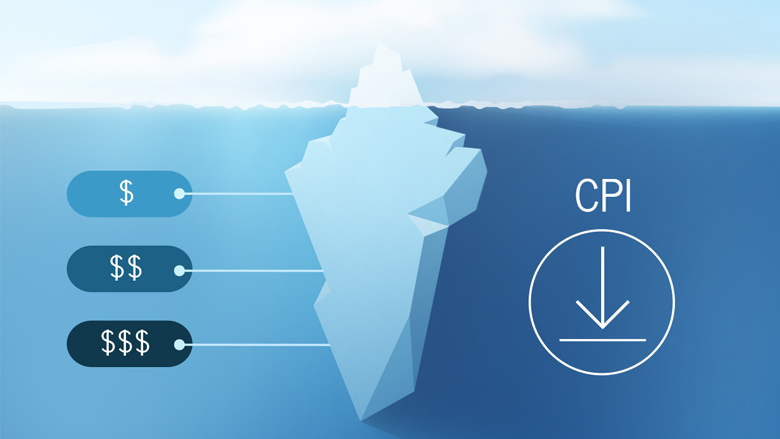

Besides, there are also not so obvious reasons. One of them is the ‘double bottom’ where a hefty part of budgets aimed at user attraction falls.

The name for this ‘double bottom’ is mediation.

We have used our in-house monitoring tools to analyze the traffic from over 2000 offers. And we got very exciting results.

Our tool was monitoring the traffic from us (Comboapp) to the end user – the app owner. Each ‘server’ used to funnel the traffic was tracked and marked as a redirect. Each such ‘server’ represents an intermediary –middleman company, which bought and resold the traffic:

Normally the last redirect before the market itself is the buyer’s tracker (Appsflyer, Adjust, Cochava). This means that 1 redirect does not involve a mediator, 2 redirects – 1 mediator and so on.

Just imagine how much each redirect increases the final cost of the install if each of the mediators adds another 10-20% to the original cost of the install! Let’s say, the cost of install is $2 in the beginning of the journey and each of the middlemen would add 10%. In this case, a rough picture of the final cost would look as follows:

And if the final cost of install remains the same for the app’s owner as of the moment of launching the campaign, then at least 1/5 of the final price for the advertiser is the revenue of mediators. This is what keeps the CPI at its high levels.

Of course, one cannot just say that the mediators are a bad thing. Each affiliated network makes the market go forward – it collects the available traffic from various small sources, signs contracts with them, controls the quality of the traffic and performs a range of other important operations, requiring market expertise, knowledge of marketing and fine-tuned tools. But the problem is that it all results in suffering on the part of mobile app developers caused by the pumped up CPI.