Remedy game development pipeline explained: how Alan Wake 2, Control 2, and other titles are funded and produced

On March 20, Remedy Entertainment published a more detailed version of its annual report. The document provides additional information about the company’s production pipeline and business strategy.

Key takeaways from the report

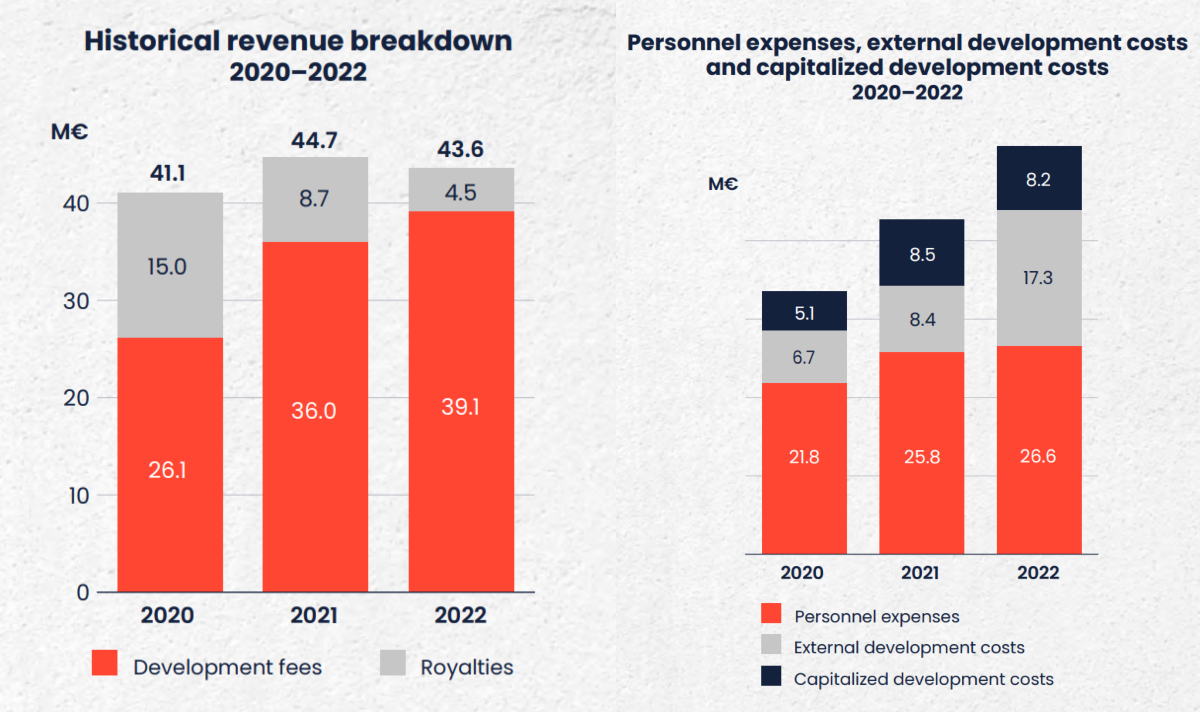

- In 2022, Remedy reached €43.6 million in revenue, down 2.5% year-over-year. Europe accounts for 27.4% of the company’s total earnings.

- The company’s EBITDA for the full year was €1.9 million, compared to €14.5 million in 2021.

- Remedy posted an operating loss of €600k, compared to €11.4 million in operating profit last year.

- The decreased profitability is a result of the company’s increased investment in game development and its Northlight engine.

- Remedy also plans to launch a new game per year starting from 2023, so this investment should pay off in the long term.

What does Remedy say about its games?

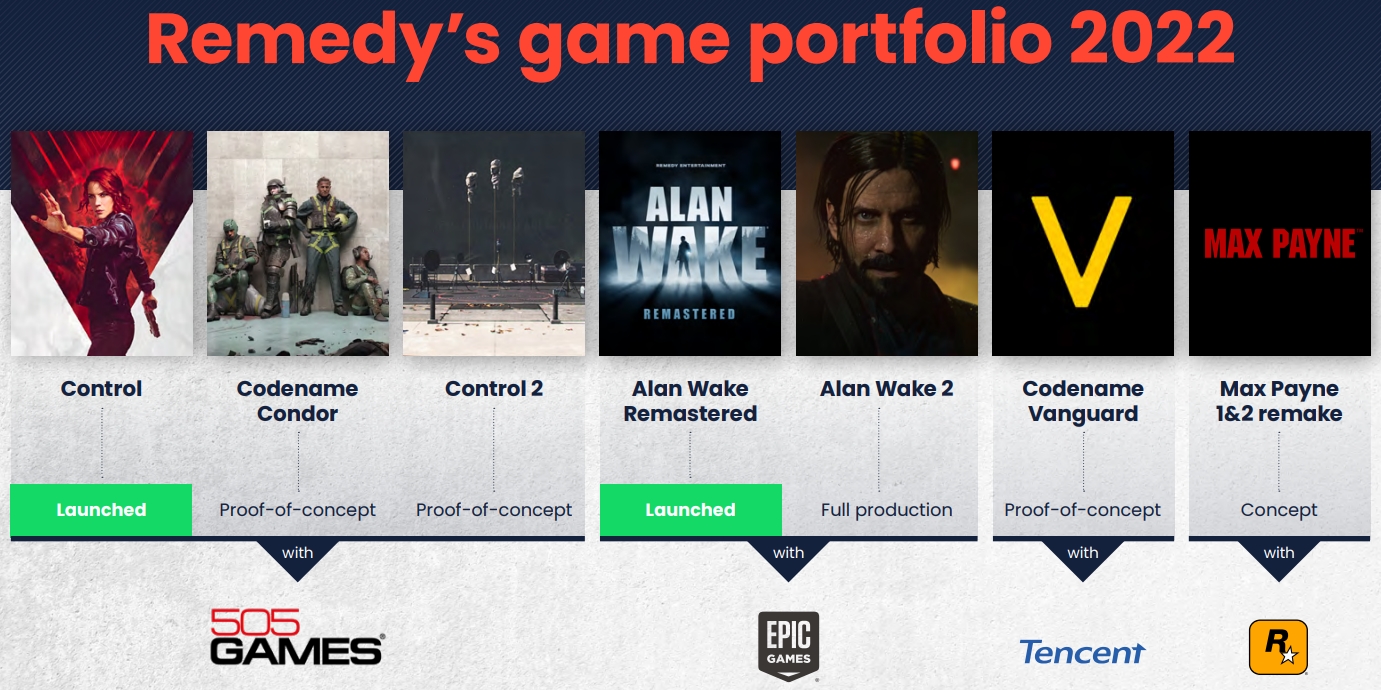

- The Finnish studio currently has five games in its pipeline, of which only Alan Wake 2 is in full production. Other titles — Condor, Control 2, and Vanguard — are at the proof-of-concept stage, and Max Payne 1-2 remake is at the concept stage*.

* According to Remedy’s own definition, the concept phase is all about prototyping and defining the game’s key elements. It lasts up to six months and requires a team of 20-30 developers.

The proof-of-concept stage is Remedy’s way of “validating the game concept and determining how the game will be developed.” During the phase, which requires a team of 30-50 people and lasts 3-6 months, the company also creates a playable demo for further iterations and presents the project to potential partners and investors.

When a game enters the full production stage, the team size increases to up to 200 people (including external staff). At Remedy, it takes 1-2 years for a project to reach the Alpha stage with full game ready. And Beta stage requires another 3-6 months of polishing.

- All these games, except for Alan Wake 2, are far from launch. As Remedy mentioned earlier, it plans to launch at least one game every year, so these titles should come out between 2023 and 2026.

- By the end of 2022, Control has reached 16.5 million players and sold 3.6 million units globally, a little update to the data published in Digital Bros’ recent report.

- Remedy confirmed that Control 2 will have a €50 million budget. The game’s development and marketing investments, as well as its future revenue will be equally split between the studio and publisher 505 Games.

- Project Condor, a 4-player co-op PvE spin-off of Control, will have a €25 million budget and will come out on PC, PlayStation 5, and Xbox Series X|S. Players will have to explore the Oldest House and survive while fighting against the Hiss.

- Alan Wake 2, fully funded by Epic Games, is expected to come out later this year. Remedy will be entitled to 50% of the game’s net revenue after Epic fully recoups its development and marketing expenses.

- The development of the Max Payne 1-2 remake is fully financed by Rockstar Games. The exact amount remains undisclosed, but it is “in line with a typical Remedy AAA-game production.” Remedy is now working on the project’s concept and core gameplay mechanics.

- Project Vanguard, described as Remedy’s first live service game, is a PvE multiplayer shooter. Built with Unreal Engine, it will come out on PC and consoles. Tencent will also fully fund the development and publishing of the mobile version.

Remedy’s business strategy

In its annual report, Remedy outlined five main goals it wants to achieve:

- To create several successful games and at least one major hit;

- To own at least three expanding game brands with long-term hit potential;

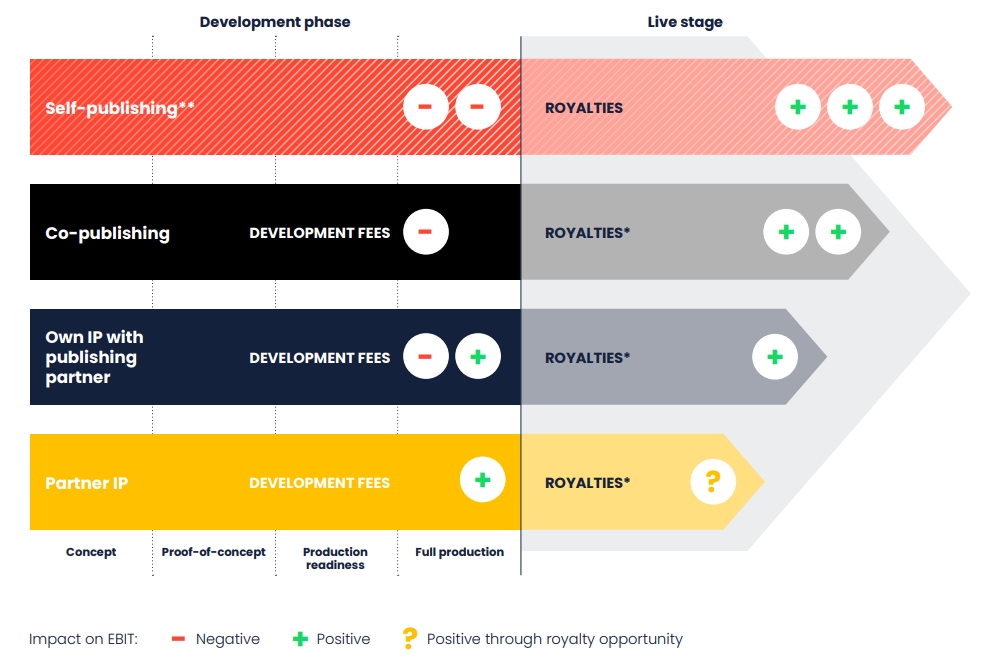

- To select the right business model for each game: partner IP (the Max Payne 1-2 remake), co-publishing (Condor, Control 2), own IP with a publishing partner (Alan Wake 2), and self-publishing*;

*Partner IP projects are funded by Remedy’s partners. The studio receives development fees, as the game’s production reaches certain milestones. Partner publishes and markets the game, also retaining control of the IP rights. “Partner IP projects carry low financial risk for Remedy, but participation in the game’s success is also limited,” the studio explains.

Co-publishing projects are co-funded by Remedy and its partner, and publishing/marketing responsibilities are distributed between the two companies. These games “carry a relatively high financial risk but also greater royalty potential.”

Own IP projects are fully or partly funded by Remedy’s partner, but the studio is responsible for the development and also retains the IP rights. Unlike in partner IP projects, development fees are without a margin. Once a partner recoups its investments, Remedy starts receiving royalties from sales.

Self-publishing projects carry the “highest financial risk but also the greatest revenue potential through game royalties.” Although Remedy hasn’t self-published any games yet, it sees this as a potential future business model.

- To become the “most attractive gaming industry employer in Europe” (as of now, Remedy employs 334 people);

- To have a profitable business with well-managed risks.