In the first half of 2021, the volume of transactions on games reached $60 billion - almost twice as much as in the whole of 2020

The video game industry has set a new record for deals. Investment banking company Drake Star Partners estimated that by July 2021, the amount spent on investments and M&A transactions turned out to be almost twice as much as in the whole of 2020.

The main thing from the report:

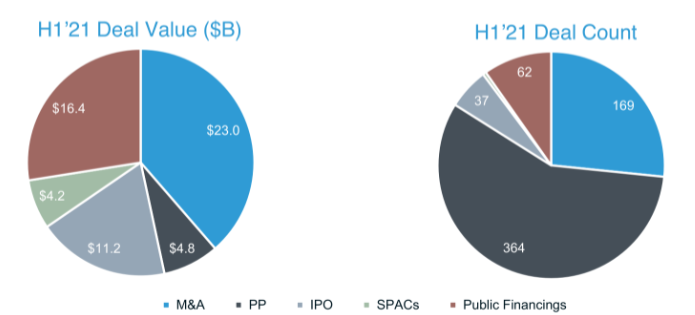

- in just six months, 635 deals related to games were announced or closed. Their total cost was $60 billion. For comparison, for the whole of last year, $33.6 billion worth of transactions were carried out;

- most of the money was spent on M&A transactions – $23 billion. This transaction format was also the most common in the industry. By July 2021, 169 M&A deals had taken place;

- public companies have attracted 62 investments worth $16.4 billion;

- 37 gaming companies held an IPO with total revenue of $11.2 billion;

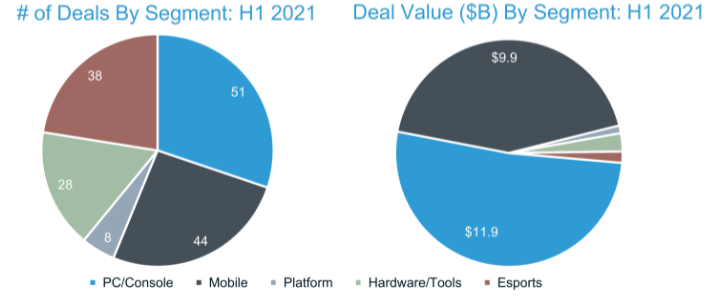

The number of different types of transactions and their cost for the first half of 2021 If we talk about platforms, the majority of M&A deals in the first half of the year concerned the PC and console segment – 51 deals.

- Mobile is a little behind — 44 deals. Also, 38 M&A deals related to esports companies;

The number of M&A transactions and their volume on different platforms in the first half of 2021 The largest M&A deal of the half-year was the purchase of ZeniMax Media by Microsoft Corporation for $7.5 billion.

- Although the takeover was talked about last year, it was officially completed only this spring;

- also in the top 3 most expensive M&A deals included the purchase of Moonton by the Chinese giant ByteDance and the acquisition of Glu Mobile by Electronic Arts;

- Epic Games attracted the largest private investment in April — $1 billion. It was followed by Roblox with $520 million and CriptoKitties with $305 million.