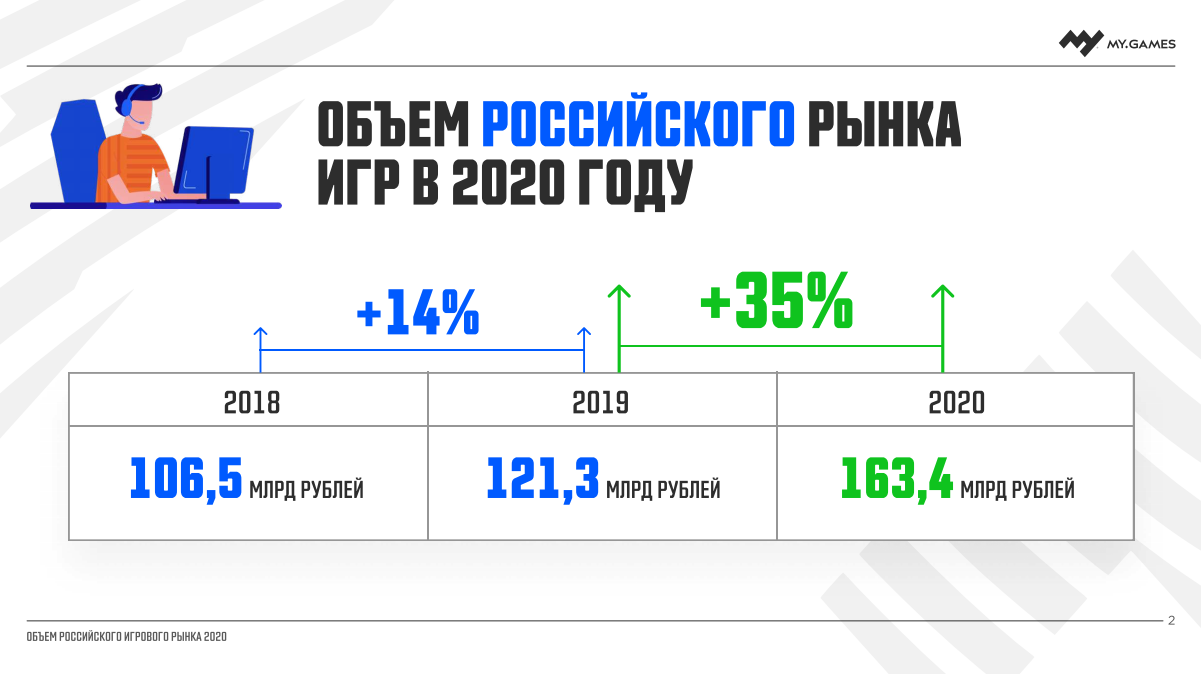

The Russian video game market in 2020 grew by 35% to 163.4 billion rubles ($2.2 billion)

The growth in dollar terms turned out to be significantly less.

The main thing

Today, on March 29, MY.GAMES published an assessment of the Russian video game market for 2020. According to her calculations, its volume for the reporting period amounted to 163.4 billion rubles. This amount is 35% more than the volume of the Russian market in 2019, when it reached the mark of 121.3 billion rubles (then the annual growth in rubles was 14% compared to 2018).

In dollars, the growth turned out to be much lower: the value of the ruble relative to the dollar in 2020 fell significantly. Based on the weighted average annual exchange rate of the ruble to the dollar for 2020 (71.94 rubles per dollar), the Russian industry earned $2.2 billion. In 2019, when the annual exchange rate was 64.6 rubles per dollar, its revenue was at the level of $1.87 billion.

In other words, in dollar terms, the annual growth of the market was not 35%, but about 21%. This is significantly more than before. For comparison, in 2019 it grew by only 10% in dollars. Obviously, the main factor that ensured the rapid growth of the market in 2020 was the lockdown, which caused an increase in Russians’ spending on entertainment.

According to representatives of MY.GAMES, last year, before the pandemic began, they predicted two times less market growth.

Growth by segment

The mobile games market grew the most over the past year — by 39% to 67.1 billion rubles. At the same time, he failed to catch up with the PC games market in terms of turnover. The latter, with an increase of 34%, reached 81.9 billion rubles. Against this background, the console segment is still small – 14 billion rubles.

The main money is generated in Russia by projects with a free-duplex monetization model. They are responsible for 83.3% of all market revenue. And this share is only growing from year to year (in 2018, fritupley accounted for 78.7% of the market turnover). By the way, consoles are the only segment where paid games earn significantly more than free—to-play (9.7 billion vs. 4.6 billion rubles).

Out of curiosity: MY.GAMES notes that in 2020, revenue grew for all mobile genres, except strategies. This does not include farms or simulators. Usually in mobile, strategies mean games in the spirit of Clash of Clans.

This trend is not exclusively Russian. It is global. Previously, the analytical platform AppMagic has already published studies stating that the popularity of this genre is only falling from year to year.