Sensor Tower: Mobile games with LiveOps generate 30 times more revenue than non-GaaS titles

Sensor Tower has released its State of Mobile Gaming 2023 report. This is a deep analysis of key market trends, as well as top performing genres, titles, and monetization strategies. Here are some findings from the study.

Key takeaways

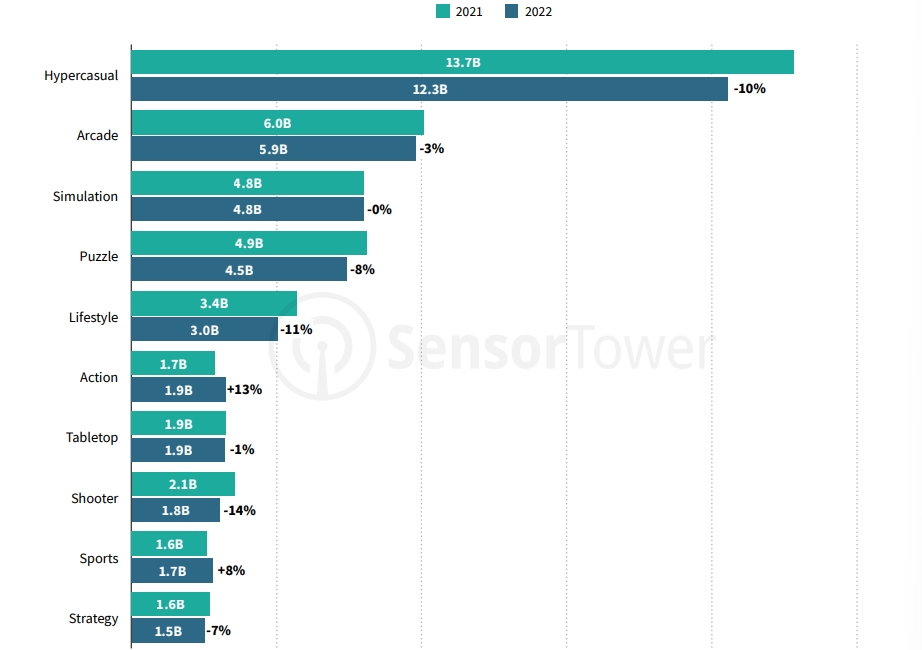

- In 2022, downloads of almost all top genres declined. The only categories to show growth were Action (+13% year-over-year) and Sports (+8 year-over-year).

- Despite a 10% decline, Hypercasual remained the top genre by downloads, with 12.3 billion installs. It is followed by Arcade (5.9 billion), Simulation (4.8 billion), Puzzle (4.5 billion), and Lifestyle (3 billion).

- According to Sensor Tower, the major decline in downloads for hypercasual games is “directly linked to user acquisition costs and monetization through the use of video ads.”

- As a response to market challenges, developers started transitioning to the so-called Hybridcasual model. This relatively new genre combines approachable core mechanics from hypercasual titles with retention and monetization tools used in midcore and casual games. You can find more data on Hybridcasual in the full report.

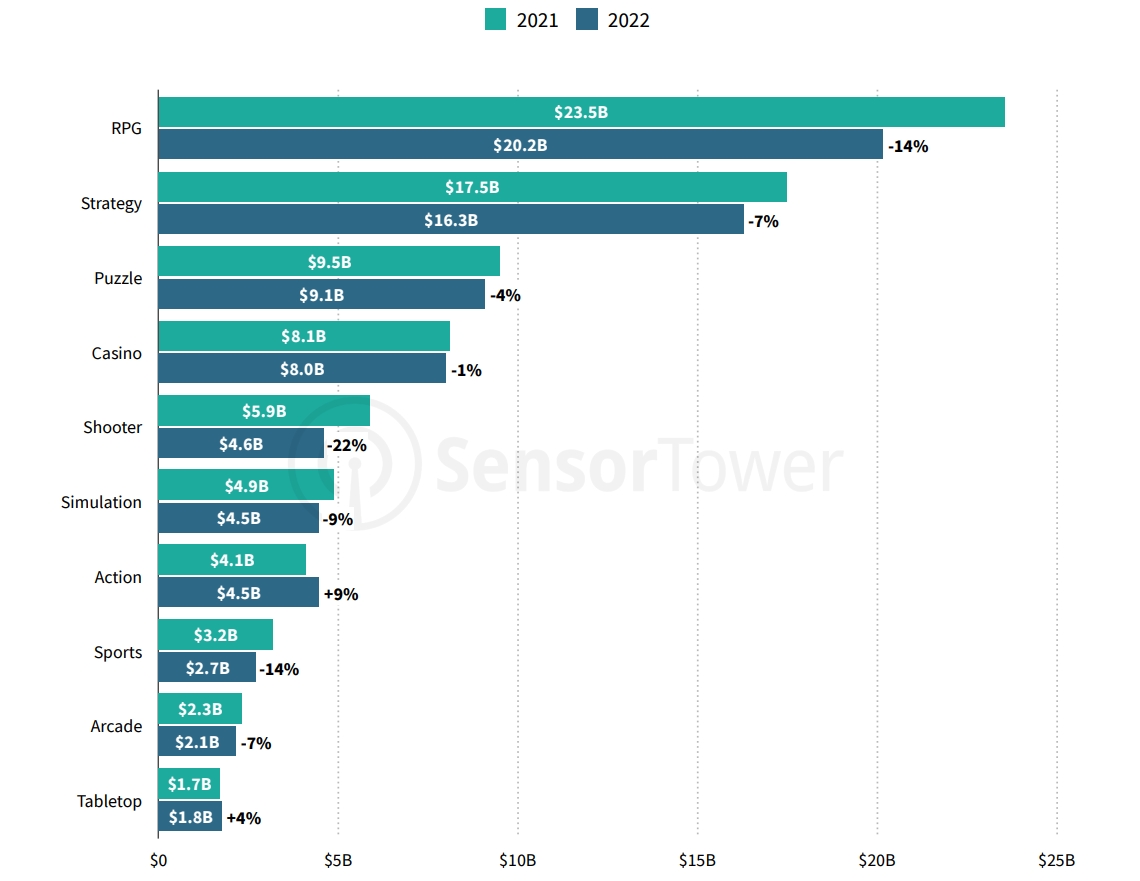

- When it comes to revenue, Action and Tabletop were the only two genres to show growth in 2022, up 9% and 4% respectively. This growth was driven by hits like Genshin Impact and Marvel Constest of Champions, as well as new succesful titles like Survivor.io.

- Shooter experienced the biggest decline, with revenue falling 22% year-over-year. However, it remained in the top 5 mobile genres by revenue, with $4.6 billion.

- In 2022, the top four game categories were RPG ($23.5 billion), Strategy ($16.3 billion), Puzzle ($9.1 billion), and Casino ($8 billion).

- It is worth noting that mobile RPG revenues have been declining for the past seven quarters. If this trend continues, Strategy could dethrone it as the highest-grossing genre.

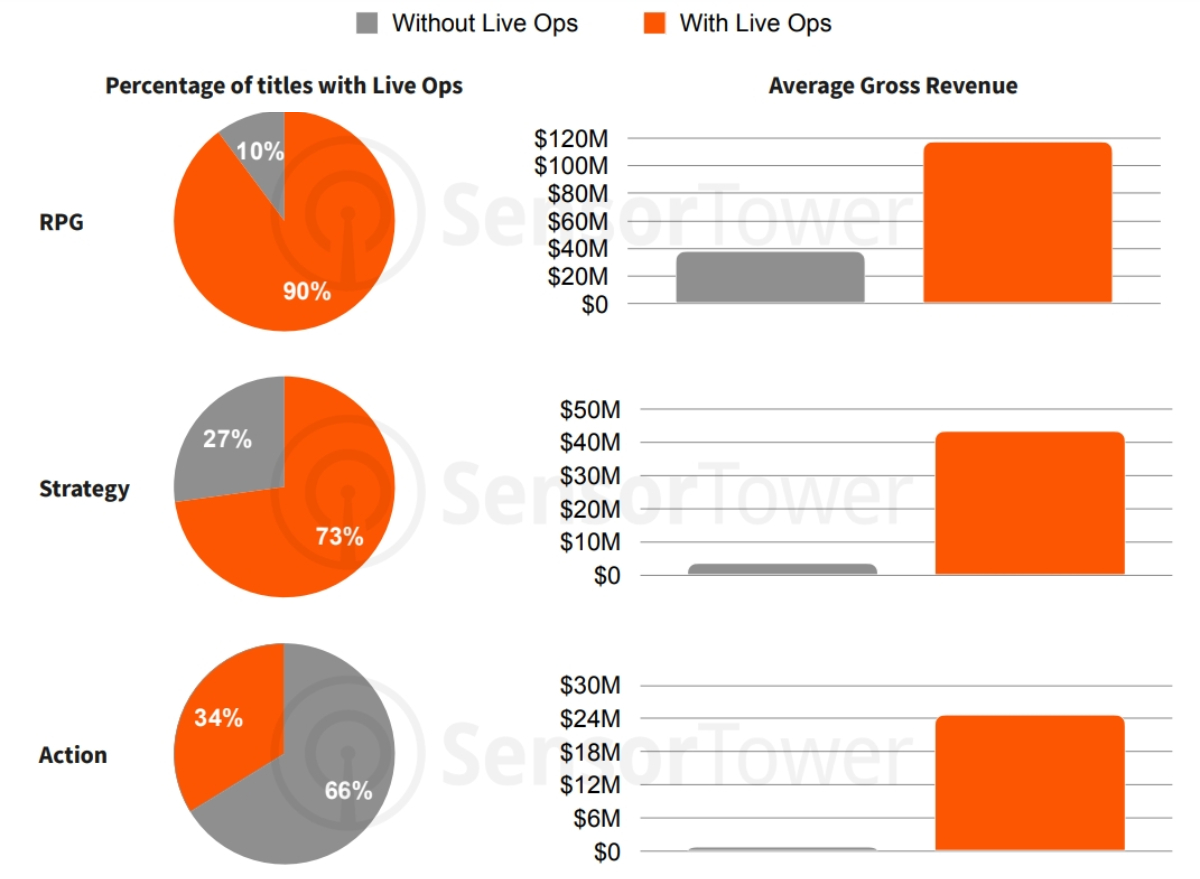

- The Games-as-a-Service model has become the key monetization and retention tool for highest-grossing mobile games. Every title in the top 10 games by revenue is supported through LiveOps.

- LiveOps is featured in 90% of highest-grossing RPGs. While only 34% of action games on mobile are supported through LiveOps, titles with this monetization strategy generate 30 times more revenue on average than games without it.

- Only 15% of mobile games feature loot boxes. But these titles account for 73% of worldwide revenue.

State of the global mobile games market

- Global mobile game revenue has been declining since peaking in the third quarter of 2021. Player spending fell 14%, from $22 billion in Q3 2021 to $18.9 billion in Q4 2022. However, it is still above pre-pandemic levels.

- Tencent’s Honor of Kings became the highest-grossing mobile game globally again. It dethroned PUBG Mobile, another hit from the Chinese tech giant, that had topped the charts for the two previous years.

- Other titles in the top include Genshin Impact, Candy Crush Saga, Roblox, Pokemon GO, Three Kingdoms Tactics, Uma Musume Pretty Derby, and Fate/Grand Order.

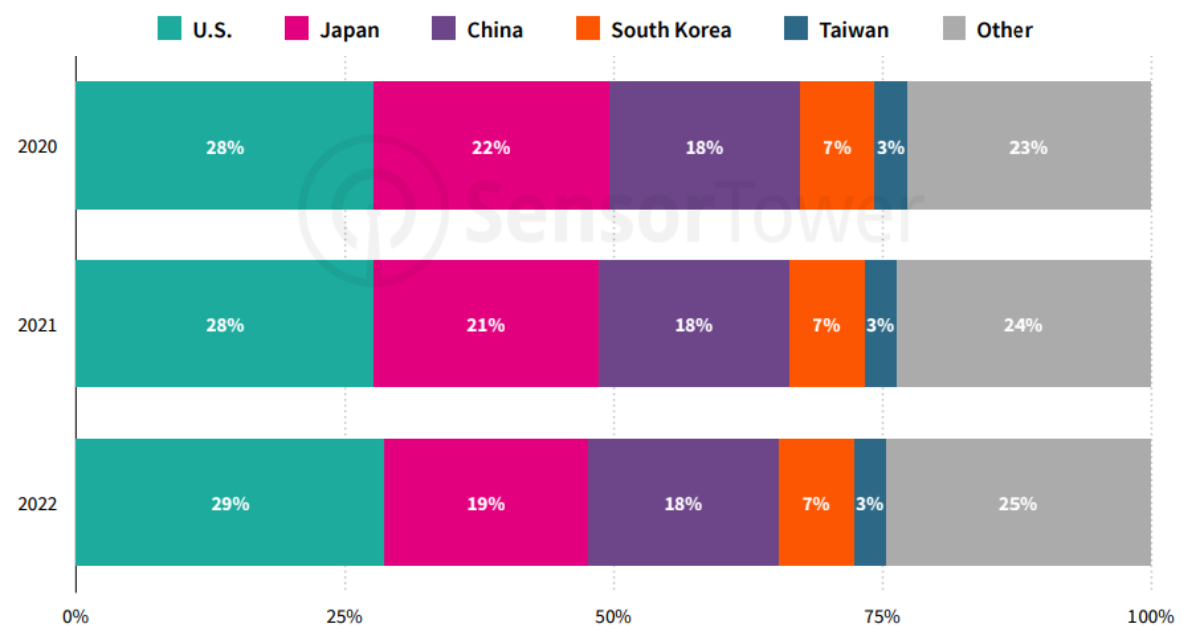

- Despite a 6% decline, the US remained the number one country by revenue. In the fourth quarter of 2022, China became the second largest market due to Japan’s 22% year-over-year decline.

- The US accounted for 29% of global player spending last year, followed by Japan (19%) and China (18%).

- Subway Surfers was the most downloaded mobile game of 2022, followed by Free Fire, Stumble Guys, Roblox, and Ludo King.

- India accounted for 17% of all downloads globally, followed by the US (8%), Brazil (8%), Indonesia (6%), and Russia (5%).

More information, including data on specific regions, external game subscriptions, and NFT titles, can be found in the full report.