The most downloaded hyper-casual games of the 1st quarter of 2020: Dmitry Kuratnik's research

It is generally assumed that hyper-casual projects have a short life span. However, they have been actively assembling installations for much longer than three months. This conclusion was made by developer Dmitry Kuratnik, analyzing the most downloaded hyper casual titles for January-March. He shared this and other observations in the column-research for App2Top.ru .

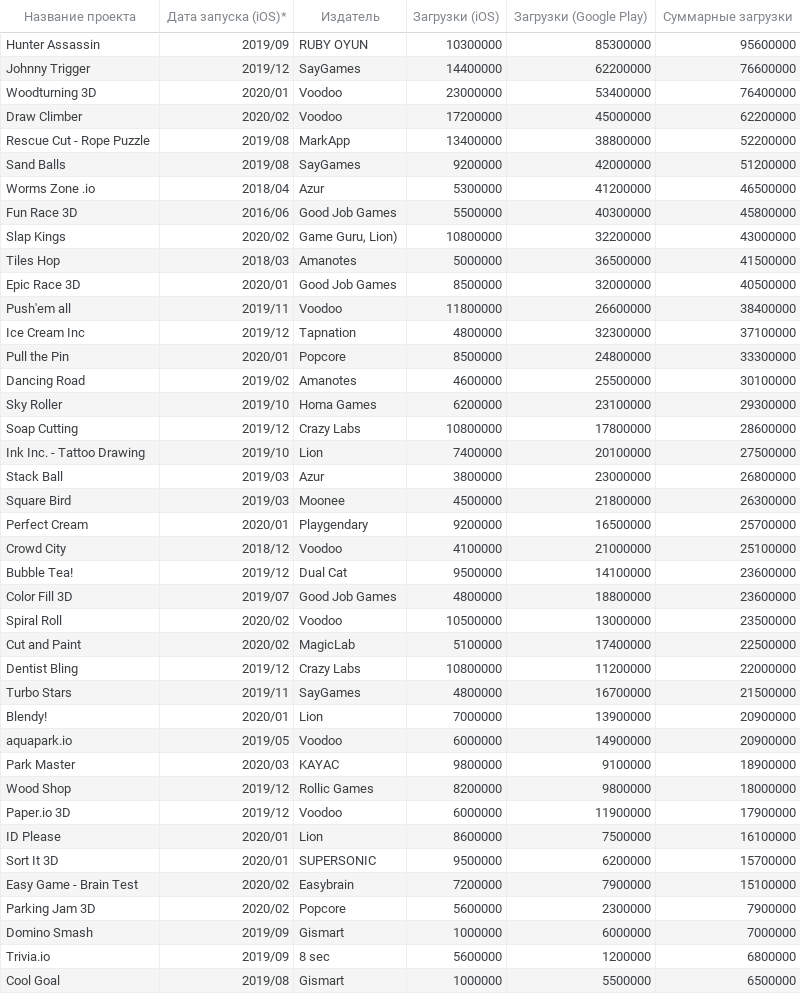

Dmitry KuratnikTop 40 most downloaded hyper casual games for January-March

Let’s look at the list of the most downloaded hyper casual games (hereinafter GC) in the first quarter (Q1) of 2020, and at the same time try to understand what is relevant at the moment and figure out what to expect in the future.

Analytics were collected using Sensor Tower. It may differ slightly from reality, but it shows the overall picture quite accurately.

I should immediately note that there are quite a lot of games in the top that were released before 2020. This refutes the myth that GK games have a small lifetime and only live for 1-3 months. We will talk about this in more detail later, and now I suggest moving on to the table and studying it carefully.

*Please note, the release date is the date of the worldwide release on the iOS platform, as it is currently the key for the GC.

1) The list includes 40 games from 22 publishers. On average, the publisher accounts for 1.8 games per quarter.

2) If we consider only those games from the top that were released in 2020, we get 14 games from 10 publishers. On average, 1.4 games per publisher per quarter. This indicates a very high competition and a great difficulty in entering the market.

3) 14 games out of 40 belong to three leading publishers: SayGames, Voodoo, Lion.

4) Only 6 games in the quarter have a total (Google Play + iOS) of more than 50 million installations. Of these, 2 games from SayGames and 2 from Voodoo.

5) 22 games have more than 25 million installations for Q1 2020.

6) In the first quarter of 2020, 28 publishers generated more than 10 million new installations from all their games. Of the 28 publishers, 22 have games in the top.

7) Important: of the 40 games reviewed, there are only 14 new games, and as many as 26 titles have been released until 2020. This is a very important point for several reasons.

- Firstly, as I have already written, it dispels the myth that the GC has a low lifetime.

- Secondly, it once again underlines the high competitiveness of the market and the complexity of releasing new hits.

- Thirdly, following from the first two points, it can be assumed that in the future it will only be more difficult to work with GC, because tops will be filled with old games. In other words, new games will have to compete not only with new products, but also with a large library of old projects.

8) 4 games out of 40 were released before 2019.

9) 1.27 billion installs are on Google Play and 950 million are on iOS. Google Play/ iOS ratio = 1.33.

10) The 14 games discussed above, released in 2020, account for 421 million installations (Google Play + iOS).

11) The 26 games discussed above, released before 2020, account for 846 million installations (Google Play + iOS).

Important: most installations are on old games, not on recently released ones.

12) If we consider the top 40 games by the number of installations, we can draw the following conclusions:

- only a few have more than 50 million installations per quarter (I call such games “super hits”);

- few games have more than 25 million installs per quarter (such games can be called “hits”);

- a good and successful game in the current market can be considered the one with more than 10 million installations per quarter.

Top 29 Most Successful Hypercasual Game Publishers for January-March

Now let’s look at the top 29 publishers of GC games as of the first quarter of 2020. The table below shows the total number of installations in Q1 2020 from all the publisher’s products.

*Those publishers who had no major new releases in the first quarter of 2020 are highlighted in red.

Conclusions and patterns drawn from the above table:

- Top 3 publishers: Voodoo, Lion, SayGames;

- 8 publishers did not have major releases in Q1 2020, but at the same time they have quite a lot of new installations at the expense of old products;

- 4 publishers received more than 200 million new installations in the quarter;

- 9 publishers received more than 100 million new installations in the quarter.

As a bonus, I share a link to Google-a table with source data, a copy of which you can make yourself, so that you can then independently process the data at your discretion, look for additional patterns and draw your own conclusions: https://cutt.ly/7yY6jHN .

Also on the topic:

- From December to March, downloads of hyper casual games increased by 103%AppMagic: the most downloaded and highest-grossing mobile games in May 2020

- “The average Voodoo hit brings $1 million to the developer”: AYA games about the hyper-casual games market

- Is there any news?

Share it with us, write to press@app2top.ru