Is it worth taking up the development of merge games? Analysis from AppMagic

In May App2Top.ru published his own analysis of the merge-games market. Not all market participants agreed with our conclusions at that time. The answer to that material can be considered the current AppMagic study. Its authors look at the prospects of the genre differently.

Olga Sobolevskaya and Maxim Samorukov

Since the release of Merge Dragons! (and as new hits in the merge genre appear) in the community of mobile game developers, conversations about this direction do not stop.

We became curious, what is the reason for such enthusiasm? And is the idea of developing a merge game so attractive today?

To find out, we studied the market of these games, and also talked with six experts in this niche:

- Egor Pavlyuk, the leading business development manager of AppQuantum;

- Alina Zlotnik, producer of AppQuantum;

- Sergey Belkov, former senior game designer of EverMerge, one of the most successful games in the genre;

- Maxim Babichev, CBDO in Green Grey;

- By Rustam Batyrkhanov, CEO of Happy Games Studio;

- By Andrey Chaika, CEO of 4Enjoy studio.

How to understand the boundaries of the Merge genre? What about hybrid games?

To begin with, it is important to decide which projects we consider to be merge games?

It is clear that we refer all projects with merge core mechanics to the genre.

At the same time, it is not obvious whether projects of other genres, where elements of merge mechanics are used, should be considered as merge games. Let’s recall, for example, Top War, Gold & Goblins or Rush Royale.

In Top War, the merge mechanic performs the function of keeping the player at an early stage, it is designed to increase early retention. However, in endgame, the user plays the most ordinary 4X strategy.

As for Rush Royal, it is rather a mix of Clash Royal and classic representatives of the Tower Defense genre. In it, a strong strategic component coexists with the need for direct control. As part of the core gameplay, the player fights the enemy through the management of many units. The game, rather, it makes sense to refer to RTS (real-time strategy) than to merge. At the same time, yes, merge elements are present in Rush Royal core gameplay. However, this does not change the fact that the game is essentially RTS.

Adding merge elements to games of other genres is an interesting trend. According to many of our speakers, it has commercial prospects. But we did not take into account such projects in our study. It is more logical to refer them to completely different genres.

Important: One of the key characteristics of merge mechanics is its high addictiveness. Therefore, it is not surprising that it (or its elements) are used together with strong monetization solutions and retention meta in other genres.

Simple and complex merge games

When analyzing the market indicators of the genre, first of all, we always pay attention to the following parameters:

- niche size;

- its dynamics;

- degree of monopolization;

- heterogeneity;

- availability of new successful titles.

Also, if we want to get a correct assessment of a niche, we need to be sure that the applications in it are homogeneous in their key characteristics:

- cor-mechanics;

- meta-gameplay;

- target audience.

Starting from the latter, we are faced with the fact that there are two large homogeneous groups of projects in the niche of merge games. We are talking about merge games with and without meta.

Games from one group are incomparable with games from another neither in terms of development costs, nor in terms of user engagement strategy, nor in terms of mechanics, nor in terms of business metrics.

- Merge without meta (they are also “simple merge”) are, as a rule, minimalistic puzzles without any seriously developed goal—setting system, narrative and leveling.

- Merge with meta are serious big products that are difficult to develop and have huge commercial potential.

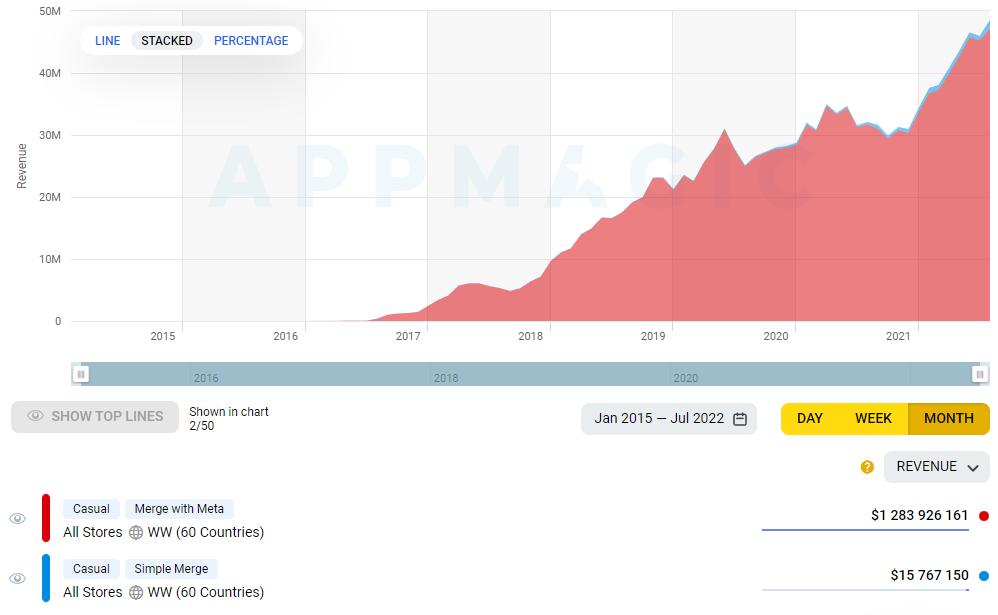

Simple merge games (games without meta) have practically no IAP revenue.

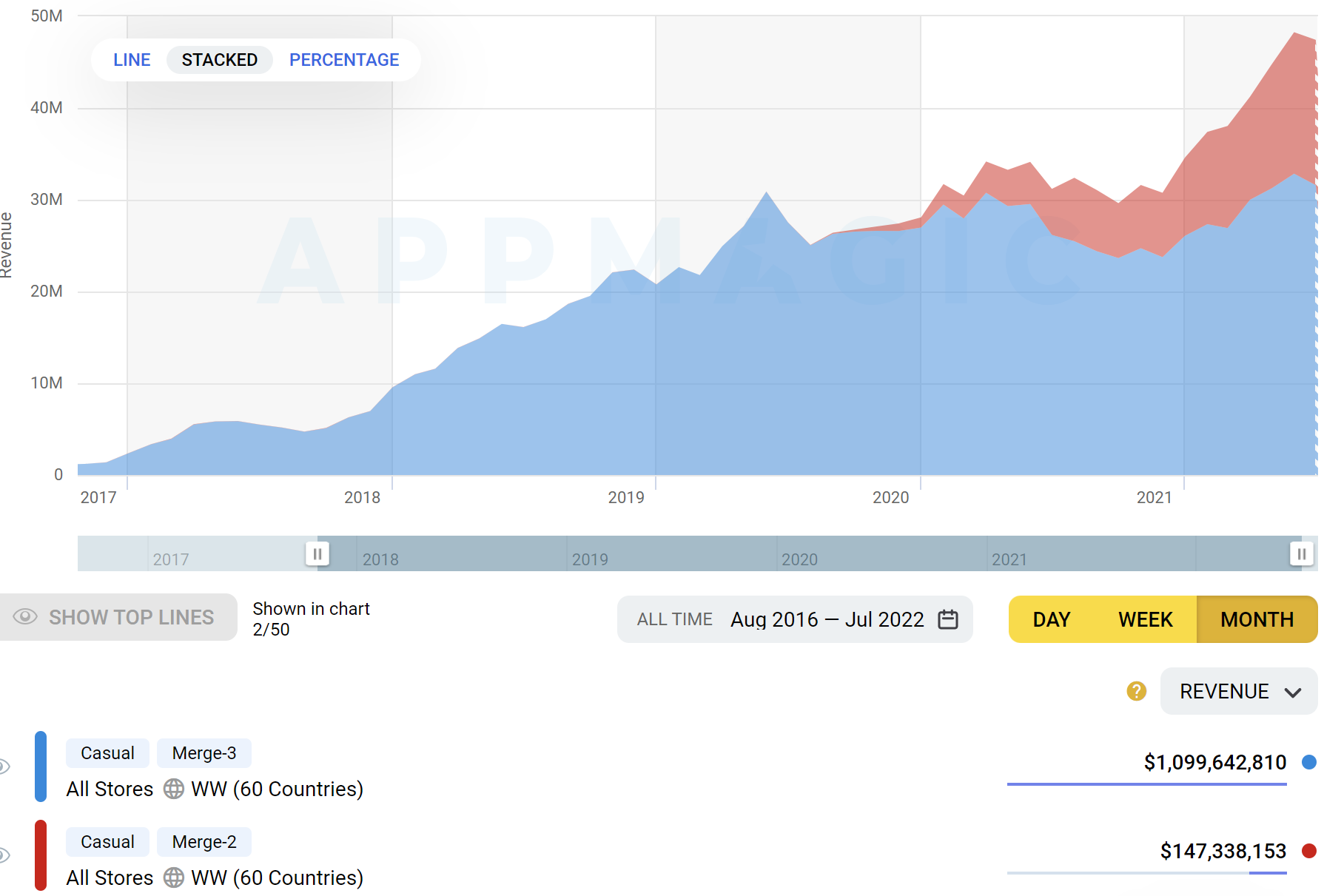

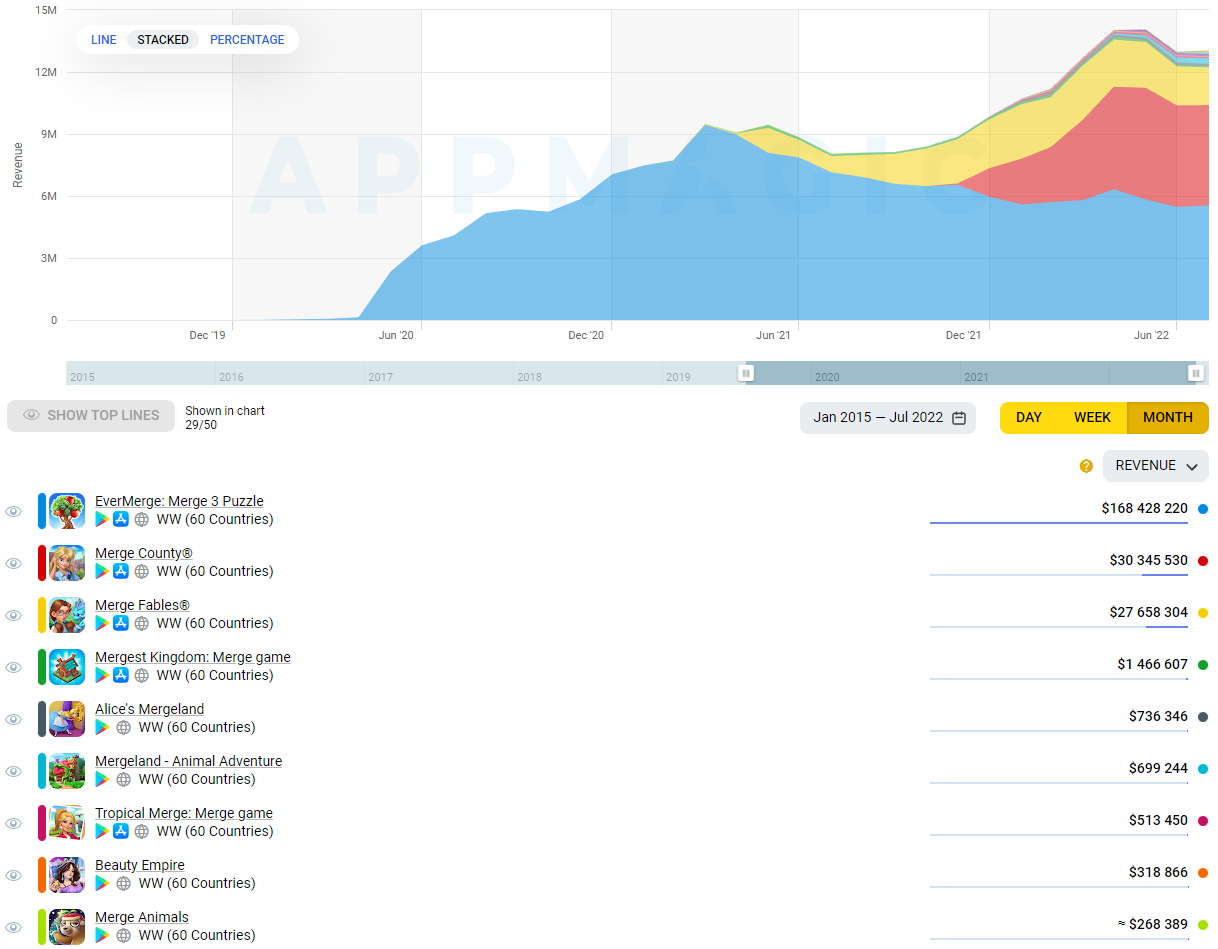

Comparison of revenue from IAP merge games with meta (red color) and merge games without meta (blue color)

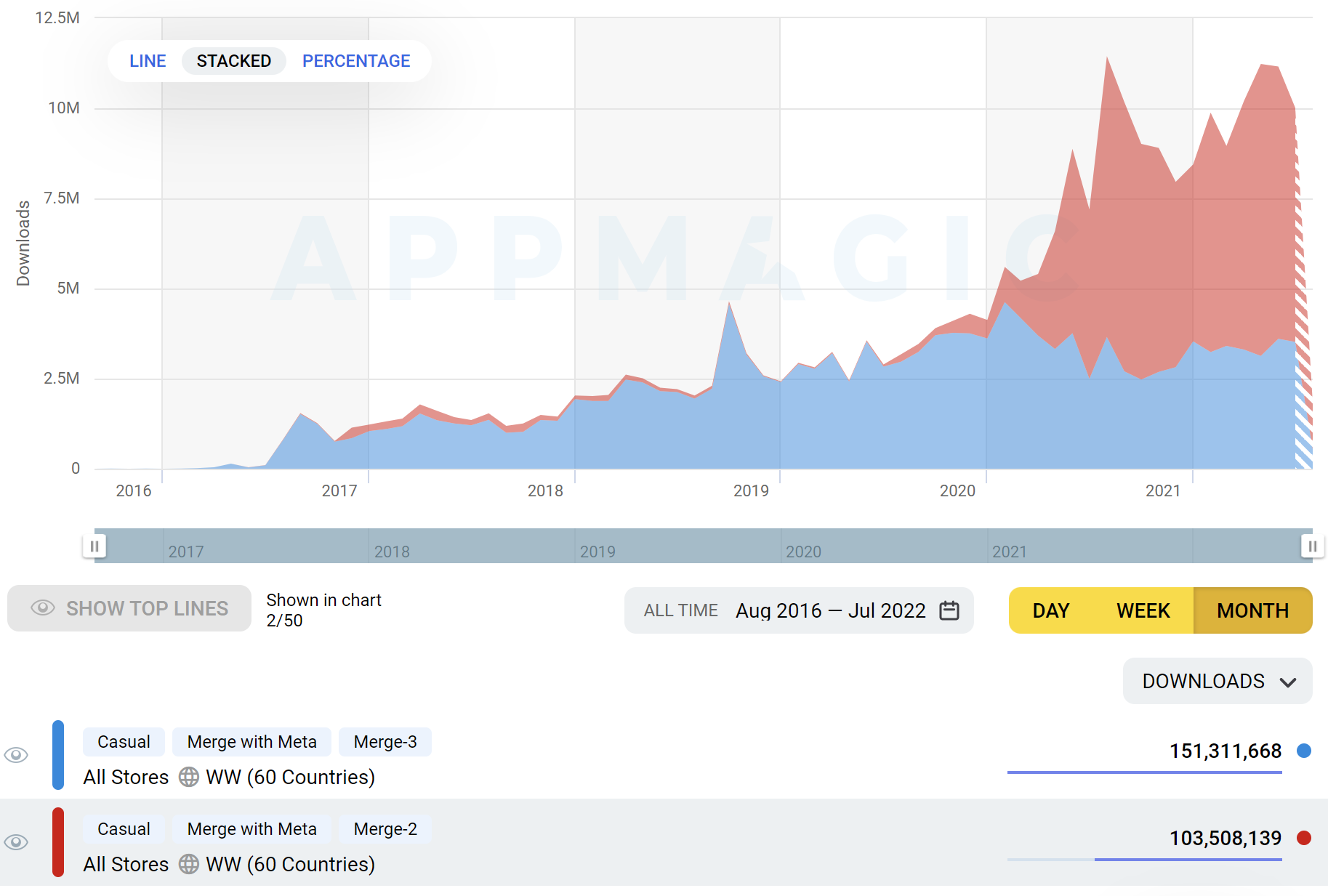

However, in terms of installations, merge games without meta are twice as fast as merge games with meta.

Comparison of the number of installations for merge games with meta (red) and merge games without meta (blue)

Most simple merge games resemble classic hyper-casual titles by their device. They often show full—screen ads, they have minimalistic gameplay.

Accordingly, the market for such projects resembles the market for hyper-casual projects. It is extremely dynamic. Games are constantly appearing and disappearing here. Only very few manage to stay for a long time.

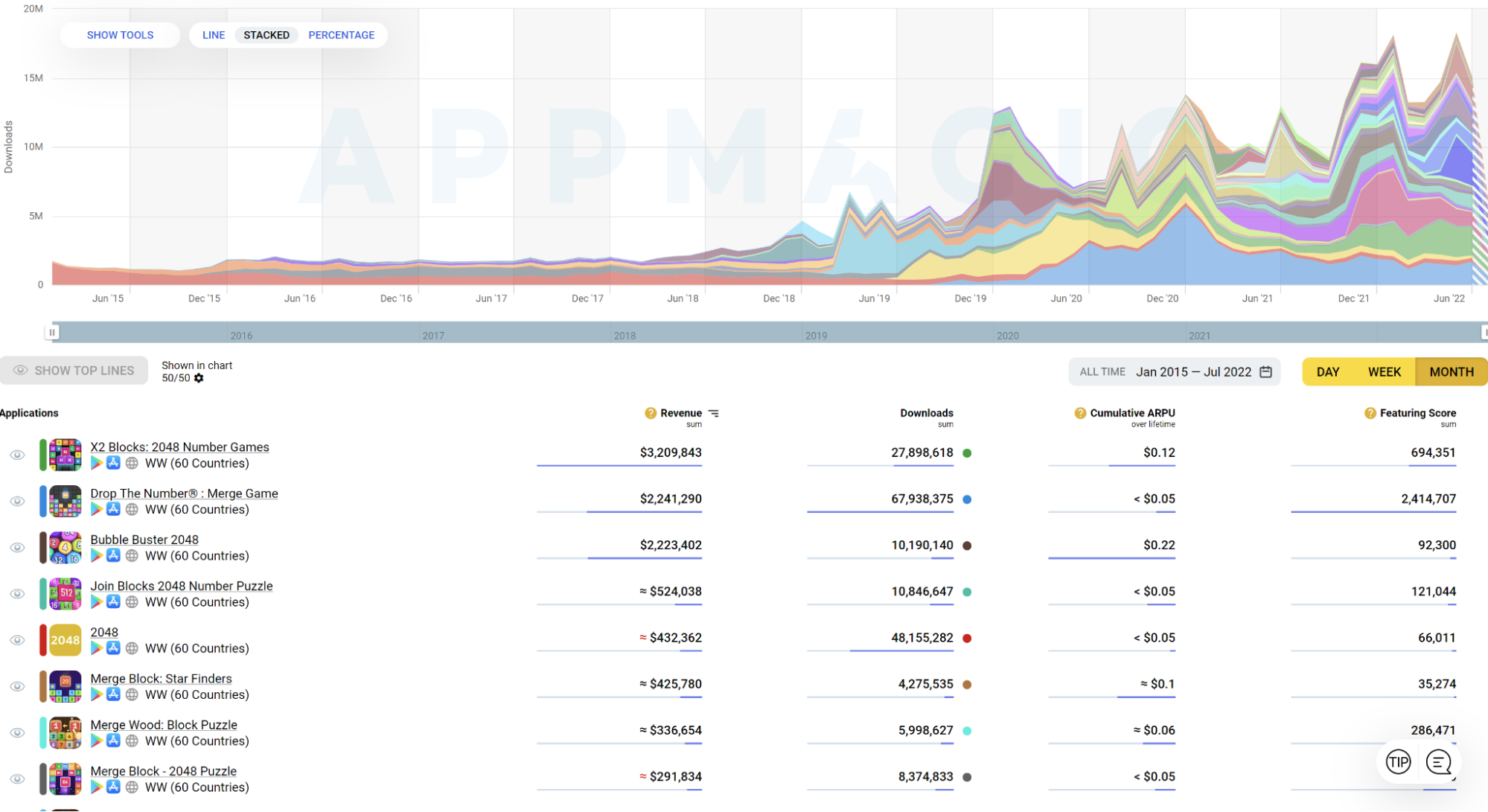

Dynamics of installations of simple merge games

Since simple merge games in their essence (in terms of game design, monetization, production complexity, lifecycle, and so on) are very similar to hyper-casual titles, they are not of interest to us now.

Merge games with meta are a completely different matter. Actually, by merge they are primarily understood today.

Merge-2 and merge-3

Merge games with meta are usually divided into merge-2 and merge-3 (in the first case, in core mechanics, two elements must be combined to create a new item, in the second – three).

This approach is legitimate, because, as a rule, merge-2 and merge-3 games differ from each other not only in core mechanics.

- In merge-2, the core and meta are separated. Meta-gameplay exists outside of the main playing field and is related to core gameplay only economically (at the balance level). One of the consequences of this organization of the game is the ability to easily make adjustments to the meta or even replace it with another. In merge-3, meta is combined with core gameplay. They are simultaneously present on the playing field and are deeply tied to each other.

- Most merge-3 games are more correctly called merge-5. The fact is that combining three elements gives one element of the next level. At the same time, the combination of five elements gives two items of the next level. This motivates users to combine items five or more at a time whenever possible. So the core gameplay of games in the merge-3 genre has become more about the effective management of items on the field than about the merging of elements.

- In merge-2, the field is usually of limited size and fits into the screen. In merge-3, the main playing field is usually larger than the screen and it needs to be “explored”.

- In merge-3, there are characters on the playing field. The type of interaction with them may vary greatly from game to game, but their main function is the same: they are necessary to open new territories of the playing field.

- Gaming sessions in merge-3 are usually longer than in merge-2. They are also differently structured. The player can prolong the game session by switching between different gameplay elements or optimizing the location of objects on the playing field. Successful representatives of merge-3 are created so that the player has the opportunity to stay in the game as long as possible. This approach works well for long-term retention. As a result, the core gameplay of merge-3 is more complex and diverse. At the same time, the retention of the first days of merge-2 is higher.

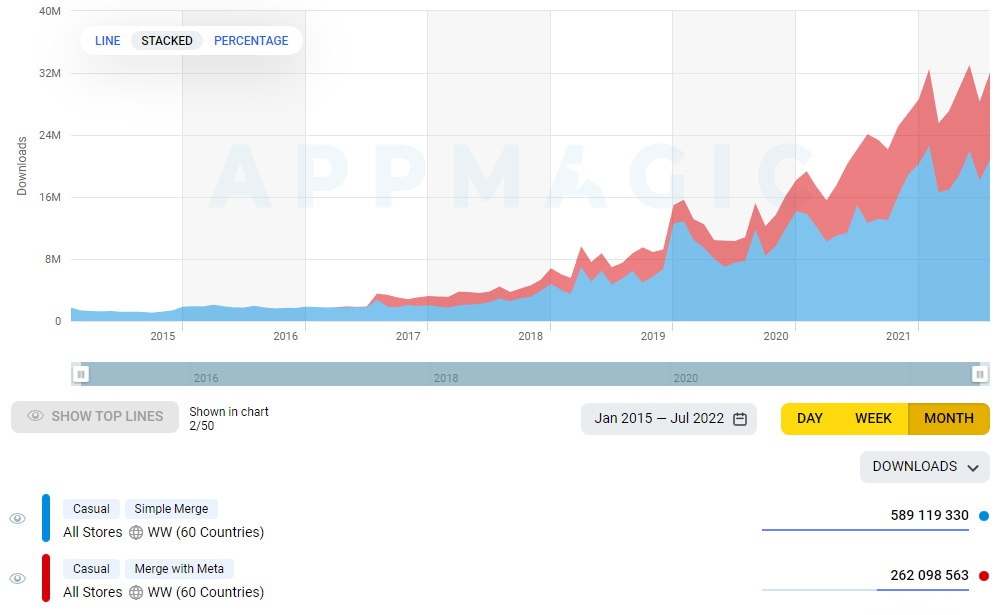

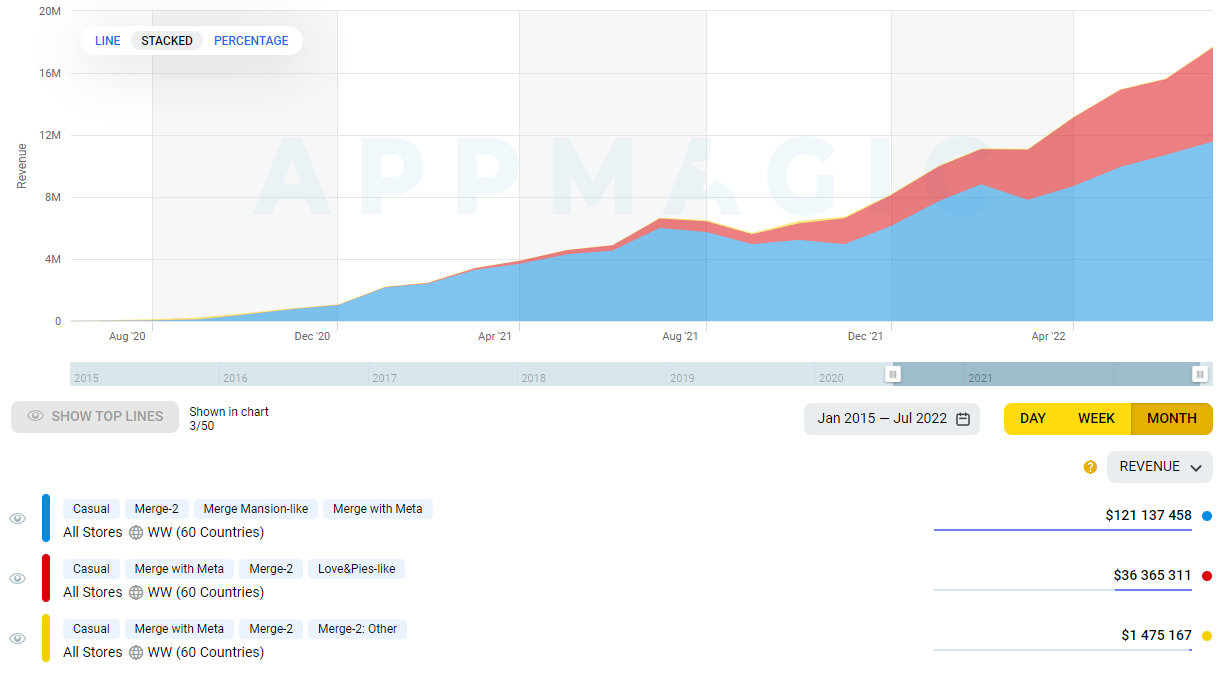

The level of IAP revenue at merge-3 is significantly higher than at merge-2.

Revenue dynamics of merge-2 and merge-3

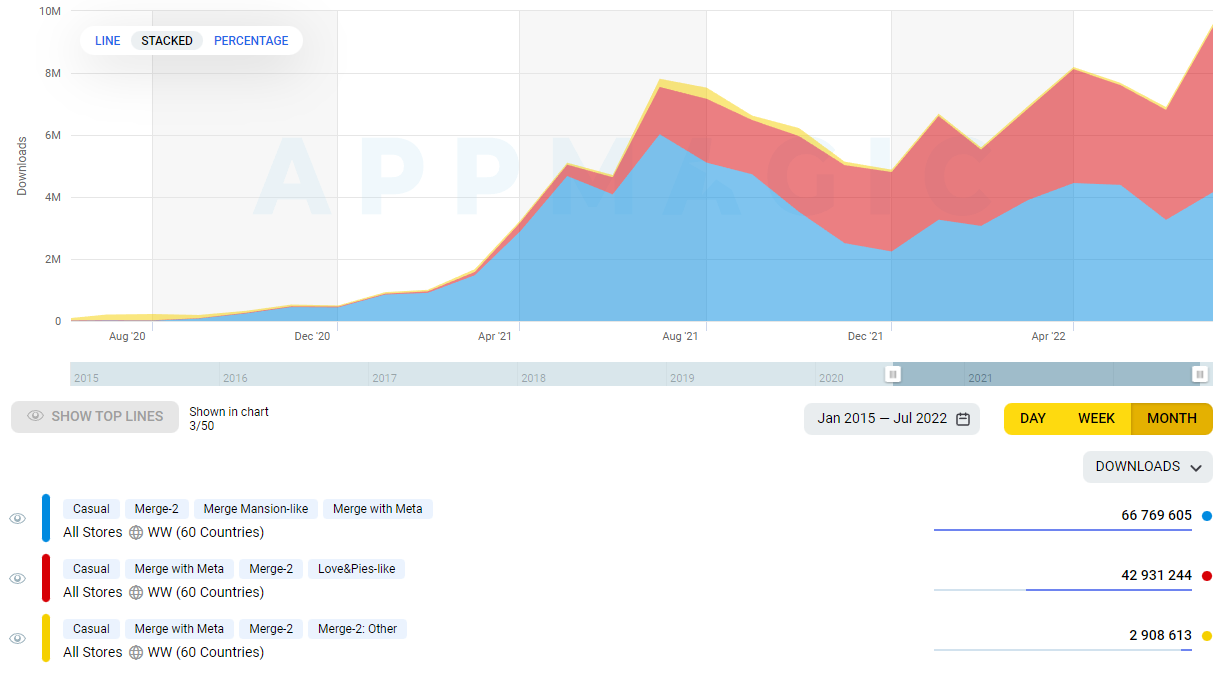

At the same time, games with merge-3 generate fewer downloads.

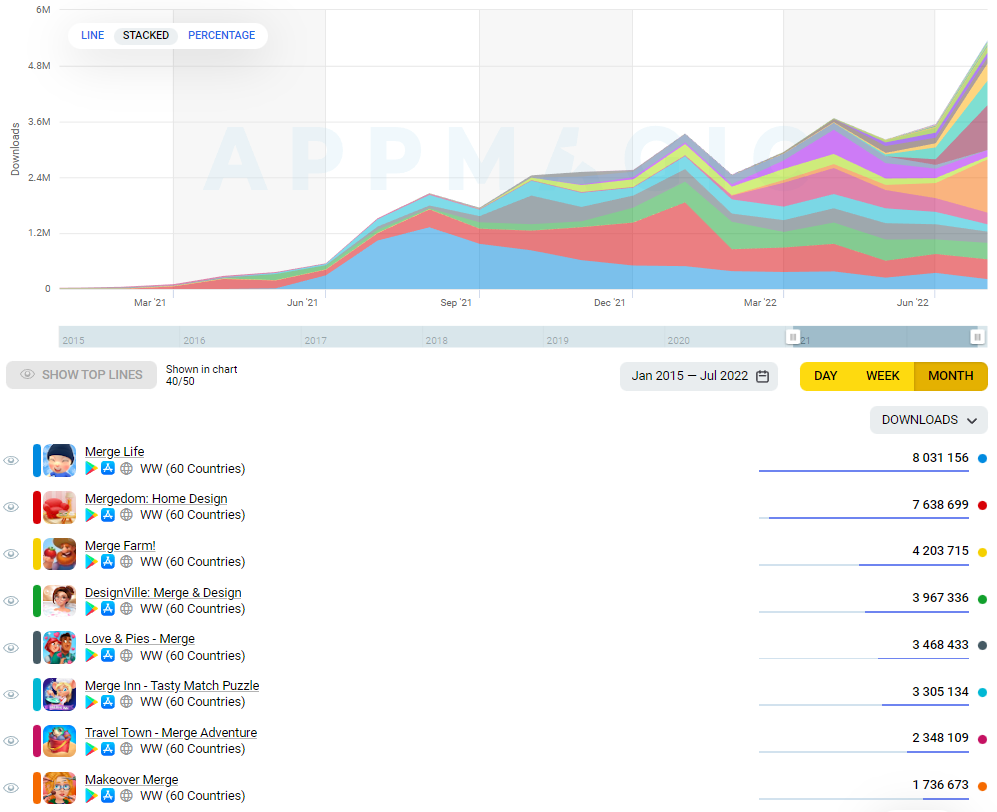

Dynamics of merge-2 and merge-3 downloads

Together, this determines the colossal difference in LTV IAP between merge-2 and merge-3: $1.4 versus $7.4 (world) and $4.2 versus $17 (USA).

It would seem that now we have homogeneous subsets and we can start studying the resulting subgenres, right? And here it is not!

Merge-3

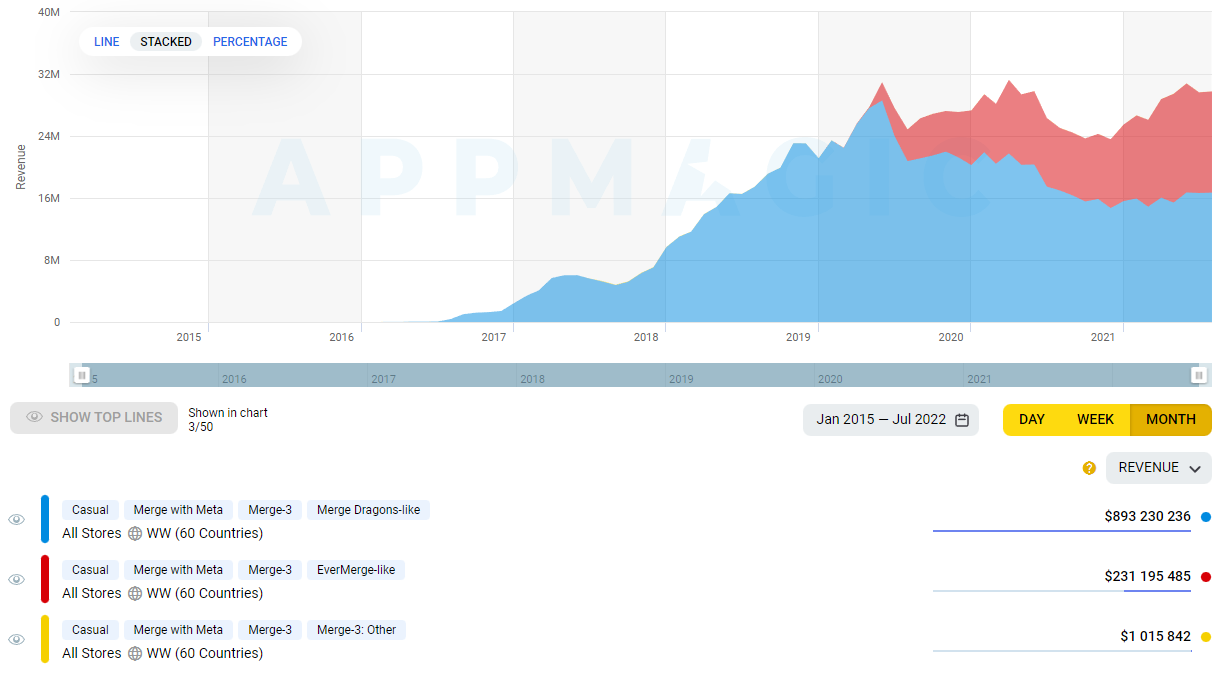

Merge-3 forms two subsets of very similar games.

The number one group is the ideological heirs of Merge Dragons!, the first merge blockbuster. All games in this group (hereinafter MDL or Merge Dragons!-likes) how twins look like each other.

The second group is the ideological heirs of EverMerge (hereinafter EML or EverMerge—likes), which are also extremely similar to each other.

At the same time, there are significant differences between the games of these two groups.

- In MDL, in addition to the main location, there are levels, as well as restrictions on their passage (for example, time limits or the number of moves). This works for monetization, forcing users to purchase boosters or additional attempts to complete levels. There is nothing like this in EML or any other type of merge games.

- MDL also has the mechanics of reviving the dead earth with the help of special characters (usually dragons). The player discovers new territories as these creatures accumulate and merge.

- There is nothing similar in EML games. Instead, in EML, new territories are opened with the help of rare elements (EML resembles “farms” in this aspect).

- In addition, each of the groups (MDL, EML) has its own set of unique mechanics.

There is also a third merge-3 group. These are all the games that were not included in the first two groups. There are not so few titles in this group, but their combined performance is small.

Dynamics of merge-3 downloads (MDL, EML and others)

Merge-3 revenue dynamics (MDL, EML and others)

In other words, successful game concepts, alternative to Merge Dragons! and EverMerge, not in this segment.

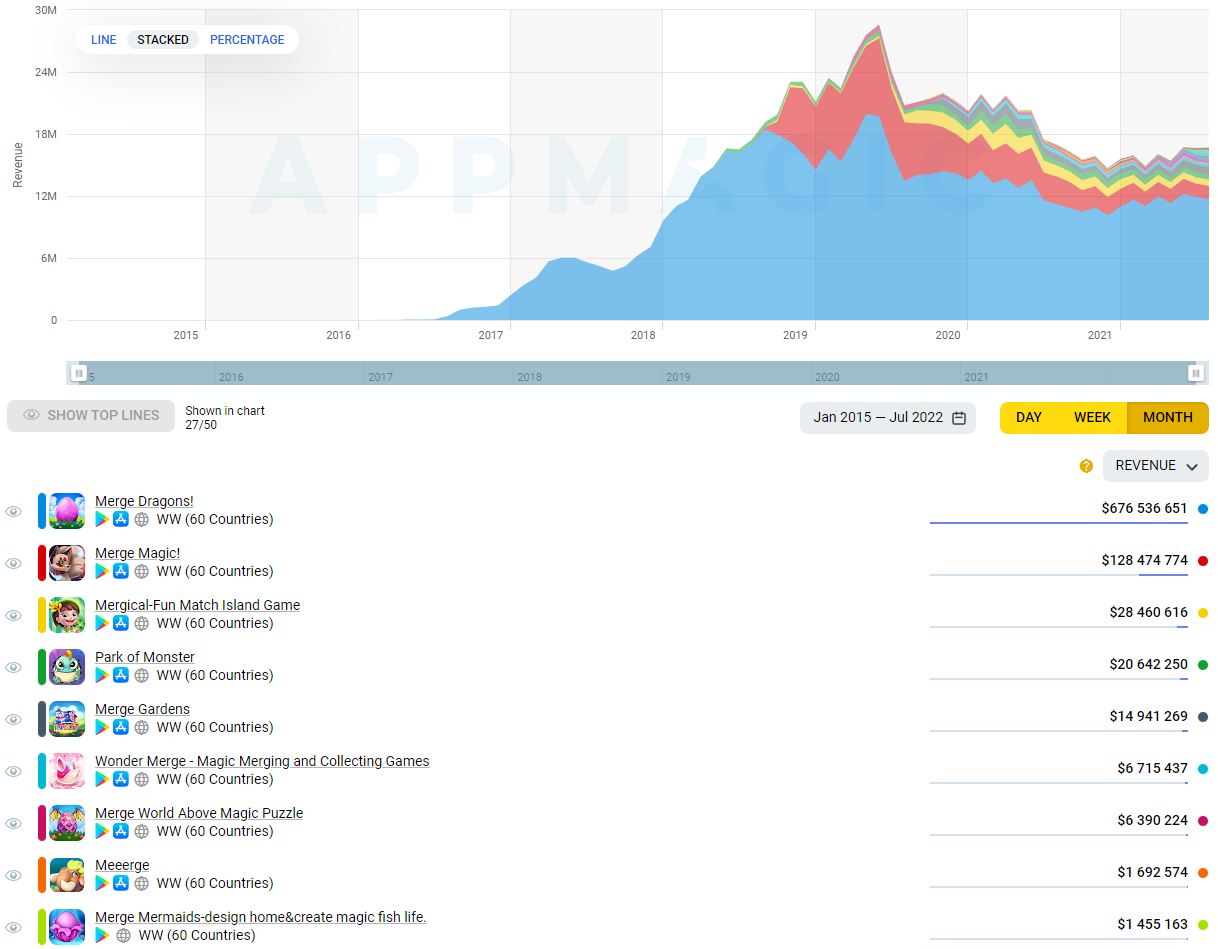

Merge-3 — MDL

Let’s take a look separately at the first group — MDL.

MDL revenue dynamics

Dynamics of MDL downloads

What does the market data tell us?

Let’s start with the fact that MDL is a subgenre with a high average LTV, so first of all you need to look at the Revenue indicator.

The two biggest games of this subgenre are Merge Dragons! and Merge Magic! — developed by Gram Games studio. Both titles were released more than three years ago. Since then, there have been no new games that have achieved a similar level of success, although many have tried.

The cumulative number of MDL downloads is constantly decreasing. This indicates that the subgenre is currently unable to compete for users with other subgenres (and genres in general) with the same target audience.

It cannot be said that new games in the niche do not earn anything. Among them there are titles that earn significant amounts (in the region of $ 200-600 thousand per month). However, their revenue is not growing, and the projects themselves, apparently, are experiencing difficulties with attracting users.

The revenue values of even the most successful new releases in this subgenre do not look like the limit of dreams for most studios. At the same time, the development of a high—quality game in the spirit of Merge Dragons is not the cheapest enterprise. According to the estimates of our interlocutors, it takes about a year of work by a team of 15-20 people to bring the game to the softlonch (without taking into account its scaling for operation and marketing after launch).

We can conclude with a certain degree of confidence that at the moment the evolution of MDL games has reached a dead end:

- the market has not seen new successful ideas for several years;

- there are no new big successful titles either;

- market leaders do not replace each other.

Such market markers indicate that it is very dangerous to enter the genre.

Our interlocutors also did not express any enthusiasm about this subgenre.

Merge-3 — EML

Let’s move on to the second merge-3 group.

EML revenue dynamics

Dynamics of EML downloads

Games of this genre, as well as MDL, are characterized by high LTV. The revenue graph shows that 99% of the money comes from three games, while the rest of the games do not earn.

Can this be explained by the fact that the genre is young? Or the quality level of most titles?

No.

There are plenty of high-quality releases in this subgenre, but there are practically no successful ones.

Nevertheless, the presence of two new very successful followers of EverMerge, who appeared literally in the last year and a half, signals that there is a place for new players in the market.

What about the evolution of the genre?

The most obvious change in the genre is that Merge County, the newest of the three market leaders (and, it seems, the most promising), has changed the traditional setting for this subgenre from Fantasy to Real Life. The latter is traditionally considered a good solution for expanding the target audience. Usually, if an extremely successful and well—established reference setting already exists in the genre, the decision to choose another one is considered quite risky. Apparently, in the case of Merge County, the risk was not in vain.

But is it worth taking up work on EML now?

Our interlocutors admit that for a relatively large company that can afford relatively high costs for developing high-quality EML, creating such a game makes sense.

By relatively high costs, we mean the 15-20 people mentioned earlier who will work on the game for at least a year before the softlonch. After that, the team will have to be at least tripled.

Merge-2

There are also subgenres in the merge-2 niche. There are also two of them.

The first subgenre is the ideological heirs of Merge Mansion, the super hit of Metacore Games studio (we will call this type of games — MML or Merge Mansion-likes)

The second subgenre is games similar to Love & Pies from Trailmix (hereinafter LPL or Love & Pies-likes).

The most significant difference between MML and LPL is the ordering system.

In MML, meta puts the order before the session. The player performs it in the core gameplay. The reward for completing is the items needed for further progress.

In LPL, the system works a little differently. The order is placed in the core gameplay itself. Order fulfillment is rewarded with gold. And already the player spends gold in meta for further progress.

The release of content for the LPL is better controlled. Moreover, in such titles, the rate of content consumption is lower.

Important: tasks in merge games are not only a goal-setting tool. They also serve as a tool for removing unnecessary/interfering objects from the playing field. The high rate of content consumption, characteristic of MML, forces game designers:

- reduce the number of times a player can combine items within a free session;

- to increase the recharge time of emitters (from which elements for merging fall out).

All this often leads to the fact that the game becomes very “greedy”, and the game session is disappointingly short.

As in the case of merge-3, a third subset can also be distinguished in merge-2. It includes all titles that are not included in the first two groups. And, again, there are quite a lot of such projects, but their cumulative results are very insignificant.

Merge-2 revenue dynamics

Dynamics of merge-2 downloads

As for the complexity of creating merge-2, then, according to all our interlocutors, it is relatively small. A team of 8-12 people will be able to bring the game to the softlonch in 6-9 months.

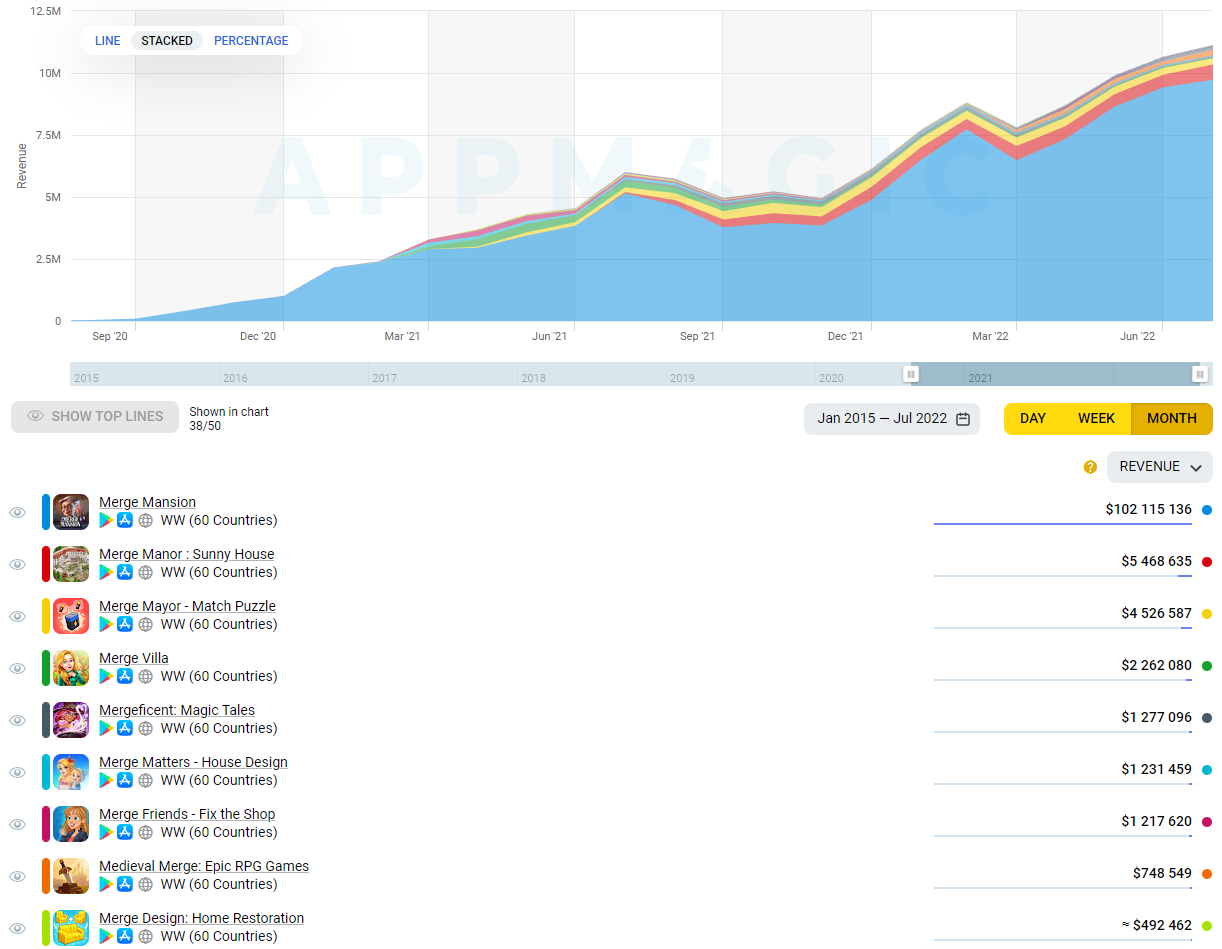

Merge-2 — MML

Merge Mansion completely dominates the MML segment. The game has no competitors in the niche.

Revenue dynamics of MML

Dynamics of MML downloads

By the way, in 2021 Metacore, the developer of Merge Mansion, released two new MML games. They did not become successful, despite the apparent advantages of the company (experience, financial resources).

Because of all this, MML does not look like an attractive direction.

But the question remains: how did Merge Mansion itself become so popular and why do its indicators continue to grow?

The same Merge Mansion

There is quite a lot of talk on the sidelines about the astronomical amounts that Metacore invests in game traffic. There is an opinion that the game will not be able to recoup them.

Is there any way to shed light on this issue?

As it turns out, yes.

There is a register of Finnish companies Finder.fi . On it, you can get acquainted with the financial statements of any company registered in the country (an analogue of the domestic Rusprofile).

According to Metacore, financial indicators for the last four years are available on the site.

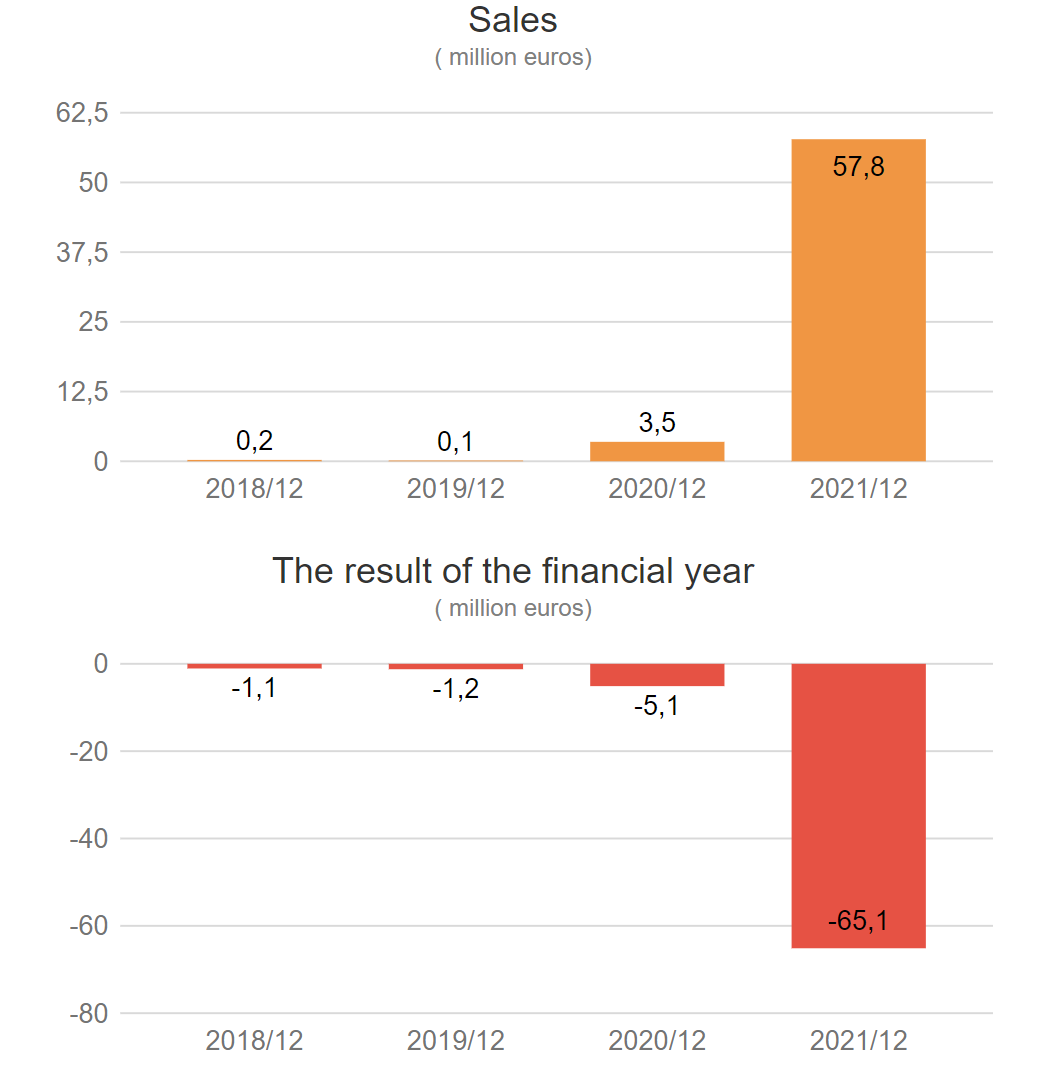

Metacore Sales and Profit/Loss

Metacore Registration Data

Turnover, EBITDA, profit and number of Metacore employees

According to Metacore reports, when developing Merge Mansion, the studio employed from 11 to 15 employees. According to the Metacore release grid, we can see that at that time the company was also developing and supporting other titles.

Moreover, we see that in 2019 the total expenses of the company amounted to €1.1 million. Taking into account that in 2019 Metacore already had several games released on the market, a certain part of this money had to go to marketing.

It is more difficult to analyze 2020. At the end of this year, Metacore began scaling Merge Mansion. Accordingly, the company’s total expenses have increased dramatically. Because of this, we can no longer even estimate their development budget approximately. However, it should be noted that by the end of 2020, when Merge Mansion had already become noticeable on the market, the company still employed no more than 15 employees.

It seems to us that this just shows how much it takes to develop a game of this level. Of course, the company involved outsourcing. But it was hardly about significant volumes.

From the reports, we can also conclude that during the period of active scaling of Merge Mansion, personnel costs were negligible compared to marketing costs. According to the results of the period from 2020 to 2021, the latter reached €130 million. During this period, the game earned approximately €61 million.

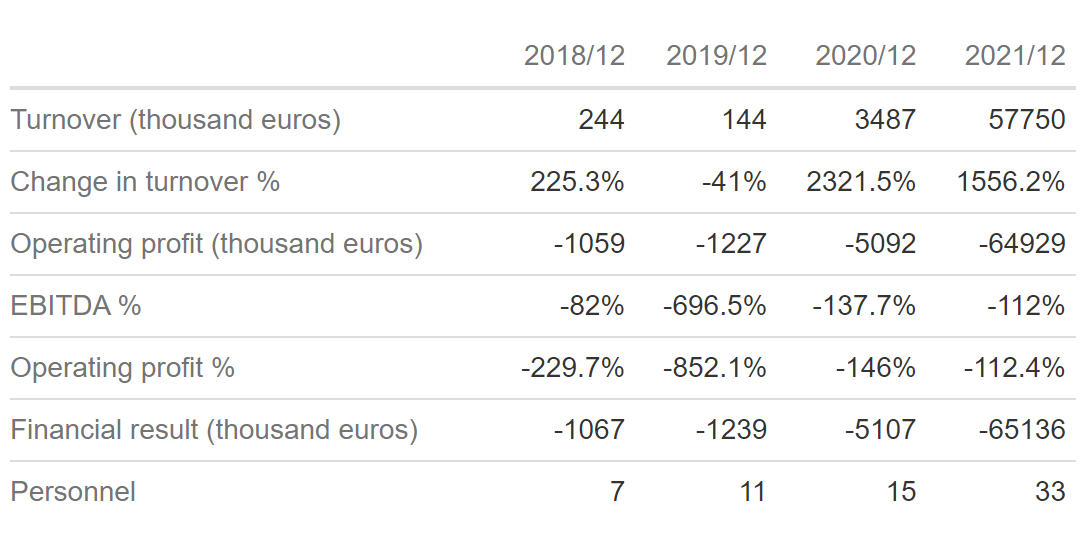

Net IAP revenue of Merge Mansion from January 2020 to December 2021

At least, that’s how much is indicated in the company’s financial report. At the same time, we see that net IAP revenue for this period amounted to €47 million ($48.4 million).

Based on these two figures, we can calculate that the game’s revenue from advertising for two years amounted to around € 14 million, or 23% of the company’s total revenue.

According to the game data to date, the ROI (including revenue from organic traffic) for the first year of the user’s life (starting from the moment of his involvement) is approximately 70-80%. This is a fairly low indicator even for games with a very long life of the paying player (such as match-3, for example).

However, if we take into account the accumulation rate of cumulative RpD (revenue per downloads ratio), the current value of this indicator, as well as the IAA revenue rate calculated above (from advertising), we can say that Metacore’s investments in attracting users, which at first glance seem absurd, can pay off handsomely.

Now is the time to remember that Supercell is a partner and investor of Metacore. This company is behind an incredibly successful product line, some of which have provoked the emergence of new genres with their success. We can assume that the guys from Supercell know what they are doing.

To sum up, we believe that the secret of Merge Mansion’s success lies in the following:

- the game became a pioneer, its appearance created a new subgenre of games;

- the game has a very bold and risky marketing strategy designed to “play for a long time”.

Merge-2 — LPL

The titles of this group are less similar to each other than in the groups discussed above.

Applications of this subgenre are the “descendants” of MML. What distinguishes them from projects in the spirit of Merge Mansion, we have already mentioned a little above — a different logic for issuing tasks. At the same time, in other aspects, the projects of this group may also differ significantly from each other. At a minimum, this suggests that within this niche, new and unexpected approaches are still being accepted by the audience.

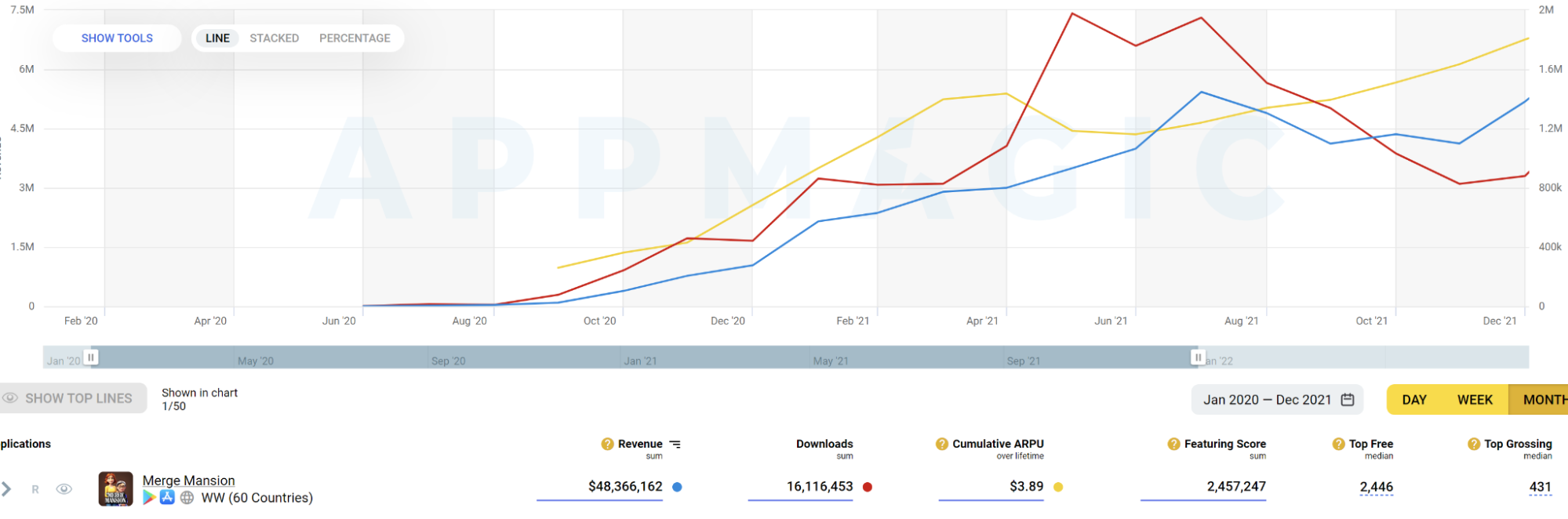

LPL revenue dynamics

Dynamics of LPL downloads

According to our interlocutors, the IAA revenue of a successful LPL accounts for 50% to 90% of total revenue. In other words, we can safely take the IAP revenue figures of these games and multiply them at least twice.

The question arises: what is the situation with games in the spirit of Merge Mansion? Is it really impossible to monetize them with advertising?

Can. However, the order system introduced in LPL is a very successful solution, which, it seems to us, is the future of the entire merge—2 branch of games.

Evolution of the LPL

Our experts also think so, despite the fact that in terms of total revenue, the LPL niche is still significantly behind the total revenue of MML (more precisely, one game — Merge Mansion).

Among the advantages of the genre are:

- extremely high level of early retention (retention of the first day is at the level of 50-60%, and in some early tests — all 75%);

- a broad target audience;

- a high degree of freedom in the choice of meta (it is here, as in match-3, separated from the core).

The latter allows you to introduce any well-established meta into games of the genre. From decorating in the spirit of Homescapes to choosing dresses and matching makeup as in Project Makeover.

In addition, today in the stores you can already find games designed for a midcore audience. For example, Medieval Merge.

Other innovations can be observed in the LPL. For example, the introduction of several simultaneous game fields (not tied to live-ops, but permanent); or the addition of emitters that need to be activated using elements obtained in the process of combining items.

Among the disadvantages of the genre are:

- the target audience of merge-2 largely coincides with the target audience of match-3, which greatly increases the CPI even in cases when the purchase is made with optimization for installations. The guys from AppQuantum said that for games of the genre on tangible volumes of CPM unwinding with install-optimised UA campaigns are at the level of $100-150 when targeting iOS in the USA.

- the retention of 30 days is not very high — about 10%, which is lower than that of merge-3 (around 15% for successful games).

What to keep in mind if you decide to do Merge

We asked our interlocutors from AppQuantum to give some tips to studios who are thinking about the possibility of taking up the development of a merge game. Here is their answer:

“The main council: you have to design the game with the expectation of a very long life of the player. It should be interesting for him to stay in the game for several years. This is the only way you can beat off the cost of expensive traffic. This implies that you need to prepare for a few things.

- At the endgame, you will have a lot of balance problems that will arise due to the fact that the player will continue to play all the time on the same board, on which objects, emitters, and everything that game designers will place on it during this time will accumulate for months and years. Simply put, over time, the endgame balance can turn into hell.

- If you are doing merge-2, you will need a very serious expertise in advertising monetization.

- You will also need expertise in live-ops. It can take a lot of time and money (perhaps too much) to figure out what works and what doesn’t. Therefore, cooperation with those who have a great relevant expertise can be a good solution.

Moreover, of course, you will need a lot of resources to scale success and maximize ROI: deep personalization of monetization solutions, powerful product and marketing analytics, a purchasing team, a team of advertising creative developers, and so on.”

Conclusion

We asked each of our interlocutors if they would advise us to start creating a merge game in a small or medium-sized studio today.

The answer was about the same for everyone: merge-2 is much more interesting than merge-3 in terms of the ratio of possible risk to possible reward (especially if the team is ready to offer new ideas when working on meta and monetization). Our interlocutors also noted that merge-3 today is more the prerogative of large teams.

PS: We ask you not to consider this material an investment recommendation.