Casual and hyper-casual: comparison of indicators of two mobile genres from GameAnalytics

Hyper-casual games have appeared on the market not so long ago, but they are rapidly bypassing related casual games in many ways. The current metrics of these genres were compared by GameAnalytics specialist Ivan Bravo. And he also assessed how the indicators of hyper-casual correlate with the successes of more established mobile genres.

The portal made a squeeze from the analyst’s report App2Top.ru .

Bravo compared hyper-casual and casual games according to the following parameters:

- number and duration of gaming sessions;

- DAU;

- retention.

Important clarification: in the original text of Bravo, hyper-casual games are called Arcade. The author explains this by the fact that hyper-casual has not yet been placed in a separate category in gaming stores, so most projects in the genre are classified as arcades. In our squeeze, the concept of “hyper-casual games” is used, but on infographics they are presented as Arcade.

Gaming sessions

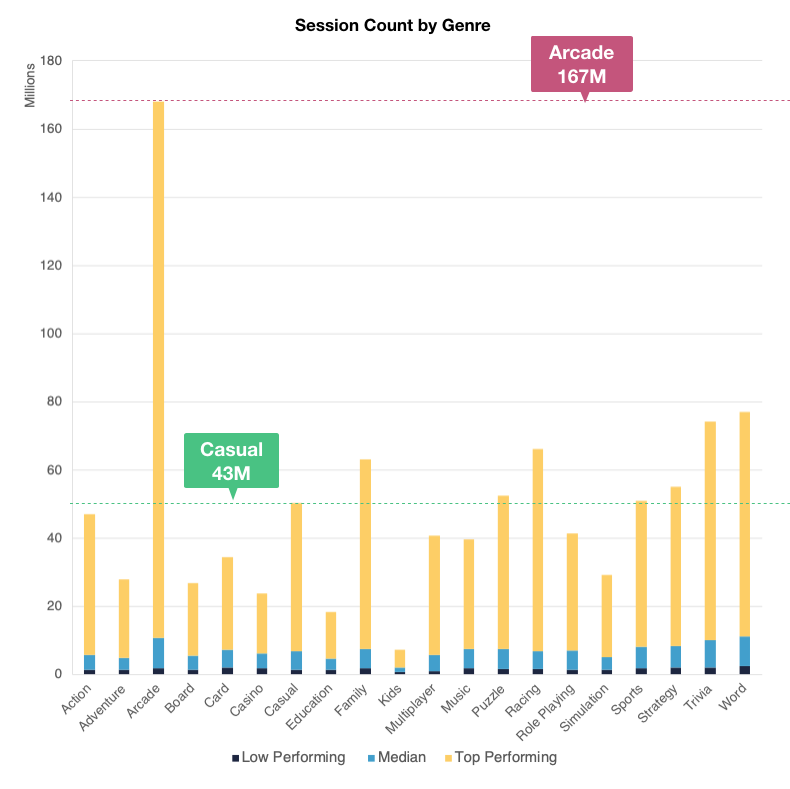

- The casual genre as a whole accounts for 43 million sessions per year. Hyper-casual games bypass this indicator at times: on average, the annual number of sessions in them tends to 167 million.

Number of gaming sessions (by genre)Nevertheless, the duration of sessions in casual games is twice as long as in hyper-casual games.

- According to this indicator, the latter are on the 19th place in the top twenty mobile genres. Hyper-casual is second only to the musical game genre (Music).

- So, the median length of a gaming session in the industry is 14 minutes and 30 seconds. In hyper-casual games, the median session duration is only 6 minutes and 42 seconds. This is five times less than that of the top (compared to the rest) “casino” genre.

- However, it is worth remembering that the whole essence of hyper-casual is in a large number of sessions and their shorter duration. That’s why 6 minutes 42 seconds is not too disappointing.

- In addition, hyper-casual gaming sessions last five times longer in total for the whole year than sessions for the rest of the market.

DAU

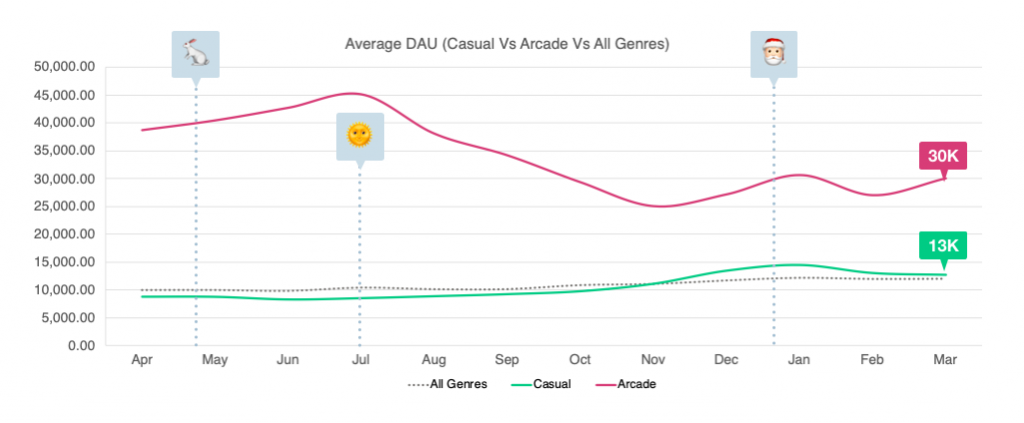

- The average DAU of top hyper-casual games is 94 thousand people. This is the highest result on the mobile market: the average hyper-casual game is 3.5 times more popular than games of other genres. But it should be noted that the average DAU in hyper-casual games shows negative dynamics.

Average DAU of casual, hyper-casual and on average of all genresThe casual genre, on the contrary, is rapidly increasing DAU.

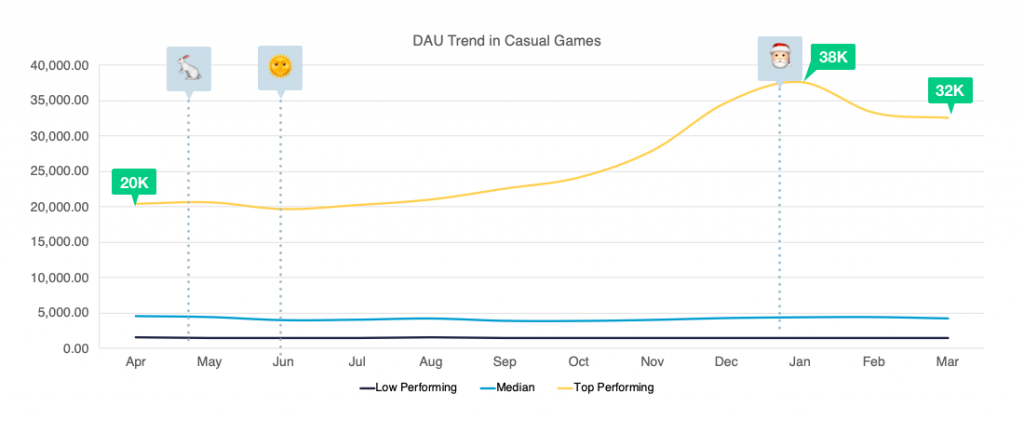

- Over the past year alone, its audience has grown by 50%. The achieved average for the most popular games of this genre is 26 thousand people. At the same time, their top indicator is 38 thousand people.

The DAU indicator for casual games of varying degrees of popularityRetention

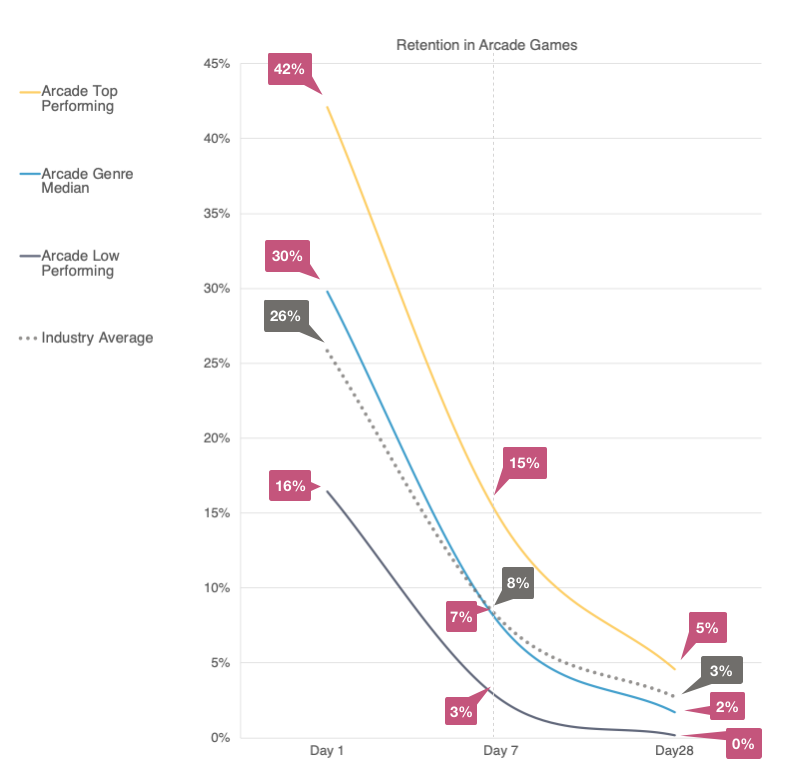

- Here, hyper-casual games are also superior to casual ones, though not by much. The most popular hyper-casual titles are among the top 5 best genres for D1 retention with an indicator of 42%. Casual girls have a retention of D1 — 40%.

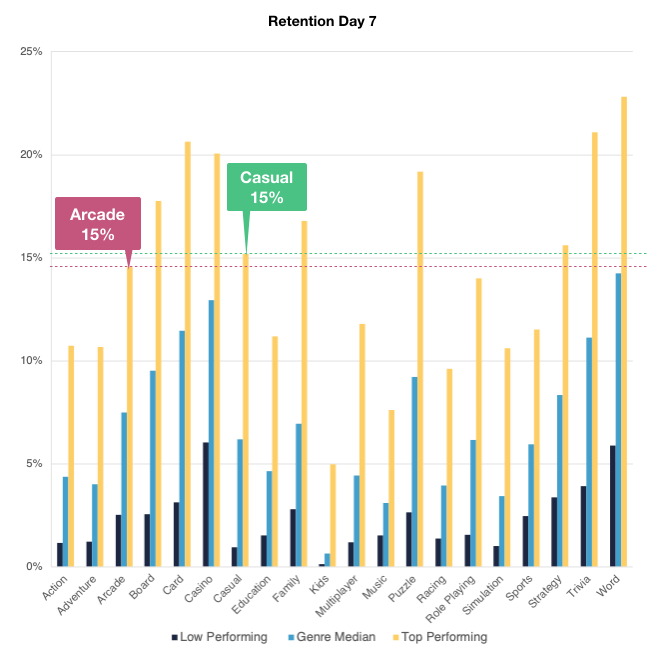

Retention in hyper-casual gamesThe retention rate of D7 for both hyper-casual and casual titles is 15% (if, again, we take the most popular representatives of both genres).

- By the way, usually hyper-casual games fall to the 10th place in retention among all genres a week after release. That is, these titles are starting to lag behind puzzle games and word games. But developers can gradually improve retention, for example, by rebuilding and polishing the main cycle of the game and effective advertising monetization.

D7 retention (by genre)Selection

Ivan Bravo’s research is based on data obtained from 3 billion players worldwide and from 70 thousand games in 20 different genres. Data collection was carried out from the second quarter of 2018 to the 1st quarter of 2019 inclusive.

Also on the topic: