Assessment of the mobile game market from Adjust and Applovin: not only downloads, but also the number of sessions with retention have fallen

Adjust, together with Applovin, has released a report on the state of affairs in the mobile market — Mobile app trends: 2024 edition. A separate chapter is devoted to mobile games. Read more about them in our material.

Most of the results presented in the study are based on the original data from Adjust and Applovin. However, at the beginning of the chapter, the company's analysts, with reference to Juniper Research, cite the following fact:

- In 2024, $ 103 billion will be spent on advertising games, and by the end of 2025, the costs may already amount to $ 131 billion.

Unfortunately, further, based solely on their own sources, Adjust and Applovin do not provide a real estimated amount for advertising costs over the past year.

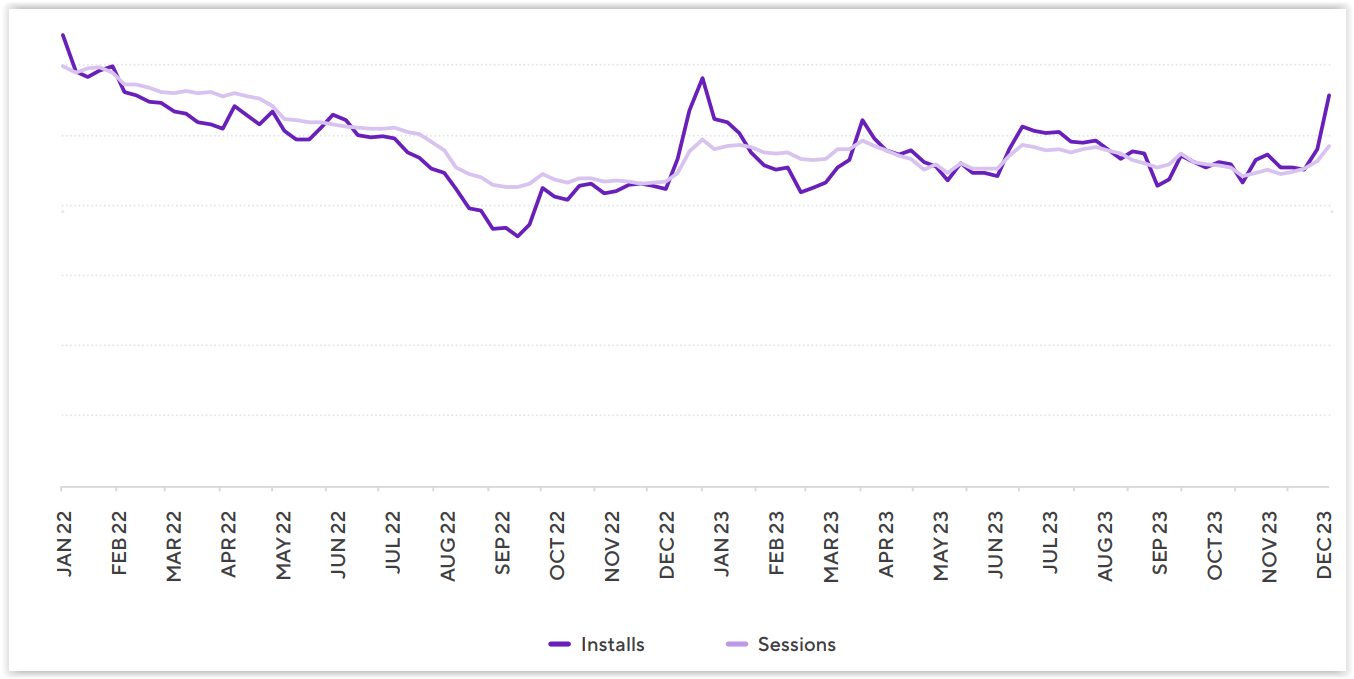

Analysts of the marketing companies Adjust and Applovin, analyzing in detail the results of the situation in the mobile games market, begin by talking about the decline in global installations:

- Mobile game downloads fell by 2% by the end of 2023%;

- The number of gaming sessions fell by 7% by the end of 2023.

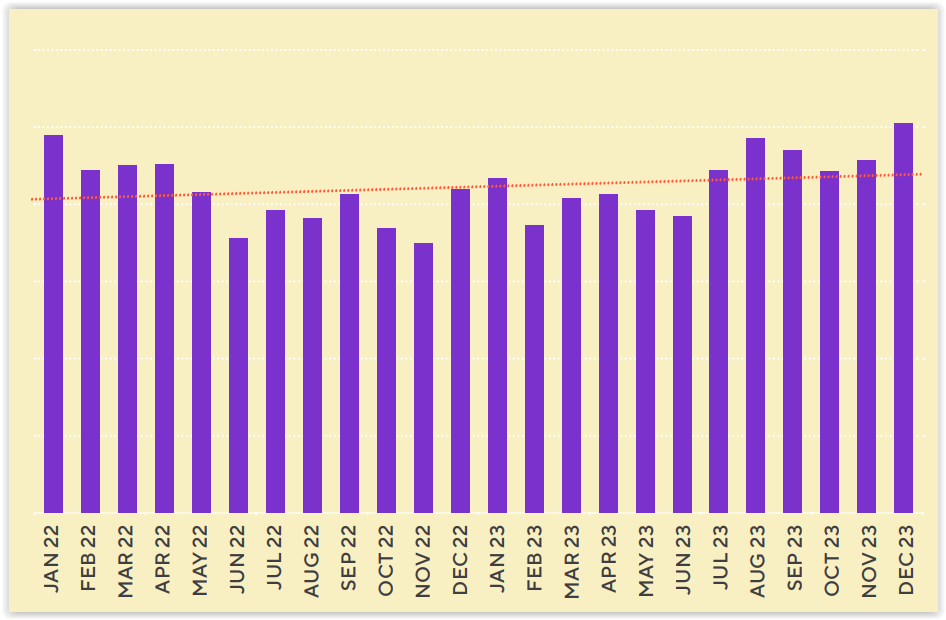

Dynamics of game downloads and sessions (January 2022 — December 2023)

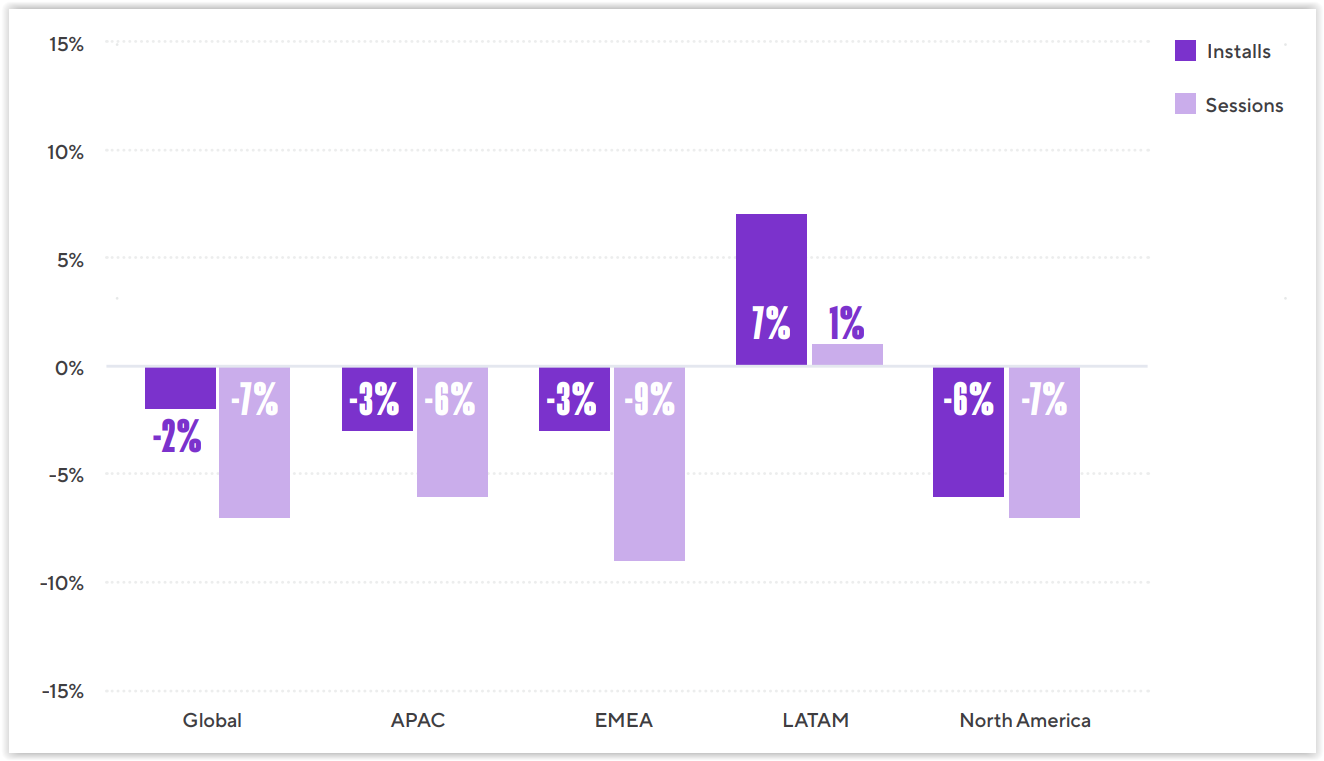

By region, the situation looks just as disappointing. The only region where, as a result of last year, both downloads and sessions in the games increased is Latin America.

Change in the number of game downloads and sessions in 2023 relative to 2022

However, the authors of the study are confident that the boom of hybrid casual games will correct the situation. Moreover, partly thanks to him, in November-December 2023, global mobile game downloads were 7% higher than in the same period of 2022.

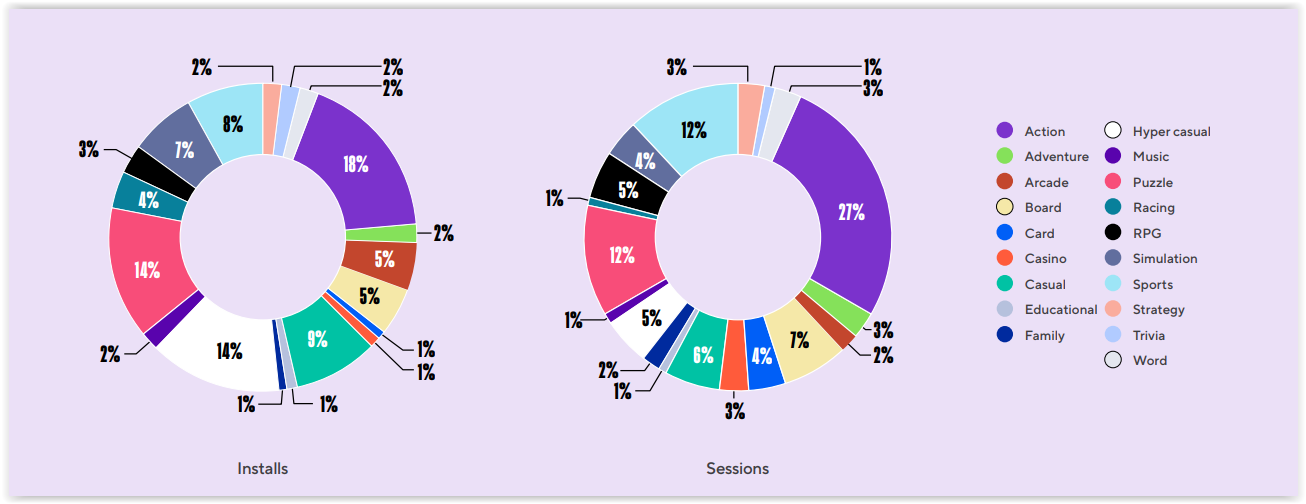

Analysts do not focus on this, but according to the data presented, it is clear that there is a disparity between the number of installations and sessions by game genres.

Vertical distribution of game downloads and sessions (2023)

For example, hyper casual games account for 14% of all game downloads, but they account for only 5% of all game sessions. The reverse is the case with action games. They account for 18% of downloads, but 27% of all sessions.

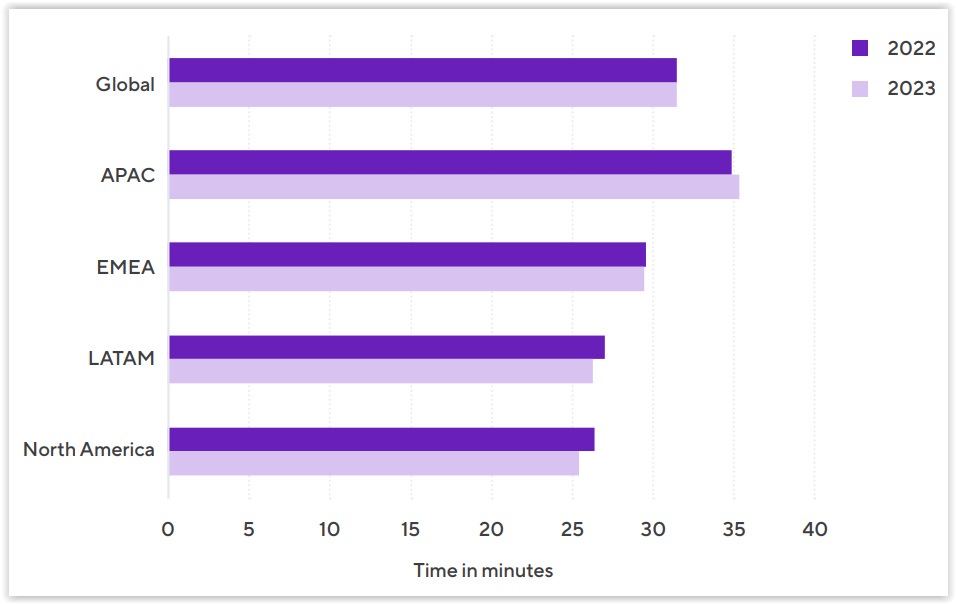

The average duration of a gaming session in 2023 has not changed compared to 2022. It is at the level of 32 minutes. However, it "jumps" from region to region and, as expected, from genre to genre.

Average length of gaming sessions by region (2023)

The highest average session in action games (over 45 minutes) and role-playing games (over 40 minutes). One of the shortest average sessions among all genres is for hypercausal titles (over 16 minutes).

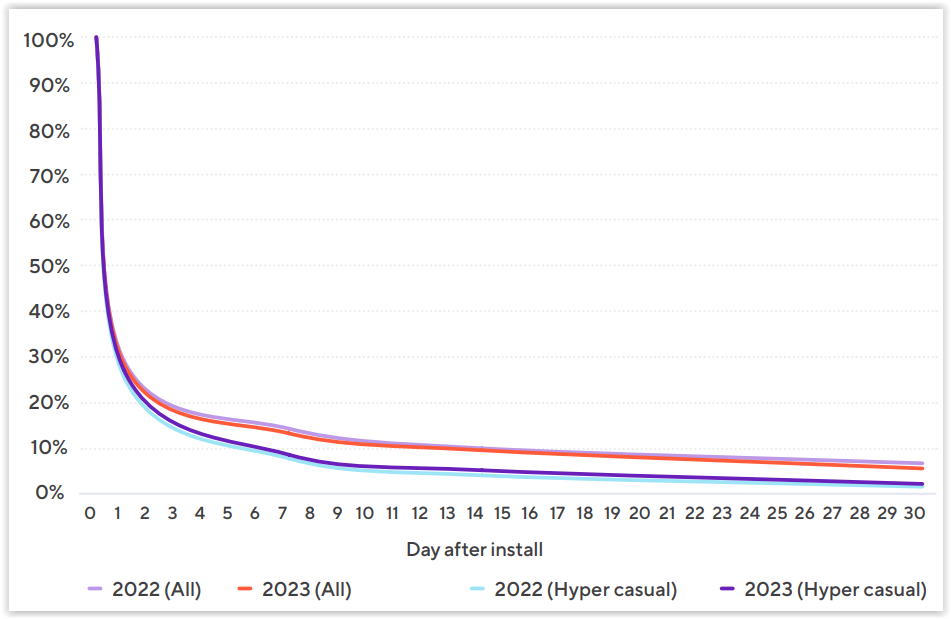

In 2023, compared to 2022, not only downloads with sessions fell, but also the average retention rate for games. D1 fell from 29% to 28.3%, D7 decreased from 14% to 13%, and D30 — from 6.4% to 5.3%.

Comparison of retention curves (2022-2023)

But the situation with hyper-casual games is the opposite. In this vertical, the average retention level was growth. However, it is insignificant: D1 increased from 26% to 27%, D7 increased from 8% to 8.4%, and D30 — from 1.8% to 2%.

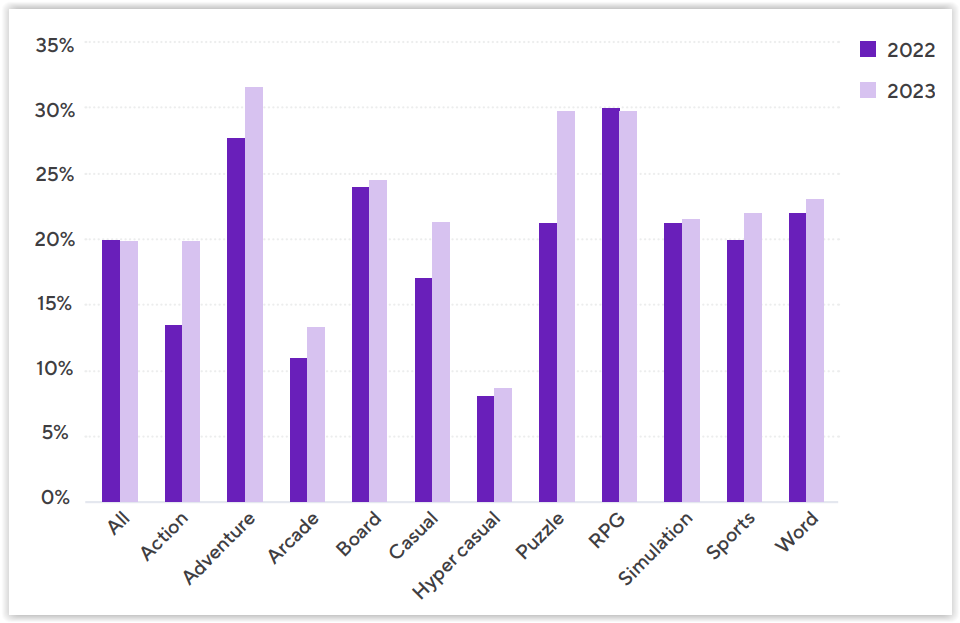

The average level of engagement (here Stickiness is the ratio of the number of active users per day to the number of active users per month) in 2023 remained at 20%. Although there has been growth in many genres.

"Stickiness" by genre (2022-2023)

For example, verticals such as action games, casual projects and puzzles added more than 5% in engagement. Adventures remained the leader in "stickiness", which also significantly increased the indicators — up to 31.6%.

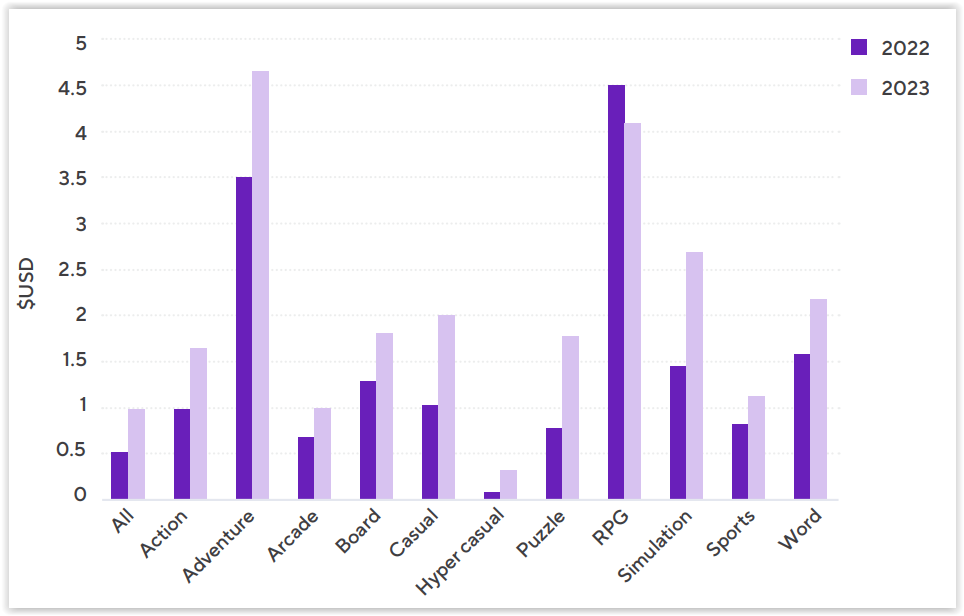

If we return to the conversation about the drop in downloads last year, then his Adjust and Applovin experts explain the increase in the necessary costs for attracting an audience: eCPM in most verticals increased in 2023.

eCPM by genre (2022-2023)

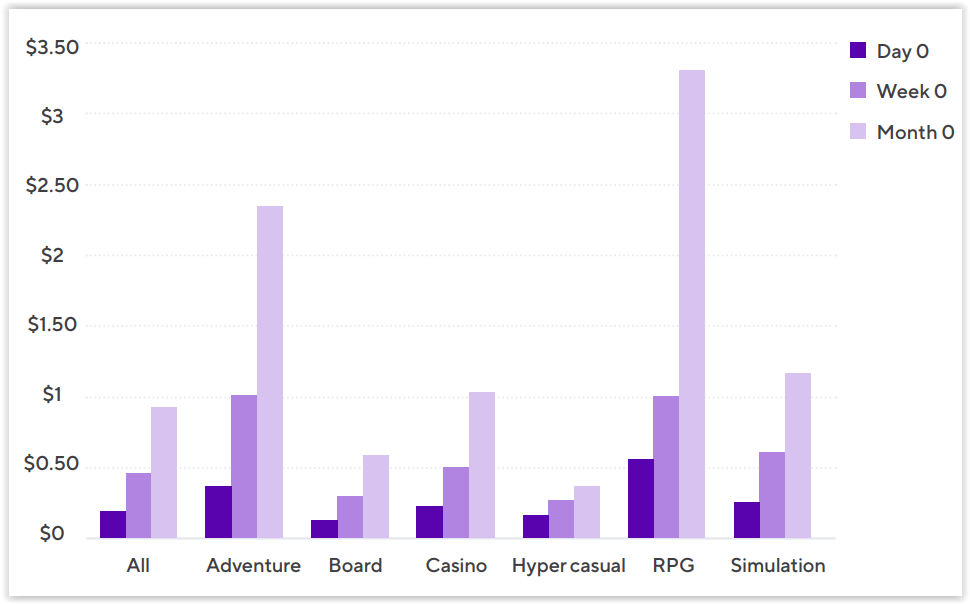

The authors of the study do not talk about the dynamics of LTV in gaming applications (apparently, advertising LTV, since the values are too small), they only share its average values broken down by verticals and time.

Cumulative LTV by genre (2022-2023)

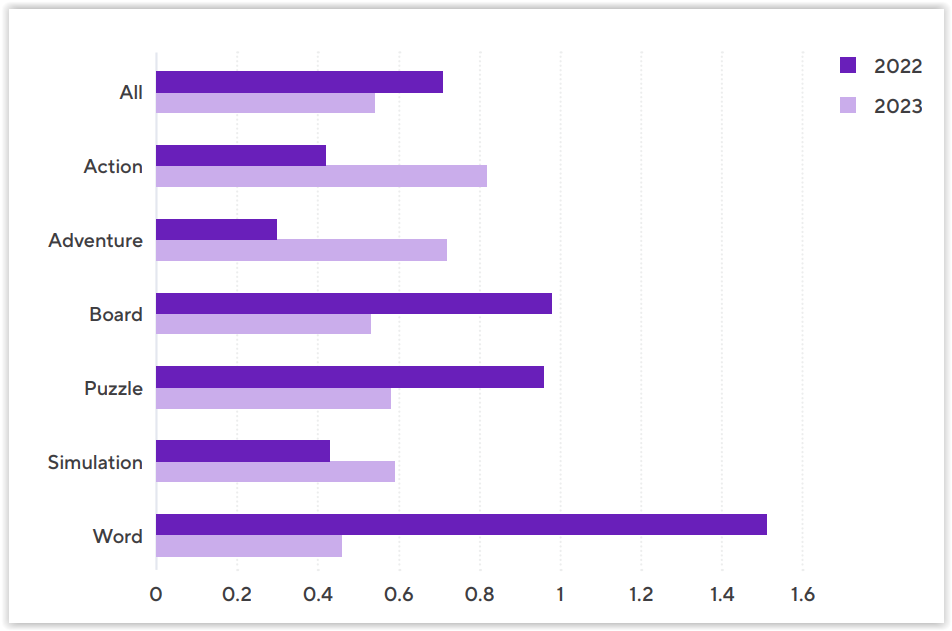

Of particular interest is the graph of the ratio of organic to paid downloads by genre. In general, it fell from 0.71 to 0.54 last year. First of all, this affected such verticals as board games, puzzles and word games.

The ratio of paid installations to organic ones (2022-2023)

However, in the case of action games and adventures, the situation is reversed. Analysts believe that this indicates an increase in interest in these areas.

Speaking about the dynamics of revenue from IAP in games, the overall trend in 2023, according to Adjust and Applovin, was positive. The average annual increase was 6%. The December figures for 2023 turned out to be 17% higher than those for December 2022.

Revenue dynamics from IAP in mobile games (January 2022 — December 2023)

Analysts believe that growth will continue next year. In their opinion, it will be achieved by the introduction of AI tools for advertising personalization and monetization by marketers and developers.