RedTower is a game publisher launched by Vlad Paper. Each of his games generates 2 million installs without buying traffic

Popular video blogger Vlad Paper opens the game publishing house RedTower. His company is ready to provide any project with guaranteed organic matter of 2 million units. How it works — in conversation with App2Top.ru Ruslan Voronetsky, Business Development Director of A4 Group of companies, who manages the blogger’s non-YouTube businesses, as well as Nikolay Voronkovich, CEO of RedTower publishing house, told.

Alexander Semenov, Editor-in-Chief App2Top.ru : Not everyone is aware of the situation on YouTube. Tell us, who is Vlad Paper?

Ruslan Voronetsky

Ruslan Voronetsky, Business Development Director of A4 Group of companies: In short, Vlad Paper is a top YouTube blogger in Runet, who has become an idol of a huge number of children throughout the CIS, thanks to his channel with cool content in the form of challenges. Now the channel has more than 30 million subscribers, and each video gets an average of 12-15 million views.

Important: Vlad, judging by key metrics (total number of views, viewability, engagement, and so on), is one of the leading bloggers not only in Russian, but also in the global YouTube.

Many perceive video bloggers exclusively as celebrities whose main business is content. But do I understand correctly that Vlad is trying to break out of this paradigm?

Voronetsky: I wouldn’t say that Vlad is trying to escape from somewhere.

Rather, Vlad is not just a celebrity, but an entrepreneur who is looking for new business opportunities. As a result, he launches new directions, the task of which is very simple: to deliver cool products to the markets.

At the same time, content creation is still our number one priority. But, yes, today we are moving in the direction of developing an ecosystem around our audience.

And for this, A4 holding was just launched?

Voronetsky: Let’s just say that the holding was created as an internal laboratory, whose task is to find new niches, create products in them and deliver to the audience.

The huge success on the channel gives us the opportunity to deliver the product to the audience very quickly and very cheaply. But at the same time, we try not to lose focus and not throw the market and users all in a row.

What place does the game publisher RedTower occupy in the holding?

Voronetsky: It became the first side project. Considering the entire mobile games market, its growth and the popularity of mobile games among our audience, we have great hopes for this direction. We cannot disclose revenue details, but in the near future we want this business to compete with the YouTube channel in terms of earnings. Therefore, given our high expectations, we devote a lot of time to it and actively invest our resources in it.

Vlad was not confused by the fact that games, no matter what hype around this topic, are still a high-risk story?

Voronetsky: Vlad made his channel in 2014, so high risks are not something new for him.

In general, our model minimizes risks both for us and for the studio, which is good. But there is also a downside to the coin: you can relax and remain an average person forever.

What kind of games does RedTower play?

Voronetsky: This is a publishing house that has all the tools to make an average project by metrics commercially successful.

Here we see a very, as it seems to us, noble mission. Thousands of game projects are discarded by publishers every month, although the audience may well like them, but they do not find commerce in them.

First of all, we want to deliver cool content to the audience and find profitable tools for the growth of commercial metrics for studios. We are successfully doing this on the YouTube platform. We are confident that we will be able to do this in the mobile games market as well.

If we talk about genres, we are mainly looking towards hyper-casual games, since this is still an actively growing market. At the same time, casual and midcore projects are also of interest to us.

We recently released “Horror Stories — Adventure City“, which rather falls under the definition of a content casual game, before that the project “Puzzles” was a hit.

“Horror stories — the city of adventures”

Right now we are working with two studios on large projects (including match3), but the main focus is still hyper-casual games.

Vlad promotes RedTower projects in commercials to ensure push?

Voronetsky: Yes, we can make a video for very promising projects.

In the conversation before the interview, you mentioned that RedTower’s story is not the easiest. Before you came to A4, the guys were making games and a lot of things didn’t work out. Tell me, what was the problem?

Voronetsky: The story was not easy, because the team did not have time to work together. Therefore, the projects were in development for a long time, rarely came out, and their quality was average. Despite this, they earned.

As a result, we got the impression that we are losing something, that we need to look for a different approach.

Do I understand correctly that there were no traffic problems? Only on Vlad’s popularity alone have games been downloaded well and are still being downloaded?

Voronetsky: Yes, this was the main trigger of internal changes. We saw that the games were not “wow”, but each of them turned out to be in the top, each received 1 million or more downloads in a couple of days without purchase, each turned out to be profitable.

Then it became interesting to us: what will happen if we release a good and high-quality product that will immediately be created with an eye to a worldwide release?

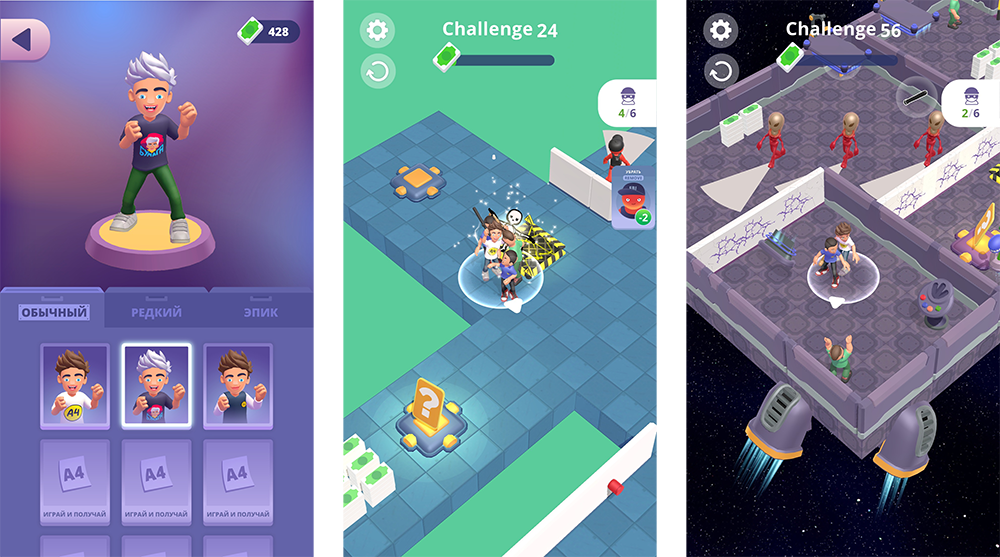

By the way, the quality of our latest projects is much higher than before. Both “Horror Stories” and “A4 Bank Robbery Challenge” are products of a completely different level.

“A4 Bank Robbery challenge”

And what has changed in the company for this?

Voronetsky: The key was the decision to become a partner for other studios in the first place.

We had to change a lot: starting from very small and insignificant (a new website, positioning, developing a unique offer for studios) and ending with fundamental things (finding and hiring new people, developing a funnel of projects, creating infrastructure, and so on).

And as a result, how does publishing work today?

Voronetsky: He works today as follows:

- we communicate with studios and look at projects (as a rule, these are either projects that the guys have in their desk, and they had borderline metrics, or new projects that are at the demo stage);

- some of the projects are immediately discarded, and some are sent to receive metrics for tests (this is primarily necessary to understand how much they will grow when we add YouTube channel characters);

- next, together with Vlad and the production team, we consider the project separately as a game and separately as a business (if we like it as a game, then we can neglect business metrics);

- we coordinate the launch date, the plot of the commercial and the integration format;

- while everything is being prepared, the guys are making a softlonch, finishing and improving the project.

- on the day of the release of the video, we open the project to the whole world.

In the first two days, the project is steadily downloaded from a million users. We are gaining another million in the next two days. We usually get into the CIS tops. The players have been playing for a very long time and a lot. This ensures us, together with the studio, a completely successful launch.

The project with us becomes unambiguously commercially successful. The whole question is the amount of success (here everything depends not only on us, but also on the studio).

At the same time, there remains the issue of scaling. Vlad, as your cases show, can really provide traffic in the CIS. But real success cannot be regional in nature. Are you ready to invest (and how much) in the game outside of the Commonwealth countries?

Nikolay Voronkovich, CEO of RedTower Publishing House: Of course, we are ready!

In the CIS, we hit the ceiling pretty quickly and within a couple of months we buy out almost all the traffic that is interested in the project and that would give a positive ROI.

And we have one of the stages of publishing — this is just the purchase of traffic globally. When launching games, we are going to try everything in our power and competence to positively purchase and scale in Tier-1.

But right now we don’t have a global launch case to brag about. I am sure he will appear soon. Unfortunately, I can’t reveal the details yet, but we can already use YouTube traffic not only in the CIS, but also in other GEO.

As soon as the studio and I realize that it is possible to scale the project globally, we will invest significant resources in its development. As they say: there is money, money is not a problem, there would be a project.

Now our team has strong competencies in advertising monetization, analytics, creatives and UA. There is its own BI, which allows you to better see the patterns and test results in the project. We also have a calendar of launchies (we will launch 5 projects in the next two months).

The team has very clear and clear OKRs that simply leave no other options how to buy traffic everywhere, including in the world. This is very important for our group of companies — we don’t want to be guys who work only in the CIS.

Steering towards the end of the conversation. Do I understand correctly that RedTower is a plus or minus a standard young GC publisher who has the opportunity to drain traffic from YouTube as a trump card, thereby including without fear of IDFA cancellation?

Voronkovich: Yes and no.

You’re really right that our unique model allows you to use and monetize YouTube traffic very effectively.

But I would not like to use the phrase “standard young publisher”. Yes, we are not in the top publishers yet. But this only means that we have something to strive for. Our team tries very hard, pays a lot of attention to working with studios. We have very strong analytics, we prepare cool technical specifications for studios, we make bug reports, we have a personalized approach to each team.

And a block of relevant questions from the developers:

- According to what schemes are you ready to work with teams?

We work on the revenue share model. We can consider other options, but so far there has not been a single other case.

- Who has the IP for the game?

The rights to the game are transferred to the publisher for the duration of the contract. If for some reason the contract is terminated, the rights to the game are returned to the developer, with the exception of the content owned by A4.

- Do you sign an NDA before testing?

No, we don’t make any agreements at the testing stage.

- What platforms are you testing on?

We mainly test on Android in different regions. Usually we use Google Ads as a traffic source, less often we use Facebook

- How exactly do you usually test?

I think it’s no secret that the main purpose of the test is to understand how the game is potentially interesting to a wide audience. So we do two tests. The first is for CTR, in which the advertising company is configured with minimal targeting restrictions. Here we set only the GEO and the operating system, and in creatives we use only the gameplay screencast. We try to make all creatives typical, without screwing up the chips that raise the conversion. If the gameplay is interesting to a wide audience, then there is something to work on and in the future the CTR will only be higher.

- Do you prepare creatives yourself?

We prepare some creatives ourselves, but we order most of them from partners.

- Is there your own dashboard for tracking metrics?

Yes! Right now, together with our data science specialists, we are finishing the development of our own custom BI-system with dashboards tailored to a specific project. This allows you to analyze the project more effectively and work on its improvement.

- What are the “pass-through” indicators for the adoption of the project?

“Passing” indicators may differ depending on the project. There may be a small D1, but a high D7 and in general LTV is higher, so I will give the average metrics that we are focusing on.

D1\R1 > 35%

D7\R7 > 8%

CPI up to $0.35

CTR > 3%